Tag Archive: $CNY

FX Daily, June 10: Collective Sigh of Relief Lifts Equities, Yields, and the Dollar

Overview: A global sigh of relief that the US will not tariff all its imports from Mexico. Equities are all higher, and the weekend demonstrations in Hong Kong over a bill allowing extraditions to the mainland for the first time did not deter investors from bidding up the Hang Seng over 2.3%, the most this year. European equities are following suit.

Read More »

Read More »

FX Weekly Preview: US Policy Mix Flips and Will Take the Dollar with It

There is a new game, afoot. For the last couple of years, it has been about normalizing policy. Even the Bank of Japan, which has never declared it was tapering, has gradually reduced the amount of government bonds it purchases. Countries like the US, or Canada in 2017, who could raise interest rates were rewarded with stronger currencies.

Read More »

Read More »

FX Daily, June 7: Jobs Data and Tariffs Dominate

Overview: Global equities continue to recover from the recent slide. Chinese and Hong Kong markets were on holiday today, but the MSCI Asia Pacific Index eked out a minor gain and ensured that its four-week slide ended. Europe's Dow Jones Stoxx 600 is up about 0.7% through the European morning.

Read More »

Read More »

FX Daily, May 23: Trade, Brexit, and Disappointing Flash PMIs Weigh on Global Markets

Overview: The deterioration of the investment climate is spurring the sales of stocks and the buying of bonds. The dollar is firm. China and the US appear to be digging as if the trade tensions will remain for some time and the breech is beginning to look too big for Trump and Xi to pull another rabbit out of the hat like they did at the end of last year when the tariff truce was struck. The move against Huawei and possible a number of...

Read More »

Read More »

FX Daily, May 21: Equities Find Some Traction while the Dollar Firms

Overview: Equities are paring some of their recent losses. The MSCI Asia Pacific Index is posting its first back-to-back gain in a month, led by a more than 1% rally in China. Heightened prospects for an Australian rate cut in a few weeks helped extend the run in the local equity market to a new record high. European bourses are higher, with the Dow Jones Stoxx 600 rising around 0.3% in the morning session.

Read More »

Read More »

FX Daily, May 20: Politics Overshadows Economics Today, but Japan’s Economy Unexpectedly Expanded in Q1

Encouraged by the election results, investors bid up Indian and Australian currencies and equities. Japan offered a pleasant surprise by reporting the world's third-largest economy expanded in Q1. Most other equity markets in Asia fell, and European stocks have the week with small losses.

Read More »

Read More »

FX Weekly Preview: The Week Ahead featuring the Battle for 7.0

The strategic objective is to integrate China into the world economy. The liberal international solution was trade, investment flows, and cultural exchanges. The rise of nationalism and China's own willingness to flaunt the international rules are defeating the strategy.

Read More »

Read More »

FX Daily, May 17: China Questions US Sincerity

Since the presidential tweets on May 3, the US had the initiative in the negotiations with China, but today, China has pushed back. It is cool to the idea promoted by the US that trade talks will resume shortly. Now it may take the Trump-Xi meeting at the end of next month to restart talks. This, coupled with US sanctions on Huawei banning imports from it and sales to it, threatens to disrupt business and this took a toll on Chinese, Taiwanese and...

Read More »

Read More »

FX Daily, May 15: Angst Continues

Overview: Disappointing Chinese April data spurred speculation that more stimulus will be forthcoming and bolsters hopes that a trade deal with the US by the end of next month helped Asian Pacific equities advance for the first time this week. Indonesia, which reported a record trade deficit on the back of collapsing exports (-13.1% year-over-year in April, nearly twice the decline expected after a 10% fall in March) kept the pressure on its...

Read More »

Read More »

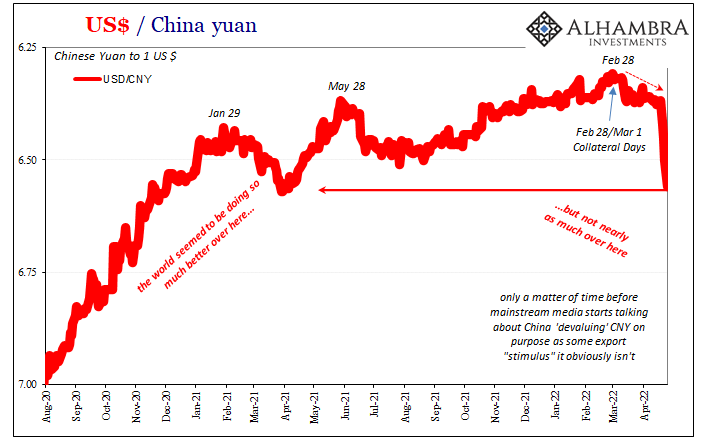

Why China Finds it Difficult to Weaponize the Yuan and US Treasuries

It looks so easy on paper. China can sell its holding of US Treasuries and/or weaken the yuan to offset the tariffs and boost exports. It is the first and easy answers from strategists, journalists, and some academics. Often times, it is presented a novel idea; as if diplomats, investors, and policymakers have not thought it.

Read More »

Read More »

FX Daily, May 14: Too Weak to Muster Much of a Turnaround Tuesday, Markets See Small Reprieve

President Trump's willingness to meet China's Xi at the G20 meeting at the end of next month and his "feeling" that an agreement will still be found seemed sufficient to break the momentum that had swept through the capital market.

Read More »

Read More »

FX Daily, May 13: Investors Still Looking for New Balance

The end of the tariff truce between the US and China has discombobulated investors. They had been repeatedly that a deal was close and there had even been talk at the US Treasury about where Trump and Xi should meet to sign the agreement. Now China was given around a month to capitulate to US demands or face a 25% tariff on their remaining exports to the US.

Read More »

Read More »

FX Weekly Preview: Trade, the Dollar, and the Week Ahead

China is isolated on trade. No one supports its trade practices. The idea that China was going to "naturally" evolve to be more like the US, or Europe for that matter, was always fanciful and naive. The emergence of China, as Napoleon warned two centuries ago, would make the world shake.

Read More »

Read More »

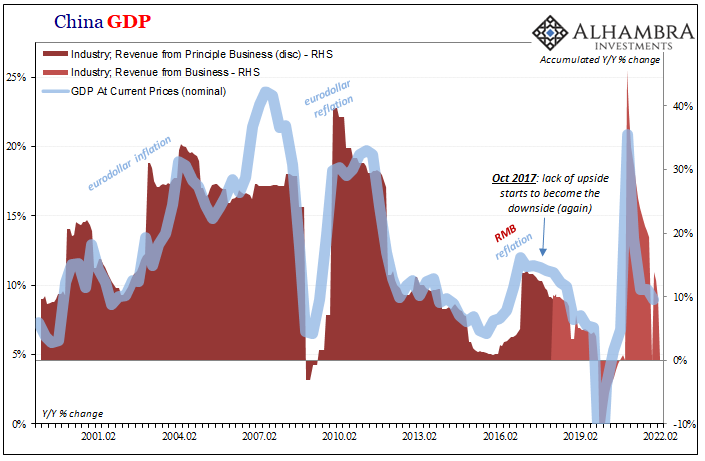

China’s Export Story Is Everyone’s Economic Base Case

The first time the global economy was all set to boom, officials were at least more cautious. Chastened by years of setbacks and false dawns, in early 2014 they were encouraged nonetheless. The US was on the precipice of a boom (the first time), it was said, and though Europe was struggling it was positive with a more aggressive ECB emerging.

Read More »

Read More »

FX Daily, May 08: Markets Trying to Stabilize

Overview: It is taking investors a bit more than two sessions to find its footing after being the unexpected end of the tariff truce between the US and China struck last December. Asia Pacific equities tumbled after the S&P 500 shed nearly 1.7% yesterday, the third largest decline in 2019, but Europe's Dow Jones Stoxx 600 is consolidating near yesterday's lows.

Read More »

Read More »

FX Daily, May 06: Trump’s Tariff Tweets Help Investors Discover Volatility

Reports that a US-China deal could be struck by May 10 before the weekend left investors ill-prepared for the presidential tweets yesterday that announced that the US was ending the tariff truce. Trump indicated that the 10% tariff on $200 bln of Chinese goods would be lifted to 25% at the end of the week and that the remaining $325 bln of Chinese goods that have not been subject to an extra levy, will be slapped with a 25% tariff soon.

Read More »

Read More »

April Monthly Currency Outlook

Poor economic data and soft inflation saw several central banks, including the Federal Reserve and European Central Bank, take a dovish turn in March. Contrary to expectations that interest rates would rise as the G3 central banks were no longer adding to their balance sheets on a combined basis.

Read More »

Read More »

Europe and China

The US-China trade talks look like they may very well continue through most of the second quarter, despite how much progress is being claimed. Meanwhile, the tariffs remain in effect, but the market's sensitivity to developments has slackened since it was clear the Trump and Xi were not going to meet at the end of this month.

Read More »

Read More »

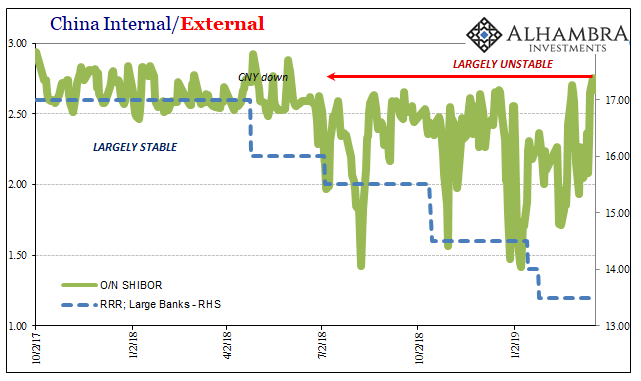

February 2019 PBOC/RMB Update

This will serve mostly as an update to what is going on inside the Chinese monetary system. The PBOC’s balance sheet numbers for February 2019 are exactly what we’ve come to expect, ironically confirmed today on the domestic end by the FOMC’s dreaded dovishness. Therefore, rather than rewrite the same commentary for why this continues to happen I’ll just link to prior discussions.

Read More »

Read More »

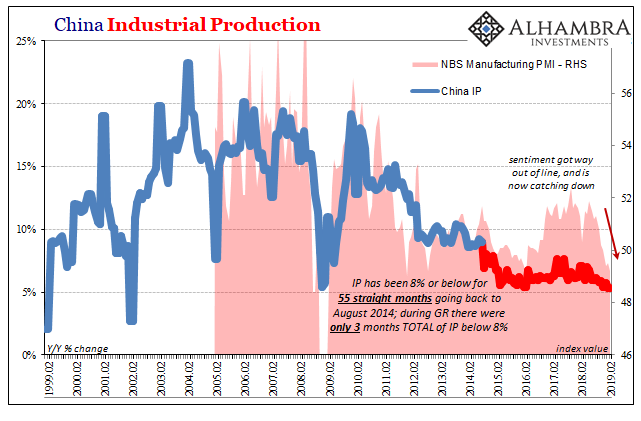

No Sign of Stimulus, Or Global Growth, China’s Economy Sunk By (euro)Dollar

Najib Tun Razak was elected as Malaysia’s Prime Minister in early 2009. Taking office that April amid global turmoil and chaos, Najib’s first official visit was to Beijing in early June. His father, also Malaysia’s Prime Minister, had been the first among Asian nations to open formal diplomatic relations with China thirty-five years before.

Read More »

Read More »