Tag Archive: China

FX Daily, October 31: No Good Deed Goes Unpunished

Overview: The equity and bond rally in North America yesterday carried over into today's session. With some notable exceptions, like China, Taiwan, Australia, and Indonesia, most bourses in Asia Pacific and Europe traded higher. US shares are little changed in early Europe after the S&P 500 rose to new record highs.

Read More »

Read More »

FX Daily, October 29: Calm before the Storm

The more prominent events this week still lie ahead, and the capital markets are trading accordingly. The rally that lifted the S&P 500 to new record highs yesterday carried over into Asia, where most equity markets rose, though China, Hong Kong, and South Korea were notable exceptions. European shares are struggling in the early going after the Dow Jones Stoxx 600 set new highs for the year yesterday.

Read More »

Read More »

FX Daily, October 28: Politics Dominates Start of the Week before Yielding to Policy and Economics

Overview: The pre-weekend rally in US shares, with the S&P 500 flirting with record highs and the back-up in US yields, set the tone for Asia Pacific trading earlier today. Nearly all the equity markets advanced, and bond yields rose. Europe's Dow Jones Stoxx 600 took a five-day advancing streak into this week, but shares are struggling to sustain the upside momentum.

Read More »

Read More »

FX Daily, October 25: Limping into the Weekend both Fighting and Talking

Overview: Amazon and Intel earnings offered conflicting impulses for Asia Pacific equities, but Japanese, Chinese, Australian, and South Korean shares advanced. This will allow the regional MSCI benchmark to solidify its third consecutive weekly gain. Europe's Dow Jones Stoxx 600 is little changed, and it too is closing in on its third weekly advance.

Read More »

Read More »

Cool Video: China Still Needs to Provide more Stimulus

The IMF projects that China will expand by less than 6% in 2020, but unless China provides more stimulus, it may be difficult to achieve. This is not only my view but also the view of Helen Qiao, the chief economist for Greater China at Bank of America. I was on the Bloomberg set with Alix Steele and Ms. Qiao earlier today.

Read More »

Read More »

The Dollar-driven Cage Match: Xi vs Li in China With Nowhere Else To Go

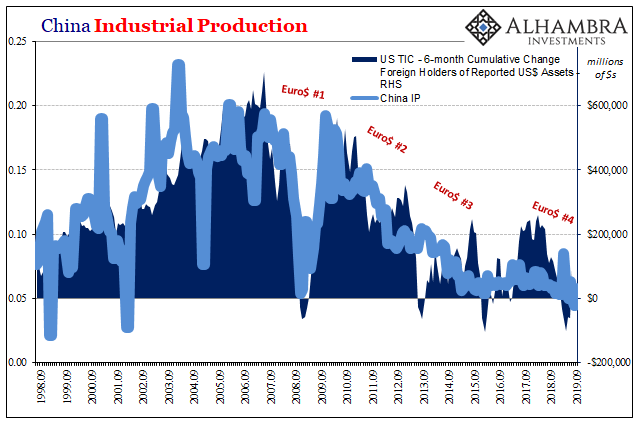

China’s growing troubles go way back long before trade wars ever showed up. It was Euro$ #2 that set this course in motion, and then Euro$ #3 which proved the country’s helplessness. It proved it not just to anyone willing to honestly evaluate the situation, it also established the danger to one key faction of Chinese officials.

Read More »

Read More »

FX Weekly Preview: The Week Ahead Excluding Brexit

I feel a bit like the proverbial guy that asks, "Besides that, Mrs. Lincoln, how did you like the play?" in trying to discuss the week ahead without knowing the results of the UK Parliament's decision on the new deal negotiated between Prime Minister Johnson and the EU. I will write a separate note about Brexit before the Asian open. However, there are several other developments next week that will help shape the investment climate.

Read More »

Read More »

FX Daily, October 18: Markets Becalmed Ahead of the Week

Overview: The global capital markets are ending the week on a subdued note as the UK Parliament decision on Saturday is awaited. The weaker Chinese Q3 GDP had little impact outside of China, where stocks fell over 1%. A brief suspension of hostilities by Turkey was sufficient for the US to lift its threatened sanctions.

Read More »

Read More »

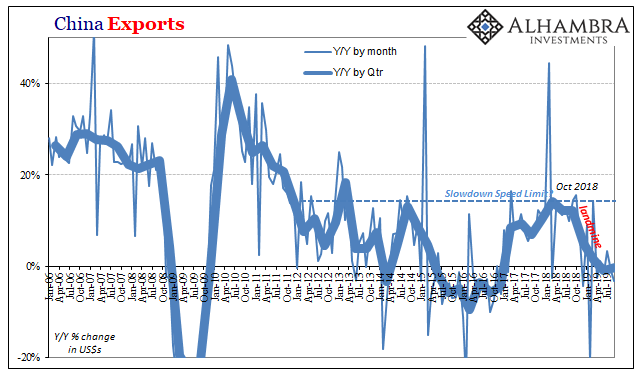

China’s Dollar Problem Puts the Sync In Globally Synchronized Downturn

Because the prevailing theory behind the global slowdown is “trade wars”, most if not all attention is focused on China. While the correct target, everyone is coming it at from the wrong direction. The world awaits a crash in Chinese exports engineered by US tariffs. It’s not happening, at least according to China’s official statistics.

Read More »

Read More »

FX Daily, October 15: Non-Disruptive Brexit Hopes Remain Elevated

Overview: Ideas that a Brexit deal may be close is helping to firm sterling, while soft Chinese PPI offset the spike in food prices to show the weakness of the world's second-largest economy. Minutes from the meeting of the Reserve Bank of Australia earlier this month kept a door open to a rate cut before the end of the year. Japan returned from holiday, and the Nikkei gapped higher, and its nearly 1.9% advance led the MSCI Asia Pacific Index...

Read More »

Read More »

FX Daily, October 14: Optimism Took the Weekend Off

Overview: Japanese and Canadian markets are on holiday today. While the US bond market is closed, equities maintain their regular hours today. Asia Pacific equities rallied, led by 1% of more gains in China, Taiwan, South Korea, and Thailand. The buying did not continue in Europe, and after a 2.3% rally before the weekend, the Dow Jones Stoxx 600 is about 0.75% lower in the European morning.

Read More »

Read More »

FX Weekly Preview: Same Three Drivers in the Week Ahead but Changing Tones

Three themes have dominated the investment climate: US-China tensions, Brexit, and the policy response to the disinflationary forces. None have been resolved, which contributes to the uncertainty for businesses, households, and investors. However, the negativity that has prevailed is receding a little.

Read More »

Read More »

EM Preview for the Week Ahead

EM benefited greatly from the improvement in US-China trade relations and quite possibly Brexit. The dollar is likely to remain under some pressure near-term as a result. Yet we must caution investors against getting too optimistic. The details of the partial trade deal still need to be worked out, while existing tariffs will still remain in place if the deal is signed next month as most expect.

Read More »

Read More »

FX Daily, October 10: Setback for the Greenback

Conflicting headlines about US-China trade whipsawed the markets in Asia, but when things settled down, perhaps, like the partial deal that has been hinted, net-net little has changed. Asian equities were mixed, with the Nikkei, China's indices, and HK gaining, while most of the others slipped lower. The 0.9% gain in the S&P 500 yesterday failed to lift European stocks, and the Dow Jones Stoxx 600 is near the week's lows.

Read More »

Read More »

FX Daily, October 9: Hope is Trying to Supplant Pessimism Today

Overview: The 1.5% drop in the S&P 500 and the deterioration of US-China relations and the prospects of a no-deal Brexit failed did not carry over much into today's activity. Asia Pacific equities were mostly a little lower, though China and India bucked the regional trend, while Korea was closed for a national holiday. Taiwan led the losses amid a sell-off in semiconductor stocks.

Read More »

Read More »

FX Daily, October 8: Not a Good Day for Negotiators

The re-opening of Chinese markets after a long holiday did not produce the volatility that many expected. Chinese stocks alongside most Asia markets traded higher today, and the yuan advanced. After opening higher and extending its recent rally, Europe's Dow Jones Stoxx 600 turned down, even though Germany announced an unexpected gain in August industrial output. US shares are trading a bit lower.

Read More »

Read More »

FX Daily, October 7: Markets Unsettled to Start the Week

Overview: The global capital markets are uneasy as the risks that have dominated investors' concerns--trade and Brexit--remain front and center today. Expectations are low that this week's talks between the US and China will lead to a breakthrough or will be sufficient to postpone further the next round of tariff increases set for next week.

Read More »

Read More »

FX Weekly Preview: China Returns, ECB Record, Fed Minutes and the Week Ahead

Many high-income countries experienced little growth but strong price pressures in the 1970s. Since the mainstream economics said the two were mutually exclusive, a new term had to be created, hence stagflation. Fast forward almost half a century later, and mainstream economists are still having a problem deciphering the linkages between prices and economic activity, such as inflation and employment.

Read More »

Read More »

FX Daily, October 2: Greenback Shows Resiliency, Stocks Don’t

Shockingly poor ISM data sent shivers through the market on Tuesday and hand the S&P 500 its biggest loss in five weeks and took the shine off the greenback. The S&P 500 reached a five-day high before reversing course and cast a pall over today's activity. All the markets were lower in Asia Pacific, with China and India closed for holidays.

Read More »

Read More »

FX Weekly Preview: Forces of Movement at the Start of Q4 19

The world's largest economy appears to have grown by about 2% in Q3 at an annualized pace, the same as in Q2, and in line with what many Fed officials understand to be trend growth. The strength of the US labor market underpins consumption, the powerful engine of the US economy. The latest readings of both the labor market and consumption will highlight the economic data in the week ahead.

Read More »

Read More »