Tag Archive: China

FX Weekly Preview: Six Events to Watch

The divergence thesis that drives our constructive outlook for the dollar received more support last week than we expected. A few hours after investors learned that Japan's flash PMI remained below the 50 boom/bust level, Europe reported disappointing PMI data as well. And a few hours after that the US reported that retail sales surged in March by the most in a year and a half (1.6%).

Read More »

Read More »

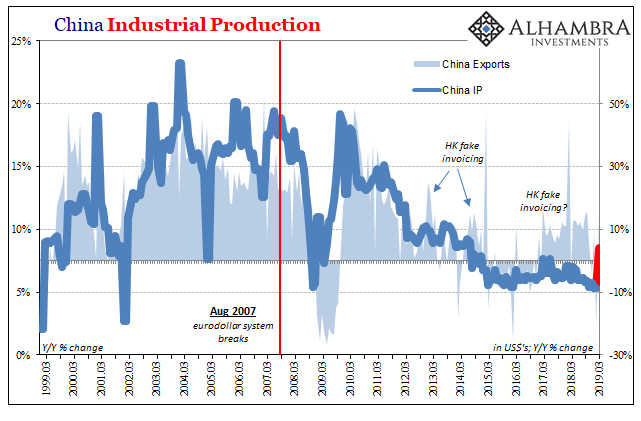

China’s Blowout IP, Frugal Stimulus, and Sinking Capex

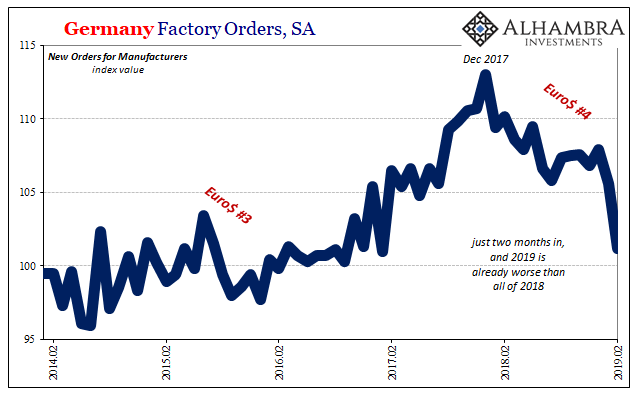

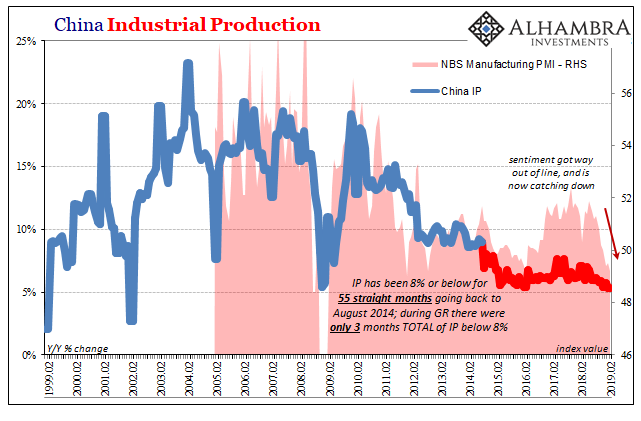

It had been 55 months, nearly five years since China’s vast and troubled industrial sector had seen growth better than 8%. Not since the first sparks of the rising dollar, Euro$ #3’s worst, had Industrial Production been better than that mark. What used to be a floor had seemingly become an unbreakable ceiling over this past half a decade. According to Chinese estimates, IP in March 2019 was 8.5% more than it was in March 2018. That was far more...

Read More »

Read More »

FX Daily, April 17: Veracity of Chinese Data Questioned, but Lifts Sentiment Nevertheless

The veracity of Chinese data will be questioned by economists, but today's upbeat reports round out a picture that began with stronger exports and a surge in lending. Chinese officials, we argue, had a "Draghi moment" and decided to do "whatever it takes" to strengthen the economy in the face of US tariffs and during the 70th anniversary of the Revolution.

Read More »

Read More »

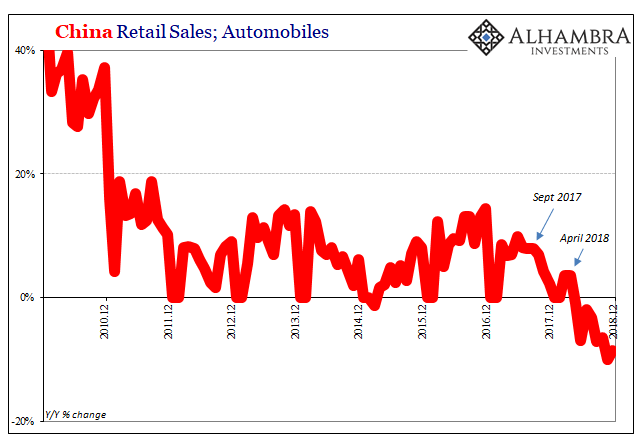

Coloring One Green Shoot

China’s Passenger Car Association reported last week that retail sales of various vehicles totaled 1.78 million units in March 2019. The total was 12% less than the number of automobiles sold in March 2018. This matches the government’s data, both sets very clear as to when Chinese economic struggles accelerated: May 2018.

Read More »

Read More »

FX Daily, April 12: Euro Bid Above $1.13 for the First Time this Month

Overview: The consolidative week in the capital markets is drawing to a close. Equity markets are narrowly mixed. In Asia, most indices outside of the greater China (China, Taiwan, and Hong Kong) edged higher, leaving the MSCI Asia Pacific Index slightly lower on the week. The MSCI Emerging Markets Index snapped a ten-day rally yesterday and is little changed so far today.

Read More »

Read More »

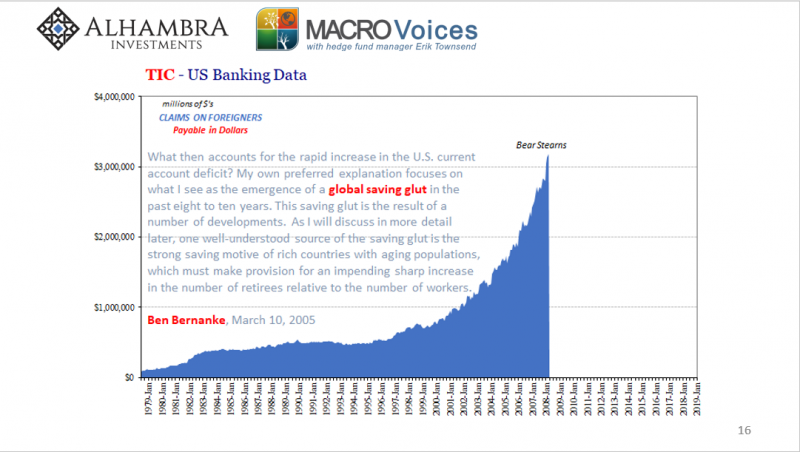

Why 2011

The eurodollar era saw not one but two credit bubbles. The first has been studied to death, though almost always getting it wrong. The Great Financial Crisis has been laid at the doorstep of subprime, a bunch of greedy Wall Street bankers insufficiently regulated to have not known any better. That was just a symptom of the first. The housing bubble itself was more than housing.

Read More »

Read More »

FX Daily, April 11: Market Yawns at Latest Brexit Extension

The S&P 500 closed higher yesterday for the ninth session in the past ten, but the coattails are short and global equities are trading with a heavier bias today. A firm CPI reading in China took a toll local shares with the Shanghai Composite, shedding 1.6%, the most in more than two weeks. European bourses are mostly in the red.

Read More »

Read More »

FX Daily, April 10: Be Careful What You Wish For

There were only a few formal disputes under NAFTA 1.0. It says more about the adjudication process than the underlying issues. It was not binding. The Democrats want stronger enforcement provisions in what the NAFTA 2.0. It is understandable. Still, without opening up the agreement, which had been already agreed to by three heads of state, it is difficult to see how this will happen.

Read More »

Read More »

FX Daily, April 8: Brexit, the EU-China, and the Abandonment of the Open Door

(I am in Mexico at the World Trade Center General Assembly, participating on a panel about USMCA--NAFTA2.0--for which approval remains elusive. It is possible that the US threatens to pull out of NAFTA 1.0 to force action by the US Congress. Mexico is due to pass legislation this week that may meet demands by the some in the US and Canada for stronger labor protections.

Read More »

Read More »

FX Weekly Preview: Important Steps Away from the Abyss

It seems to be well appreciated among by policymakers and investors that the system is ill-prepared to cope with another financial crisis. It is understandable that so many are concerned that the end of the business cycle could trigger a financial crisis. In practice, it seems like it has worked the other way around. The financial crisis triggered the Great Recession.

Read More »

Read More »

External Demand, Global Means Global

The Reserve Bank of India (RBI) cut its benchmark money rate for the second straight meeting. Reducing its repo rate by 25 bps, down to 6%, the central bank once gripped by political turmoil has certainly shifted gears. Former Governor Urjit Patel was essentially removed (he resigned) in December after feuding with the federal government over his perceived hawkish stance.

Read More »

Read More »

FX Daily, April 04: Limited Price Action Does not Do Justice to Macro Developments

Overview: The global capital markets are subdued despite several macro developments. The US and China may announce as early as today when the two presidents will meet to ostensibly sign a trade deal, while House of Commons effort to block a no-deal exit goes to the House of Lords today. India cut interest rates by 25 bp, the second consecutive cut.

Read More »

Read More »

FX Daily, April 01: China Reanimates the Animal Spirits, While Europe Finds New Ways to Disappoint

Overview: Better than expected German retail sales ad employments reports at the end of last week has been followed by gains in China's official PMI and Caixin's manufacturing reading. However, the spillover from China was limited in Asia. Japan's Tankan survey and outlook disappointed and South Korea's exports and imports were weaker than expected.

Read More »

Read More »

FX Weekly Preview: The Green Shoots of Spring

Investors have worked themselves into a lather. Equities crashed in Q4 last year amid on corporate earnings and concerns about growth. The Fed’s tightening decision in December was made unanimously. The above-trend growth, the preferred inflation measure was near target, unemployment was the lowest in a generation and real rates were historically low.

Read More »

Read More »

Europe and China

The US-China trade talks look like they may very well continue through most of the second quarter, despite how much progress is being claimed. Meanwhile, the tariffs remain in effect, but the market's sensitivity to developments has slackened since it was clear the Trump and Xi were not going to meet at the end of this month.

Read More »

Read More »

FX Weekly Preview: The Week Ahead

The combination of the dovish hold by the Federal Reserve and the eurozone's miserable flash Purchasing Managers Index casts a pall over the economic outlook. Japan's flash PMI remained stuck at February's 48.9, while core inflation unexpectedly eased. Three months after the European Central Bank stopped buying bonds, the German 10-year Bund yield fell below zero for the first time since 2016.

Read More »

Read More »

Slump, Downturn, Recession; All Add Up To Sideways

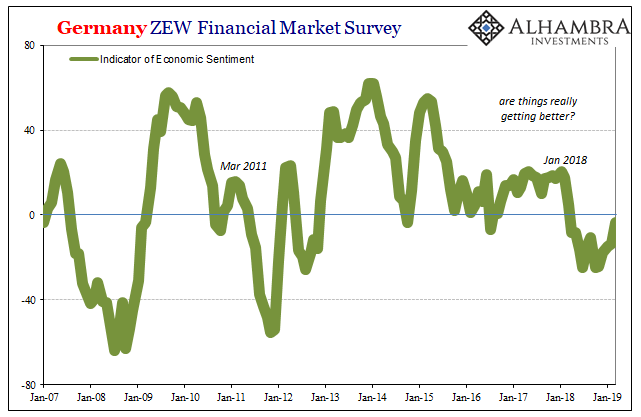

According to Germany’s Zentrum für Europäische Wirtschaftsforschung, or ZEW, the slump in the country’s economy has now reached its fourteenth month. The institute’s sentiment index has improved in the last two, but only slightly. As of the latest calculation released today, it stands at -3.6.

Read More »

Read More »

There at the Beginning

Sometimes it is difficult to gain perspective. That is why it may be difficult to see the forest for the trees. It is as we spend most of our time climbing a mountain: One handhold and foothold at a time. Immediacy and urgency limit our peripheral and forward visions.

Read More »

Read More »

No Sign of Stimulus, Or Global Growth, China’s Economy Sunk By (euro)Dollar

Najib Tun Razak was elected as Malaysia’s Prime Minister in early 2009. Taking office that April amid global turmoil and chaos, Najib’s first official visit was to Beijing in early June. His father, also Malaysia’s Prime Minister, had been the first among Asian nations to open formal diplomatic relations with China thirty-five years before.

Read More »

Read More »

China Has No Choice

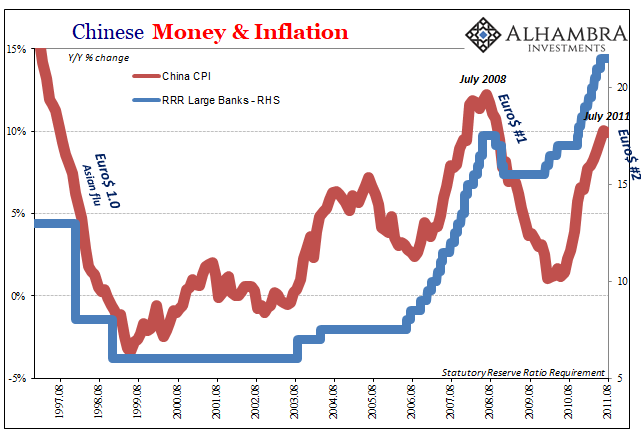

China’s central bank was given more independence to conduct monetary policies in late 2003. It had been operating under Order No. 46 of the President of the People’s Republic of China issued in March 1995, which led the 3rd Session of the Eighth National People’s Congress (China’s de facto legislature) to create and adopt the Law of the People’s Republic of China on the People’s Bank of China.

Read More »

Read More »