Tag Archive: China

FX Daily, July 22: Pang of Uncertainty Spurs Profit-Taking

The optimism among investors appears to have evaporated in the face of new US-Chinese tensions, possible delays in the next US fiscal stimulus, and new record virus infections in Australia and Hong Kong. US stocks had pared early gains yesterday, and the high-flying NASDAQ finished lower after setting new record highs.

Read More »

Read More »

Of Incomplete Plans and Recoveries

At the monthly press conference China’s National Bureau of Statistics (NBS) now regularly gives whenever the Big Three economic accounts are updated (this time along with quarterly GDP), spokesman Liu Aihua was asked by a reporter from Reuters to comment on how the global economic recession might impact the Communist government’s long range goal of reaching its assigned GDP target.

Read More »

Read More »

FX Daily, July 20: Markets Yawn, Deal or No Deal

Overview: While there are signs that Europe has reached a compromise on the grant/loan issue, the spillover into the markets is quite limited. China, with Shanghai's 3.1% gain, led a few markets in the Asia Pacific region higher, including Japan and India. Most markets were lower, and Europe's Dow Jones Stoxx 600 is a fractionally firmer, recovering from initial losses.

Read More »

Read More »

FX Daily, July 16: Equities Slide and the Greenback Bounces After China’s GDP and Before the ECB

Overview: Profit-taking, perhaps spurred by disappointing retail sales figures, sent Chinese equity markets down by 4.5%-5.2% today, the most since early February. It appears to be triggering a broader setback in equities today. The Hang Seng fell 2%, and most other markets in the region were off less than 1%.

Read More »

Read More »

FX Daily, July 15: The Dollar Slumps and EU Court Rules in Favor of Apple

A recovery in US stocks yesterday, coupled with optimism over Moderna's vaccine, is providing new fodder for risk appetites today. Equities are being driven higher, and the dollar is under pressure. Most equity markets in Asia advanced. China and Taiwan were exceptions, and, in fact, the Shanghai Composite fell for the second consecutive session for the first time in a month.

Read More »

Read More »

FX Daily, July 14: Turn Around Tuesday Began Yesterday

Overview: Turn around Tuesday began yesterday with a key reversal in the high-flying NASDAQ. It soared to new record highs before selling off and settling below the previous low. The S&P 500 saw new four-month highs and then sold-off and ended on its lows with a loss of nearly 1% on the session. Asia Pacific shares fell, led by declines in Hong Kong and India.

Read More »

Read More »

FX Daily, July 13: Risk Appetites Firm, but the Greenback is Mixed

Equities began the week on a firm note in the Asia Pacific region. The Nikkei gained more than 2%, and the profit-taking seen in China ahead of the weekend was a one-day phenomenon. The Shanghai Composite rose 1.8%, and the Shenzhen Composite surged 3.5%. Taiwan and South Korea markets also rallied more than 1%.

Read More »

Read More »

FX Daily, July 10: Surge in Coronavirus Spooks Investors as China Takes Profits

Record fatalities in a few US states, coupled with new travel restrictions in Italy and Australia, have given markets a pause ahead of the weekend. News that two state-backed funds in China took profits snapped the eight-day advance in Shanghai at the same time as there is an attempt to rein in the use of margin.

Read More »

Read More »

Second Wave Global Trade

Unlike some sentiment indicators, the ISM Non-manufacturing, in particular, actual trade in goods continued to contract in May 2020. Both exports and imports fell further, though the rate of descent has improved. In fact, that’s all the other, more subdued PMI’s like Markit’s have been suggesting.

Read More »

Read More »

Cool Video: Dollar, Trade, and China on TDA Network

I began my career as a reporter on the floor of the Chicago Mercantile Exchange, covering the currency futures and short-term interest rate futures for a news wire. Among other things, I learned that often, the locals, people trading with their own money and wits, would take the opposite side of trades of the institutional players.

Read More »

Read More »

FX Daily, July 6: New Record Number of Covid Cases Doesn’t Curtail Appetite for Risk

Overview: A new daily high number of contagions globally has been reported, but the risk-appetites have been stoked. Chinese stocks have been on a tear. The Shanghai Composite rallied 5.7% today to bring the five-day advance to 13.6%. Most other regional markets, including Hong Kong, rallied as well (3.8%). Australia was the main exception, and it pulled back by 0.7%. It is still up a solid 3.4% over the past five sessions.

Read More »

Read More »

FX Daily, July 1: Second Verse Can’t be Worse than the First, Can it?

The resurgence of the contagion in the US has stopped or reversed an estimated 40% of the re-openings, but the appetite for risk has begun the second half on a firm note, helped by manufacturing PMIs that were above preliminary estimates or better than expected. Except for Tokyo and Seoul, equities in the Asia Pacific region rose. The MSCI Asia Pacific Index rose almost 15.5% in Q2.

Read More »

Read More »

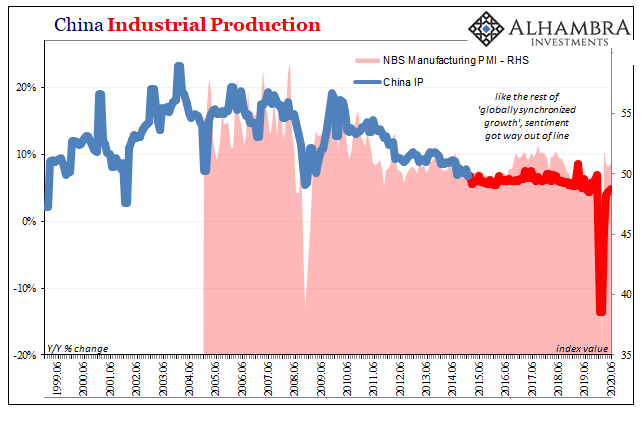

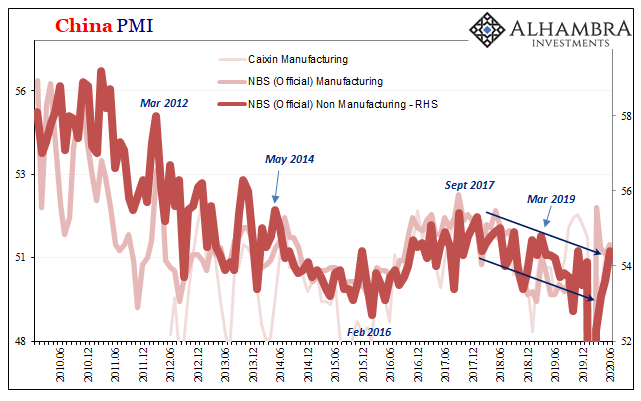

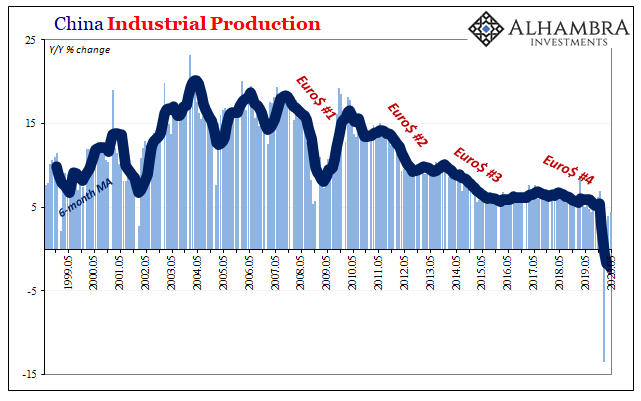

What The PMIs Aren’t Really Saying, In China As Elsewhere

China’s PMI’s continue to impress despite the fact they continue to be wholly unimpressive. As with most economic numbers in today’s stock-focused obsessiveness, everything is judged solely by how much it “surprises.” Surprises who? Doesn’t matter; some faceless group of analysts and Economists whose short-term modeling has somehow become the very standard of performance.

Read More »

Read More »

FX Daily, June 30: When Primary is Secondary

The gains in US equities yesterday carried into Asia Pacific trading today, but the European investors did not get the memo. The Dow Jones Stoxx 600 is succumbing to selling pressure and giving back yesterday's gain. Energy and financials are the biggest drags, while real estate and information technology sectors are firm. All the markets had rallied in the Asia Pacific region, with the Nikkei and Australian equities leading with around 1.3%...

Read More »

Read More »

FX Daily, June 29: USD is Offered in Quiet Start to the New Week

The combination of rising virus cases and the sell-off in the US before the weekend dragged nearly all the Asia Pacific bourses lower. The Nikkei led the way with more than a 2% drop, but most bourses were off more than 1%. China and Taiwan were also greeted with selling as markets re-opened from a two-day holiday at the end of last week.

Read More »

Read More »

FX Daily, June 24: Risk Appetites Satiated for the Moment

Overview: The rally in risk assets in North America yesterday is failing to carry over into today's activity. Asia Pacific equities were mixed. Korea and Indonesia led the advances with more than 1% gain. China and Taiwan also gained. Japan and Hong Kong. Europe's Dow Jone's Stoxx 600 is giving back yesterday's gains (~1.3%) plus some and US stocks are heavy.

Read More »

Read More »

FX Daily, June 23: Weebles Wobble but they Don’t Fall Down

Overview: After early indecision, investors ramped the demand for risk assets, encouraged perhaps by indications that the Trump Administration going to support at least another trillion-stimulus package. The NASDAQ rallied to new record highs, and the dollar got thumped across the board. However, in early Asia activity, Trump adviser Navarro seemed to have told Fox News that the US-China trade deal was over.

Read More »

Read More »

FX Daily, June 22: Dollar Begins Week on Back Foot

Overview: Investors begin the new week, perhaps slowed a bit by the weekend developments and the growth of new infections. Equities are mixed. The MSCI Asia Pacific Index snapped a four-day advance, though India bucked the regional trend and gained 1%. Europe's Dow Jones Stoxx 600 is recovering from an early dip to four-day lows. US shares are trading higher after the S&P 500 closed below 3100 ahead of the weekend after reaching 3155.

Read More »

Read More »

FX Daily, June 17: Correction Phase does not Appear Over

Overview: Investors have not yet completely shaken off the angst that saw equities slide last week. All equity markets in the Asia Pacific region, but Japan, edged higher today, including China, India, and South Korea, where political/military tensions are elevated. Europe followed suit, and the Dow Jones Stoxx 600 is firm near yesterday's highs. It has entered but not yet filled the gap created by the sharply lower opening on June 11.

Read More »

Read More »

A Chinese Outbreak (of Li v. Xi, Round 2)

Here they are again, seemingly at odds over how to proceed. Reminiscent of prior battles over whether to revive the economy or just let it go where it will, it appears as if China is in for Xi vs. Li Round 2. Or is it all just clever politics? Li Keqiang may be nominally the Chinese Premier but he’s a very distant second on every list of power players. Xi Jinping holds all the top spots, including a 2017-18 consolidation of power that left Xi...

Read More »

Read More »