Tag Archive: China Industrial Production

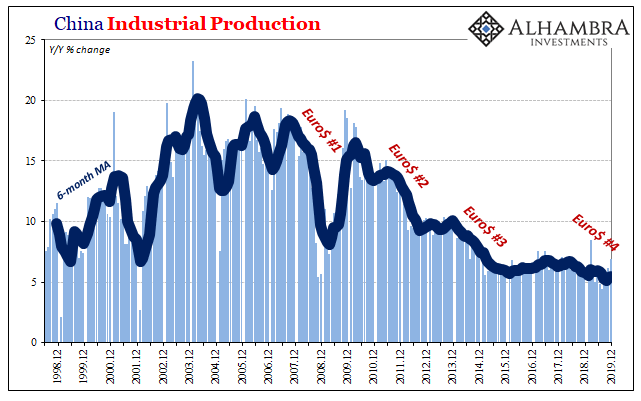

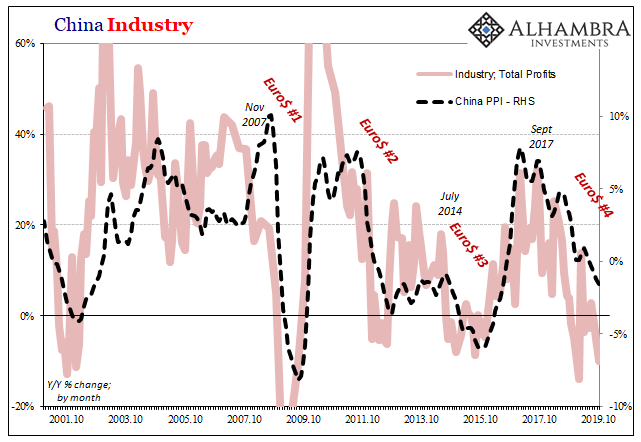

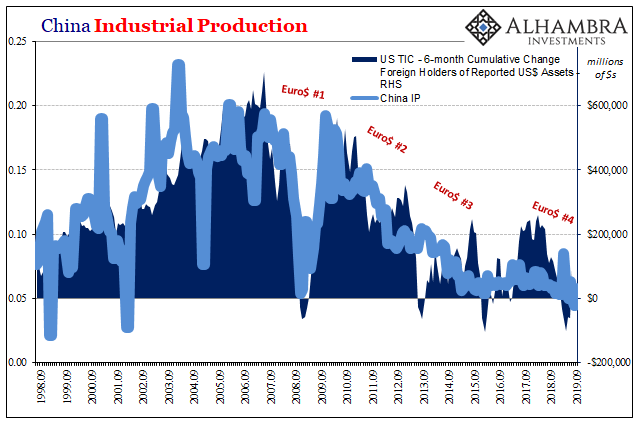

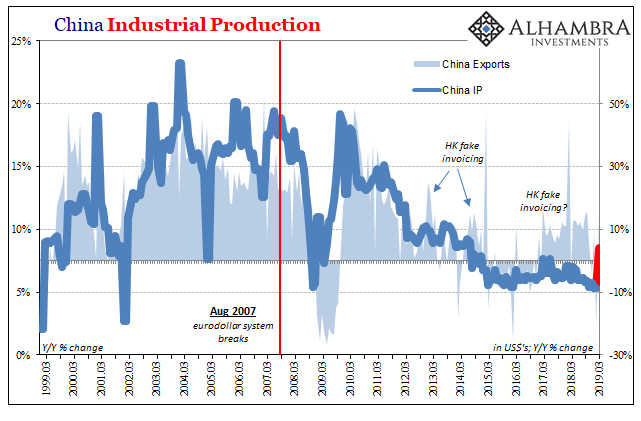

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

Assessing China’s Economic Risks

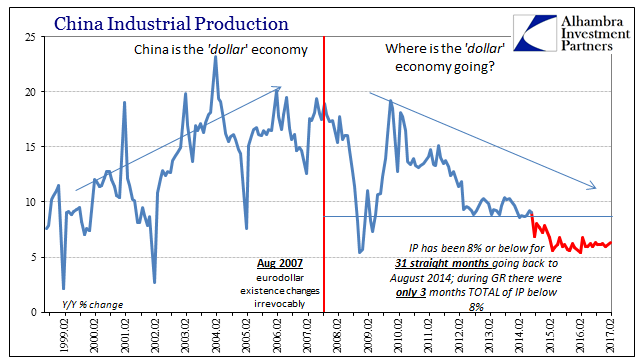

First quarter GDP in China rose 6.9%, better than expected and above the government’s target (6.5%) for 2017. It stands to reason, however, that if Communist officials thought they could get 6.9% to last for the whole year they would have made it their target, especially since 6.5% would be less than the GDP growth rate for 2016 (6.7%). In only that one way is China’s GDP statistic meaningful.

Read More »

Read More »

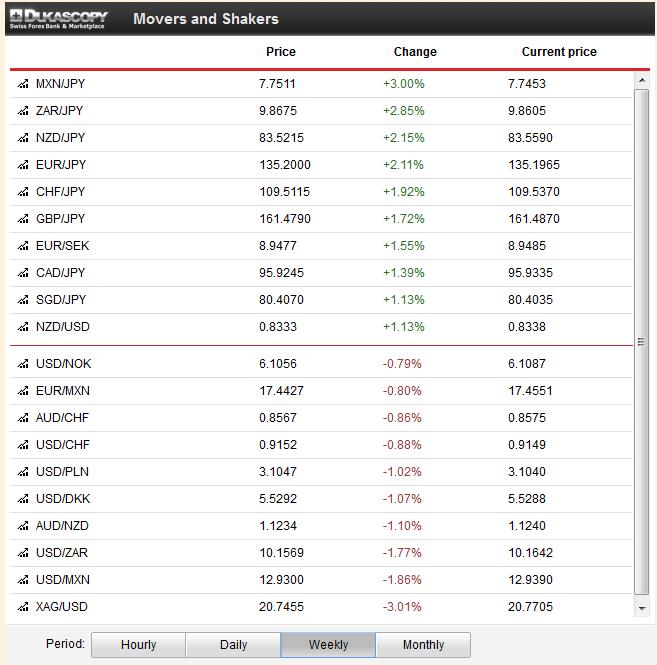

FX Daily, April 17: Markets Trying to Stabilize in Holiday-Thin Activity

Financial centers in Europe are closed for the extended Easter holiday. Australian and New Zealand markets were also closed. The drop in US 10-year Treasury yields in early Asia, with a brief push below 2.20%, appears to have kept the dollar under pressure. As the North American market prepares to open, the dollar is softer against the all major currencies and many emerging market currencies.

Read More »

Read More »

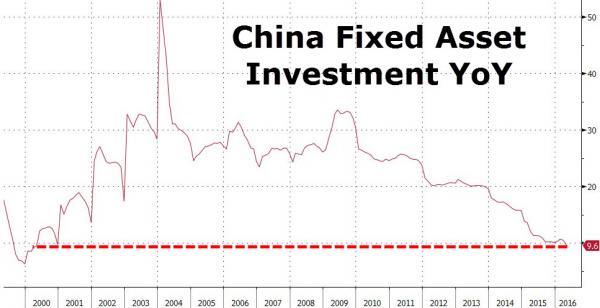

China Starts 2017 With Chronic, Not Stable And Surely Not ‘Reflation’

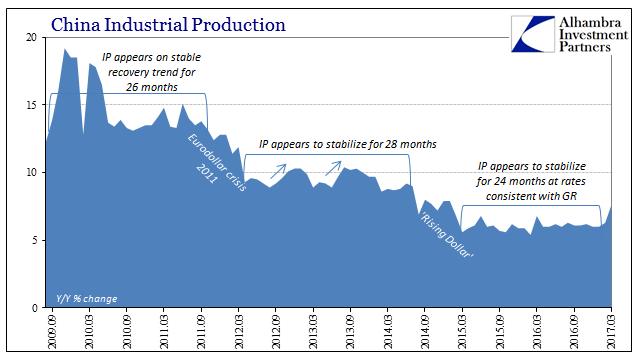

The first major economic data of 2017 from China was highly disappointing to expectations of either stability or hopes for actual acceleration. On all counts for the combined January-February period, the big three statistics missed: Industrial Production was 6.3%, Fixed Asset Investment 8.9%, and Retail Sales just 9.5%.

Read More »

Read More »

FX Daily, March 14: Brexit Takes Fresh Toll on Sterling, While Dollar Firms more Broadly

UK Prime Minister May got the parliamentary approval the courts ruled was necessary to formally trigger Article 50. It is not clear what UK she will lead out the EU. Scotland is beginning the legal proceedings to hold another referendum on independence. There is some talk that Northern Ireland, which voted to remain, might be allowed to rejoin the Republic of Ireland.

Read More »

Read More »

FX Daily, January 20: Trump Day

The dollar peaked against the yuan two days after the Federal Reserve hiked interest rates in the middle of last month. We argue that that is when the market correction began, not at the turn of the calendar. Despite claims that China's currency is dropping like a rock, it has actually risen for the fifth consecutive week. That is the longest rising streak for the yuan since early 2016.

Read More »

Read More »

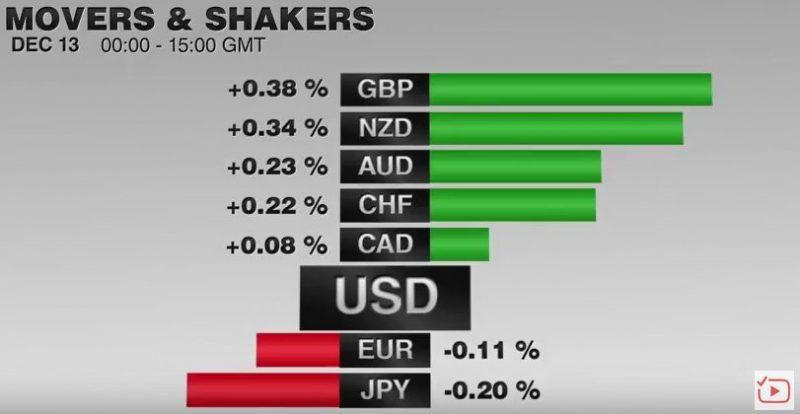

FX Daily, December 13: Narrowly Mixed Dollar Conceals Resilience

The US dollar is little changed against most of the major currencies. The dollar finished yesterday's North American session on a soft note, but follow through selling has been limited. After rallying to near 10-month high above JPY116 yesterday, the greenback finished on session lows near JPY115.00. Initial potential seemed to extend toward JPY114.30, but dollar buyers reemerged near JPY114.75, and it rose back the middle of the two-day range...

Read More »

Read More »

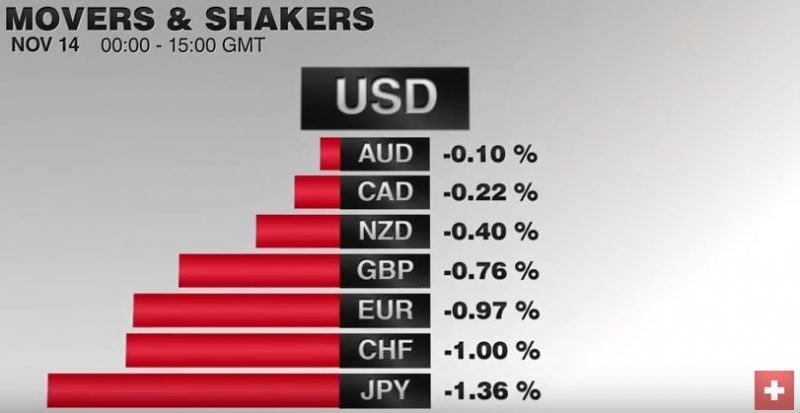

FX Daily, November 14: Dollar Steps Up to Start Week

The US dollar rally that moved into a higher gear in the second half of last week has begun the new week with a bang. It is up against nearly all the major and emerging market currencies. Even sterling, which last week, managed to eke out modest gains against the greenback is under pressure today.

Read More »

Read More »

FX Daily, October 19: FX After China GDP

The Swiss Franc has strengthened against the pound as global uncertainty persists in the form of the UK’s Brexit vote and the US Presidential Election. Looking ahead it seems the CHF may soften a little as we learn of the new President, I found it very interesting that yesterday Paddy Power paid out on any bets for Hilary Clinton to become President in the United States.

Read More »

Read More »

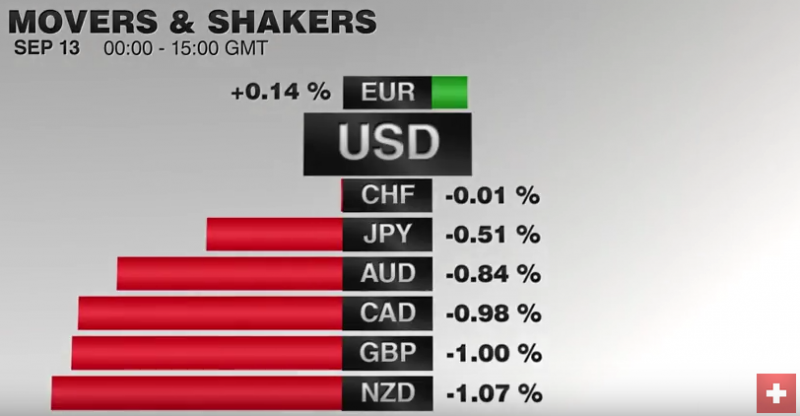

FX Daily, September 13: Much Noise, Weak Signal

The last ECB meeting and Dragh's hawkish comments is for us the main reason of the euro strength, this despite stronger Swiss GDP growth.

Read More »

Read More »

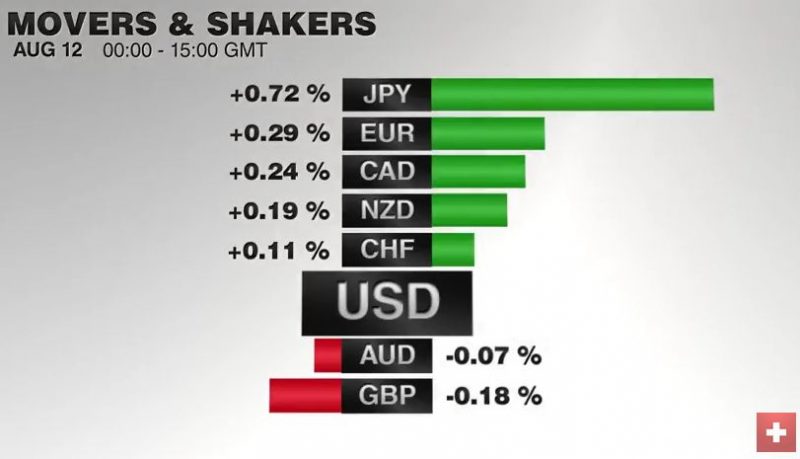

FX Daily, August 12: Summer Markets Grind into the Weekend

There is a general consolidative tone in the capital markets as the week draws to a close. The US retail sales report may offer a brief distraction, but it is unlikely to significantly shift expectations about the trajectory of Fed policy. Indeed, it might not really change investors' information set.

Read More »

Read More »

FX Daily, July 15: Sterling and Yen Remain Key Drivers in FX

The US dollar is broadly mixed against the major currencies. The Swiss franc's 0.25% gain puts it at the top of the board, after sterling's earlier gains were largely unwound in late-morning turnover. The yen is the weakest major; extending its loss by 0.6%, to bring the weekly decline to more than 5%. The pre-referendum result high for the dollar was near JPY106.85. Today's high has been about JPY106.30. In emerging markets, we note that the...

Read More »

Read More »

China and Japan Chart Update

A chart-up from China and Japan. Growth of Chinese industrial production, retail sales, fixed asset investment is at lows not seen since the Asian financial crisis. The Yuan is falling. Economic data from Japan is not a lot better.

Read More »

Read More »

Fundamentals,FX,Gold and CHF:Week November 11 to November 15

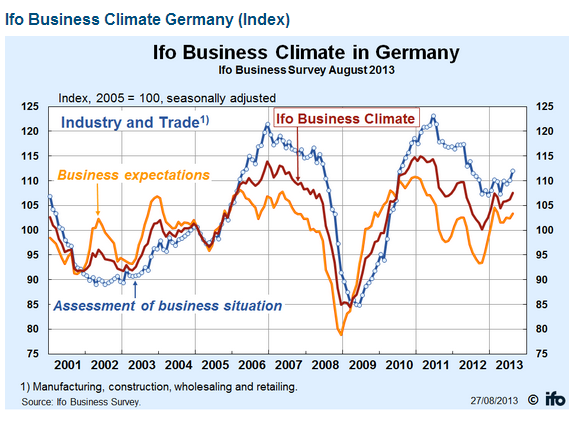

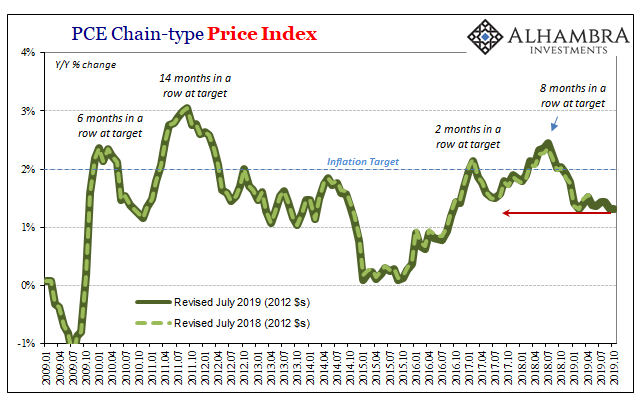

Fundamentals with highest importance: In Janet Yellen’s hearing at the Senate Banking Commission, the future Fed chair emphasized the need to provide support to the economic recovery and to overcome low inflation. Her speech supported equities, gold and US Treasuries. GDP in the Euro zone rose by 0.1% QoQ in line with expectations, but less …

Read More »

Read More »