Tag Archive: China Gross Domestic Product

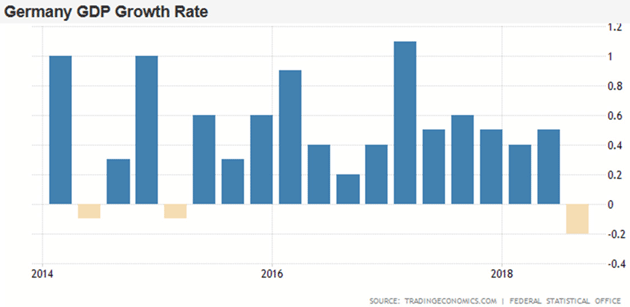

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health. A stronger than expected number should be taken as positive for the EUR and a lower than expected number as negative to the EUR.

China Enters 2020 Still (Intent On) Managing Its Decline

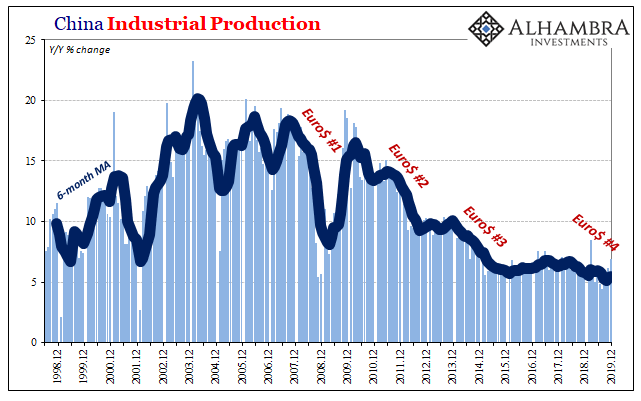

Chinese Industrial Production accelerated further in December 2019, rising 6.9% year-over-year according to today’s estimates from China’s National Bureau of Statistics (NBS). That was a full percentage point above consensus. IP had bottomed out right in August at a record low 4.4%, and then, just as this wave of renewed optimism swept the world, it has rebounded alongside it.

Read More »

Read More »

More Synchronized, More Downturn, Still Global

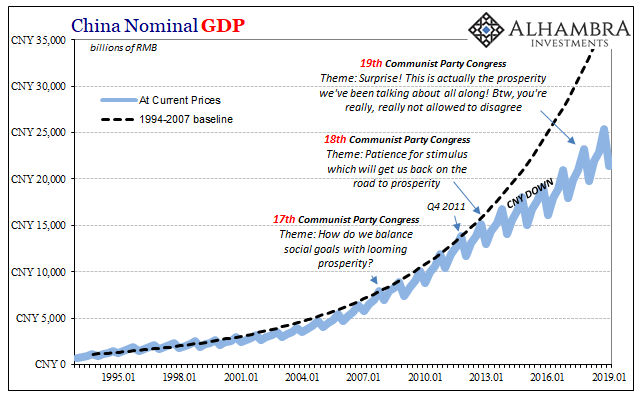

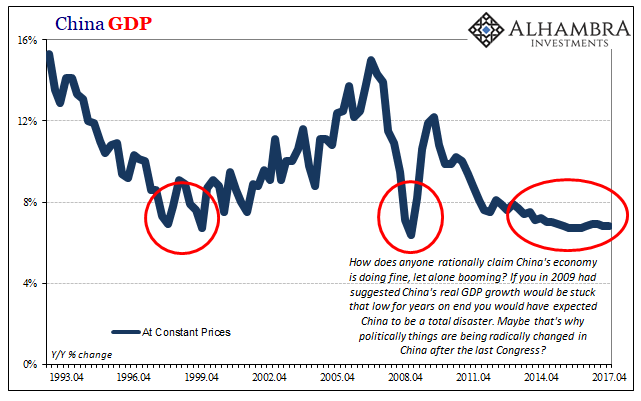

China was the world economy’s best hope in 2017. Like it was the only realistic chance to push out of the post-2008 doldrums, a malaise that has grown increasingly spasmatic and dangerous the longer it goes on. Communist authorities, some of them, anyway, reacted to Euro$ #3’s fallout early on in 2016 by dusting off their Keynes. A stimulus panic that turned out to be more panic than stimulus.

Read More »

Read More »

FX Daily, October 18: Markets Becalmed Ahead of the Week

Overview: The global capital markets are ending the week on a subdued note as the UK Parliament decision on Saturday is awaited. The weaker Chinese Q3 GDP had little impact outside of China, where stocks fell over 1%. A brief suspension of hostilities by Turkey was sufficient for the US to lift its threatened sanctions.

Read More »

Read More »

China’s Big Gamble(s): Betting on QE Again?

As an economic system, even the most committed socialists had come to realize it was a failure. What ultimately brought down the Soviet Union wasn’t missiles, tanks, and advanced air craft, it was a simple thing like bread. You can argue that Western military spending forced the Communist East to keep up, and therefore to expend way too much on guns at the expense of butter.

Read More »

Read More »

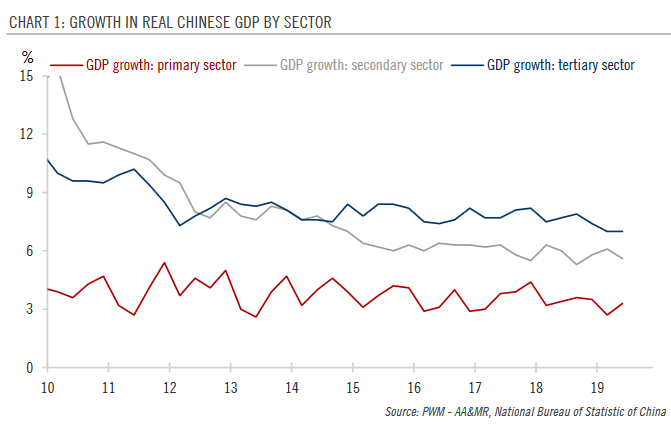

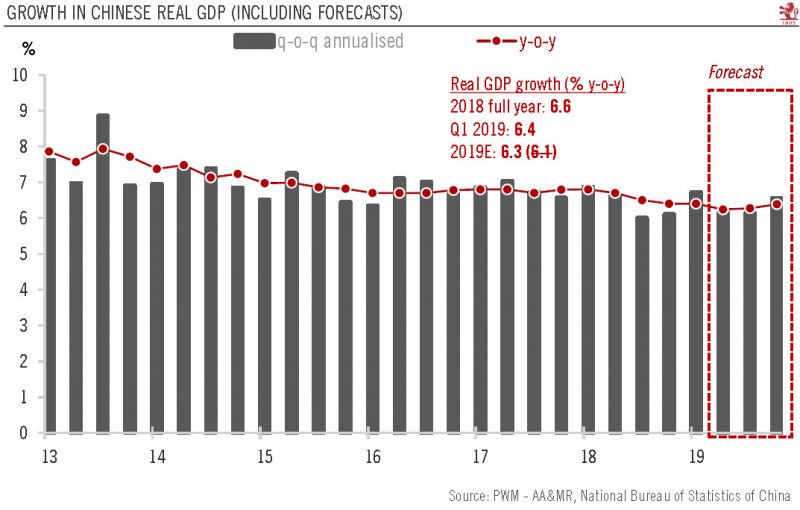

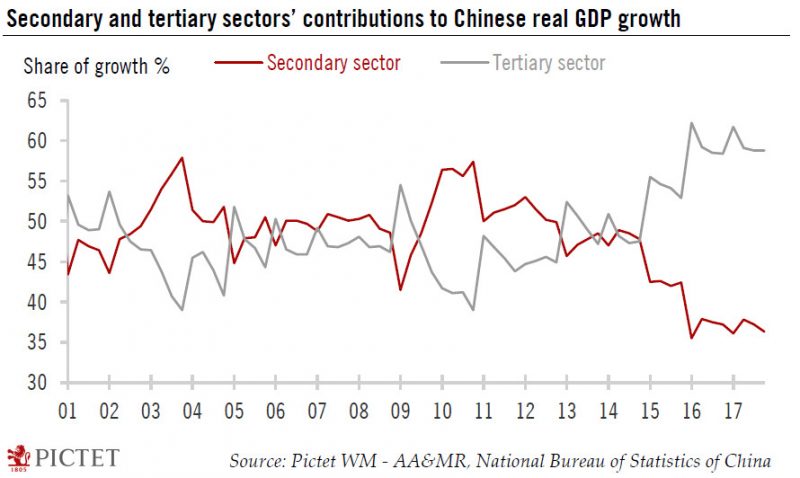

China: Q2 growth lowest in decades

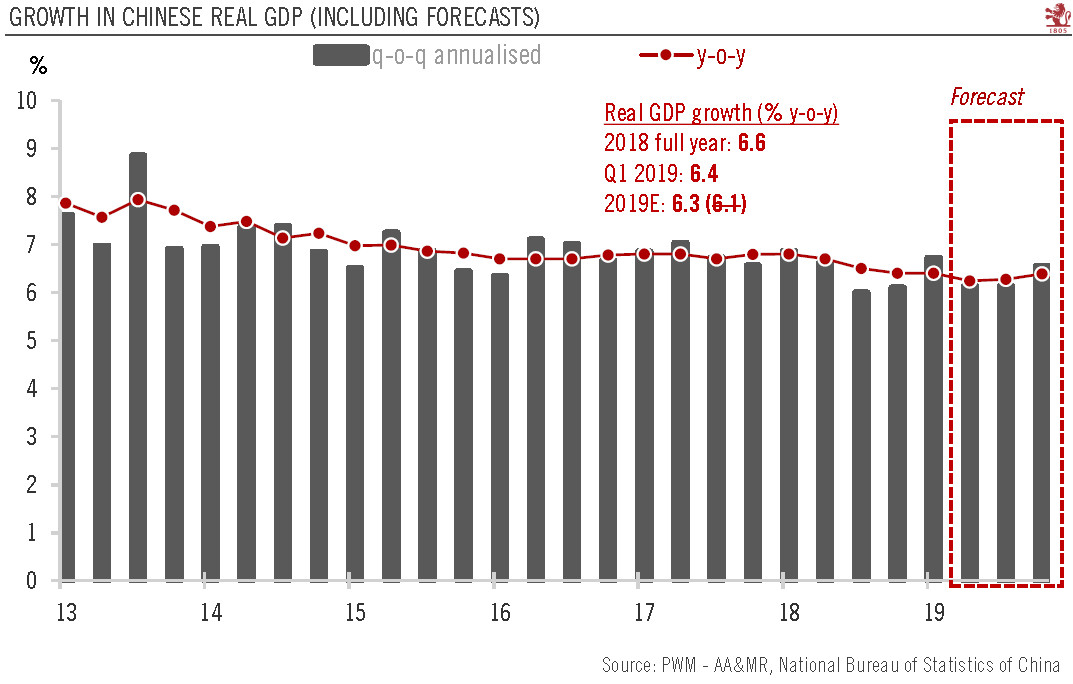

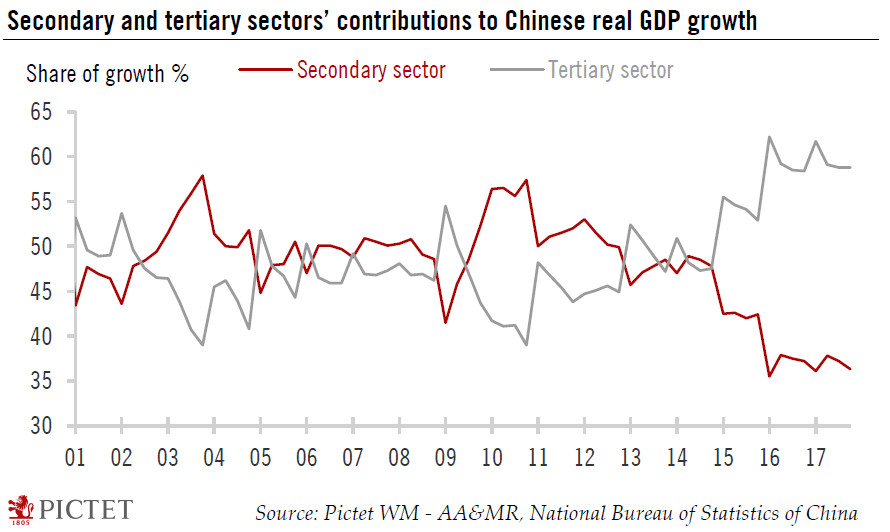

Downward pressure on growth persists amid ongoing trade tensions.Chinese real GDP growth came in at 6.2% year-over-year (y-o-y) in Q2, down from 6.4% in Q1, and the lowest quarterly growth in over two decades.The tertiary sector (mainly services) continued to lead growth, expanding by 7.0% y-o-y in Q2, the same as in Q1.

Read More »

Read More »

FX Daily, July 15: Marking Time on Monday

Overview: The new record highs in US equities ahead of the weekend coupled with Chinese data that suggested the economy was gaining some traction as Q2 wound down is helping underpin risk appetites to start the week. Japanese markets were closed today, but equities were mostly firmer in the Asia Pacific regions, markets in China, Hong Kong, Taiwan, and India firmed.

Read More »

Read More »

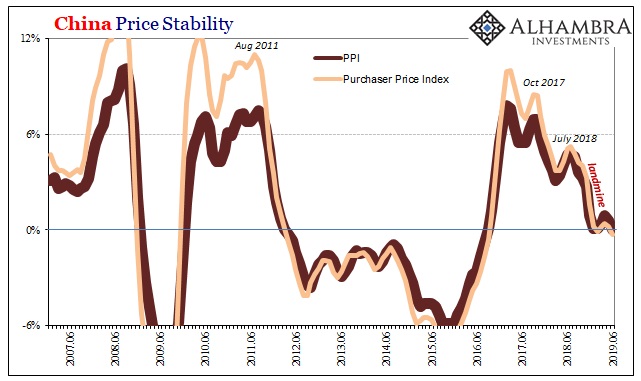

As Chinese Factory Deflation Sets In, A ‘Dovish’ Powell Leans on ‘Uncertainty’

It’s a clever bit of misdirection. In one of the last interviews he gave before passing away, Milton Friedman talked about the true strength of central banks. It wasn’t money and monetary policy, instead he admitted that what they’re really good at is PR. Maybe that’s why you really can’t tell the difference Greenspan to Bernanke to Yellen to Powell no matter what happens.

Read More »

Read More »

What Tokyo Eurodollar Redistribution Really Means For ‘Green Shoots’

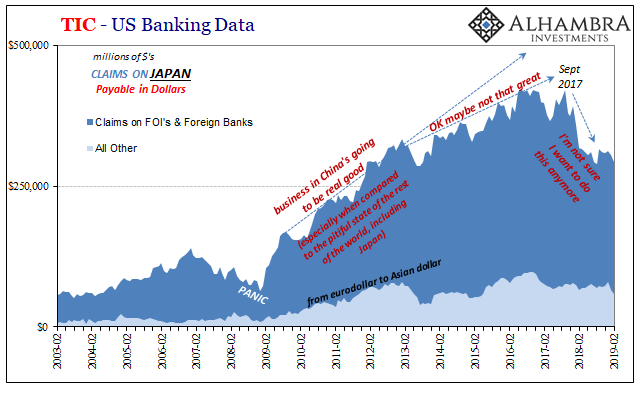

Last April, monetary officials in Japan were publicly contemplating ending asset purchases under QQE. This April, they are more quietly wondering what other financial assets they might have to buy just to keep it all going a little longer. I’d suggest something like the clouds passing over the islands or the ocean water surrounding them. Nobody would notice either way and it would be equally as effective.

Read More »

Read More »

The Eurodollar, Unfortunately, Is What Is Rebalancing China’s Services Economy

If the “equation” CNY DOWN = BAD is valid, and it is, then what drives CNY downward in the first place? In conventional Economics, authorities command the currency to affect the level of exports. In reality, that’s not at all how it works. The eurodollar system of shadow money is almost purely calculated risk versus return.

Read More »

Read More »

China: Q1 growth beats expectations

The Chinese economy grew at a faster rate than expected in the first quarter as policy stimulus effects kick in.The National Bureau of Statistics of China published Q1 GDP figures along with some key economic indicators for March. The data generally surprised on the upside. While we had previously flagged the upside risk to our earlier GDP forecast following the rebound in PMIs and strong credit numbers, the latest data releases still surprised to...

Read More »

Read More »

China’s Eurodollar Story Reaches Its Final Chapters

Imagine yourself as a rural Chinese farmer. Even the term “farmer” makes it sound better than it really is. This is a life out of the 19th century, subsistence at best the daily struggle just to survive. Flourishing is a dream.

Read More »

Read More »

Brexit, EU, Germany, China and Yellow Vests In 2019 – Something Wicked This Way Comes

“Something wicked this way comes” warns John Mauldin. Shaky China: Chinese landing could be harder than expected. Brexit and EU Breakage: “I have long thought the EU will eventually fall apart”. Helpless Europe: If Germany sneezes, their banks & the rest of continent catches cold. We may see “yellow vests” spread globally: Economics is about to get interesting …

Read More »

Read More »

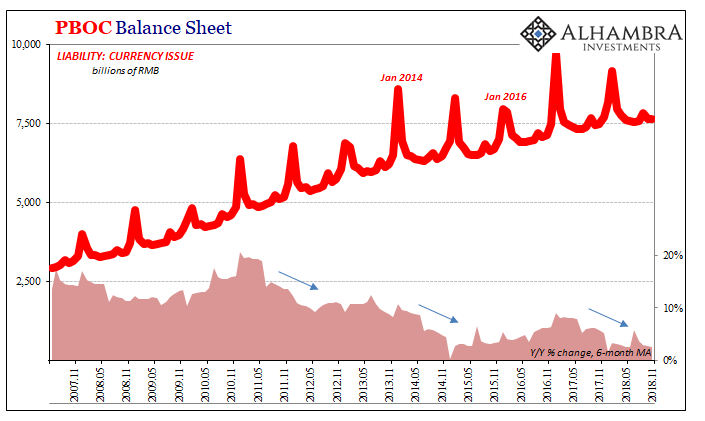

China’s Global Slump Draws Closer

By the time things got really bad, China’s economy had already been slowing for a long time. The currency spun out of control in August 2015, and then by November the Chinese central bank was in desperation mode. The PBOC had begun to peg SHIBOR because despite so much monetary “stimulus” in rate cuts and a lower RRR banks were hoarding RMB liquidity.

Read More »

Read More »

FX Daily, July 16: Dollar Softens a Little as Market Awaits Developments

The US dollar is slightly softer against most of the major currencies but is in narrow ranges ahead of today's key events, which include US retail sales and the debate in the UK parliament over Brexit. The yen is the main exception. The local markets are closed for a public holiday, and the yen did initially strengthen (the dollar eased to ~JPY112.10) but surrendered those gains and consolidating its biggest loss last week in 10 months.

Read More »

Read More »

The Boom Reality of Uncle He’s Globally Synchronized L

Top Chinese leadership is taking further shape. With Xi Jinping’s continuing consolidation of power going on right this minute, most of the changes aren’t really changes, at least not internally. To the West, and to the mainstream, what the Chinese are doing seems odd, if not more than a little off. Unlike in the West, however, there is determined purpose that is in many ways right out in the open. Many here had been expecting that outgoing PBOC...

Read More »

Read More »

China Going Boom

For a very long time, they tried it “our” way. It isn’t working out so well for them any longer, so in one sense you can’t blame them for seeking answers elsewhere. It was a good run while it lasted. The big problem is that what “it” was wasn’t ever our way. Not really. The Chinese for decades followed not a free market paradigm but an orthodox Economics one. This is no trivial difference, as the latter is far more easily accomplished in a place...

Read More »

Read More »

China: 2018 GDP forecast revised up

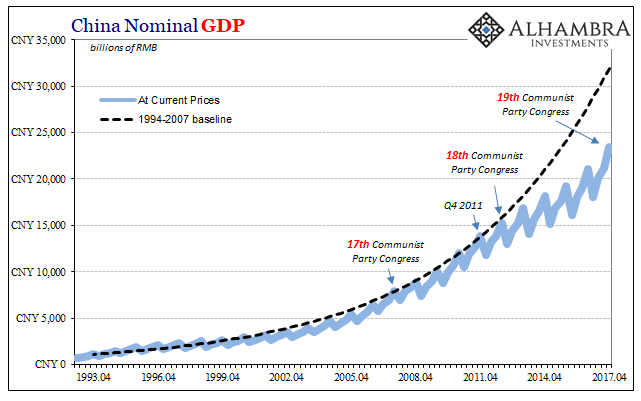

The Chinese economy ended 2017 on a strong note. In Q4 2017, China’s GDP amounted to Rmb23.4 trillion (about USD3.7 trillion), rising 1.6% over the previous quarter and 6.8% year-over-year (y-o-y) in real terms. Full-year GDP came in at Rmb82.7 trillion (about USD12.9 trillion), growing by 6.9% in real terms and beating the consensus forecast as well as our own estimate (both at 6.8%).

Read More »

Read More »

FX Daily, January 18: Currencies Consolidate After Chop Fest

The US dollar rallied in the North American afternoon yesterday and the timing coincided with the release of the Fed's Beige Book that saw several districts report wage and price pressures. The US 10-year yield moved toward toward 2.60%, and helped by speculation that as US companies repatriate earnings kept abroad that they may have to liquidate the investments, some of which are thought to be in Treasuries.

Read More »

Read More »

FX Daily, October 19: Kiwi Drop and Sterling Losses Punctuate Subdued FX Market

The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these factors has been addressed to some extent. Circuit breakers have been introduced, and have evolved. The financial capacity has grown immensely.

Read More »

Read More »

There Is Only One Empire: Finance

There's an entire sub-industry in journalism devoted to the idea that China is poised to replace the U.S. as the "global empire" / hegemon. This notion of global empire being something like a baton that gets passed from nation-state to nation-state is seriously misleading, in my view, for this reason:

Read More »

Read More »