As an economic system, even the most committed socialists had come to realize it was a failure. What ultimately brought down the Soviet Union wasn’t missiles, tanks, and advanced air craft, it was a simple thing like bread. You can argue that Western military spending forced the Communist East to keep up, and therefore to expend way too much on guns at the expense of butter.

Even if that was the case, the Soviet system had no surplus of bread from which to begin. It stood in sharp contrast to the American system which produced an overabundance of butter – and guns.

While one after another the Socialist states fell to populist unrest, standing almost alone the Chinese would first repress (Tiananmen Square) and then open up. Not politically, mind you, not at first. Leader Deng Xiaoping in January 1992 would famously embark on his nanxun, the imperial tour of China’s south.

As he explored was little more than vast empty stretches, he would proclaim kai fang; or, open up! Having learned something from the Soviet collapse, there had to be more thought about the way reforms would be carried out. In Communist China it would be very different; it had to be.

The Russians tried political reform (majority rule) at the same time as economic reform. That was their downfall, according the Chinese. They began the process out of necessity from a very weak position.

Make the masses happy and then let them in. Deng’s philosophy was turned into his successor’s doctrine. Jiang Zemin would eventual encode his Three Represents into the operating technocratic guidelines for the early part of the 21st century.

The Three Represents are being conducted in the same order they are given: economy, culture, politics…

The Chinese Communists would do it differently – and therefore survive. Deng Xiaoping was an economic reformer but he was by no means a pluralist. To him, you were a Communist or you were nothing. [A]ny means for strengthening China’s economy was in consideration of strengthening China’s socialist structure. Economic growth was one means, the key means to a political end.

China would grow rich, maintain its cultural identity, and then the majority would enthusiastically welcome Communism with Chinese Characteristics in every one of its forms, dissatisfaction melting away into the prosperous landscape. The people, and not just in China, would come to appreciate and admire the genius of mixing Deng with Chen; both men agreed there had to be a birdcage, and through the efforts of Jiang they would further recognize the technocratic Chinese structure as the best way to decide its proportions.

It was all going so well…until 2008. Was Deng like Alan Greenspan in that he just happened to be in the right place at the right time, the accidental beneficiary of the eurodollar’s rapid maturity? I don’t want to take too much away here, in that there was more than luck involved in positioning China to really take advantage of what was coming – in sharp contrast to the rest of the Communist clique.

| But at its root, China’s prosperity depended upon more outside than in. That’s a pretty big flaw given how the last decade has unfolded on the outside; or, more precisely, offshore. As noted earlier today, the attempted transition toward an inner-facing economic system isn’t quite going as planned.

China’s population, though, has still been thinking in the same order as 1995; get wealthy, maintain China’s cultural identity, and then political reform allowing the majority into the process once it was proved they should be happy with the results. It is at this point you might recognize the dangers officials faced only starting in 2015. |

China GDP, 2001-2019 |

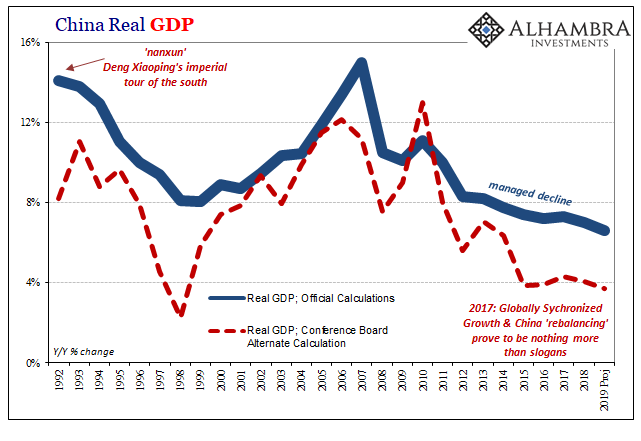

| China’s GDP numbers have always been suspect. Alternate calculations like those made by the US Conference Board suggest not just less growth overall but more so when the numbers differ. When China’s economy has been really weak that’s when the Communists attempt to “smooth” out the difference.

It’s almost like Keynesian “stimulus” in that regard; fill in the troughs with fake growth and then give it back by underestimating when the economy goes on the upswing. |

China Real GDP, 1992-2019(see more posts on China Gross Domestic Product, ) |

| The problem beginning in 2015 is therefore all the more stunning. After the slowdown in 2012-13, which was likely worse than estimated by official GDP, it seems like there may have been some expectation for 2014 to pay off. Instead, global growth (not yet synchronized) would run smack into Euro$ #3 catching everyone by surprise.

One of the strangest episodes of Euro$ #3 was the ridiculously over-the-top currency management which showed up in March 2015. From this context you can appreciate the attempt, the priority of stabilizing the currency at an extremely crucial moment even at great cost. |

China Internal/External, 2014-2015 |

| What they were doing, that’s not really the issue in my eyes. It was a make or break moment, to hold together whatever might remain of all three of the Three Represents.

But why March-April 2015? Was it chosen at random? Seems highly unlikely. Since we’ll likely never know for sure, you are free to draw your own conclusions. In my view, it was Europe and to a lesser extent the United States. I think there was a specific purpose behind the CNY gamble – the ECB had just launched its QE. At the same time, the Federal Reserve which had been gung-ho about getting on with interest rate hikes began to express more serious doubts (the first Fed “pause”). It seems at least plausible that Chinese monetary officials at the PBOC and Economic officials in the government were willing to stake real effort in the (vain) hopes Europe’s QE and a less “hawkish” Fed might stabilize the global system for them. |

PBOC Balance Sheet, 2014-2016 |

| If those together had worked, holding fast to CNY would’ve kept China’s economic damage to a minimum, perhaps setting the stage for a sharper and less risky comeback in 2016 and 2017. Smooth out the stats and hold fast on the currency, therefore maybe a realistic chance to keep the miracle somewhat together and at least moving in the right direction.

So, it is curious that once again we see a lot of the same things from March-July 2015 being repeated in the Chinese domain. CNY has clearly been fixed since around May 17, and the “assets” are again showing up as “other.” Furthermore, what’s the ECB and Fed up to over the next few months? There are going to be rate cuts and very likely at least a European restart of their QE. In other words, are we seeing China stake CNY to above 7.0 on the same (bad) premise(s) as 2015? It may not be as random a place to draw the line as it might otherwise seem. In the political context, it’s as rational as maybe anyone should expect. The 19th Communist Party Congress already rewrote the Three Represents so that the first promises only “quality” economic growth (wink, wink). That’s already a pretty big downgrade – and one directly related to losing that 2015 gamble. |

PBOC Balance Sheet, 2017-2019 |

| The last thing authorities want politically is for the majority currently on the outside expecting to be let in to be let down twice in quick succession; October 2017 already gave up on robust economic growth and the universally wealthy background for continued political reform; now there’s the very real chance China could surrender economic growth.

It is a volatile and unpredictable mix, risks not just for the Chinese to be concerned with. The Communists managed to stave off the Soviet ending for thirty years. Maybe they thought they had been the secret ingredient behind China’s miracle transformation. Voluntary or not, it’s a more treacherous world on the other side of the miracle. There’s already a lot being staked on this week’s rate cuts. Way beyond the hopes being traded at the NYSE, it is sobering to think what else might be riding on them. And that the Fed and ECB are the basis for it all. The risks being priced in German bunds at -40 bps really do make rational sense. |

IMF World Economic Outlook, 1980-2019 |

Tags: $CNY,Bonds,China,China Gross Domestic Product,economy,EuroDollar,Federal Reserve/Monetary Policy,Markets,newsletter,PBOC,Politics,Taxes/Fiscal Policy