With these speculative and risk management skills accessible only to the wealthy, no wonder only the wealthy have gained purchasing power in the 21st century.

Let’s start with an excerpt from a recent personal account by the insightful energy/systems analyst Ugo Bardi, who is Italian but writes his blog Cassandra’s Legacy in English: Becoming Poor in Italy. The Effects of the Twilight of the Age of Oil.

“I am not poor. As a middle class, state employee in Italy, I am probably richer than some 90% of the people living on this planet. But wealth and poverty are mainly relative perceptions and the feeling I have is that I am becoming poorer every year, just like the majority of Italians, nowadays.

I know that the various economic indexes say that we are not becoming poorer and that, worldwide, the GDP keeps growing, even in Italy it sort of restarted growing after a period of decline. But something must be wrong with those indexes because we are becoming poorer. It is unmistakable, GDP or not. To explain that, let me tell you the story of the house that my father and my mother built in the 1960s and how I am now forced to leave it because I can’t just afford it anymore.

Back in the 1950s and 1960s, Italy was going through what was called the “Economic Miracle” at the time. After the disaster of the war, the age of cheap oil had created a booming economy everywhere in the world. In Italy, people enjoyed a wealth that never ever had been seen or even imagined before. Private cars, health care for everybody, vacations at the seaside, the real possibility for most Italians to own a house, and more.

My father and my mother were both high school teachers. They could supplement their salary with their work as architects and by giving private lessons, but surely they were typical middle-class people. Nevertheless, in the 1960s, they could afford the home of their dreams. Large, a true mansion, it was more than 300 square meters, with an ample living room, terraces, a patio, and a big garden.

My parents lived in that house for some 50 years and they both got old and died in there. Then, I inherited it in 2014. As you can imagine, a house that had been inhabited for some years by old people with health problems was not in the best condition.

we started doing just that. But, after a couple of years, we looked into each other’s eyes and we said, ‘this will never work.’

We had spent enough money to make a significant dent in our finances but the effect was barely visible: the house was just too big. To that, you must add the cost of heating and air conditioning of such a large space: in the 1960s, there was no need for air conditioning in Florence, now it is vital to have it. Also, the cost of transportation is a killer. In an American style suburb, you have to rely on private cars and, in the 1960s, it seemed normal to do that. But not anymore: cars have become awfully expensive, traffic jams are everywhere, a disaster. Ah…. and I forgot about taxes: that too is rapidly becoming an impossible burden.

And so we decided to sell the house. We discovered that the value of these suburban mansions had plummeted considerably during the past years, but it was still possible to find buyers.

What’s most impressive is how things changed in 50 years. Theoretically, as a university teacher, my salary is higher than that of my parents, who were both high school teachers. My wife, too, has a pretty decent salary. But there is no way that we could even have dreamed to build or buy the kind of house that I inherited from my parents.

Something has changed and the change is deep in the very fabric of the Italian society. And the change has a name: it is the twilight of the age of oil. Wealth and energy are two faces of the same medal: with less net energy available, what Italians could afford 50 years ago, they can’t afford anymore.

But saying that depletion is at the basis of our troubles is politically incorrect and unspeakable in the public debate. So, most Italians don’t understand the reasons for what’s going on. They only perceive that their life is becoming harder and harder, despite what they are being told on TV.”

To resource depletion I would add lower returns on both capital and labor–what is known as diminishing returns: the same investment yields less output.

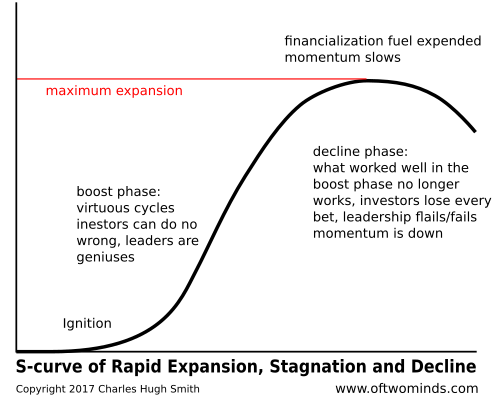

| This decay of return on investment manifests as an S-Curve, which is a constant reference point in my work: an investment that earns a large output at first yields less and less, until the yield (output) stagnates and then declines. Increasing the investment no longer reverses the decline, and often accelerates the decline into a crash.

The 1960s “Economic Miracle” (called Les Trente Glorieuses in France, the thirty years of growth from 1945 to 1975) wasn’t just the result of cheap oil/fuel; credit/investment-starved economies generated outsized returns as capital investments expanded production and productivity, raising wages which then increased consumption and production in a self-reinforcing feedback loop.

Labor was relatively cheap, and capital investments in equipment, social investments in infrastructure and human capital investments in education all boosted the productivity of labor while boosting wages and consumption.

|

S-curve of Rapid Expansion, Stagnation and Decline |

Compare this to the present: ordinary financial capital earns 2% at best and zero or even less than zero in developed economies. Owners of capital have a hard time finding any high-yield investment that isn’t a speculative gamble based on financialized leverage or debt.

This is why corporations are pouring trillions of dollars of capital into stock buybacks that generate no new goods and services: they can’t find any productive use for the capital, so they use buybacks to boost the value of their shares.

Professor Bardi labors in higher education. Back when university credentials were relatively scarce, and higher education actually boosted the productivity of the graduates, the labor of professors generated substantial economic value.

Now that college diplomas have lost their scarcity value, and developed-world work forces are over-credentialed, the value of higher education credentials and those who issue them has declined accordingly. In a global economy with an abundance of over-credentialed workers, the claim that more education creates more value is no longer valid.

If there is an oversupply of chemistry graduates, graduating another 10,000 chemistry majors doesn’t boost productivity at all; rather, it misallocated vast amounts of financial and human capital.

The net result is that the return on ordinary capital and labor, even that of college professors, has declined while the cost structure of increasingly complex societies has soared.

If we consider higher resource costs and higher costs of systemic complexity, and declining returns on capital and labor as inputs, we can see that the only possible output of such a system is declining purchasing power, which we experience as becoming poorer: our labor buys less and our savings earn next to nothing unless we have the specialized knowledge and risk appetite to engage in speculative gambles.

With these speculative and risk management skills accessible only to the wealthy, no wonder only the wealthy have gained purchasing power in the 21st century. The result is only the wealthy can afford what was once affordable to the middle class.

| The decline in the value of conventional labor and purchasing power is visible in this chart of labor’s share of the national income. |

Workers Share of National Income, 1994 - 2020 |

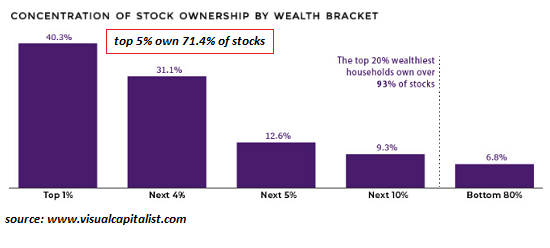

| Ownership of speculative capital is concentrated in the top 5% of households, guaranteeing that speculative gains from asset bubbles are also concentrated in the top 5%– roughly 6 million households, with the majority of the gains concentrated in the top few hundred thousand households. |

Concentration of Stock Ownership by Wealth Bracket |

Outsized gains are now only available to the few with the skills and experience required to gamble high-risk assets successfully, and this is becoming more difficult; even the professional class of money managers are increasingly unable to beat passive index funds.

The top 5% are riding high now that central banks have inflated stupendous bubbles in stocks, housing and other assets, but these gains are speculative.These gains are often viewed as permanent entitlements (i.e. bubbles never deflate), but if history is any guide, those holding speculative gains as if they were a form of savings are in for a rude awakening in the next few years.

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the book's website.

Full story here

Are you the author?

Previous post

See more for

Next post

Tags: newsletter