Tag Archive: China Consumer Price Index

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

FX Daily, May 11: Stocks Slide but Little Demand for Safe Havens

The sell-off in US shares yesterday has triggered sharp global losses today, and there is no flight into fixed income as benchmark yields are higher across the board. Nor is the dollar serving as much as a safe haven. It is mostly softer against the major currencies.

Read More »

Read More »

FX Daily, July 9: The Dollar is Sold through CNY7.0 as Chinese Equities Continue to Rally

Investors continue to clamor into risk assets. Led by Chinese shares, the MSCI Asia Pacific Index pushed higher for the third session this week to new five-month highs. Europe's Dow Jones Stoxx 600 is trying to snap a two-day decline with the help of better than expected revenues for its largest tech company.

Read More »

Read More »

FX Daily, June 10: Corrective Forces Still Seem in Control Ahead of the FOMC Outcome

The pullback ins US shares yesterday has not derailed the global advance. Japanese and Chinese markets were mixed, the Hang Seng slipped, and Indonesia was hit with profit-taking, but the MSCI Asia Pacific Index eked out a small gain. It has fallen once past two and a half weeks. The Dow Jones Stoxx 600 opened higher but is falling for the third consecutive session.

Read More »

Read More »

FX Daily, May 12: Markets Tread Water, Looking for New Focus

Overview: Investors seem to be in want of new drivers, leaving the capital markets with little fresh direction. While Japanese and China equities were little changed, several markets in the region, including Australia, Hong Kong, Taiwan, and India, were off more than 1%. European bourses are mostly higher after the Dow Jones Stoxx 600 slipped 0.4% yesterday.

Read More »

Read More »

FX Daily, January 9: Animal Spirits Roar Back

Overview: The S&P 500 recovered from a 10-day low to reach a new record high, which set the tone for the Asia Pacific and European markets today. The MSCI Asia Pacific Index jumped by the most in a month with the Nikkei's 2% advance leading the way. More broadly, the markets in Taiwan, South Korea, Hong Kong, India, and Thailand all rose more than 1%.

Read More »

Read More »

FX Daily, December 10: Capital Markets: Still Seems to be the Calm before the Storm

Overview: Equities are trading lower, and bonds are mixed as the FOMC, UK election, and the US decision on the December 15 tariffs draw near. The MSCI Asia Pacific Index three-day rally ended today as only China and South Korea's markets rose. Europe's Dow Jones Stoxx 600 gapped slightly lower at the open.

Read More »

Read More »

FX Daily, October 15: Non-Disruptive Brexit Hopes Remain Elevated

Overview: Ideas that a Brexit deal may be close is helping to firm sterling, while soft Chinese PPI offset the spike in food prices to show the weakness of the world's second-largest economy. Minutes from the meeting of the Reserve Bank of Australia earlier this month kept a door open to a rate cut before the end of the year. Japan returned from holiday, and the Nikkei gapped higher, and its nearly 1.9% advance led the MSCI Asia Pacific Index...

Read More »

Read More »

FX Daily, September 10: Turn Around Tuesday

Overview: The momentum from the end of last week carried into yesterday's activity, but the momentum began fading. Today, equities were mixed in Asia Pacific and weaker in Europe. The Dow Jones Stoxx 600 reversed lower yesterday and is slipped further today. The S&P 500 may gap lower at the open.

Read More »

Read More »

FX Daily, July 10: North American Focus: Poloz and Powell

Overview: The US Treasury market is retreating for the fourth consecutive session ahead of Fed Chairman Powell's testimony before Congress. It is the longest losing streak in six months, and the 10-year yield has risen 15 bp over the run. This is helping drag up global yields, and today Asia Pacific yields mostly rose 2-3 basis points while core European bond yields are 5-7 bp higher and peripheral yields up a little less.

Read More »

Read More »

FX Daily, June 12: Anxiety Ticks Up, Risks Pared

Overview: The S&P 500 snapped a five-day advance yesterday and set the heavier tone for equities today. Continued protests in Hong Kong were not shrugged off as they have been in the last couple of sessions. The Hang Seng's nearly 1.9% decline was the largest in a month and led the region lower.

Read More »

Read More »

FX Daily, May 09: De-Risking as US-China Trade Talks Resume

The end of the tariff truce between the US and China continues to dominate investment considerations. The truce was often cited in narratives explaining the recovery of equities from the Q4 18 slide. Ahead of the midnight US tariff hike, global equities are being smashed. Korea's Kospi was off 3%, and Hong Kong's Hang Seng was shed 2.4%. Shanghai lost 1.5%.

Read More »

Read More »

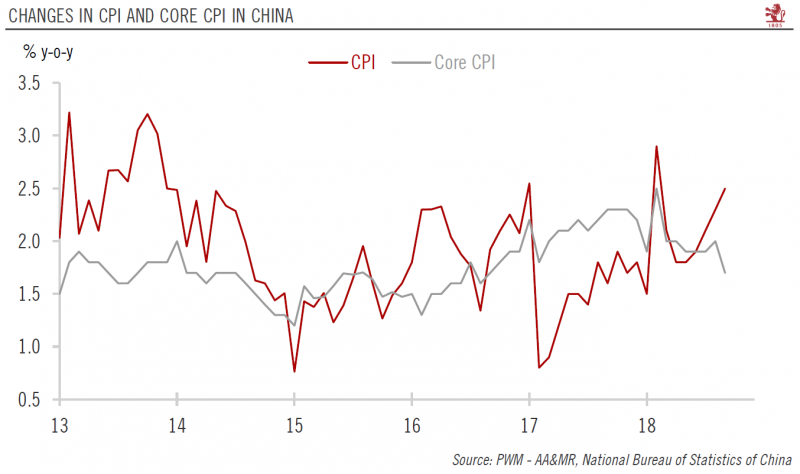

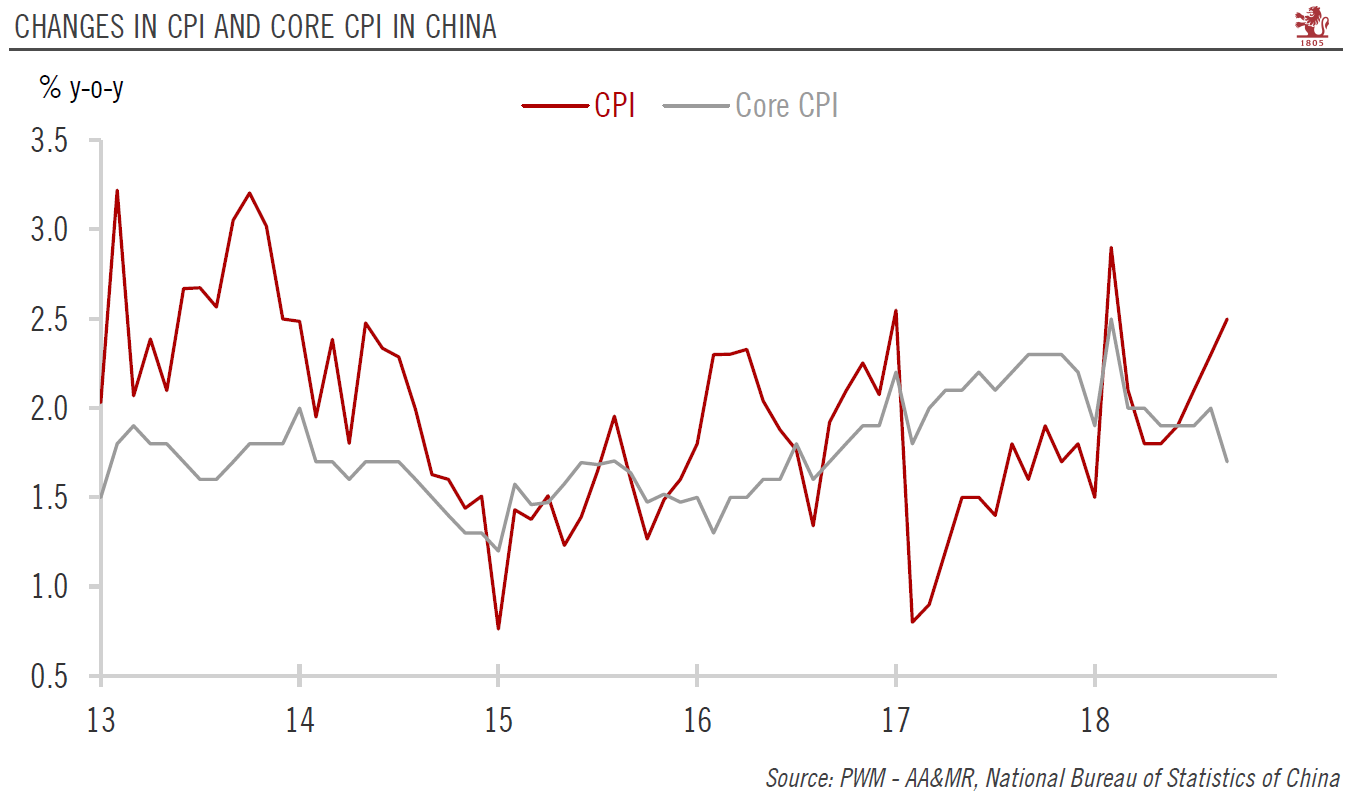

Inflation Environment remains Benign in China

The headline consumer price index (CPI) in China picked up slightly in September, rising by 2.5% year-over-year (y-o-y) compared with 2.3% in August, driven by higher food price and fuel prices. Excluding food and energy, core inflation in China actually eased to 1.7% y-o-y in September from 2.0% in August.

Read More »

Read More »

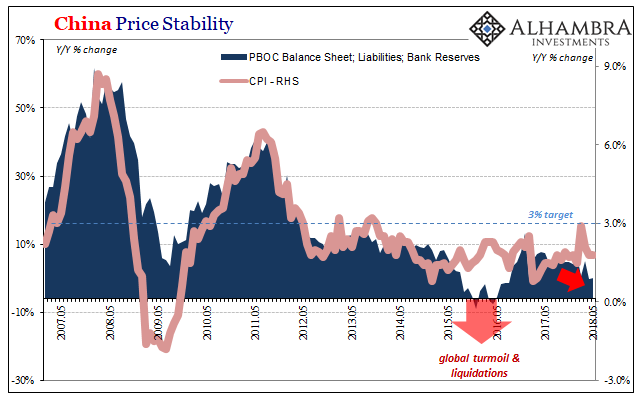

China’s Seven Years Disinflation

In early 2011, Chinese consumer prices were soaring. Despite an official government mandate for 3% CPI growth, the country’s main price measure started out the year close to 5% and by June was moving toward 7%. It seemed fitting for the time, no matter how uncomfortable it made PBOC officials. China was going to be growing rapidly even if the rest of the world couldn’t.

Read More »

Read More »

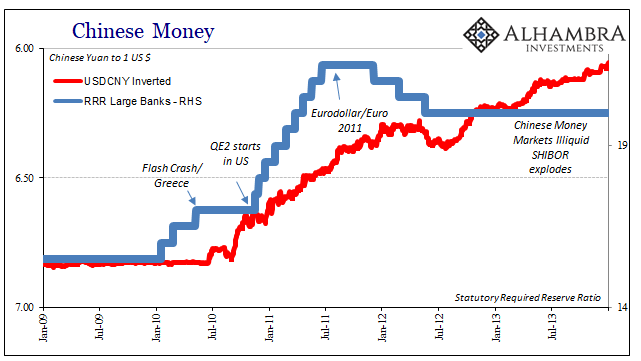

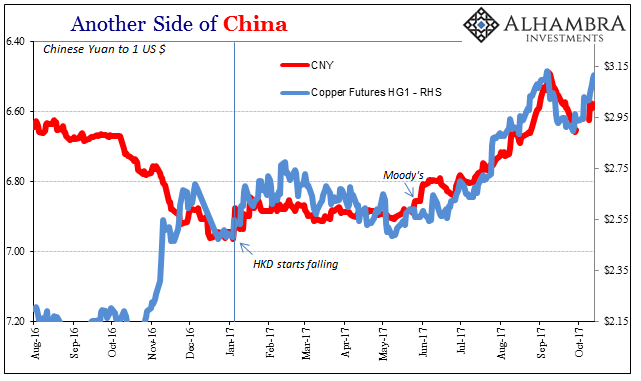

Chinese Inflation And Money Contributions To EM’s

The People’s Bank of China won’t update its balance sheet numbers for May until later this month. Last month, as expected, the Chinese central bank allowed bank reserves to contract for the first time in nearly two years. It is, I believe, all part of the reprioritization of monetary policy goals toward CNY. How well it works in practice remains to be seen.

Authorities are not simply contracting one important form of base money in China (bank...

Read More »

Read More »

FX Daily, April 11: Mr Market Waits for Other Shoe to Drop

Between Syria, trade tensions, and the US special investigator into Russia's attempt to influence the US election, market participants are cautious as they wait for another shoe to drop. The US equity market recovery yesterday has short coattails as markets in Asia and Europe struggle. Bond yields are mostly softer, and the US 10-year note yield is dipping back below 1.80%.

Read More »

Read More »

FX Daily, March 09: Today is about Jobs, but Not Really

The US Administration has softened its initial hardline position of no exemptions for the new steel and aluminum tariffs. There is little doubt that the actions will be challenged at the World Trade Organization and the idea that national security includes the protection of jobs for trade purposes will be tested. At the same time, US President Trump has agreed to meet North Korea's Kim Jong Un.

Read More »

Read More »

FX Daily, February 09: Equity Sell-Off Extends to Asia, but More Muted in Europe

The 100-point slide in the S&P 500 and the 1000-point drop in the Dow Jones Industrials yesterday spurred more bloodletting in Asia. The 1.8% drop in the MSCI Asia Pacific Index (for a 6.7% loss for the week) may conceal the magnitude of the regional losses. At one point the CSI 300 of the large Chinese mainland shares was off more than 6% before closing off 4.3% (and 10% for the week). The H-shares index was down 3.9% and 12% for the week.

Read More »

Read More »

FX Daily, January 10: Yen Short Squeeze Extended

Sparked by fears that the BOJ took a step toward the monetary exit by reducing the amount of long-term bonds it is buying, there is an apparent scramble to cover previously sold yen positions. The dollar finished last week near JPY113.00. It fell to about JPY112.35 yesterday, near the 50% retracement of the greenback's bounce from the late-November lows near JPY110.85.

Read More »

Read More »

Global Inflation Continues To Underwhelm

Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months there has been more influence...

Read More »

Read More »

NAFTA Worries Take Toll, Yellen’s Best Guess Supports Greenback

Risk that NAFTA collapses weighs on CAD and MXN. Yen is slightly firmer despite US yields edging higher and weekend polls suggesting LDP could nearly secure a 2/3 majority of its own. The sterling is consolidating after sharp moves at the end of last week.

Read More »

Read More »