Tag Archive: Brexit

FX Daily, June 18: Draghi Ends Calm Ahead of FOMC, Sending the Euro and Yields Down

Overview: ECB President Draghi underscoring the likely need for more stimulus broke the subdued tone as market participants took a "wait and see" stance ahead of tomorrow's FOMC decision. Draghi's comments sent the euro through $1.12 for the first time in two weeks and drove European bonds yields to new lows.

Read More »

Read More »

FX Daily, May 30: Kill Bull: Intermission

Overview: After significant moves in equities and interest rates, investors are taking a collective breath, waiting for fresh developments. A nervous calm has settled over the capital market. China, Japan, and Australian equities leaked lower, but other bourses in the region, including Korea and Taiwan posted modest gains, while Indonesian equities are still responding positively to the recent election.

Read More »

Read More »

FX Daily, May 28: Risk Appetites Curbed, US Leadership Awaited in FX

Overview: The euro initially reacted positively to the EU Parliament elections. The populists did not do quite as well as many expected. The two main groupings failed to secure a majority, but with the help of the Liberals, and possibly the Greens, that did well throughout Europe, a new European Commission will be forged. The heads of state meet later today, but no real decisions are likely. The horse trading will likely take most of the next...

Read More »

Read More »

FX Weekly Preview: The Evolution of Three Issues are Key in the Week Ahead

As May winds down, the light economic calendar will allow investors to take their cues from the evolution of three disruptive forces--trade, Brexit and the US economy. With actions against Huawei and possibly a handful of Chinese surveillance equipment producers, the US raised the stakes. The retaliatory tariffs are effective on June 1, but Beijing has not formally responded to the moves against Chinese companies.

Read More »

Read More »

FX Daily, May 23: Trade, Brexit, and Disappointing Flash PMIs Weigh on Global Markets

Overview: The deterioration of the investment climate is spurring the sales of stocks and the buying of bonds. The dollar is firm. China and the US appear to be digging as if the trade tensions will remain for some time and the breech is beginning to look too big for Trump and Xi to pull another rabbit out of the hat like they did at the end of last year when the tariff truce was struck. The move against Huawei and possible a number of...

Read More »

Read More »

FX Daily, May 22: Sterling Can’t Get Out of Its Own Way

Overview: There is a nervous calm in the capital markets. Yesterday's rally in US shares failed to excite global investors. China, Hong Kong, and Taiwan markets fell, while Japan was mixed. Foreign investors continued to sell Korean shares, but the Kospi rose. European shares narrowly mixed, leaving the Dow Jones Stoxx 600 little changed.

Read More »

Read More »

FX Daily, May 17: China Questions US Sincerity

Since the presidential tweets on May 3, the US had the initiative in the negotiations with China, but today, China has pushed back. It is cool to the idea promoted by the US that trade talks will resume shortly. Now it may take the Trump-Xi meeting at the end of next month to restart talks. This, coupled with US sanctions on Huawei banning imports from it and sales to it, threatens to disrupt business and this took a toll on Chinese, Taiwanese and...

Read More »

Read More »

FX Daily, May 16: US Struggles to Strike a Less Strident Tone

Overview: Retail sales and industrial production disappointed in both the US and China prior to the end of the tariff truce, declared by the US in a series of presidential tweets on May 5. The reaction function of the US to the drop in equities was to play down tensions on three fronts. First, a US team is expected to return to Beijing in the coming weeks.

Read More »

Read More »

FX Daily, May 15: Angst Continues

Overview: Disappointing Chinese April data spurred speculation that more stimulus will be forthcoming and bolsters hopes that a trade deal with the US by the end of next month helped Asian Pacific equities advance for the first time this week. Indonesia, which reported a record trade deficit on the back of collapsing exports (-13.1% year-over-year in April, nearly twice the decline expected after a 10% fall in March) kept the pressure on its...

Read More »

Read More »

FX Daily, May 09: De-Risking as US-China Trade Talks Resume

The end of the tariff truce between the US and China continues to dominate investment considerations. The truce was often cited in narratives explaining the recovery of equities from the Q4 18 slide. Ahead of the midnight US tariff hike, global equities are being smashed. Korea's Kospi was off 3%, and Hong Kong's Hang Seng was shed 2.4%. Shanghai lost 1.5%.

Read More »

Read More »

FX Daily, May 08: Markets Trying to Stabilize

Overview: It is taking investors a bit more than two sessions to find its footing after being the unexpected end of the tariff truce between the US and China struck last December. Asia Pacific equities tumbled after the S&P 500 shed nearly 1.7% yesterday, the third largest decline in 2019, but Europe's Dow Jones Stoxx 600 is consolidating near yesterday's lows.

Read More »

Read More »

FX Daily, May 06: Trump’s Tariff Tweets Help Investors Discover Volatility

Reports that a US-China deal could be struck by May 10 before the weekend left investors ill-prepared for the presidential tweets yesterday that announced that the US was ending the tariff truce. Trump indicated that the 10% tariff on $200 bln of Chinese goods would be lifted to 25% at the end of the week and that the remaining $325 bln of Chinese goods that have not been subject to an extra levy, will be slapped with a 25% tariff soon.

Read More »

Read More »

FX Daily, May 02: Dollar Consolidates Fed-Inspired Recovery

Overview: The US dollar is consolidating yesterday's post-Fed rally, and this is giving it a slightly heavier tone today. Equities are mostly lower and Europe's Dow Jones Stoxx 600 is off about 0.5% in late morning turnover, which if sustained would be the largest decline in three weeks. The S&P 500 posted a potential key reversal yesterday by setting new record highs and then closing below the previous session's low.

Read More »

Read More »

FX Daily, April 30: Dollar Pares more Gains as EMU GDP Surprise

Overview: The S&P 500 set a new record high and close yesterday, but the lift to global markets was not strong enough to overcome the disappointing Chinese PMI. Although Chinese equities traded higher on ideas that the news will spur additional stimulative measures, other Asian markets were mixed.

Read More »

Read More »

FX Daily, April 23: Oil Extends Gains While Markets Await Fresh Incentives

Overview: Financial centers that have been closed for the extended holiday have re-opened, but the news stream is light and market participants are digesting developments and positioning for this week's central bank meetings and the first look at Q1 US GDP. The US decision to end exemptions to the embargo against Iran led to a surge in oil prices, which are extending gains to new six-highs today.

Read More »

Read More »

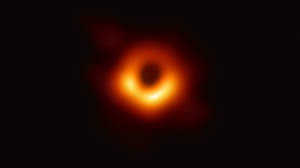

Cool Video: Discussion of the Deflationary Risks in Japan and Brexit

I joined CNBC Asia’s Amanda Drury and Sri Jegarajah via Skype earlier today as the new week was beginning in Asia. In this three minute clip, we discuss the outlook for the BOJ and sterling. Most of the rise in Japan’s inflation is due to food and energy prices. Despite an aggressive balance-sheet expansion effort, the BOJ has missed its target by a long shot.

Read More »

Read More »

FX Weekly Preview: Six Events to Watch

The divergence thesis that drives our constructive outlook for the dollar received more support last week than we expected. A few hours after investors learned that Japan's flash PMI remained below the 50 boom/bust level, Europe reported disappointing PMI data as well. And a few hours after that the US reported that retail sales surged in March by the most in a year and a half (1.6%).

Read More »

Read More »

FX Daily, April 11: Market Yawns at Latest Brexit Extension

The S&P 500 closed higher yesterday for the ninth session in the past ten, but the coattails are short and global equities are trading with a heavier bias today. A firm CPI reading in China took a toll local shares with the Shanghai Composite, shedding 1.6%, the most in more than two weeks. European bourses are mostly in the red.

Read More »

Read More »

FX Daily, April 8: Brexit, the EU-China, and the Abandonment of the Open Door

(I am in Mexico at the World Trade Center General Assembly, participating on a panel about USMCA--NAFTA2.0--for which approval remains elusive. It is possible that the US threatens to pull out of NAFTA 1.0 to force action by the US Congress. Mexico is due to pass legislation this week that may meet demands by the some in the US and Canada for stronger labor protections.

Read More »

Read More »

FX Weekly Preview: Important Steps Away from the Abyss

It seems to be well appreciated among by policymakers and investors that the system is ill-prepared to cope with another financial crisis. It is understandable that so many are concerned that the end of the business cycle could trigger a financial crisis. In practice, it seems like it has worked the other way around. The financial crisis triggered the Great Recession.

Read More »

Read More »