Found 1,381 search results for keyword: label

Great Graphic: US 2-Year Premium over Japan and Germany

This Great Graphic was composed on Bloomberg. It shows two time series. The yellow line shows the premium the US pays over Germany for two-year money. The white line shows the premium the US pays over Japan for two-year money. The premiums have risen sharply since mid-October and today are at new multi-year highs. … Continue...

Read More »

Read More »

Great Graphic: Canadian Dollar and the Two-Year Rate Differential

The Canadian dollar is more than a petro currency. It is also subject to the same forces of divergence that have lifted the US dollar more broadly. Since the beginning of the year, the US two-year yield has risen 26 bp while Canada's two-year yield has fallen almost 39 bp. This Great Graphic, created on …

Read More »

Read More »

Pure Gold and Soggy Dollars

We’re going to be introducing some new formats. One of them is quick article links, with the good ones labelled Pure Gold and the bad ones labelled Soggy Dollars.

Pure Gold

When a Fed-induced boom turns to bust: “In the lynch-mob....

Read More »

Read More »

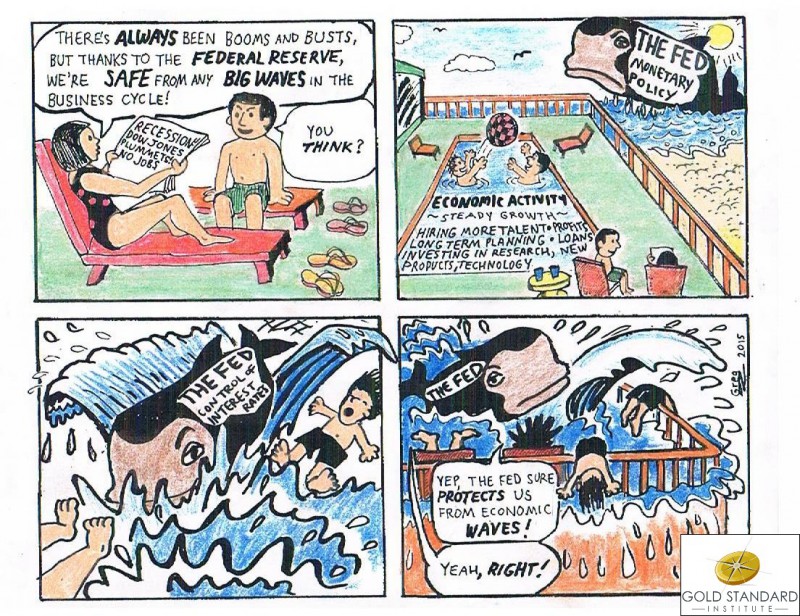

How Could the Fed Protect Us from Economic Waves?

Mainstream economists tell us that the Federal Reserve protects us from economic waves, indeed from the business cycle itself. In their view, people naturally tend to go overboard and cause wild swings in both directions. Thus, we need an economic central planner to alternatively stimulate us and then take away the punch bowl.

The very idea of centrally planning money and credit boggles the mind.

Read More »

Read More »

What Happens When Credit Is Mispriced?

Keith Weiner explains what happens when credit is mispriced. The rich are privileged because they can profit on the volatility and the bubbles the cheap credit createes.

Read More »

Read More »

Volckers Attack on Stagflation

In this chapter we describe how Volcker managed to defeat stagflation; he applied the monetarist models that had been applied successfully in Switzerland and Germany. Thanks to this effort, the dollar stopped its secular decline.

Read More »

Read More »

America’s Nine Classes: The New Class Hierarchy

Eight of the nine classes are hidebound by conventions, neofeudal and neocolonial arrangements and a variety of false choices. There are many ways to slice and dice America's power/wealth hierarchy. The conventional class structure is divided along the lines of income, i.e. the wealthy, upper middle class, middle class, lower middle class and the poor.

Read More »

Read More »

Russia, Europe, and the new international order

By Josef Janning – 09 Apr 14 Via the European Council of Foreign Relations. The premise of an international order defined by the West and shared by the rest has been shown to be faulty. Ever since the Soviet Union fell apart and nationalism re-emerged as a divisive as well as cohesive factor in Eastern … Continue reading...

Read More »

Read More »

Net Speculative Positions, Global Stock Markets, Week October 29

Submitted by Mark Chandler, from marctomarkets.com The US Dollar Index reached its best level in more than six weeks on Friday. Yet it managed to only close a couple of ticks higher, as if warning short-term participants against ideas that a breakout is at hand. This also appears to be the message of the …

Read More »

Read More »

The “Beautiful” De-Leveraging

A beautiful deleveraging balances the three options. In other words, there is a certain amount of austerity, there is a certain amount of debt restructuring, and there is a certain amount of printing of money. When done in the right mix, it isn’t dramatic. It doesn’t produce too much deflation or too much depression. There is slow growth, but it is positive slow growth. At the same time, ratios of debt-to-incomes go down. That’s a beautiful...

Read More »

Read More »

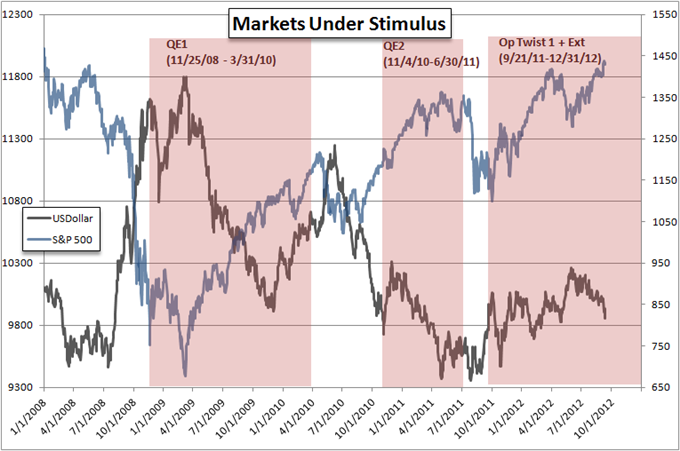

It’s not simply QE3

Submitted by Mark Chandler, from marctomarkets.com The outcome of the FOMC meeting is not just a new round of quantitative easing, some might call it QE3. What the Fed announced represents a new chapter in its policy response. The first distinguishing aspect of its decision is the open-ended nature of it. While it has not indicated … Continue reading...

Read More »

Read More »

Net Speculative Positions , Global Markets and Outlook, week from August 20

Currency Positioning and Outlook, week from August 20 Submitted by Mark Chandler, from marctomarkets.com The market is like expectant parents who don’t know the gender of the fetus. They know something big is around the corner, but they don’t have enough information to make some important decisions. They can contemplate the future, but there …

Read More »

Read More »

Net Speculative Positions and Technical Analysis,week from August 6

Currency Positioning and Technical Analysis, week from August6 Submitted by Marc Chandler from MarctoMarkets.com The overall technical tone of the US dollar is suspect. During the last few months, it has been trending lower against the dollar-bloc currencies, Canadian and Australian dollars and the Mexican peso. The greenback has trended higher against the euro and Swiss …

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): November 2010

EUR/CHF Continues Lower Presently down at 1.3055 from early 1.3090, having been as low as 1.3037 so far. Earlier I was reading comments made by UBS economist Huenerwadel, who said “At least from a fundamental point of view and aware of the increased long CHF positioning, very little speaks in favour of a materially higher EUR/CHF … Continue reading...

Read More »

Read More »

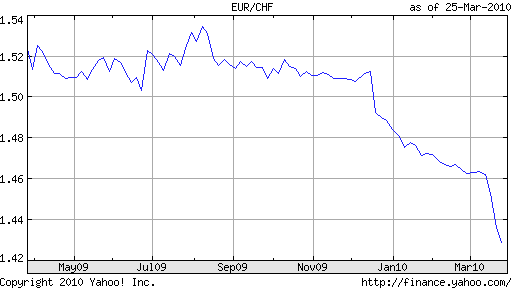

Swiss Franc Surges to Record High: Where was the SNB? (March 2010)

Mar. 26th 2010 Extracts from the history of the Swiss Franc (March 2010) One of the clear victors of the Greek sovereign debt crisis has been the Swiss Franc, which has risen 5% against the Euro over the last quarter en route to a record high. 5% may not sound like much until you … Continue...

Read More »

Read More »