Found 1,383 search results for keyword: label

European Banks Bad Loans and Coverage

European banks are worrisome. EBA's stress test results will be out at the end of the week. Nonperforming loans are a separate issue, but also need to be addressed.

Read More »

Read More »

Great Graphic: OIl Breaks Down Further

With today's losses the Sept contract has retraced 50% of this year's rally. The oil glut has partly been transformed into a gasoline glut. US rig count is rising and output has increased two weeks in a row.

Read More »

Read More »

Great Graphic: Aussie Approaches Two-Month Uptrend

Australian dollar is the second heaviest currency this week after a key downside reversal at the end of last week. It is approaching an uptrend line near $0.7450. Many perceive an increased likelihood that the RBA eases and many are reassessing chance of a Fed hike later this year.

Read More »

Read More »

Great Graphic: Equities Since Brexit

Since the UK voted to leave the EU, emerging market equities have outperformed equities from the developed markets. This Great Graphic, composed on Bloomberg, shows the MSCI Emerging Market equities (yellow line) and the MSCI World Index of developed equities (white line).

Read More »

Read More »

Great Graphic: The Yuan’s Weakness

Don't be fooled, the yuan has fallen more against its basket that against the dollar this year. It is not clear what China means by stable. Market forces appear to be moving in the same direction as officials wish.

Read More »

Read More »

Great Graphic: What are UK Equities Doing?

Domestic-oriented UK companies have been marked down. The outperformance by UK's global companies is a negative view of sterling. The drop in interest rates is in anticipation of a recession and easier BOE policy.

Read More »

Read More »

Great Graphic: Sterling Monthly Chart and Outlook

Sterling's losses are not simply a product of thin liquidity or panic. Both main political parties are in disarray just when strong leadership is needed. The rough projection pre-vote of what could happen on Brexit suggests $1.20-$!.2750.

Read More »

Read More »

Quitting the Cucumber Affair

Winners and Quitters Vince Lombardi, the famous American football coach, once said, “Winners never quit and quitters never win.” Maybe he meant that winners overcome obstacles to reach their goals while quitters give up and fall short… or somethin...

Read More »

Read More »

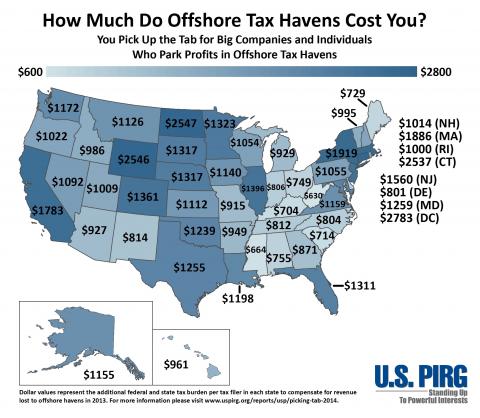

Panama Tax Haven Scandal: The Bigger Picture

The “Panama Papers” tax haven leak is big … After all, the Prime Minister of Iceland resigned over the leak, and investigations are taking place worldwide over the leak. But the Panama Papers reporting mainly focuses on friends of Russia’s Putin, Ass...

Read More »

Read More »

Great Graphic: Oil Flirts with Four-Month Uptrend

The broader technical tone has weakened. The RSI has turned lower. The MACDs are also turning lower with a bearish divergence. The five-day moving average may move below the 20-day moving average for the first time since mid-April later this week....

Read More »

Read More »

Democratic Deficit: Is the UK Referendum the Tip of the Iceberg?

One of the most profound criticisms of the EU that it remains, even at

this late date, primarily an elite

project. The democratic deficit has grown, according to the latest

Pew Research multi-country poll.

The Pew Research sur...

Read More »

Read More »

Wealth Management Products: What Could Possibly Go Wrong?

Wealh Management Products issuance equaled $1.1 trillion in 2015, a nearly 75% jump on the prior year and equaling 40% of the total growth in credit. Almost one-third of the WMP were bought by credit institutions for inclusion in other WMP – WMP Squared!

Read More »

Read More »

Great Graphic: Despite Higher Oil Prices, Middle East Pegs Remain Under Pressure

With today’s gains, the price of Brent has nearly doubled from its lows in January. Of course, the price of oil is still less than half of levels that prevailed two years ago. At the same time, many leveraged investors cast a jaundiced eye toward currency pegs. Many have concluded that the Middle East currency pegs …

Read More »

Read More »

Great Graphic: Brexit Risks Rise

Brexit Predict This Great Graphic shows the price people are willing to pay to bet that the UK votes to leave the EU at the June 23 referendum on the PredictIt events markets. We included the lower chart to give some sense of volume of activity on this wager in this event market. Presently, one … Continue reading »

Read More »

Read More »

First Skirmishes in Long Battle

For various reasons, well beyond the scope of this short note, China has amassed huge industrial capacity, well beyond its ability to absorb. In part, that is one of the challenges that the “One Belt One Road” addresses. Export the spare capacity by building infrastructure, networking east and central Asia (included parts of the former …

Read More »

Read More »

Great Graphic: Gold and the Dollar

Many investors still think about gold as if it were money. Economists identify three functions of money: store of value, means of exchange, and a unit of account.

It can be a store of value, but the price fluctuates compared with other form...

Read More »

Read More »

Great Graphic: Dollar Pushes Back Below JPY110

The yen is the strongest of the major currencies. It has gained about 0.65% against the dollar. It has been grinding lower throughout the Asian and European session and has remained in narrow ranges near its highs in the US morning. Japan still seems isolated in terms of it desire to intervene. Ahead of the … Continue reading...

Read More »

Read More »

Why is Freddie Mac Reporting a Loss?

A Sudden Turn for the Worse Freddie Mac posted a loss of $354 million this quarter, versus a $2.16 billion gain the previous quarter. Fannie Mae did slightly better with net earnings of $1.1 billion, which were still substantially down from $2.5 b...

Read More »

Read More »