A Sudden Turn for the Worse

A Sudden Turn for the Worse Freddie Mac posted a loss of $354 million this quarter, versus a $2.16 billion gain the previous quarter. Fannie Mae did slightly better with net earnings of $1.1 billion, which were still substantially down from $2.5 b... - Click to enlarge

Freddie Mac posted a loss of $354 million this quarter, versus a $2.16 billion gain the previous quarter. Fannie Mae did slightly better with net earnings of $1.1 billion, which were still substantially down from $2.5 billion the previous quarter though.

Instead of delving into the entrails of the financial statements, I would like to ask a broader question: Why is Freddie reporting a loss at all (and why is Fannie barely profitable)?

Using September 2008 as a starting point, what kind of business climate have they been operating under since the Treasury took over as conservator?

Monopolistic Dominance. The agencies are now over 70% of the residential mortgage market, and increasing, with no competition in sight.

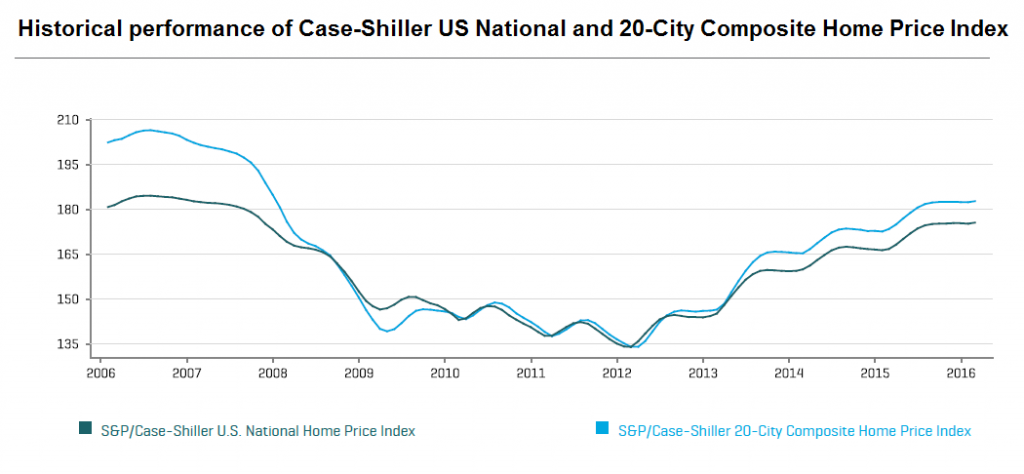

Historical performance of Case-Shiller US Home Price Indexes.Price Appreciation. Per Case Shiller, housing price has been appreciating steadily for the last 4-5 years. In other words, loan to value ratios should be decreasing, reducing the risk of loan losses in the event of a default. |

Defaults, foreclosures and REO inventory. Borrowing a chart from my cyber-friend Bill of Calculated Risk (who really has great simple and to the point charts), it is obvious that the worst time was over five years ago and that loan losses should be continuously improving.

REO Inventory: Fannie and Freddie through Q1 2016REO (real estate owned) inventory of Fannie and Freddie – declining since Q3 2010. |

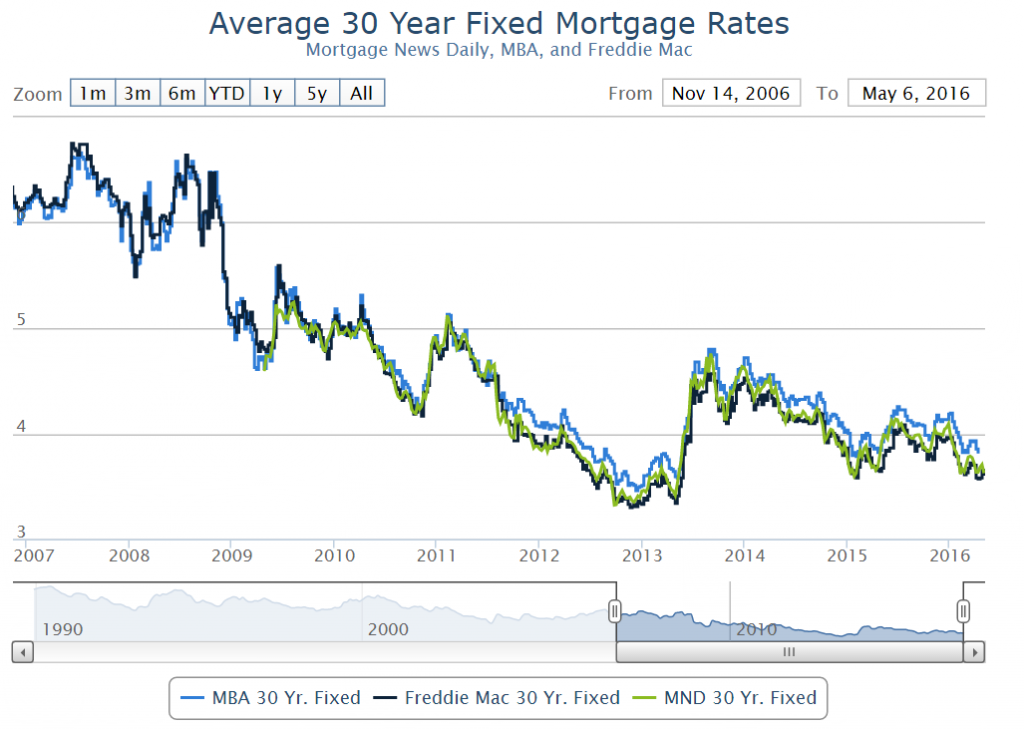

Accommodative Interest Rates. Aside from a minor bump in 2013, mortgage rates have been steadily declining (see chart from Mortgage News Daily below). Theoretically, payments are easier for borrowers to service. In addition, if held in a portfolio, these loans should be gaining in value inversely proportional to the drop in rates.

Average 30 Year Fixed Mortgage Rates30 year fixed mortgage rates (MBA, Freddie Mac, MND) – a steady downtrend – click to enlarge. |

Easy Money?

There is no need to go any further. As global economies struggle, the agencies cannot be offered a better environment to make easy profits. So once again, why is Freddie Mac reporting a loss? In order to answer that question, we need to determine what type of businesses Freddie and Fannie are engaged in.

If they are a secondary market mortgage companies, conditions couldn’t be any better. First one buys up a bunch of loans, secured by “highly qualified” borrowers with residential real estate as collateral, collecting fees in the process. Then one securitizes them and sells them via Wall Street, with the Federal Reserve as an ultimate buyer to guarantee the success of these bond issues, collecting more fees in the process.

If this business model is sound, then why has not a single competitor emerged? During the sub-prime era, private label MBS were issued by every Tom, Dick and Harry. You may remember these as Fremont, Countrywide, Indymac, Long Beach, New Century, Novastar, in addition to a few names that are still around today.

When was the last time we heard of a WFC, or JPM, or BofA MBS issue? Do you suppose Jamie Dimon (JPM) or Lloyd Blankfein (Goldman) have made too much money already and have decided not to participate in the lucrative secondary market, if there is easy money to be had?

Freddie Mac, weeklyFreddie Mac’s share price weekly, over the past 5 years. |

The truth is no one in the private sector can compete with the government-subsidized price and terms of the agencies. The agencies are essentially running money-losing operations.

What if the agencies were to operate as insurance companies? In other words, they would buy mortgages from originators using pre-determined guidelines, then resell the bundles with the stamp of an agency guarantee, collecting a guarantee fee in the process.

Based on the recent decline in loan losses, the agencies should be making a fortune. Just imagine them as selling flood insurance policies during a prolonged drought. It is all premiums coming in and no claims to pay out.

Stress Testing

The agencies are actually both of the above, and more. If this is such a lucrative business, why are there no competitors? Wall Street is so desperate for ideas that it is willing to throw billions behind little cameras strapped on your forehead, or wristbands that tell you how many times you bounced around, or software that allows users to send naked photos of themselves instantly to the world using their phones. Why wouldn’t Wall Street be salivating over a proven trillion dollars industry that provides the financing backbone to the real estate market?

Wall Street is desperate for IPOs or M&A deals. Can you imagine how much FRE and FNM can generate in underwriting fees? Yet, there is not a single proposal from Wall Street’s usual suspects. Instead, we only hear from shysters who try to suck all cash flow from operations, while leaving all future liabilities to the government (aka taxpayers).

Here is a misguided article by Matt Taibbi, demonizing the government for not letting these so called “activist investors” steal the operating cash flow from the agencies. I believe the government does have something to hide. If it actually disclosed the liability the agencies have incurred by their guarantees, it may not only shock the bond/real estate market, it may destabilize the entire economy.

Fannie Mae, weeklyFannie Mae share price weekly – a similar picture. At a time when the agencies should be making money hand over fist, the markets appear quite skeptical. |

The Federal Reserve performs these so called bogus stress tests on the banks, somehow determining they are all safe. They have a proven record. Greenspan said the banks understand risk better than him and they can take care of themselves. Bernanke said he did not see it coming, and so did Yellen. Now they think the too gigantic to fail banks are safe?

Instead of stress testing the banks, the Federal Reserve and the Treasury should stress test borrowers. The test is simple. Take a sample and assume that borrowers suffer a 10% or 20% or 30% loss of household income. How long would it take before such a household defaults? It is an easy and accurate test, because all the required information is in the loan application, fully documented.

If these two mortgage giants (which should have been consolidated long ago) post combined income of only $746 million last quarter under ideal conditions, what happens if the market turns sour? Can they handle a reversal in home price trends? What if defaults tick back up? How about an increase in mortgage rates by 50 basis points? Have they reserved anything for potential losses, or is the Treasury’s line of credit what they are counting on as their safety net?

Conclusion

In conclusion, I believe that just one hiccup would send these agencies down the same path that forced them into conservatorship in 2008, only it will be worse this time around. They are now the market. There is no chance that the real estate market can survive without these two giants. Maybe we should all vote for Donald Trump. He would be best suited to handle the bankruptcies.

A Sudden Turn for the Worse Freddie Mac posted a loss of $354 million this quarter, versus a $2.16 billion gain the previous quarter. Fannie Mae did slightly better with net earnings of $1.1 billion, which were still substantially down from $2.5 b... - Click to enlarge

Charts by: S&P / Case-Shiller, Calculated Risk, Mortgage News Daily, BigCharts

Chart and image captions by PT

Full story here Are you the author? Previous post See more for Next post

Tags: Ben Bernanke,Donald Trump,newslettersent,Real Estate,U.S. Case Shiller Home Price Index (Macro)