Found 1,387 search results for keyword: label

Great Graphic: Bears Very Short US 10-Year Ahead of CPI

The US reports January CPI figures tomorrow. The market seems especially sensitive to it. The main narrative is that it is an inflation scare spurred by the jump in January average hourly earnings that pushed yields higher and unhinged the stock market. This Great Graphic comes from Bloomberg and is derived from data issued by the Commodity Futures Trading Commission (CFTC).

Read More »

Read More »

Chinese textile firm buys luxury Bally brand

Luxury shoemaker Bally, which was founded in Switzerland in 1851, has again changed hands. China’s Shandong Ruyi has agreed to buy a controlling stake in the firm from Luxembourg-based JAB Holding, the companies said on Friday. “This is an important milestone for Shandong Ruyi Group in our enterprise to become a global leader in the fashion apparel sector,” Yafu Qiu, Chairman of Shandong Ruyi Groupexternal link, said in a statement.

Read More »

Read More »

Great Graphic: European Equities Lead Move

European equities peaked earlier and have fallen the furthest. MSCI EM equities faring the best, and as of now, they are still up on the year. MSCI Asia Pacific fell 3.4% today and is now down 0.33% for the year.

Read More »

Read More »

Great Graphic: Is Aussie Cracking?

The Australian dollar bottomed in early December $0.7500 after having tested $0.8100 a couple of times in September. Since early December, however, the Australian dollar appreciated by nearly 6.5%. As it tested the $0.8000 area, the momentum faded.

Read More »

Read More »

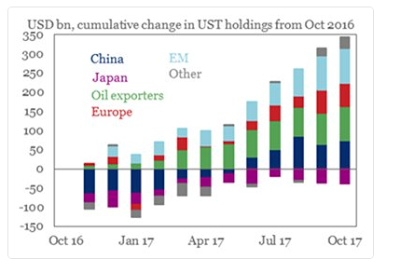

Great Graphic: Treasury Holdings

The combination of a falling dollar and rising US interest rates has sparked a concern never far from the surface about the foreign demand for US Treasuries. Moreover, as the Fed's balance sheet shrinks, investors will have to step up their purchases.

Read More »

Read More »

Great Graphic: Euro Monthly

The euro peaked in July 2008 near $1.6040. It was a record. The euro has trended choppily lower through the end of 2016 as this Great Graphic, created on Bloomberg, illustrates. We drew in the downtrend line on the month bar chart. The trend line comes in a little below $1.27 now and is falling at about a quarter cent a week, and comes in near $1.26 at the end of February.

Read More »

Read More »

Great Graphic: Progress

The world looks like a mess. While the economy appears to be doing better, disparity of wealth and income has grown. Debt levels are rising. Protectionism appears on the rise. Global flash points, like Korea, Middle East, Pakistan, Venezuela are unaddressed. At the same time, this Great Graphic tweeted by @DinaPomeranz, with a hat tip to @bill_easterly is a helpful corrective.

Read More »

Read More »

Great Graphic: Sterling Toys with Three-Year Downtrend Line

Sterling is the second major currency this year after the euro (and its shadow the Danish krone). The downtrend line from mid-2014 is fraying. Is this the breakout?

Read More »

Read More »

Reduced Trade Terms Salute The Flattened Curve

The Census Bureau reported earlier today that US imports of foreign goods jumped 9.9% year-over-year in October. That is the second largest increase since February 2012, just less than the 12% import growth recorded for January earlier this year.

Read More »

Read More »

Great Graphic: Euro Pushes below November Uptrend

Euro is lower for the third day, the longest downdraft in a month and a half. It violated the November uptrend. It is testing the $1.1800 area, which houses a few technical levels (retracement, moving average and congestion).

Read More »

Read More »

Study shows Swiss soils are suffering

A first nationwide report on the health of Swiss soils has shown that virtually all are polluted and that the resource is not being put to sustainable use. The report, published Thursday by the Federal Office for the Environment in collaboration with the offices for agriculture and spatial development, brings together information about soil health that until now has been gathered in isolation through separate cantonal or regional research projects.

Read More »

Read More »

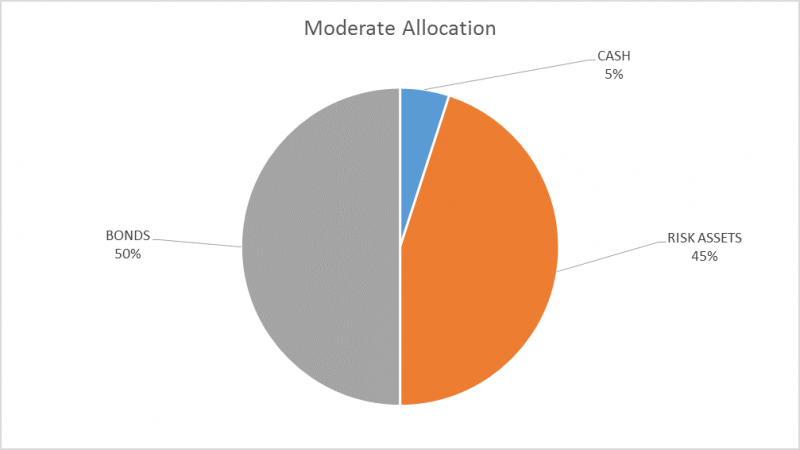

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash.

Read More »

Read More »

Great Graphic: US 2-year Yield Rises Above Australia for First Time since 2000

The US and Australian two-year interest rates have diverged. There is scope for a further widening of the spread. Directionally the correlation between the exchange rate and the rate differentials is strong, but not stable. Near-term technicals are supportive but the move above trendline resistance is needed to confirm.

Read More »

Read More »

Great Graphic: Is that a Potential Head and Shoulders Pattern in the Euro?

The euro is breaking out to the upside. The measuring objective is near $1.2150, which is near the 50% retracement of the euro's drop from the mid-2014 high. Key caveat: It is about the upper Bollinger Band and rate differentials make it the most expensive to hold since the late 1990s.

Read More »

Read More »

Stories making the Swiss Sunday papers

Good news from the Swiss watchmaking industry, plans to ban under-18s from solariums because of health risks and a warning that the Swiss railway system could face chaos in December. The Swiss watchmaking industry has made a turnaround following a three-year dip. Nick Hayek, CEO of the Swatch Group, told the NZZ am Sonntag newspaper that his company recorded a massive increase in turnover over the past two months, resulting even in production...

Read More »

Read More »

Great Graphic: Euro Approaching Key Test

Euro is testing trendline and retracement objective and 100-day moving average. Technical indicators on daily bar charts warn of upside risk. Two-year rate differentials make it expensive to be long euros vs. US. Beware of small samples that may exaggerate seasonality.

Read More »

Read More »

Swiss HSBC settles French tax fraud dispute

With a payment of €300 million (CHF350 million), the Swiss subsidiary of British bank HSBC has settled its tax fraud dispute with the French authorities. Investigations by the French government revealed that many French taxpayers had hidden their assets with help from HSBC’s private bank.

Read More »

Read More »

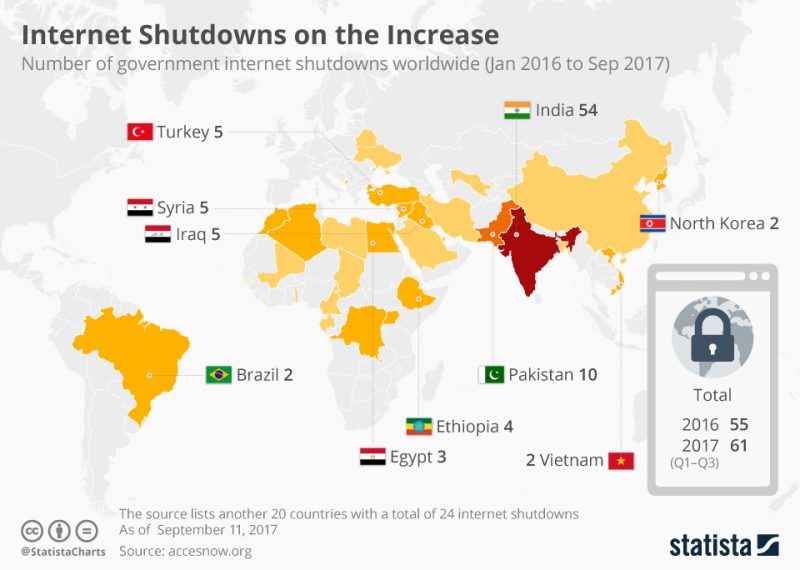

Internet Shutdowns Show Physical Gold Is Ultimate Protection

Internet shutdowns (116 in two years) show physical gold is ultimate protection. Number of internet shutdowns increased in 2017 as 30 countries hit by shutdowns. Democratic India experienced 54 internet shutdowns in last two years; Brazil 2. EU country Estonia, a technologically advanced nation, experienced a shutdown. Gallup poll shows Americans more worried about cybercrime than violent crime. Governments use terrorist threat as reason for...

Read More »

Read More »

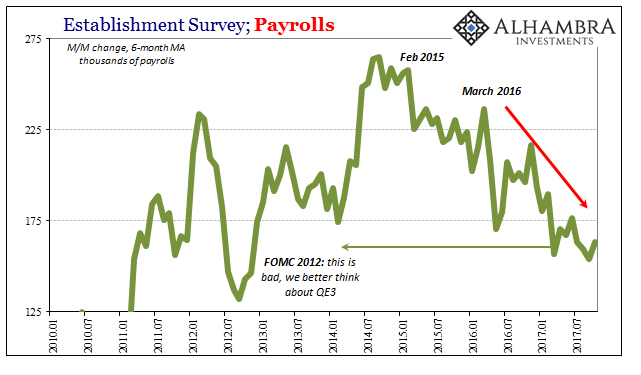

Four Point One

The payroll report for October 2017 was still affected by the summer storms in Texas and Florida. That was expected. The Establishment Survey estimates for August and September were revised higher, the latter from a -33k to +18k. Most economists were expecting a huge gain in October to snapback from that hurricane number, but the latest headline was just +261k.

Read More »

Read More »

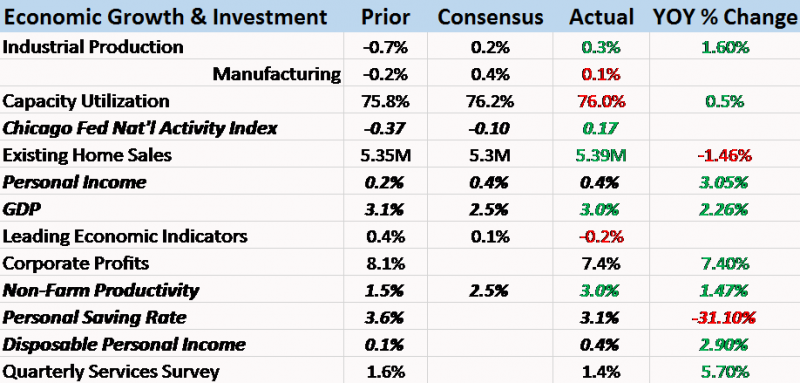

Bi-Weekly Economic Review: Gridlock & The Status Quo

The good news is that the economy just printed its second consecutive quarter of 3% growth, a feat not accomplished since Q2 and Q3 2014. The bad news is that the growth spurt in 2014 was better, quantitatively and qualitatively. Those two quarters produced gains of 4.6% and 5.2% (annualized) in GDP, much better than the most recent 3.1% and 3% prints of Q2 and Q3 2017.

Read More »

Read More »