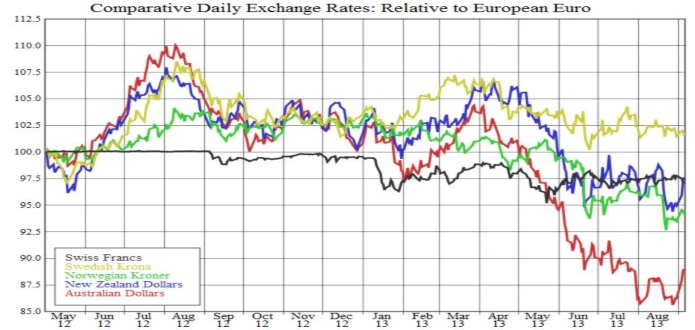

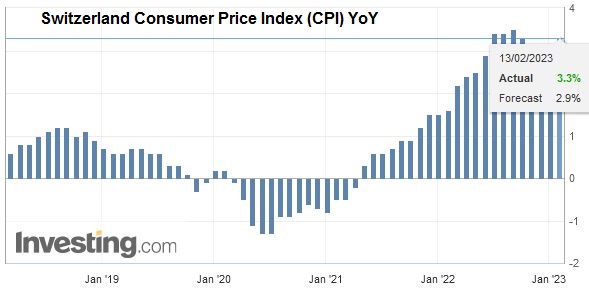

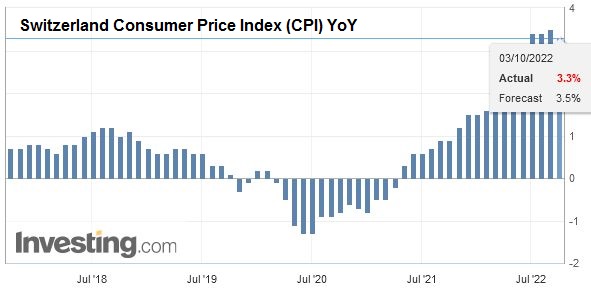

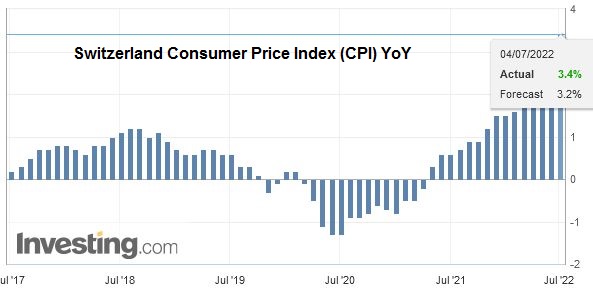

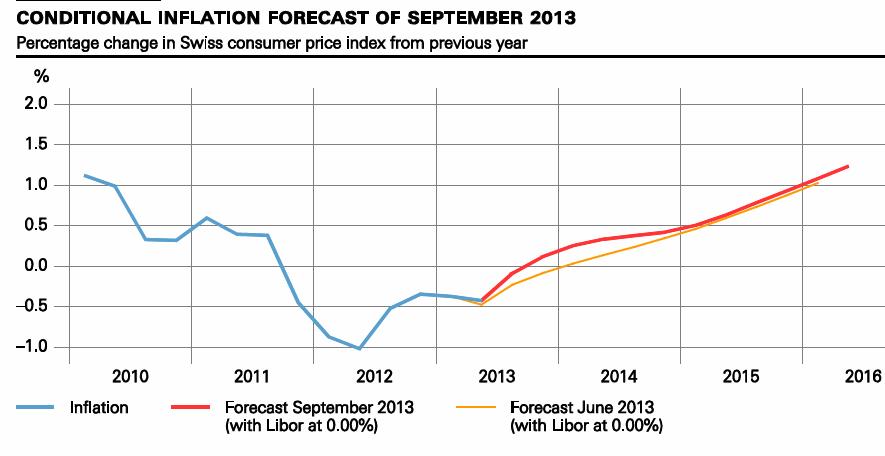

Our CHF and Gold News Bar on our home page explains daily CHF and gold price movements based on the most important fundamental indicators in a few sentences. Keep in mind that the only Swiss fundamental data that is able to move the CHF must come from the SNB and from Swiss inflation data – from 1% y/y CPI the SNB should remove the CHF cap. The other data is global macro: mostly US and German data, some European and Chinese/Japanese news publications determine CHF behaviour. CHF is positively correlated to good data from Germany and to some extent China and Japan. Good data from the United States lets CHF fall against both USD and EUR; it is hence negatively correlated to good US news. As for EUR/CHF, the Swissie is negatively correlated to good Southern European and French data. Understand the terms “American bloc” and “Asian bloc” (read here). As for gold prices please understand the basis here. Remember also that the currency movement over months is a combination of the daily movements explained here. Click here to see the news bar in a full view.

We have suspended the weekly posts. Instead we focused on more general FX considerations, e.g. the EUR/USD is poised for steady rise to 1.50. Or the FX trade of the future is EUR/CHF Short, not EUR/CHF Long.

Fundamentals with highest importance: The HSBC Flash Purchasing Manager Index (PMI) for China weakened from 50.8 to 50.4. In particular, new export orders, output prices and employment started to decrease again, while output increased.

The preliminary Markit manufacturing PMI for the United States edged up to 54.3 (vs. 52.3 expected), a 9-month high after the low of 51.8 during the government shutdown last month. In particular, output and new orders improved.

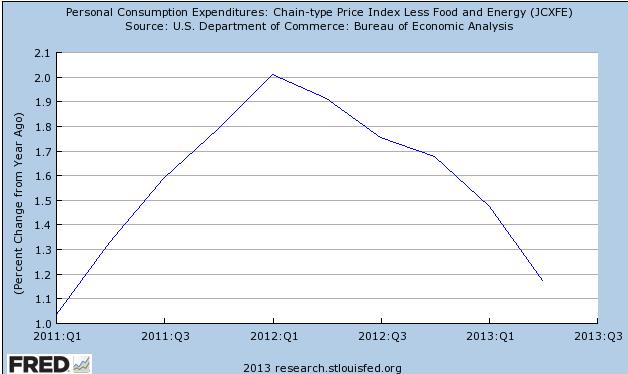

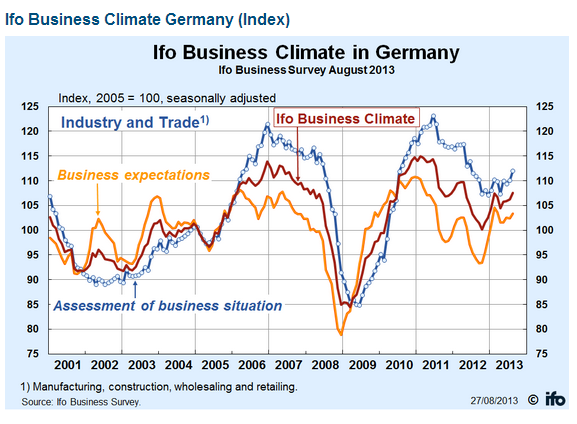

Business expectations of the German IFO index rose to 106.3 (vs. 104.0 expected). They were close to their 2011 highs. The German GDP increase of 0.3% QoQ (1.1% YoY) was confirmed in the second reading, the main drivers were investments and consumer spending, while imports finally rose more than exports. The shrinking savings rate of only 8.5% was hailed by Keynesian economists like Adam Posen, that previously critized the German export model based (here in Twitter discussion with the author). On the other side German newspapers are not happy about the 12-years low in savings.High importance: The October minutes of the Federal Reserve Open Market Committee (FOMC) indicated that several members would like to taper bond purchases in the next months. U.S. retail sales improved +0.4% MoM vs. +0.1% expected. Retail sales ex. autos and gas were up 0.4%. Consumer price inflation for the United States fell to 1.0% YoY (-0.1% MoM) mostly driven by the -4.8% YoY move in energy. Core inflation, however, is still at 1.7%. According to Bloomberg, the ECB is considering a negative deposit rate of -0.1%. This news helped to depress the EUR/USD on that day by 0.8%. The Financial Times Alphaville believes that negative rates are helpful but contractionary. One day later, Draghi emphasized that negative rates have not been discussed recently.

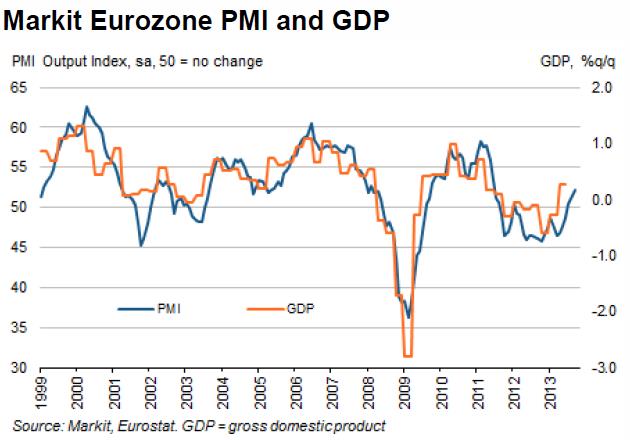

The European manufacturing PMI improved slighly to 51.5 mostly driven by the strong German PMI of 52.5. The French one fell to 47.8. The German Services PMI improved to 54.5 (up from 52.9), while the PMI for the rest of Europe depreciated. This dragged the whole European Services PMI down to 50.9 (down from 51.6).

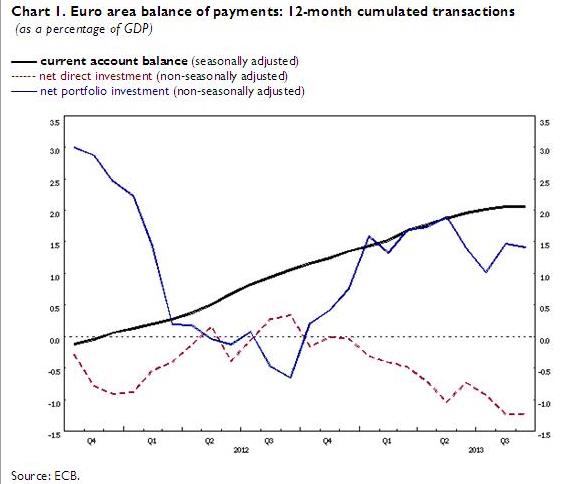

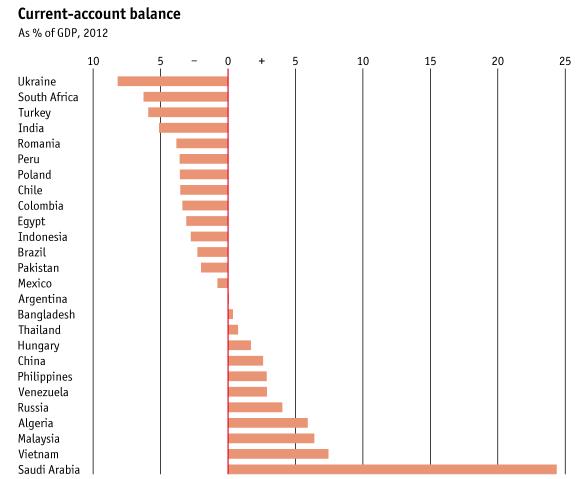

After the record-highs in Spring 2013 of 17 bln.€, per month, the September trade surplus in goods and services for the euro area fell to levels of 14.3 bln. €, which is 1.8% of (monthly) GDP. The recent tendency, however, was for rising European exports, while the contraction of imports seen until the spring stopped. The continuing European recovery attracted more foreign (e.g. American) portfolio inflows and sustained the euro.

The American NAHB housing market index continued its expansion at 54, but did not reach the highs of 59 achieved this summer.

Car registrations in the euro zone improved by 4.5% in October, mostly driven by a cash-for-clunkers-scheme in Spain (+34.4% YoY), +2.3% YoY in German and +2.6% YoY in France, while Italy lagged (-5.6% YoY). This was visible in the Spanish trade deficit that expanded back to levels seen end 2012, but made German car producers happy.

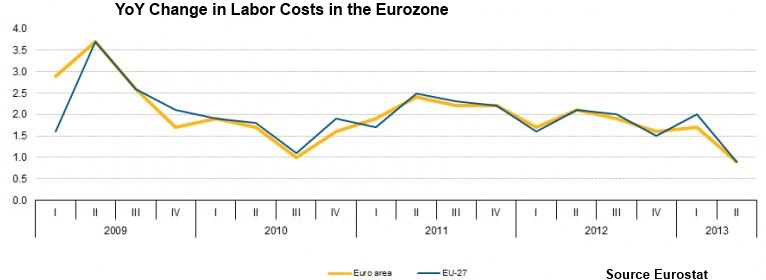

Italian contractual wages were up 1.4% YoY. As opposed to Spain, Greece or Ireland, Italian wages and labor costs seem to be downwards sticky, the consequence: higher unemployment.

Medium importance: Chinese house prices were up 9.6% against last year or 0.6% MoM. In November the Philly Fed manufacturing index inched down to 6.5 (vs. 15.0 expected), the lowest level since May. Initial jobless claims declined more than expected to 323K. Norwegian mainland GDP, which excludes volatile petroleum and ocean activities, was up 0.5% in Q3 after a weak 0.3% in the second quarter. The Australian RBA kept the policy rate unchanged at 2.5%, but is seen as slightly dovish and uncomfortable with the strong Aussie. The Bank of England’s monetary policy commitee (MPC) said that the decline in unemployment was a little faster than anticipated. The Japanese trade balance in October continued to deteriorate, the adjusted trade deficit was 1,09 bln yen, about 2% of (monthly) GDP. Compared with one year ago, imports increased by 26% and exports by 18%. In particular, imports of petroleum increased by 67%. Consequently, imports from the Middle East rose by 51% and Russia by 113%, while the Japanese managed to improve the trade surplus with the U.S. by 40% and nearly eliminated last year’s deficit with Western Europe. Given that all Japanese nuclear reactors are currently of out of production, consumer spending was recently hit by higher energy costs. Abenomics my depend on the reestablishment of nuclear power, but is politically difficult.

More on Emerging Markets: The Singaporean GDP rose by 5.8% YoY or 1.3% QoQ (vs. a 1% contraction in the first estimate). Russian industrial production fell by 0.1% YoY, mostly driven by weaker manufacturing (-1.9% YoY). Mexican retail sales were 4% down against last year, but thanks to rising exports, the GDP improved by 0.8% QoQ (+1.3% YoY) after a -0.6% in Q2.

The Brazilian current account deficit increased to 7.13 bln. USD, which is 3.3% of (monthly) GDP.

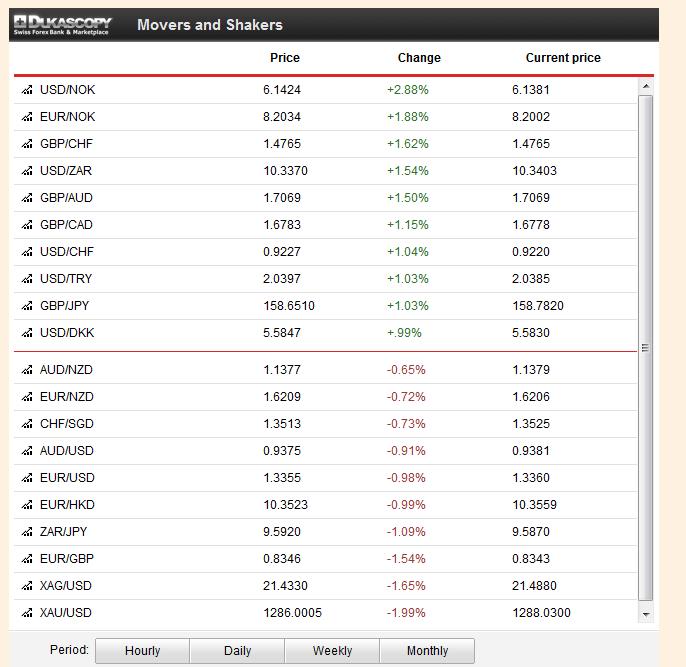

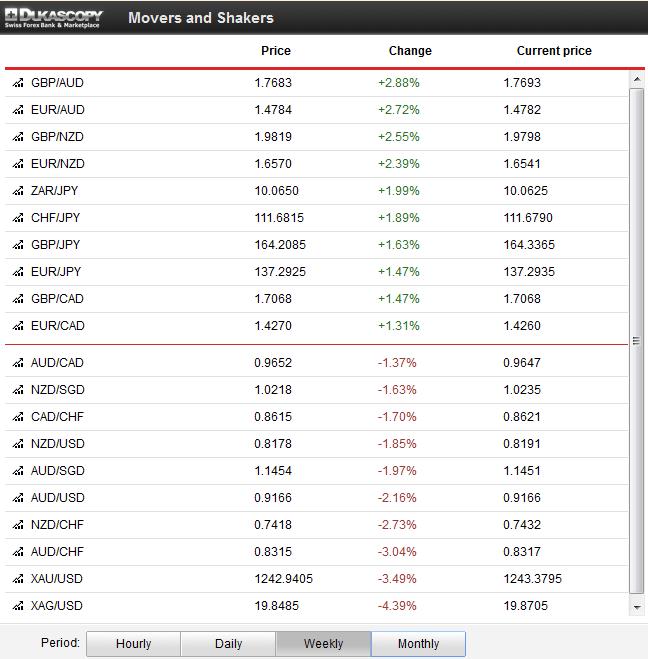

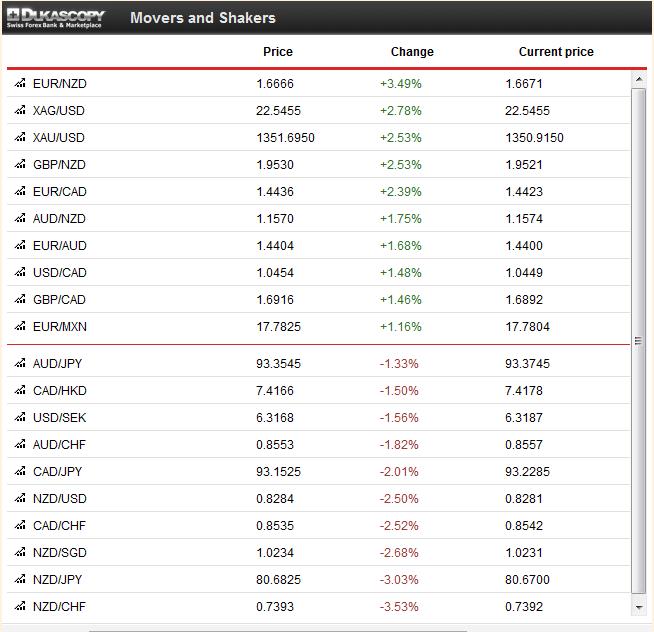

FX Price Movements

Thanks to the good German and bad Chinese data, the leaders of the week were the European currencies GBP, EUR, CHF and SEK, while the ones of the Asian bloc AUD, NZD, JPY and gold and silver lagged. Since 2009, we have seen the FX world as a bipartite division into the American bloc and the Asian bloc, driven mostly by US and Chinese data. Chinese demand for capital goods was the main driver of German exports and GDP since 2009; Germany was somehow a slave of the Chinese expansion. On the other side, European spending helped Chinese producers until austerity also weakened China. We are not sure if German spending is able to lead Europe out of recession and create something like a European bloc, driven by strong European spending, something that drove the euro up to EUR/USD 1.60 in 2007. At least this week, it looked like a concept like a European bloc could strongly influence FX rates. On the other side the strong euro, thanks to good German data despite very weak French and Italian PMIs, showed that the main driver behind the euro is Germany and the other countries are important only during times of fear.

Since 2009, we have seen the FX world as a bipartite division into the American bloc and the Asian bloc, driven mostly by US and Chinese data. Chinese demand for capital goods was the main driver of German exports and GDP since 2009; Germany was somehow a slave of the Chinese expansion. On the other side, European spending helped Chinese producers until austerity also weakened China. We are not sure if German spending is able to lead Europe out of recession and create something like a European bloc, driven by strong European spending, something that drove the euro up to EUR/USD 1.60 in 2007. At least this week, it looked like a concept like a European bloc could strongly influence FX rates. On the other side the strong euro, thanks to good German data despite very weak French and Italian PMIs, showed that the main driver behind the euro is Germany and the other countries are important only during times of fear.

Swiss data and news

The Swiss trade surplus (source in German/Italian/French) for goods increased slightly to 2.43 bln. francs, about 4.5% of (monthly) GDP. The FX rate-sensitive machinery and electronics industry continued its recovery and increased exports by 6.7% compared to October 2012 (but -0.6% for the first 10 months of this year). The food industry was still the leader for the first 10 months while the previously very strong (and relatively FX-rate insensitive) chemical and pharmaceutical industry and the watch industry lagged with a nominal 3.3% and a 1.8% rise. Falling energy prices (-11% in real or 23% in nominal terms) helped to keep the trade surplus strong.

Gold, Silver and CHF

Due to the continued weakness in emerging markets, e.g. the bad Chinese PMI and the expanding Brazilian current account, gold and silver had a very bad week. This combined with new tapering fears drove gold down to 1242$.

Thanks to better German and weaker French and Italian data, the Germany-related Swiss franc improved by 10 bips against the euro, EUR/CHF 1.2296. The USD/CHF fell to 0.9070 by 0.64%.

Fundamentals with highest importance: In Janet Yellen’s hearing at the Senate Banking Commission, the future Fed chair emphasized the need to provide support to the economic recovery and to overcome low inflation. Her speech supported equities, gold and US Treasuries. GDP in the Euro zone rose by 0.1% QoQ in line with expectations, but less than in Q2. Despite the recent critique with Germany, the main driver of 0.3% German GDP growth was consumption and not exports. French, Italian and Spanish growth rates were close to zero.

High importance: Inflation is weakening further in Europe, the UK inflation rate is at 2.2% (previously 2.7%), the Swedish CPI stands at -0.1% YoY and the Eurozone HICP at 0.7% (down from 1.1%). The Eurozone Core CPI is at 0.8%.

Japanese GDP increased by 0.5% QoQ. With rising prices, private consumption improved by only 0.1% after 0.6% in Q2. The GDP deflator still points to deflation of -0.3%.

The U.S. trade deficit in goods and services widened to 41.8 bln. US$ in September 2013. This is about 3.1% of (monthly) GDP. Chinese industrial production inched up 10.3% y/y, more than the 10% expected, while retail sales increased 13.3%. The growth rates of industrial production and retail sales are getting closer, this means rising global imbalances.

The Chinese industrial producer price index (PPI) continued to show deflationary tendencies (-1.5% y/y), while the consumer price index (CPI) was up to 3.2% y/y, the highest level since May 2012.

Industrial production in the euro zone inched down by 0.5% in September against August. Compared with September 2012, however, it was up 1.1%. Industrial production in the United States was down -0.1% MoM in October (or +3.2% YoY) while both August and September were strong with 0.5% and 0.7%. The Bank of England sees its target of 7% unemployment reached by Q3/2015 and the 2% inflation target already in 2014. This is earlier than the bank expected previously. The unemployment rate inched down to 7.6% in September from 7.7% in August.

Medium importance The Japanese not seasonally adjusted current account for September improved to 587 bln. Yen, but the adjusted current account, however, fell to -130 bln. Yen.

Japanese industrial production edged up 1.5% MoM or 5.1% YoY against October 2012, when Japan had a row with China. Standard & Poors’ downgraded France from AA+ to AA. In particular, they criticized that public debt is to be reduced mostly via tax hikes in a country where the tax burden is already very high.

More on Emerging Markets:

Despite somewhat higher PMIs, the slowing in emerging markets (except China) continued: Mexican industrial production inched down 1.6% y/y after only -0.4% in the previous month. Indian production improved only by 2% y/y. The central banks of Russia, Indonesia and Brazil are still fighting inflation and remained in tightening mode with lending rates of 5.5%, 7.5% and 9.5% respectively. Due to still high inflation, Russian GDP increased by only 1.2% in Q3/2013 y/y, economists see Brazil grow by 2.1% in 2014.

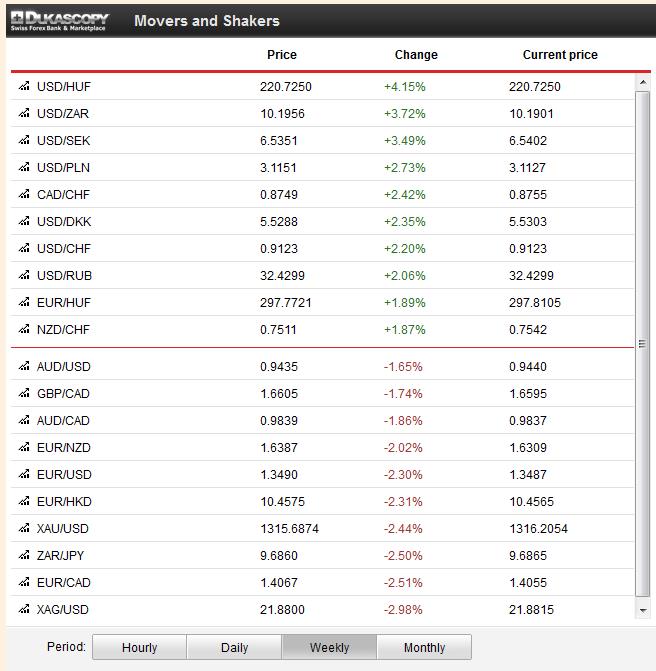

FX Price Movements

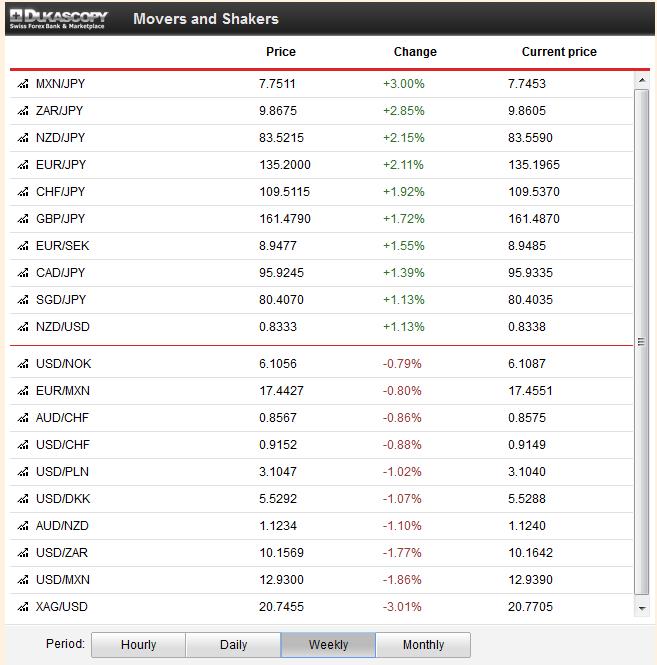

Helped by some weaker Japanese data, the clear looser of the week was the Japanese yen. Thanks to Yellen’s support, stocks and US Treasuries rallied and, logically, the funding currency JPY depreciated. The winners were the risk-on currencies MXN, ZAR, NZD, CAD and EUR, while the US dollar and the yen lagged. The Asian bloc, NZD, AUD, KRW, SGD and NOK appreciated vs. the dollar.

Swiss data and news

Recent good US data are visible on the SNB balance sheet. For the second week in a row SNB sight deposits have fallen by around 500 million (compared to a total of 368 bln. not a lot). We judge that foreign banks are retreating some funds from Switzerland (details).

The UBS bought back the Stabfund from the SNB, a win of 5.3 bln. CHF for the central bank – details. On the other side, it will still be years before the UBS will start to pay taxes, thanks to unused tax losses carried forward – details (in German). The Swiss regulator FINMA and the SNB have declared the Zurich Cantonal Bank (ZKB) as “system-relevant”, which implies that the bank needs to increase capital. – details. Thanks to cheaper energy the Swiss producer price index moved into deflation again: -0.3% YoY after 0.0% last month.

Gold, Silver and CHF

Thanks to Yellen’s support, gold remained stable this week around 1292$, even if last week’s strong NFP figures initially weakened the yellow metal. Silver depreciated by 3% given the good NFP figures and continuing low growth in emerging markets (except China). Yellen’s support and the not so bad European GDP figures helped EUR/CHF to gain some 30 pips from 1.2317 to 1.2347. Unconvincing U.S. data and Yellen’s downwards pressure weakened the the USD/CHF rate from 0.9216 to 09148.

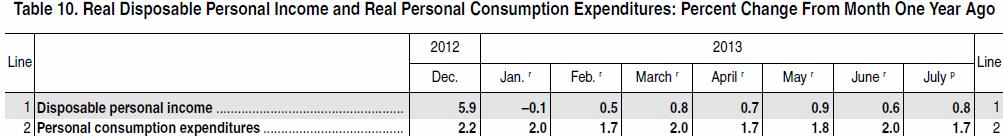

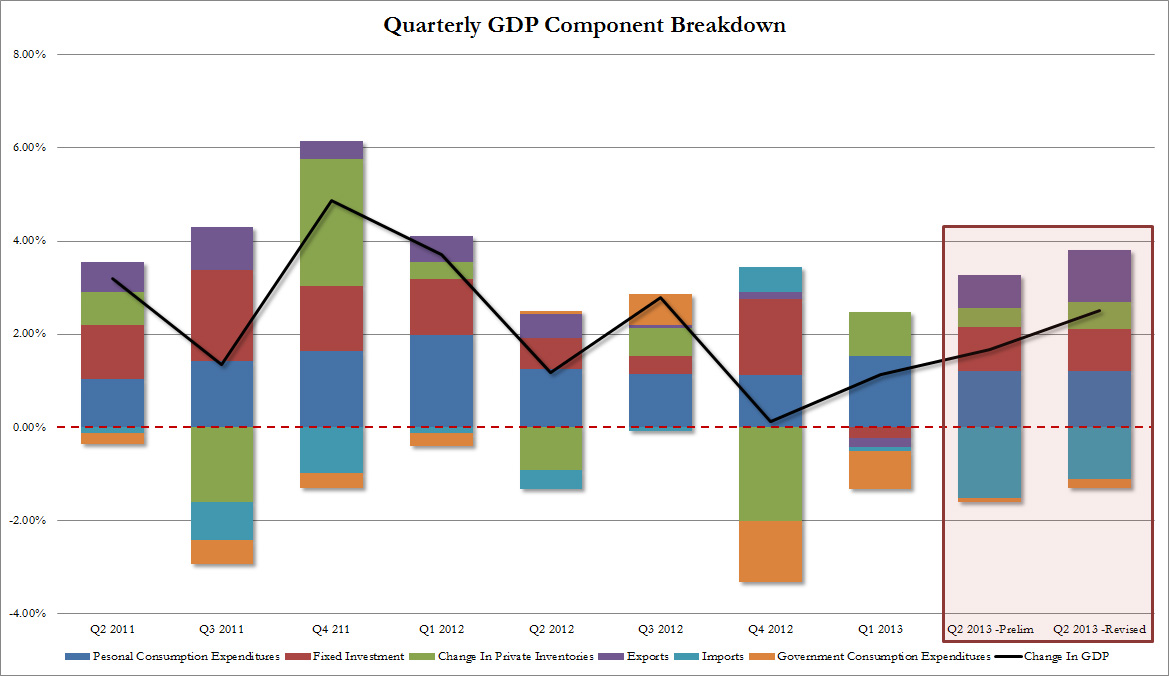

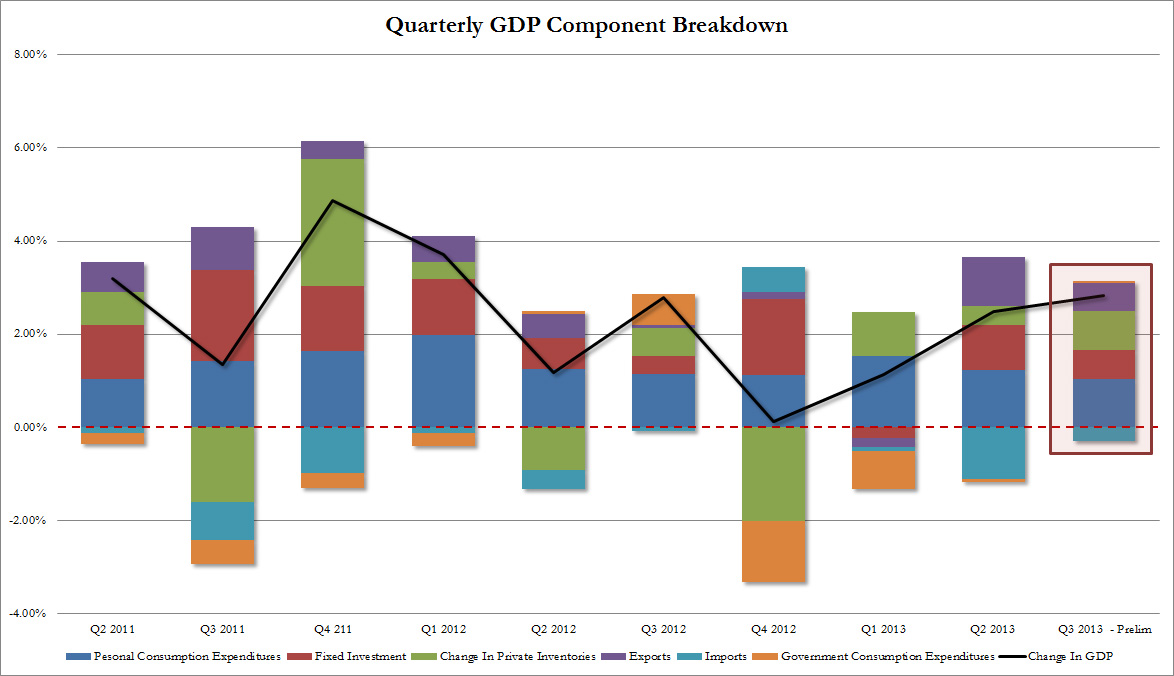

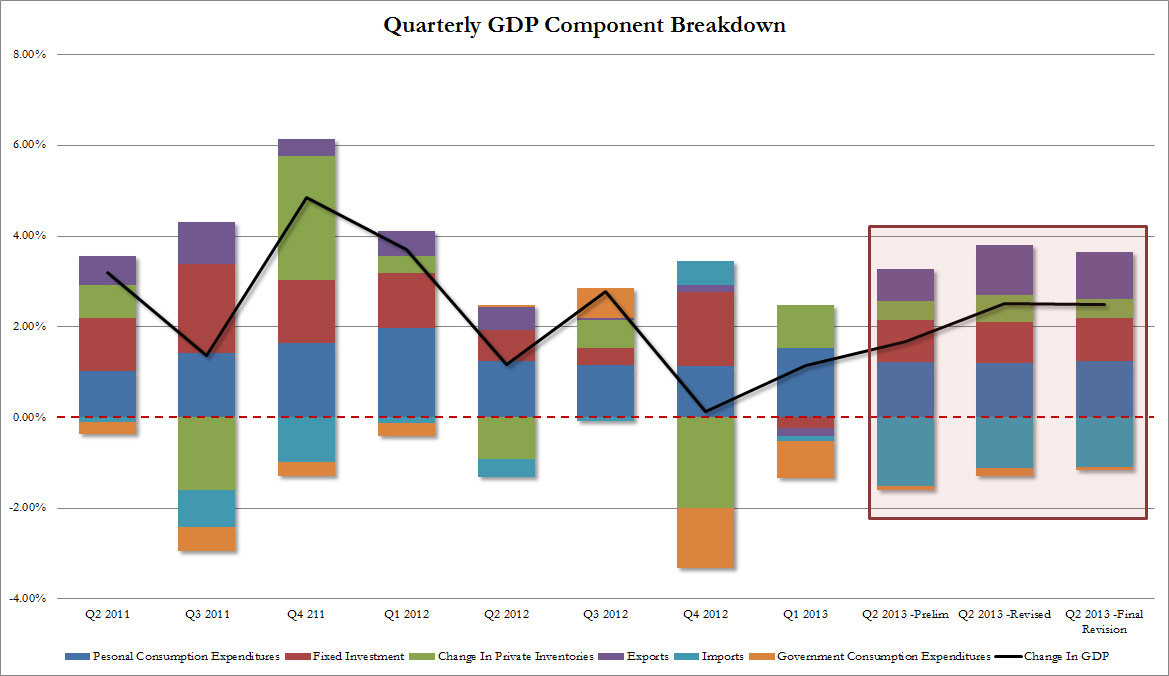

Highest importance:The U.S. GDP release for Q3, showed that despite the recent U.S. critique with Germany, the Americans are trying to follow the successful Germans: for the first time since Q1/2012 and Q2/2011 exports rose more than imports. GDP was up 2.8%, but not driven by consumption, it was mostly helped by exports (pink color below) and inventories (green).

click on graph to expand, (source Zerohedge)

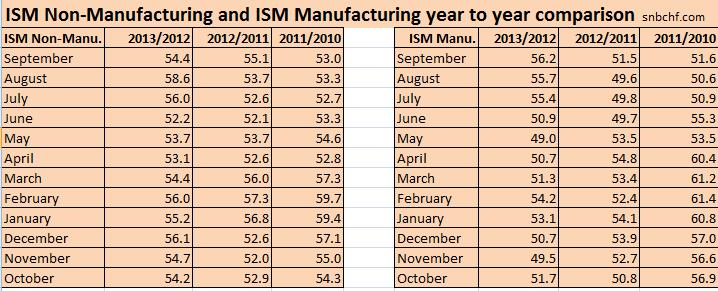

The ISM Non-Manufacturing PMI appreciated from 54.4 to 55.4 despite the government shutdown. This PMI is most important and strongly related to GDP.

The European Central Bank reduced its key lending rate from 0.5% to 0.25%. Even if the decision generated many headlines, the euro did not depreciate a lot because the deposit rate remained at 0%. EONIA rates depreciated by around 10 basis points.

According to the Non-Farm Payrolls report, American firms created 212K new jobs, far more than the 125K expected. Furloughed workers affected by the government shutdown were not considered as unemployed in this survey. In the second survey, the household survey, however, many furloughed workers were considered as temporarily unemployed or even as “out of the labor force”. Therefore, unemployment increased to 7.3% and the participation rate to 62.8%.

High importance:

The official Chinese services PMI increased from 55.4 to 56.3 in September and the HSBC services PMI from 52.4 to 52.6. This confirmed the continuing Chinese recovery. The eurozone manufacturing PMI remained stable at 51.3. German manufacturing was stronger, but Italian and French weakened. The eurozone services PMI fell to 51.6 after a value of 52.2 in September, which was driven by higher German and French values.

Medium importance:

U.S. factory orders (excl. the volatile transportation component) for August and September depreciated 0.4% and 0.2% and contradicted the recent strong ISM manufacturing PMI.

The European producer price index (PPI) fell by 0.9% YoY compared to the 1.2% increase for the U.S. and minus 1.5% for China. The weak German PPI of -0.4% and cheaper German prices were reflected in a record-high German trade surplus for goods of 18.8 billion €, 6 % of monthly GDP. German factory orders rose strongly by 3.3% MoM in September but industrial production inched down by 0.9% MoM. European retail sales in September were down on the month, but nearly unchanged YoY.

The UK continued to witness good data: rising industrial production (+2.2% yoy), higher house prices (+6.9% YoY), higher retail sales (+0.8% YoY) and a NIESR GDP Estimate of +0.7% QoQ. The British PMIs were “over-enthusiastic”: 56.0 for manufacturing, 59.1 for construction and a 16-year high of 60.1 for the services.

Swiss data

In line with falling inflation in Europe, the Swiss inflation rate fell to -0.3%, the HICP is currently 0.0% versus 0.7% in the Euro zone. In both Europe and Switzerland, recent lower energy and food prices helped to reduce costs. Prices of Swiss services are rising by 0.7% YoY. The seasonally adjusted unemployment rate remained at 3.2%, while colder temperatures increased the not adjusted figure from 3.0% to 3.1%. Swiss retail sales increased by only 1.0% YoY after 2.5% in September.

Weekly FX rates

The winners of the week were the US dollar and pound sterling thanks to very good fundamental data. But US GDP was too good, with the consequence that on Thursday stocks depreciated and the founding currency JPY improved.

Better Chinese data did not help the Asian bloc. Both the risk-on currencies AUD and NZD and the safe-havens JPY and SGD depreciated against the dollar.

The European risk-on currencies NOK and SEK were hit hard on Thursday by two pieces of news:

1) The ECB spoke about prolonged European low inflation. Traders interpreted this as longer than expected low Norwegian and Swedish interest rates or even rate cuts.

2) The stronger U.S. GDP could lead to an outflow of American risk-on funds from Norway and Sweden.

Gold, Silver and CHF

Due to the good US data, gold fell under the important 1300$ barrier again, while silver was not hit that strongly. Both the U.S. and emerging markets are recovering, this helps the silver price. But due to smaller surpluses in China and other emerging markets, gold demand by central banks is weak. Consequently, the gold/silver ratio should shrink further.

While CHF weakened against the dollar by about 1%, the EUR/CHF rate was nearly unchanged. Thanks to better U.S. data, EUR/CHF improved from 1.2306 to 1.2317 during this week. After the ECB rate cut, it had dipped to 1.2284.

This week concentrated on long awaited U.S. data:Highest importance for FX Rates:

The ISM Manufacturing Purchasing Manager Index (PMI) for October came in at 56.4, higher than the 55 expected. The value for new orders and for production remained above 60 despite the government shutdown.FOMC Meeting: The Fed keeps asset purchases unchanged, but the policy statement suggested that “tapering” could start earlier than investors thought.Inflation in the euro zone fell to 0.7% after 1.1% in September. Even the less volatile core inflation decreased to 0.8%. This triggered expectations that the ECB could cut interest rates.The official Chinese Manufacturing PMI improved to 51.4 from 51.1 and the HSBC Manufacturing PMI to 50.9 from 50.2.High Importance:

U.S. Industrial production improved by 0.6% in September after 0.4% in August. The increase was mostly driven by utilities (+4.4% MoM).U.S. Retail Sales decreased by -0.1% MoM, while retail sales excluding autos and gasoline were up 0.4%.According to S&P/Case Shiller, U.S. house prices rose again by 1.3% MoM or 12.8% YoY, more than expected.The Markit Manufacturing PMI for the U.S. contradicted the ISM PMI and indicated a level of 51.8. Especially the output component had sharp differences to the equivalent “production component” of the ISM index that showed a value of 60.2.

U.S. consumer prices inched up 1.2% YoY, core inflation was 1.7%, while services and shelter increased by 2.4%. The smaller headline figure was driven by energy that was down -3.1% on the year.In September the European unemployment rate remained at 12.2% vs. 12.0% expected. The Italian rate increased from 12.4% to 12.5%, while the German Eurostat “harmonised unemployment rate” fell to 5.2%. German retail sales will continued to under-perform for years. They increased by only 0.2% YoY.Medium importance:

Initial jobless claims were once again not convincing with a value of 340K. The ADP Nonfarm Employment change was weaker than expected with 130K new jobs, far lower than values of up to 200K seen this summer.

The producer price index (PPI) for the U.S. rose by 0.3% YoY. This after a YoY increase of 2.5% still in June.

Crude oil inventories have risen further as processing at refineries has been slowed by maintenance and outages. Crude oil fell down to 96 $. Gasoline prices are 8% cheaper than one year ago.

The Japanese unemployment rate fell from 4.1% to 4%. Industrial production rose 1.5% against August. In August it was down 0.4% YoY. Retail sales and household spending were up 3.1% and 3.7% YoY, far higher than the previous figures.

The Spanish recession has ended: GDP rose by 0.1% QoQ but was down -1.2% YoY. GDP was mostly driven by higher exports, but not by spending. The British Manufacturing PMI was still strong at 56.0 after previously being 56.3, while the Canadian RBC Manufacturing strengthened to 55.6.

After last week’s bad performance, the NZD was sustained by the RBNZ’s Wheeler who spoke about rate hikes in 2014, but the currency was still under pressure when Moody’s said it considered downgrading New Zealand’s credit rating due to the continuing current account deficit.

Terms of trades for Australian trade are weakening – imports +6.1%, exports +4.4%. This is bad for the Australian economy, a fact, highlighted by RBA governor Stevens.

Emerging markets:

Brazilian industrial production increased 2% YoY after a -1.2% contraction in August, but the trade balance went into negative territory. Similarly the Indonesian trade balance was even weaker, this after the country has had continuous surpluses in 2011 and 2012.

Swiss data

The SVME PMI weakened to 54.2 after 55.3 in the previous month. The UBS Consumption indicator improved to 1.56 and was nearly as high as in early 2011. In 2011 it topped at 1.91. Probably the most important Swiss leading indicator, the KOF Economic Barometer inched up to 1.72, the highest level since 2011.

Weekly FX rates The clear winner of the week was the US dollar thanks to expectations of earlier tapering and the strong Chicago and ISM PMIs. The potential ECB rate cut took its toll in the currencies that are driven by European demand and inflation, namely the Hungarian florint HUF, the Swedish SEK and the Polish PLN.

Gold, silver, but also emerging market currencies like ZAR, BRL, IDR and INR were hit by the stronger U.S. data. Similarly, the Aussie and the Kiwi inched down this week.

The EUR/CHF had an important change of behaviour: Since risk aversion ebbed, a stronger dollar led to an increase of EUR/CHF. But with the weak euro zone inflation figures on Thursday, CHF improved against EUR and followed the rise of the dollar.

The week contained a lot of important fundamental events, in particular Non-Farm Payrolls and preliminary “flash” PMI readings.

Highest Importance for FX Rates:

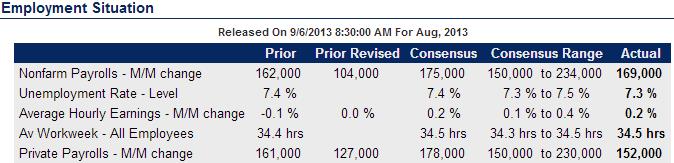

Non-Farm Payrolls (NFPs) weakened to 148K, private NFPs to 126K, both against 180K expected. Especially the private NFPs were disappointing. The decrease in the unemployment rate from 7.3% to 7.2% was driven mostly by declining participation. It showed a little divergence between the household (CPS) survey and the NFP (or CES) survey. The upgrade of the previous NFP reading from 169K to 193K was good news, even if it was mostly driven by government jobs. Private NFPs were reviewed only by 9K.

The Markit Manufacturing “flash” PMI for the United States fell to 51.0. This was the lowest reading since early 2012. Output was contracting and orders slowing, while input prices were rising.

Thanks to increasing orders, the HSBC manufacturing “flash” PMI for China rose from 50.2 to 50.9, higher than the 50.5 expected.

China’s benchmark seven-day repo rates were up nearly a full percentage point at 5 percent after the PBoC declined to inject liquidity. This move was seen as a response to the strong 9.1% YoY increase in Chinese house prices and perceived bubbles in many cities.High importance

The German manufacturing flash PMI remained stable at 51.5, while the less China-related French one declined to 49.4. The European services PMI, however, declined to 50.9 vs 52.4 expected. The business expectations of the German IFO decreased from 104.2 to 103.6.

Initial jobless claims in the U.S. were at 350K, higher than 340K expected.

The Japanese consumer price index (CPI) for September was up 1.1% YoY , but was mostly driven by higher prices for food, energy and transportation. British GDP was up 1.5% YoY and 0.8% QoQ.Medium importance

The American FHFA house price index rose only by 0.3% MoM after improvements between 0.5% and 1% per month since December.

The Michigan consumer sentiment decreased from 75.2 to 73.2 with the US government shutdown.

The Japanese trade deficit continued to deteriorate, imports were up 16.5% YoY but exports only 11.5%.

The Australian CPI increased 2.2% YoY, higher than 1.8% expected. With this news, rate hikes seem to be getting more remote.

Both the Norwegian Norges Bank and the Swedish Riksbanks left their key rates unchanged at 1.5% and 1.0%. The Riksbank has currently a dovish bias, while Norges Bank wants to keep rates until mid 2014. With falling Norwegian inflation, this is positive news for NOK/SEK (see more in our recent posts).Still bad performance in emerging markets: Mexican retail sales -2.2% YoY, -1.4% MoM. Brazilian unemployment increased from 5.3% to 5.4%.

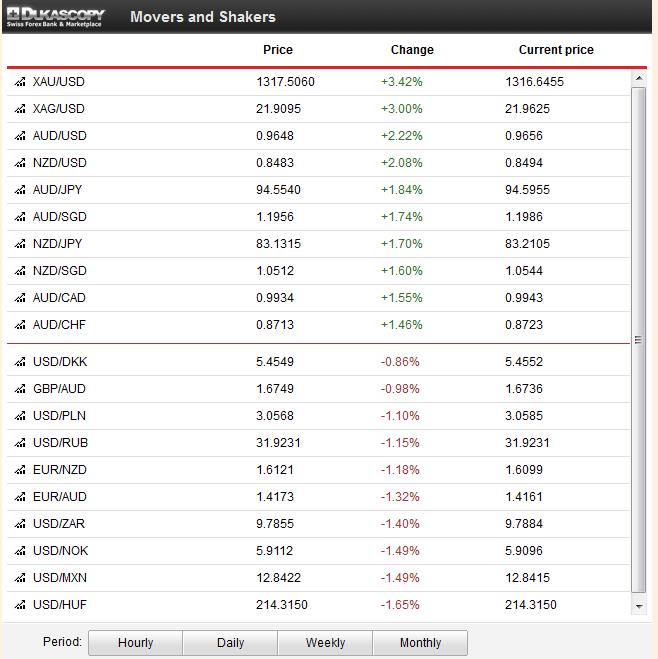

Weekly FX movements

Thanks to bad U.S. performance, gold and silver outperformed markets. Usually in these cases, silver (XAG) has about twice the performance of gold (XAU). But the PBoC tightening gave gold, the stronger crisis hedge, a relatively stronger performance.

The euro and the Swiss franc profited most from bad U.S. data and not – as usual- the yen. The Japanese currency was hit by the tightening in neighboring China and the bad Japanese trade data.

Other currencies of the American bloc, CAD and MXN, weakened with the bad U.S. data. The risk-on currencies of the Asian bloc, AUD and NZD, depreciated with the PBoC comments. The by far weakest performer was the NZD that was hit hard by the Chinese tightening and negative comments from New Zealand’s government and RBNZ’s Wheeler about the strong currency and possible interventions.

The CHF was once again the strongest currency this week. USD/CHF inched down 1% from 0.9019 to 0.8926, while the EUR/CHF fell slightly from 1.2344 to 1.2322.

Swiss Trade Surplus Achieves Record-High

The Swiss balance for trade in goods attained a new record high in Q3/2013 with 6.87 bln. CHF. Thanks to the “artificially suppressed” franc, the exchange-rate sensitive machinery industry achieved a 3.9% increase in exports against Q3/2012, the change from 2011 to 2012 was -9.6% . The food and plastics industry surprised with increases of 7 to 10% YoY, compared to +3.4% (food) and -6.1% (plastics) in 2012.

Week, October 14 – October 18

The week was driven by the following factors:

- Solid Chinese economic data including a 7.8% rise in GDP.

- The end of the debt ceiling debate, at least for now.

- The expectation by the Fed member Evans that the government shutdown has delayed Fed tapering. San Francisco Fed’s Williams even speaks of a longer time of forward guidance: Reasons are the unemployment rate of 7.3% that is still far above the (for him) natural rate of unemployment of 5.5% and the inflation rate well under 2%.

- The upcoming debt ceiling debate in January 2014 may delay tapering again.

- Relatively high U.S. unemployment initial claims (358K vs. 335K expected) and a better than expected Phily Fed manufacturing index.

As a consequence, gold, silver and the risk-on currencies of the Asian bloc, namely AUD, NZD and NOK appreciated, while the dollar weakened. Together with its friends in the Asian bloc, CHF also inched up: USD/CHF depreciated by 1% from 0.9122 one week ago to 0.9021. As usual EUR/CHF followed the weaker USD and fell from 1.2350 to 1.2344 during the week.

Chinese trade data, and in particular imports, gives a hint of upcoming industrial production and is one of the most important pieces of fundamental data. We judge that this weekend’s increase in imports (+7.4% y/y vs. 7.0% in August) will be positive for oil, silver and also partially gold. The slowing exports (-0.3% y/y vs 6.0% in August), however, are an expression of the continuing balance sheet recession for Chinese customers in Europe and the U.S. and of some over-invoicing last year and less competitiveness due to higher Chinese wages. Additionally less working-days reduced exports – but not imports.

The Michigan Consumer Sentiment fell to the weakest level since April, while the Michigan one-year inflation expectation of 2.9% was the lowest reading since October 2010 (with one exception in July 2012). No increases for industrial production in India (+0.6%) and in Mexico (-0.7% y/y) confirmed the IMF’s opinion about low growth in emerging markets. On hopes of a deal between Obama and republicans stocks were up once again despite poor fundamentals. The funding currency JPY was logically down and risk-on currencies inched up against USD in the following order: MXN, NOK, NZD, SEK and AUD. Gold continued the down-trend after the broken 1300$ support and fell nearly 2% to 1272$. EUR/CHF moved up 0.21% to 1.2350, while USD/CHF nearly unchanged at 0.9120.

Republicans offered, to President Obama, to raise the debt limit until November 22. However, they want to disallow him from using extraordinary measures when the ceiling is reached. With this news the dollar strongly improved, but soon traders realized the impact of the government shutdown. Initial jobless claims surged to 374K from 308K. One big part of this increase was caused by a computer-related backlog of claims in California. Strangely, this delay in computerization helped to reduce previous claim reports but it was not mentioned when mainstream media spoke of the record-low number of claims in recent weeks.

French industrial production in August was up 0.2% m/m but down -1.6% y/y, the Italian one -0.3% m/m, minus 4.6% y/y, and the Greek one by minus 7.2% y/y. “Tail-risks” and thanks to the U.S. recovery – “tail-fear” have vanished, but fundamentals show that the disappearance of fear was bought with lower demand and slower GDP growth in the European periphery that might last for years. On the other side, lower wages and costs have increased company margins and helped to strengthen peripheral PMIs and stocks.

The potential elimination of a U.S. default let stocks strongly rise and the safe-havens JPY and gold strongly depreciated. The yellow metal was down 1.5% to 1287$. On the other side, weak US unemployment data was positive for risk-on currencies like MXN, AUD and BRL that depend on cheap U.S. funding. BRL took additionally profit from high real returns after Banco de Brazil’s rate increase. Finally, Norwegian inflation is falling again, Norges Bank’s financial repression might end: But NOK fell nonetheless. The high number of unemployment claims helped to limit CHF losses against EUR and USD by around 0.1% for both.

Wednesday, October 9

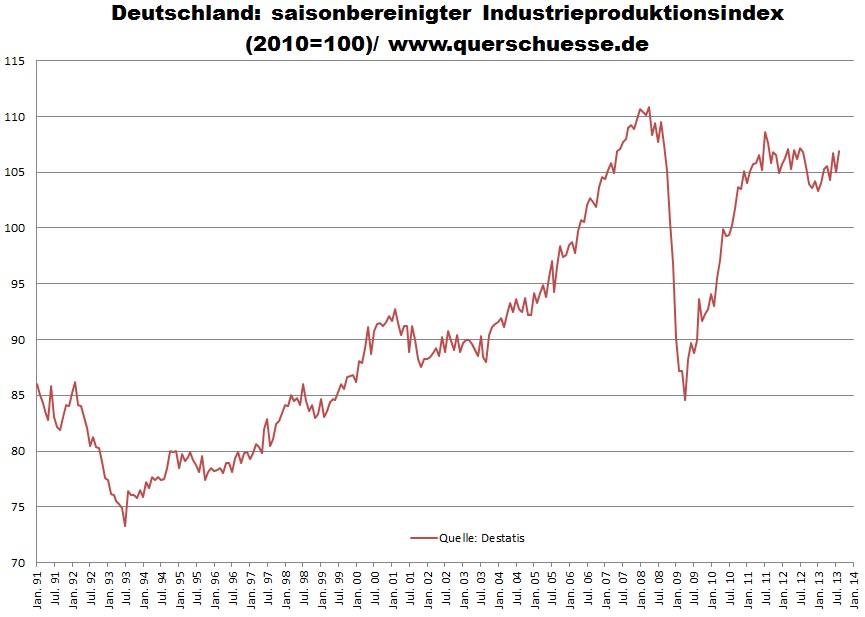

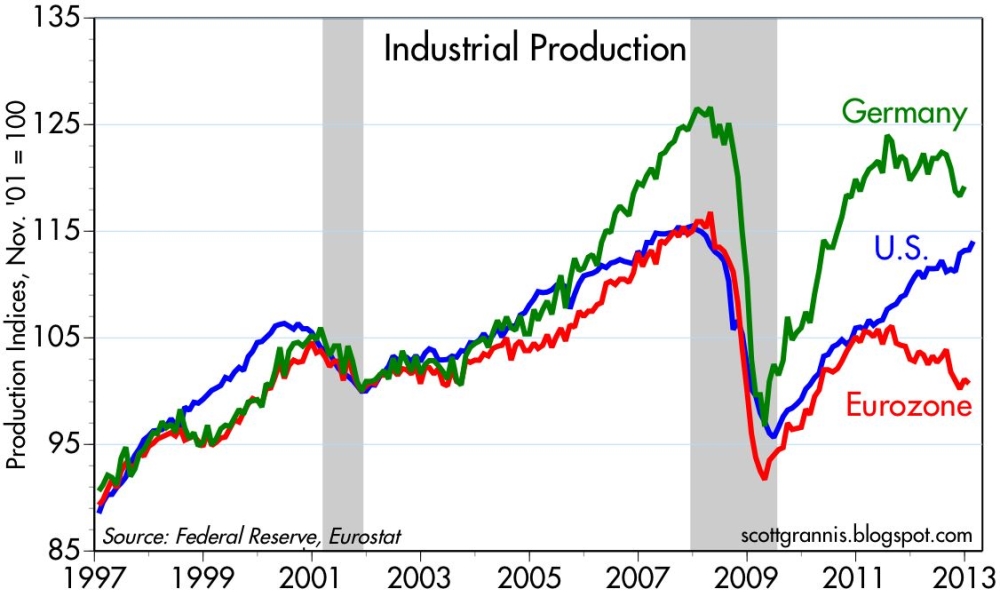

The minutes of the Fed September meeting showed that most members expected tapering to continue this year. Still, the Fed fears a loss of the good labor market momentum, a negative repercussion of rising interest rates and the U.S. budget discussion. German industrial production rose by 1.4% m/m or 0.3% y/y, in particular capital goods improved by 4.4%. Industrial production is just 4% away from the record-high in July 2007.

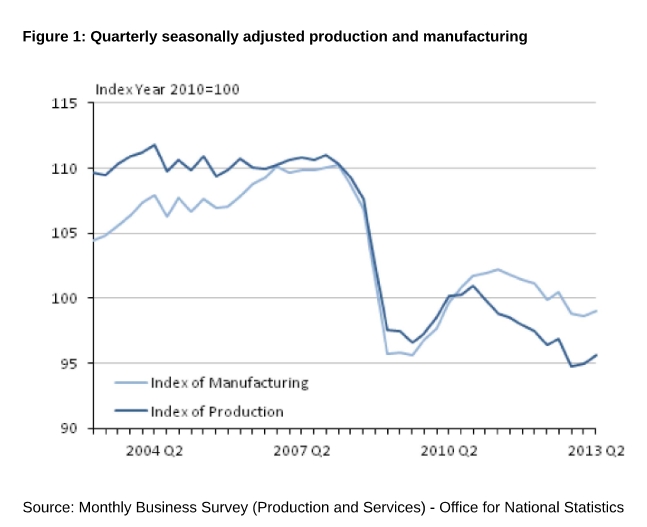

British industrial production, however, was down 1.1% m/m or minus 1.5 y/y, more than 15% weaker than in 2007.

In absence of American and Chinese fundamental news, traders could concentrate on Fed’s tapering expectations and hopes on an end of the debt ceiling debate. The dollar was the clear winner of the day. USD appreciated especially against GBP, the safe-havens CHF and JPY and the European euro, SEK and NOK. The dollar was up 0.96% to 0.9107 against the franc. As usual, since the perceived “end of the euro crisis”, the EUR/CHF followed the rising dollar and inched up 0.36% to 1.2311. Yesterday’s bad news for Emerging Markets and the stronger dollar continued to depress gold: it fell by 1.3% to 1303$.

In absence of American and Chinese fundamental news, traders could concentrate on Fed’s tapering expectations and hopes on an end of the debt ceiling debate. The dollar was the clear winner of the day. USD appreciated especially against GBP, the safe-havens CHF and JPY and the European euro, SEK and NOK. The dollar was up 0.96% to 0.9107 against the franc. As usual, since the perceived “end of the euro crisis”, the EUR/CHF followed the rising dollar and inched up 0.36% to 1.2311. Yesterday’s bad news for Emerging Markets and the stronger dollar continued to depress gold: it fell by 1.3% to 1303$.

Tuesday, October 8

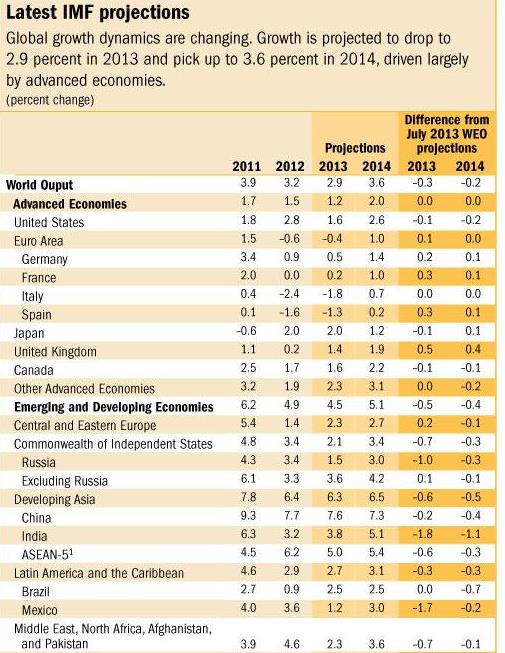

The HSBC services PMI for China came in at 52.4, weaker than the previous reading of 52.8. The American NFIB Small Business Optimism was also weaker at 93.9 (vs. 95.2 expected) and German factory orders were worse than expected. U.S. stocks fell again, in particular after the IMF cut its expectations for global economic growth. According to the IMF, the UK would see some improvements against previous forecasts; while, especially emerging markets should see less growth than the IMF thought previously.

This piece of news helped the pound to appreciate. We wonder that, similar to the wrong Fed forecasts since 2009, the IMF always projects 1% higher U.S. growth for the forthcoming year (this time 2014) than for the current year and – each time they get wrong. The reasoning for the IMF is higher U.S. credit offers and higher spending. Given that many U.S. and British households are still balance-sheet-constrained, we think that the demand for credit will not match the increased credit offer and many will prefer to pay down debt and spend less. This will limit GDP growth. We see Switzerland grow as much as the U.S. in 2014 and more than the U.S. in 2013. Two reasons: the Swiss are not balance-sheet constrained and have higher immigration.

Thanks to income from abroad, the Japanese managed to achieve a small current account surplus, but the high trade deficit weighed on the yen. In late trading the news that Obama had chosen Yellen as the new Fed chair weakened the dollar again and supported risk-on currencies like BRL, AUD and NZD. Weaker growth for emerging markets was negative for gold, the news about Yellen positive. Hence gold fell slightly to 1320$. With mostly negative news and bad equities performance, USD/CHF fell 0.1% to 0.9020. But CHF reacted to the bad news from the correlated German and emerging markets: EUR was slightly up against CHF to 1.2267. With falling energy prices compared to last year, Swiss y/y inflation for September weakened to -0.1%. The HICP remained 0.9% under the provisional reading of the euro zone.

In the absence of new major fundamental data, traders could concentrate on the discussion of whether the U.S. will technically default if the debt ceiling is not increased. The first interest payment on Treasuries will be on 31 October, but according to the Congressional Budget Office, between 22 October and the end of the month, the U.S. would need to cease payments. The S&P500 fell by 0.5%, the safe-havens of gold, JPY and CHF inched up. Thanks to their current account surpluses, both the euro and SEK were considered to be safe-havens too, and improved. Risk-on currencies, however, like AUD, NZD, NOK, MXN and BRL, weakened. Gold was up 0.7% to 1323$, the USD/CHF inched down by 0.28% to 0.9029. EUR/CHF was down 0.2% to 1.2262.

Due to the government shutdown the Non-Farm Payrolls report had been cancelled. The major news was that US House Speaker, the Republican Boehner, is determined to avoid a U.S. default and that Republicans are supposed to allow that furloughed government workers receive their pay. (see the Senate decision on Saturday). The greenback, stocks and the risk-on currencies AUD, NZD and MXN inched up. In absence of further BoJ easing measures the yen depreciated only 0.2% despite rising stock markets. The strong improvements of European currencies during this week was partially reversed: SEK fell the most, followed by GBP, CHF, and the euro. Gold was negatively affected by the positive news on the shutdown but rising copper and oil prices supported the yellow metal. It lost 0.5% to 1310$, while silver moved upwards together with other commodities. USD/CHF appreciated +0.88% to 0.9072, EUR/CHF +0.39% to 1.2296.

Thursday, October 3

For us, the U.S. Non-Manufacturing ISM index is the most important and leading global economic indicator because it reflects the state of a big part of the U.S. economy and the U.S. consumer, the main driver of global demand. The index came in short of expectations, 54.4, far weaker than the 57.4 expected. Since it is still on similar levels as in 2011 and 2012, it can be expected that GDP growth for 2013 won’t be higher than in 2011 or 2012.

On the other side, U.S. manufacturing has recovered: major reasons are the relatively low oil prices and the falling competition from Emerging Markets due to quickly rising wages.

A recovery of manufacturing together with weak oil prices would imply a reduction of the U.S. trade deficit and it would exercise further downwards pressure on gold. At 55.4, the Chinese Non-Manufacturing PMI was stronger than the previous reading at 53.9. European retail sales came in better than expected, but a look on the details shows the massive contraction compared to last year in Greece, Cyprus or Spain (between -6% and -14%), the continuing Germans reluctance to spend (+0.4% y/y) and the French resistance to austerity (+1.7% y/y). The Italian Services PMI managed to be close to the German Services PMI (52.7 vs. 53.7). If the PMIs for the rest of the eurozone are able to overtake the German one, then this might imply a rising EUR/CHF. The PMIs usually reflect y/y GDP growth (see below). However, given that Italy was in a big economic trough, it is far easier for them to grow than for Germany that has had stronger GDP growth for years.

With better European and Chinese news and weaker U.S. data, “anti-dollar currencies” or safe-havens like AUD, NOK, SEK, JPY and CHF appreciated. USD/CHF fell slightly under the 0.90 support (-0.33%) and EUR/CHF to 1.2246 (-0.11%). Gold was nearly unchanged at 1315$.

The only really market-moving piece of fundamental news was the release of the ADP unemployment report. The increase of 166K jobs came short of the expected 180K. Therefore, traders could concentrate again on the U.S. government shutdown that seems to take longer than they initially expected. Stocks fell and consequently the funding currency JPY was up – potentially helped by the increase of the Japanese sales tax. After the Italian confidence vote for prime minister Letta, the euro was a second winner. As usual, the ECB’s monthly meeting supported the euro. And as usual, but also bizarrely – the ECB-internal discussion about lowering interest rates helped the common currency to appreciate. The euro moved up against the dollar, but also against both the European safe-haven CHF and the European risk-on currencies NOK and SEK. The greenback was broadly lower, because the market thought that the shutdown will prolong the Fed’s monetary easing. The pound fell because GDP growth will be limited due to the continuing British balance sheet recession and the desire of Brits to pay down mortgage debt. Thanks to bad fundamental data from the U.S. and the expectation of a longer period of QE, gold jumped over the 1300$ support again and appreciated 2% to 1315$. As usual gold traders focused on monetary policy and ignored that the government shutdown will help to reduce U.S. debt. The rising gold price is, to a certain extent, also a reflection of rising U.S. debt and should actually decrease when debt gets limited. EUR/CHF was slightly up to 1.2260 and USD/CHF fell by 0.5% to 0.9020.

Once again China delivered a weak PMI reading. The official Manufacturing PMI arrived at 51.0 vs. 51.5 expected, PMIs of other Emerging Markets like Brazil, Russia and India were even in contraction to this area. The European Manufacturing PMI was unchanged at 51.1 against the provisional reading and slightly down vs. August. The ISM Manufacturing index, however, was strong again (56.5 vs. 55.0 expected). But it contradicted the relatively weak Markit Manufacturing PMI of 52.8, the recently not very convincing Non-Farm Payrolls and the local manufacturing readings from the New York Fed and the Richmond Fed. Still the slowing orders and exports components compared with the rising ISM price index did not convince markets of U.S. industrial strength. Despite continuing Fed support, the American standard Crude Oil fell to 101.62$, nearly 8 dollars away from the highs seen in July. Japanese average cash earnings of -0.6% y/y proved our impression that the Japanese inflation rate (recently +0.9%) will fall again to zero. For months, lower inflation and low wage increases contributed to better European PMI readings and higher company margins.

Many currencies were driven by positive news from their local PMI readings (e.g. SEK and AUD), from their central banks (e.g. AUD) or lower wage increases combined with a good Tankan reading for JPY. Currencies that depend on U.S. funding, like BRL or MXN depreciated. Gold, however, was slaughtered by the reappearance of a divergence between good U.S. and bad Chinese data. Consequently, the yellow metal inched down by 3% to 1288$ and broke major support levels around 1300$. With better U.S data, both EUR and USD rose slightly against CHF. As usually Swiss data did not move the franc: The strong SVME PMI of 55.3 could not move the franc upwards. Potentially CHF was depressed by the rising German unemployment rate (6.9% vs. 6.8% expected). Germany was finally affected by slow global growth.

Monday, September 30

The Chinese HSBC Manufacturing PMI came in weaker at 50.2 vs. 51.2 expected, while the Chicago PMI was strong with 55.7 (vs. 54.0 expected). The provisional September reading showed a record-low inflation level for the Eurozone of 1.1%, helped by low energy prices compared to one year ago, when Draghi and Bernanke had fueled oil prices. One year ago Europe exhibited stagflationary tendencies. This has changed completely now. Italian producer prices, for example, are down 2% y/y, labor costs and wages in the euro zone are rising at the slowest pace since the euro introduction, last years efforts of ECB and European leaders to slash labor costs in the periphery has started to be successful.

source Eurostat

With weak Chinese data and good U.S. news, gold depreciated to 1328$ (-0.61%). Despite better American fundamental data, CHF could appreciate; reasons were the US government shutdown and the withdrawal of Berlusconi ministers from the Italian coalition. On the other hand, weak European inflation lowers the possibility of a carry trade EUR vs. CHF and the chances of a rising EUR/CHF. With appreciating stocks most risk-on currencies were up against the dollar. One exception was NOK where the central bank is exercising financial repression: 1.5% key rate versus 3.2% inflation. NOK depreciated once again compared to the “low inflation Euro”. USD/CHF fell 0.23% to 0.9040, EUR/CHF 0.2% to 1.2230.

For a couple of months politics has not been able to influence currencies a lot: they moved with fundamental data. Today things were different: the potential government shutdown let the dollar fall against the safe-havens gold, CHF and JPY, most risk-on currencies depreciated. The good U.S. personal income reading of +0.4% MoM, the personal spending of +0.3% combined with very low U.S. inflation figures could not stop the fear. The preferred US Fed gauge “Core Personal Consumption Expenditures Deflator” was only 1.1% in Q2/2013, well below the Fed target. The continuing decline points to “never-ending” Quantitative Easing.

Rising Japanese inflation intensified the JPY strength, headline inflation is now +0.9%. Our interpretation is different: Japan is slowly reaching the end of its inflationary episode in terms of y/y price increases. We judge that by December 2013 the y/y CPI should fall to zero again. The yen has stopped falling, so fuel and energy price appreciation has slowed down. Prices for services are unchanged y/y and the CPI index ex. fresh food and energy is down -0.1% y/y for Japan in August and -0.3% for Tokyo in September. The BoJ is desperately calling for wage rises to stop a return to deflation. In Europe, however, politicians would be happy when unemployment comes down; while, European wage increases are slowing or even falling. Only in Germany is it different: despite a decline in the headline CPI to 1.4% caused by falling energy prices, Germany sees wage hikes and price increases for services of +1.6%. Gold inched up by 1% to 1336$. Due to the fear factor, silver could not follow gold and appreciated only slightly. USD/CHF inched down -0.5% to 0.9047. EUR/CHF -0.2% to 1.2253.The continuing improvement of the Swiss economy visible in the KOF Swiss Economic Barameter was not able to move the CHF, but it was rather the U.S. budget.

Rising Japanese inflation intensified the JPY strength, headline inflation is now +0.9%. Our interpretation is different: Japan is slowly reaching the end of its inflationary episode in terms of y/y price increases. We judge that by December 2013 the y/y CPI should fall to zero again. The yen has stopped falling, so fuel and energy price appreciation has slowed down. Prices for services are unchanged y/y and the CPI index ex. fresh food and energy is down -0.1% y/y for Japan in August and -0.3% for Tokyo in September. The BoJ is desperately calling for wage rises to stop a return to deflation. In Europe, however, politicians would be happy when unemployment comes down; while, European wage increases are slowing or even falling. Only in Germany is it different: despite a decline in the headline CPI to 1.4% caused by falling energy prices, Germany sees wage hikes and price increases for services of +1.6%. Gold inched up by 1% to 1336$. Due to the fear factor, silver could not follow gold and appreciated only slightly. USD/CHF inched down -0.5% to 0.9047. EUR/CHF -0.2% to 1.2253.The continuing improvement of the Swiss economy visible in the KOF Swiss Economic Barameter was not able to move the CHF, but it was rather the U.S. budget.Thursday, September 26

The major pieces of news were the “final” revision of U.S. Q2 GDP and the drop in U.S. unemployment claims to 305K, the lowest since 2007. With a 2.5% rise in GDP, growth was weaker than expected. The data showed that growth is driven mostly by investments and inventories, while U.S. personal consumption increases (+1.8%) are weaker than in Switzerland (+2.5%), for example.

click on graph to expand, source Zerohedge

Lower US unemployment figures drove some risk-on currencies lower, namely those that depend more on U.S. capital, e.g. BRL, MXN and AUD. With better U.S data, also gold (-0.9% to 1322$) and silver weakened. Potentially due to the broken 200 Day Moving Average the EUR/CHF did not appreciate despite rather good U.S. data, but fell 0.18% to 1.2278. USD/CHF went slightly up to 0.9106.

The major news was that U.S. durable goods orders only slightly increased. The more significant Core Durable Goods Orders fell by -0.1% vs. +1.0% expected. As a consequence, gold (+0.91% to 1335$) and the safe-havens CHF and JPY but also the (“German safe-haven” related) euro appreciated. Commodity currencies got hit again: BRL fell the most, followed by MXN, NZD, NOK and AUD. EUR/USD is approaching new highs and – like always since 2008 – USD/CHF new lows (see why). On Wednesday EUR/CHF fell slightly to 1.2298 and USD/CHF more strongly to 0.9088 (-0.45%).The bad New Zealand trade balance data was explained by the purchase and import of a drilling platform. Still – provided that Chinese growth remains relatively modest – it is fairly possible that the Kiwi might soon collapse, similar to 2008/2009. The NZD could finally join NOK, AUD and the currencies of the Emerging Markets in the continuing the collapse of the carry trade – especially because the NZ economy is not only driven by China but even more by demand from Australian that is weakening. New Zealand seems to be one of the last countries where consumers are spending – visible in rising imports – while the rest of world – not only Europe but also Emerging Markets and the U.S. – limit expenditures (see Paul Krugman).

Fed tapering and the increasing NZ current account deficit could lead to the phenomenon that a carry trade must end in a currency collapse (see more).

Fed tapering and the increasing NZ current account deficit could lead to the phenomenon that a carry trade must end in a currency collapse (see more).Tuesday, September 24:

The Richmond Fed Index dropped unexpectedly from 14 to 0 (vs. 12 exp.). The board consumer confidence fell slightly, while the Case Shiller Index continued its strong performance: a 12.4% y/y price increase. The IFO business expectations from Germany improved to 104.2, the best reading for 17 months, but the current situation was weaker. With the mostly bad fundamental data commodities, especially oil prices, weakened once again while stocks remained positive for most of the day, but depreciated in late U.S. trading. Commodity currencies were hit, biggest losers were NZD, NOK and MXN. Thanks to bad U.S. news, gold contradicted the downtrend in commodities and was nearly unchanged. The rather good German data was not enough to let EUR and CHF rise. The dollar appreciated against CHF by 0.20% to 0.9126, while the euro was nearly unchanged vs. CHF.

Merkel was the clear winner of the German elections, but she has no majority. Merkel has the habit of crushing her junior partners politically: the social democrats of the SPD have been weak since their coalition with Merkel in 2005, the liberal FDP since their coalition with Merkel in 2009. Hence, the potential coalition partners, the greens or the SPD might prefer to stay in the opposition or demand big political concessions from Merkel. Therefore, we judge that the Germans will not build a government very quickly; uncertainty may arise and affect markets. As for fundamentals, we observed a returning pattern from summer 2011: good Asian, mixed European and rather bad U.S. data. The Chinese HSBC Manufacturing PMI improved to 51.2 (from 50.1), European Services PMIs rose, but Manufacturing PMIs depreciated. Once again the U.S. Markit Manufacturing PMI strongly contradicted the recently strong ISM values: the Markit PMI value was at 52.8 vs. 54 expected. The US Chicago Fed activity index came in close to contraction. Driven by better Chinese data the whole Asian bloc appreciated: AUD led, then JPY, NOK, NZD, SGD, KRW and CHF. The euro inched down driven by Draghi’s comments that there might be a third Long Term Refinancing Operation. EUR/CHF recovered from an intra-day low of 1.2277 (under the 200-DMA) to 1.2294 (-0.17%), USD/CHF was unchanged around 0.9110. Due to the stronger dollar against EUR and the continuing technical downtrend, gold could not take profit from the better Chinese data as usual. The yellow metal depreciated by -0.53% to 1325$.

The St. Louis Fed president James Bullard explained that the Fed was close to tapering 10 bln. $ and that markets overreacted after the FOMC with their strong performance. As a consequence the S&P500 inched down by 0.6% and both gold and silver got destroyed again: the yellow metal lost 2.7% to 1332$. In absence of major fundamental news Fitch’s downgrade of Malta and Croatia might have weakened markets a bit. Risk-on currencies were down, led by NOK, then MXN, BRL, SEK and AUD. Both EUR and CHF depreciated slightly against USD: EUR/CHF was at 1.2316, the dollar at 0.9107. It is September, the month when USD/CHF achieves new lows.

Thursday, September 19:

The Swiss National Bank repeated the usual messages: it maintains the CHF cap and is ready to buy foreign currency in unlimited quantities. As very often in recent years, it upgraded GDP growth expectations (by 0.5% to 1.5%-2%), and this time also inflation expectations (by around 0.2%).  After the strong fall of USD/JPY after the FOMC, markets quickly remembered that the principal funding currency is currently the yen and not the dollar. A JPY 5 trn stimulus package that includes about JPY 1.4 trn of corporate tax cuts weakened the yen additionally. After moderate, 0.6%, stock price increases yesterday, the S&P500 added another 1.2% and the yen depreciated by 1.34%. Better than expected home sales, a very good Phily Fed (22.3 vs. 10 exp., in-line with the strong ISM) and lower than expected jobless claims helped the greenback to improve. The whole Asian bloc inched down, JPY fell the most, followed by AUD, NOK, SGD and NZD. But also the American risk-on currencies BRL, MXN and CAD fell after strong gains yesterday. The SECO upgraded Swiss growth from 1.4% to 1.8% – no surprise after the 2.5% YoY increase in Q2. Maybe because of this news, or potentially due to higher expected Swiss inflation, both USD and EUR weakened by -0.12% against CHF despite good US fundamentals. Due to better US data, gold fell slightly.

After the strong fall of USD/JPY after the FOMC, markets quickly remembered that the principal funding currency is currently the yen and not the dollar. A JPY 5 trn stimulus package that includes about JPY 1.4 trn of corporate tax cuts weakened the yen additionally. After moderate, 0.6%, stock price increases yesterday, the S&P500 added another 1.2% and the yen depreciated by 1.34%. Better than expected home sales, a very good Phily Fed (22.3 vs. 10 exp., in-line with the strong ISM) and lower than expected jobless claims helped the greenback to improve. The whole Asian bloc inched down, JPY fell the most, followed by AUD, NOK, SGD and NZD. But also the American risk-on currencies BRL, MXN and CAD fell after strong gains yesterday. The SECO upgraded Swiss growth from 1.4% to 1.8% – no surprise after the 2.5% YoY increase in Q2. Maybe because of this news, or potentially due to higher expected Swiss inflation, both USD and EUR weakened by -0.12% against CHF despite good US fundamentals. Due to better US data, gold fell slightly.

For about one year quantitative easing supported the U.S. housing market. With today’s decision not to taper, the dollar strongly depreciated. Markets were anticipating that money would leave the United States, which may imply that there will be less available funds for the U.S. housing market. Why, by the way, did investors put their money in U.S. housing? Simply because U.S. housing was cheap and there was no better place. Europe was doing austerity. Emerging Markets had too high wage increases, they were experiencing high inflation and their exports were hit by European austerity. Remember that the U.S. can only grow more strongly than the rest of the world and the dollar can only appreciate when oil is cheap and money is expensive – like during the 1980s when high interest rates slowed Emerging Markets and the rest of the world. But we do not live in this world any more, the leading emerging economy, China, has its own financing via current account surpluses and high central bank reserves.Our regular pattern is achieved again: when the Fed does quantitative easing, then EUR/USD reaches a new high, but also the USD/CHF a new low, and – as usual – the EUR/CHF weakens. The dollar was down against all major currencies. USD/CHF down 1.51% to 0.9117 and EUR/CHF -0.23 to 1.2340. Gold inched up 4.7% to 1365$.

Major fundamental news came from China, once again positive data: foreign direct investments in China rose by a strong 6.37%. US core inflation rose slighly to 1.8%, while the headline figure fell to 1.5% y/y from 2.0% y/y. The main reason for this decline was that one year ago between July and August 2012 energy prices surged – after Draghi’s “whatever it takes”. Hence, energy commodities inched up 1% y/y in July 2013, but they were down -2.2% y/y in August. Eurostat data showed that in July the euro zone trade surplus increased again to 18.2 bln. euro. With better Chinese data and lower U.S. inflation, the whole Asian bloc improved, led by NZD, then AUD, SGD, CHF and NOK. A rather dovish stance of the Australian RBA could not stop the increase of the AUD; both NZD and AUD are for us mostly driven by Chinese news and the relatively high Aussie and Kiwi rates. Commodities were weaker again, led by losses in Brent oil that fell on the evidence that Assad has used sarin. Gold followed the weaker oil price and fell slightly to 1310. USD/CHF was down 0.16% to 0.9258 and EUR/CHF was nearly unchanged.

The news that the “more hawkish” Lawrence Summers dropped out of the race for the new Fed chairman, let the dollar fall against all other majors initially. The euro inched up to 1.3385 intra-day. But finally markets decided based on fundamental news. The strong 0.4% increase in U.S. industrial production and the weak European inflation of 1.3% helped the greenback to recover and finish the day positively. The NY Empire State Manufacturing Index, however, did not confirm the strong ISM index and was only slightly in expansion territory. In Europe the inversion of trade balances continued: the Norwegian surplus is shrinking and the Italian one rising. The reason is simple, Norwegians are consuming and imports are rising, while exports, especially to the euro zone, are shrinking. Italian imports, however, are falling due to austerity and exports are unchanged. The falling Norwegian trade surplus combined with dovish monetary policy are the reasons why NOK has depreciated this year. USD/CHF inched up 0.19% to 0.9270 and EUR/CHF was nearly unchanged at 1.2364. With stronger U.S. data, gold was weaker again to 1313 (-1.3%) and completely unimpressed by the Summers exit, a fact that should have strengthened gold.

The leading news came from U.S. retail sales and the Michigan consumer sentiment. Retail sales were up +0.2% instead of 0.5% expected; sales excluding autos and gas +0.1% (vs +0.3% exp.) The Michigan consumer sentiment disappointed at 76.8 vs. 82.0 expected. The euro could not take advantage of the weaker U.S. data because European unemployment was down -1% y/y (vs. -0.9% exp.). The Eurostat report confronts the y/y employment increases in Germany, Austria, the UK and the Baltics of between 0.6% and 3% with jobs losses in Southern Europe between -2.2% for Italy and -6.1% for Cyprus. Due to weak Emerging Markets and sluggish car demand, export-oriented nations like the Netherlands, Finland, Slovakia or Poland shed jobs too. DJ reports said that Obama has not made any decisions on the Fed chair. First gold continued the technical movement to 1308$ before finally recovering to 1326$. We think that fundamental U.S. data helped metals and not the news about Summers. Thanks to bad US data and despite rising stocks, the safe-havens JPY and CHF improved, while most risk-on currencies were lower against the greenback. Both SEK and NOK were hit by the fall of Swedish GDP by 0.2% against Q1. EUR/CHF fell by 0.12% to 1.2362 and USD/CHF 0.11% to 0.9296. The Swiss PPI of +0.2% m/m did not have an influence.

Thursday, September 12:

Gold and silver prices suffered a collapse. Speculations that the more hawkish Lawrence Summers could be the new Fed chairman came in only on Friday and they are therefore not responsible. We think that technical factors and future traders are more important for gold and silver prices than they are for currency valuations. The break of the 1350-1355$ support further weakened the yellow metal, it fell to 1327$ by nearly 3%. Several fundamental factors plus the absence of (recently very good) news from China triggered this development. The most important one was the strong decrease of U.S. initial unemployment claims (from 330K down to 292K). They were, however, driven by a under-reporting in two states. The second reason was the weaker industrial production in the Euro zone in July. We think that sluggish demand from China and other Emerging Markets during the PBoC tightening period in June/July dampened especially German industrial production, for us a temporary movement. The following chart shows how Germany took advantage of the strong advances of China and Emerging Markets aided by Fed Quantitative Easing between 2009 and 2011, while since 2010 the rest of the Euro zone has clearly under-performed the U.S. Given that the euro crisis. austerity and the Southern European house price collapse really started in 2010/2011, this under-performance is no wonder.

Another driver for lower gold prices was the 1960s-style proxy war between the U.S. and Russia/China called “Syrian civil war”: The Russians yesterday achieved yet another accomplishment against an American attack on Assad, when Syria vowed the chemical-weapons ban. But oil prices did not react to this, solely gold and silver depreciated. With weaker stocks the safe-havens JPY, CHF and the US dollar were the strongest, while most risk-on currencies fell, especially the Aussie after bad higher unemployment. The euro depreciated slightly against CHF, while the dollar slightly improved.

Wednesday, September 11:

Markets decided once again that fundamentals were more important than news on Syria. Hence they reevaluated yesterday’s good Chinese data combined with the relatively high 2.4% y/y increase in Japanese producer prices (CGPI). As a consequence, the whole Asian bloc appreciated after some like JPY and CHF were “innocently hit” by the Syria news yesterday. The bearish currencies of the Asian Bloc led this time: JPY, CHF and SGD, while the risk-on currencies NZD, AUD and KRW had smaller increases against the dollar. With the Chinese recovery, we judge that RBNZ’s Wheeler will have a hard time to weaken the NZD against markets. Stocks rose again and so did the risk-on currencies of the American Bloc: BRL, MXN and CAD. With the weak US NFP numbers, the attacks against BRL seem to be over, USD/BRL has fallen from a top of 2.45 on August 21 to 2.27. The attacks against Indian INR and Indonesian IDR, however, might continue a bit longer because these two countries have far weaker current accounts and higher inflation.

Thanks to stronger Asian data, USD/CHF depreciated 0.50% to 0.9302 and EUR/CHF 0.15% to 1.2385. Gold was nearly unchanged.

Once again China delivered: 10.4% y/y rise in industrial production (vs. 9.9% expected or only +8.9% on July 15th). Fixed asset investments were again on a regular yearly increase of 20.4% and retail sales were on 13.4% after the slowing in June/July. As a consequence, the carry trade continued and the risk-on currencies of the Asian bloc improved: NOK, that was additionally helped by higher than expected inflation, improved most, followed by AUD, NZD and KRW. The news that Assad accepted the Russian plan to hand over the chemical weapons to international control, sustained stocks and the greenback, but this weakened oil, gold (down 1.58% to 1365$), silver and the funding currency JPY. Thanks to cheaper oil prices USD/CHF appreciated to 0.9346 (+0.25%), even if CHF usually reacts positively to good China news. EUR/CHF even inched up to 1.2400 (+0.35%).

Continuing the good Chinese data, 7.2% higher YoY exports (vs. 5.5% expected) raised hopes on a new global carry trade against JPY and – with Friday’s weak NFP numbers – also against the dollar. The bad US NFP, the slight miss in Japanese GDP (0.9% vs. 1.0% expected) and the weaker than expected Japanese GDP deflator of -0.5% raised hopes on more BoJ easing. This boosted the Nikkei and weakened the yen. Risk-on currencies, but also the ones with high current account surpluses (i.e. NOK, SEK, SGD, CHF and EUR), inched up against the dollar in the following order: BRL led, then NOK, SEK, SGD, MXN, EUR, CHF, AUD and NZD. Cable was close to a new 6 months high. The USD/CHF rate fell to 0.9323 (-0.53%), EUR/CHF was unchanged at 1.2357. Once again fundamentals were more important for currencies than Syria news: the carry trade of commodity and risk-on currencies ignored the collapse of oil prices after Russia proposed to hand over the Syrian chemical weapons to international control. Gold was nearly unchanged at 1386$: good Chinese data sustained the yellow metal while fewer fears about Syria weakened it.It was proven again that Swiss data does not matter for the CHF FX rate: the franc improved despite weak Swiss retail sales (+0.8% y/y vs. 3.2% exp.) and a n unconvincing unemployment reading: 3.0% unchanged seasonally adjusted unemployment, but 8.5% more unemployed people than one year ago. On the other side, Swiss Statistics, published some weeks ago, showed that employment has risen by 1.7% y/y. Strangely both unemployment and employment were higher – the reason: continuing immigration to Switzerland.

Friday, September 6:

The US Non-Farm Payrolls (NFP) figures were disappointing. The reason for the lower unemployment rate of 7.3 was entirely the weaker participation rate, while prior NFP readings were revised downwards. The US recovery remains the one of the older employees, the one of the part-time jobs and the one with the longest delay. Most interestingly, the NFP contradicted the strong ISM indices, a fact that could leave markets with interpretation difficulties. Our interpretation is that after the quite strong job creation over the winter months, companies are increasing margins now, which is visible in higher headline ISM numbers compared to the employment component.

With weaker US data, stocks, gold (+1.66% to 1392 $), silver and the currencies of the Asian bloc improved: NZD led, followed by JPY, NOK, CHF, AUD, SGD and KRW. But thanks to less tapering fears, also the risk-on currencies of the American bloc were stronger: MXN, CAD, SEK and BRL. The USD/CHF fell to 0.9374 (-0.8%) and – like always on weaker US data – the EUR/CHF depreciated to 1.2357 (-0.33%). With some seasonal effects on food prices and a continuing sell-off in clothes, Swiss inflation eased. It was slightly down on a monthly basis, but unchanged at 0% y/y.

Thursday, September 5:

The ISM Non-Manufacturing PMI had the strongest performance since March 2011. Even if crude oil prices have reached a new record for a September 05 date, the report shows that the strong input price increases have slowed. The reasons for us are the slowing in US wage increases, while weaker growth in emerging markets and tapering fears limit commodity prices. Job data was mixed: less initial jobless claims but the ADP report indicated that job creation might still be slow. The greenback was stronger against all major currencies, especially vs. Europeans SEK, NOK and CHF. These three weakened more than others due to the decrease in German factory orders. USD/CHF improved 0.98% to 09445 and EUR/CHF 0.36% to 1.2398. Currency price movements ignored the comments by the ECB. The following graph indicates how the commodity currency NOK followed the weak performance of another currency of the Asian bloc, AUD, despite being “the sexiest currency” according to Société Generale. The SEK, a member of the American bloc, however, followed the strong US performance.

Traders finally digested the strong ISM index: consequently gold and silver had a very bad day. Gold was down 1.3% to 1393$ and silver even 3.5%. A stronger than expected Australian GDP and a less dovish RBA let both AUD and NZD to rise. This was sustained by an increase in the Chinese HSBC Services PMI to 52.8 from 51.3 and a higher US trade deficit driven by higher prices for imported oil. The German Services PMI improved against the preliminary reading of August 22, while the one for the whole euro zone weakened. The stronger Chinese data and the higher US trade deficit helped to strengthen the other currencies of the Asian bloc: SGD, KRW and NOK inched up. Thanks to rising stock markets, the funding currency JPY depreciated. With rising stocks, EUR/CHF improved to 1.2353 (+0.15%), despite better German data. USD/CHF was slightly down to 0.9358 (-0.06%).

Tuesday, September 3:

The weaker CHF after the strong Swiss GDP data sustained the fact that trading algorithms ignore Swiss fundamentals as long as no SNB rate hike expectations exist. The market-mover was the strong U.S. ISM Manufacturing index with 55.7 vs. 54.0 expected. On the other hand, the Markit Manufacturing PMI fell to 53.1, but construction spending was up 0.6% m/m. The Chinese Non-Manufacturing Index, at 53.9, was slightly weaker than the previous reading. With the help of a less dovish RBA, the AUD improved. The other currencies of the Asian bloc, however, depreciated due to weaker Chinese and stronger U.S. data: SGD, NZD, KRW and JPY fell. Thanks to stronger U.S. data, USD/CHF inched up 0.17% to 0.9364 and EUR/CHF 0.04% to 1.2334. Despite weaker Chinese and stronger U.S. data, gold (+1.25% to 1411$) and silver (+0.1%) appreciated. The fact that gold was stronger than silver shows that prices were driven by Syria fear after Obama won the backing of key senators.

With lower or no current account surpluses in China and other Emerging Markets, gold purchases by central banks are limited. Silver, however, profits from the recovery in China; therefore, we see the gold/silver ratio falling further. See also our recommendation for silver purchases in April.

Monday, September 2:

The Chinese recovery we have been speaking of since the strong import figures on August 8, intensified. The HSBC PMI moved from 47.7 to 50.1 and the official PMI inched up slightly to 51. The latter contains rather bigger and state-led firms and was less hampered by restrictive monetary policy of the PBoC. The Eurozone Manufacturing PMI came in at 51.4, slightly above the preliminary reading of August 22. The German PMI, however, was at 51.8, weaker than the preliminary one at 52. Thanks to better Chinese data the currencies of the Asian bloc improved: KRW, AUD, NZD, NOK and, as usual, gold (+0.96% to 1396$) and silver. As a general rule, JPY improves on better Chinese data as well, but not this time. Hopes of a carry trade vs. JPY let the greenback rise against the yen. Due to weaker German data, USD/CHF rose 0.24% to 0.9348 and EUR/CHF 0.11% to 1.2329. The Swiss SVME PMI confirmed the German weakness and inched lower from 57.4 to 54.6.

Friday, August 30:

Market movements were caused by good Japanese data and the therefore stronger funding currency yen. The Japanese headline CPI rose to 0.7% y/y, industrial production by 3.2% m/m and the manufacturing PMI to 52.2, while the unemployment rate fell to 3.8%. European unemployment was unchanged at 12.1%, while business and consumer sentiment is improving in both Europe and the US (the Michigan sentiment was up to 82.1%). The Chicago PMI came in as expected at 53.0. With this rather weak regional reading and 3 positive and 3 negative (e.g. NY, Phily Fed) ones, our forecast for Tuesday’s ISM Manufacturing PMI is now at 53.0 compared to a 54.0 consensus estimate. The BEA personal income and outlays report showed that American incomes are rising mostly thanks to rising incomes on rents and on assets, but far less on wage income. The big gap between spending increases and income is (finally?) getting smaller again; interestingly the data about slowing US spending comes at a time when Europeans are reducing their austerity (click to expand graph).

The weaker euro zone inflation reading (1.3% vs. 2.0% in the US) could increase margins and make the rather cheap European stock markets more interesting. This is yet another reason why we expect EUR/USD to rise. On Friday, however, Kerry’s words about a limited action in Syria let oil, gold and silver depreciate, gold was down 1.27% to 1395. But due to the stronger funding currency all commodities, stocks and the risk-on currencies BRL, NZD, SEK, NOK and MXN lost, while the Asian bloc safe-havens KRW, SGD, CHF and JPY improved. EUR/CHF inched down -0.26% to 1.2295 and USD/CHF -0.11% to 0.9300. The Swiss KOF leading index traced the European recovery and improved to 1.36 delivering the best reading since November 2012.

Thursday, August 29:

Despite some good European data (rising French and Italian confidence, the retail PMI increased to over 50), the euro has already weakened in the Asian and European session: traders anticipated the expected 2.2% increase in US GDP for Q2 vs. 1.7% in the first reading. The release of the 2.5% rise in GDP (vs. 2.2% expected) only added a bit to the dollar strength. The good GDP revision was mostly due to a lower current account deficit, thanks to a weak China and tapering fears, and consequently lower oil prices in May/June.

But this narrowing in the “oil trade deficit” should be partially reversed by higher energy prices in Q3, especially if the Nobel prize winner for peace goes to war alone. See also our “Why There Won’t Be A Strong Dollar Even If The Financial Establishment Thinks So” from July 24th that anticipated the recent dollar weakness.

Like nearly always in the case of stronger US data, the CHF weakened more than the euro itself. USD/CHF was up 0.92% to 0.9313, EUR/CHF up 0.20% to 1.2328. Like always, Swiss fundamental data – this time the rise of 1.7% in Swiss employment vs. Q2/2012 – did not move CHF at all. The greenback improved between 0.1% and 0.6% against most other major currencies. With the strong US data, Gold (-0.96% to 1404$) and silver lost again.

The fears about a war in Syria eased. A reason might be that the nature of U.S. evidence became clear. U.S. intelligence had intercepted “an official at the Syrian Ministry of Defense exchanged panicked phone calls with a leader of a chemical weapons unit”. That however raised the assumption that an officer overstepped his bounds and the attack was not ordered by Assad.Fundamentals: A weaker than expected German consumer confidence reading and a continuation of bad European money supply and bank lending data made the euro, NOK, SEK and CHF fall against the dollar. European lending is weaker than at the height of the euro crisis one year ago despite Draghi’s OMT. The reverse carry trade phase in favor of the USD that has lasted since April continued. Apart from NOK, the other carry trade currencies MXN, AUD, NZD, CAD and especially the Asian INR and IDR were once again lower. USD/CHF was up 0.45% to 0.9218 and EUR/CHF +0.09% to 1.2299. Gold (-0.25% to 1417$) and silver reversed some of yesterday’s gains and depreciated.

Tuesday, August 27:

Fundamental drivers were overshadowed by Syria war fears. John Aziz explains that both parties in Syria have access to chemical weapons, but for Assad the use of chemical weapons were the last thing he would do, because it would bring the United States and Britain into the war. For Aziz it is a political decision to strengthen the Syrian rebels. China’s answer was clear: “The Bush Administration faked evidence about weapons of mass destruction in Iraq, so the Obama Administration could do the same thing.” Let’s hope that the performance of U.S. intelligence has improved compared to the Iraq war era and that they are not only spying successfully on their and European citizens.The main fundamental data was the German IFO index and the slowing pace of increases in the Case-Shiller-Index.Seasonality proves that home prices in Spring and Summer are usually higher. Despite that, prices were up only 12.1% y/y in June 2013 compared to 12.2% in May. The Richmond Manufacturing Index (+14 vs. -7 expected) was the third regional index with good, in this case even comparable to early 2011, data, while three others had weaker data before.

Due to the war fears, stocks fell and gold, silver, the yen and the European safe-havens of German Bunds and the Swiss franc improved. Driven by better German data, CHF, NOK and SEK inched up, NOK was additionally helped by higher Brent prices. Other risk-on currencies like AUD, NZD, MXN and KRW depreciated. Despite war fears, oil prices inched up only 3%. USD/CHF was down 0.56% to 0.9178 and EUR/CHF fell 0.41% to 1.2290. Gold was up 1.67% to 1416$.

Traders started the week positively, EUR/CHF rose by 0.2% during the day. But then weak durable goods orders (-7.3% vs. -4% expected, core durables -0.6% vs. +0.5% expected) continued the bad U.S. performance. The – compared to durables orders – less important Dallas Fed business index delivered the second good regional reading, while three regional indices had disappointed previously. Only in late US trading did U.S. foreign secretary Kerry’s speech about Syria drove stock markets downwards. USD/CHF was nearly unchanged at 0.9221 and EUR/CHF unchanged at 1.2332. Gold (+0.44% to 1402$) and silver continued their winning streak together with most currencies of the Asian bloc, led by NZD, JPY and KRW. With bad US data, the risk-on currencies of the American bloc MXN, BRL, CAD and SEK depreciated. MXN and by consequently also BRL, were additionally hit by very weak Mexican trade balance data.

Friday, August 23: