Category Archive: 2.) Pictet Macro Analysis

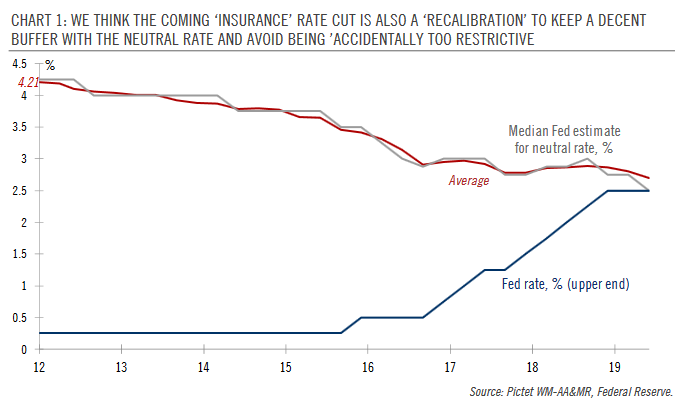

Powell’s Congressional testimony sets the scene for rate cut

The Fed will likely cut rates by 25 basis points on 31 July, with a similar cut possible as early as September.During his testimony before the House of Representatives on Wednesday, Federal Reserve Chairman Jerome Powell repeated the dovish signals he gave at the Fed press conference in June, hinting at a rate cut at the next Federal Open Market Committee (FOMC) meeting on 31 July.

Read More »

Read More »

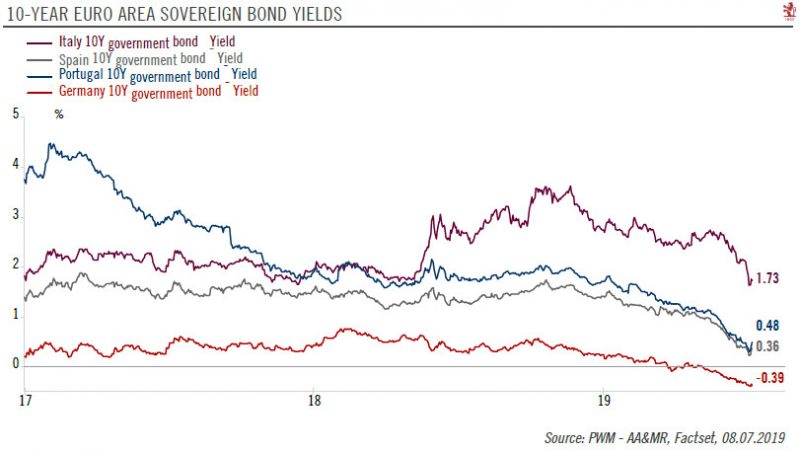

The ECB moves to keep euro bond yields down

Prospects of more ECB easing has contributed to an across-the-board rally in euro sovereign bonds yields and could help limit volatility in peripheral bonds.Since Mario Draghi in June signalled the European Central Bank’s (ECB) readiness to embark on more easing should the euro area economy fail to regain speed, euro sovereign bonds yields have fallen across the board, with the 10-year Bund yield briefly moving below -0.4% (the same level as the...

Read More »

Read More »

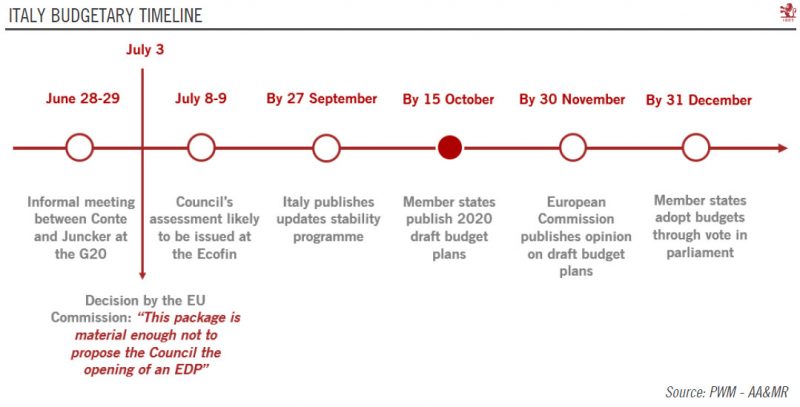

A truce between Rome and Brussels

For now, Italy has avoided Brussels' Excessive Deficit Procedure. But tensions are set to rise again in the autumn when Italy presents its 2020 budget package.In its mid-year budget revision, the Italian government lowered its 2019 deficit target. The government pointed to better-than-expected revenues for this revision, including tax revenues that were EUR3.5bn higher than expected and an additional EUR2.7bn in other revenues (including dividends...

Read More »

Read More »

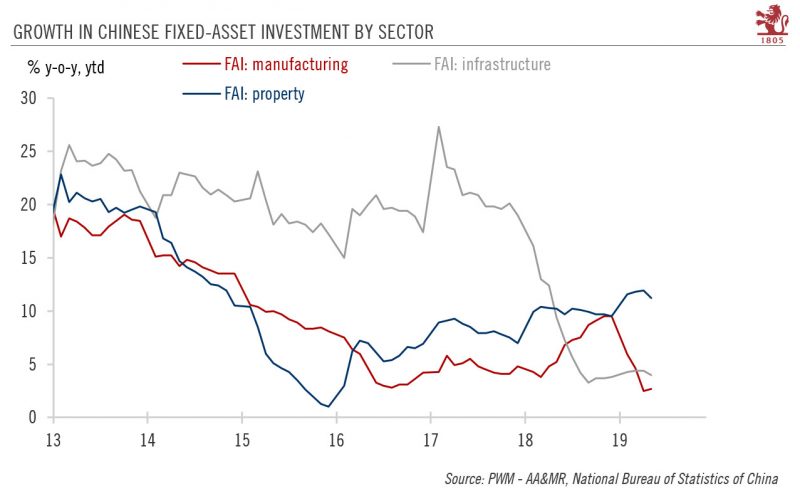

China looks to new policies to boost infrastructure spending

To stabilise growth, the Chinese government will likely put more focus on infrastructure investment. A new policy announced recently could give a further boost to this sector.Activity data in May point to continued weakness in Chinese economic momentum, with growth in both fixed-asset investment and industrial production slowing last month.

Read More »

Read More »

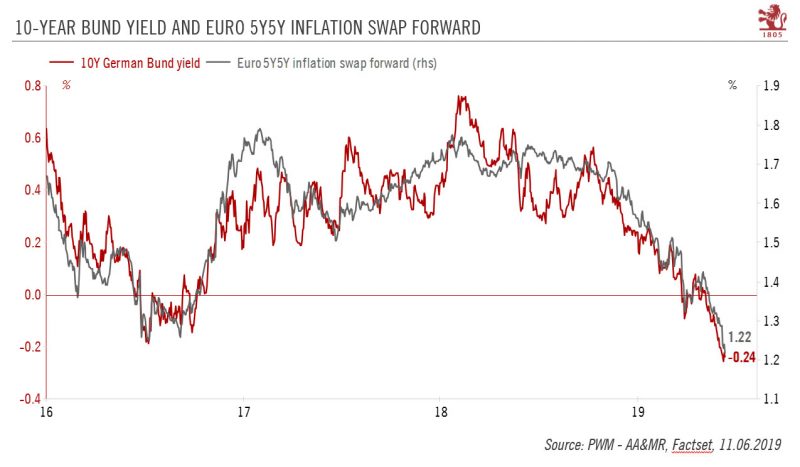

Bund yields-Heading further down?

Our central forecast is for Bund yields to rise (feebly) into positive territory by the end of this year, although risks are tilting to the downside.Four main factors have been driving down the 10-year Bund yield, which reached an all-time low of -0.26% on June 7. Considering changing circumstances, we have lowered our year-end target for the 10-year Bund yield from 0.3% to 0.1% and expect it to remain in negative territory until at least October...

Read More »

Read More »

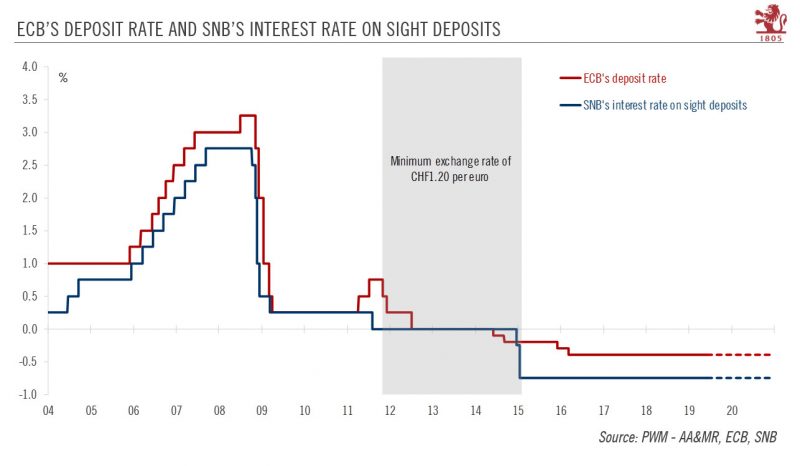

How dovish can Swiss monetary policy go?

The Swiss National Bank finds itself having to deal with an uncertain growth and inflation outlook as well as persistent external risks, but it is unlikely to pre-empt the ECB on interest rates.At its meeting on 13 June, the Swiss National Bank (SNB) will face an uncertain growth and inflation outlook. Economic data have been mixed and, more importantly, external risks (intensification of trade disputes, Brexit, Italian budget disagreements…) have...

Read More »

Read More »

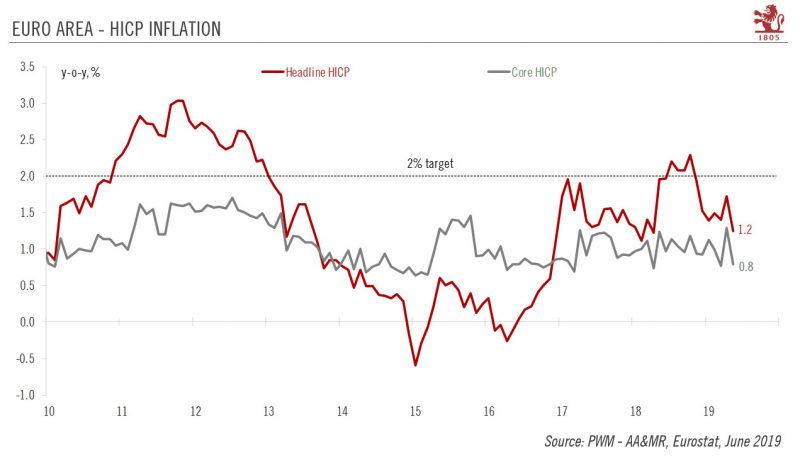

Why has euro inflation stayed so low?

Weak inflation data pose a conundrum, both in terms of the growth outlook and the ECB’s policy stance. We believe the ECB will stay on hold in 2020.The euro area headline flash Harmonised Index of Consumer Prices (HICP) dropped to 1.2% year on year in May from 1.7% the previous month. Core inflation fell by 50bp to 0.8% y-o-y.

Read More »

Read More »

Bonds Are Pricing In Possibility of Global QE, Says Pictet’s Ducrozet

Jun.05 — Frederik Ducrozet, strategist at Pictet Wealth Management, explains why quantitative easing may be “back on the table” for markets. He speaks with Bloomberg’s Nejra Cehic on “Bloomberg Surveillance.”

Read More »

Read More »

Avenues worth exploring in strategic asset allocation

The prospect of diminishing returns for classic, and previously highly effective, 60/40 portfolios (60% equities, 40% bonds) is leading to changes in strategic asset allocation. Efforts to improve prospects include identifying macroeconomic regimes to guide investments and refining how diversification is understood.

Read More »

Read More »

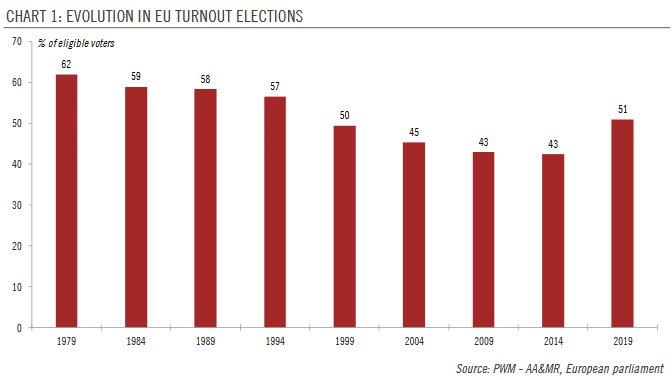

European elections – a more diverse but still pro-Europe parliament

Voter turnout for European parliament elections surged across the continent, exceeding 50% for the first time in a quarter century and breaking the downward trend of the last four decades. However, differences in turnout across the EU have been substantial and a more fragmented parliament has emerged.Voter turnout was up for the first time ever and at 51%, higher than in any election since 1994. The results delivered a parliament with a...

Read More »

Read More »

Pictet — In Conversation With Cesar Perez Ruiz

Head of investments and CIO at Pictet Wealth Management, Cesar Perez Ruiz says that something has to give when it comes to investment in 2019. While he expects economic growth to uptick in the second half of the year, the current climate of markets moving out of fear and geopolitical uncertainty – in particular the evolving relationship between China and the US – isn’t without its opportunities, especially if you’re prepared to trade fast and look...

Read More »

Read More »

Pictet — In Conversation With Cesar Perez Ruiz

Head of investments and CIO at Pictet Wealth Management, Cesar Perez Ruiz says that something has to give when it comes to investment in 2019. While he expects economic growth to uptick in the second half of the year, the current climate of markets moving out of fear and geopolitical uncertainty – in particular the …

Read More »

Read More »

Rising downside risks to euro area growth

While our forecasts remain unchanged for now, external drags on growth prospects for the euro area look set to persist for longer than we had previously expected.A potential improvement in euro area growth in H2 2019 on the back of a revival in the global economy is in jeopardy due to the intensifying trade dispute between the US and China.

Read More »

Read More »

Pictet – In Conversation with Rahaf Harfoush

Anthropologist Rahaf Harfoush was in the Bahamas for 2019’s Latam Family Office Master Class to enlighten Latin American families on how shifting technology consumption is affecting how we interact with each other and redefining our belief systems. Despite the challenges for companies and individuals when it comes to navigating fake data and adapting to a new digital ethical landscape, she also argues that there are plenty of investor prospects, in...

Read More »

Read More »

Pictet — Multi-Generational Wealth, Nassau

Technology plays an increasingly important role in our lives, from business interactions to the way we communicate in our private lives. Pictet’s 2019 edition of its annual Latam Family Office masterclass – which took place in Nassau, the Bahamas – delved into this topic around the central themes of geopolitics, families and the new power of social media. Alongside a Pictet line-up that included managing partners Marc Pictet and Boris Collardi,...

Read More »

Read More »

Pictet – In Conversation with Rahaf Harfoush

Anthropologist Rahaf Harfoush was in the Bahamas for 2019’s Latam Family Office Master Class to enlighten Latin American families on how shifting technology consumption is affecting how we interact with each other and redefining our belief systems. Despite the challenges for companies and individuals when it comes to navigating fake data and adapting to a …

Read More »

Read More »

Pictet — Multi-Generational Wealth, Nassau

Technology plays an increasingly important role in our lives, from business interactions to the way we communicate in our private lives. Pictet’s 2019 edition of its annual Latam Family Office masterclass – which took place in Nassau, the Bahamas – delved into this topic around the central themes of geopolitics, families and the new power …

Read More »

Read More »

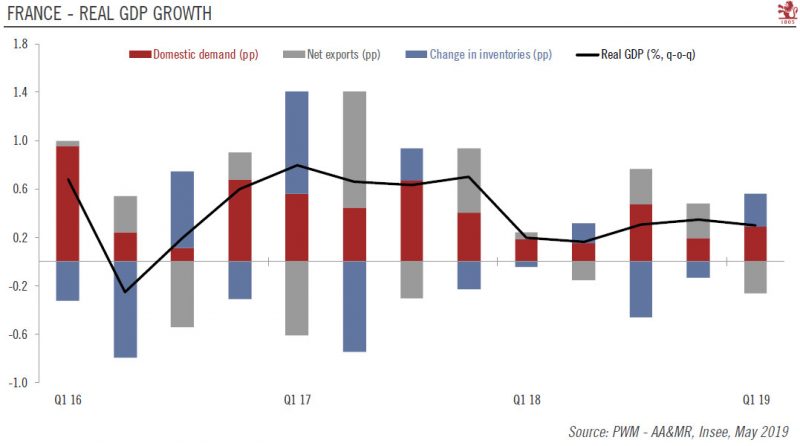

French tax cuts designed to reboot Macron’s presidency

The French government’s respond to the ‘yellow vest’ protests could provide a meaningful boost to consumer spending, mostly next year.Following a series of townhall meetings with French citizens up and down France, President Emmanuel Macron responded to social unrest with two doses of fiscal easing.

Read More »

Read More »

Pictet Perspectives — What we are watching for now

Equity markets have reached new highs, extending the longest bull market in US history. However, César Pérez Ruiz, Head of Investments and CIO at Pictet Wealth Management, is conscious of complacency in markets and keeping protection on portfolios as tail risks remain. Geopolitical developments such as the potential escalation of Iranian tensions and drawn-out trade negotiations between the US and China, could send short-term volatility through...

Read More »

Read More »

Pictet Perspectives — What we are watching for now

Equity markets have reached new highs, extending the longest bull market in US history. However, César Pérez Ruiz, Head of Investments and CIO at Pictet Wealth Management, is conscious of complacency in markets and keeping protection on portfolios as tail risks remain. Geopolitical developments such as the potential escalation of Iranian tensions and drawn-out trade …

Read More »

Read More »