Category Archive: 2.) Pictet Macro Analysis

A reality check on China’s return to work

The recent recovery in industrial activity seems to have stalled, probably because of the collapse in external demand and high levels of vigilance inside China. Since the large-scale coronavirus infection was contained, the Chinese government has been trying hard to get the economy back on track. The end of the lockdown in Wuhan after two in a half months is an important milestone in that respect.

Read More »

Read More »

Central banks to the rescue

While expecting long-term yields to be capped, we remain neutral on US Treasuries. We think peripheral euro area bonds to avoid the levels of stress seen during the sovereign debt crisis.

Read More »

Read More »

Pictet & Mater — Furnishing a sustainable future

Long before environmentalism became a popular concern, Henrik Marstrand created Mater in 2006, a Danish furniture company that prides itself on timeless design with sustainability at its core. Designing and producing all their own pieces, Marstrand’s new line of outdoor chairs and tables was based on original designs from Nanna and Jørgen Ditzel and is made from recycled fishing nets and ropes. This initiative is helping to offset the five million...

Read More »

Read More »

Pictet & Mater — Furnishing a sustainable future

Long before environmentalism became a popular concern, Henrik Marstrand created Mater in 2006, a Danish furniture company that prides itself on timeless design with sustainability at its core. Designing and producing all their own pieces, Marstrand’s new line of outdoor chairs and tables was based on original designs from Nanna and Jørgen Ditzel and is …

Read More »

Read More »

Weekly View – Merkel under pressure

Euro-area growth has hit a slow patch. Following promising signs of having turned a corner, economic data released last week revealed that Q4 growth in the euro area reached its slowest pace since the European debt crisis. German growth was flat for Q4, in line with expectations. As far as Germany’s outlook goes, dark clouds have taken the form of an uncertain political environment and China’s recent weakness.

Read More »

Read More »

Pictet Perspectives — From the last 10 years to the coming one

The end of 2019 marks an opportunity to review not only a year, but a decade in the economy and markets. Central banks certainly dominated the last decade, but corporations also delivered – driving earnings growth that propelled both stock price returns and dividends. 2019 was an exceptional year in markets but earnings growth was flat. We go into 2020 with some reason for continued caution but also grounds for optimism, given several patches of...

Read More »

Read More »

Pictet Perspectives — From the last 10 years to the coming one

The end of 2019 marks an opportunity to review not only a year, but a decade in the economy and markets. Central banks certainly dominated the last decade, but corporations also delivered – driving earnings growth that propelled both stock price returns and dividends. 2019 was an exceptional year in markets but earnings growth was …

Read More »

Read More »

House View, January 2020

Our asset allocation is dominated by a wish to stay diversified in a fragile environment. Continued ‘noise’ around trade is likely to leave markets alternating between disappointment and hope. With this in mind, we have a neutral stance on government bonds and developed-market equities alike, although we still see select opportunities in equities and appreciate the protective function of safe-haven bonds.

Read More »

Read More »

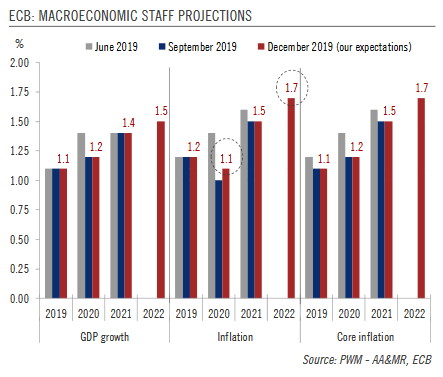

ECB: Preview of the review

We see the ECB remaining on hold throughout next year although we believe it could tweak some of the technical parameters of its toolkit. The first press conference of any new ECB President is an event in itself, and this time will be no different. Christine Lagarde's debut this week will understandably attract a lot of attention as the media and market participants scrutinise both form and substance.

Read More »

Read More »

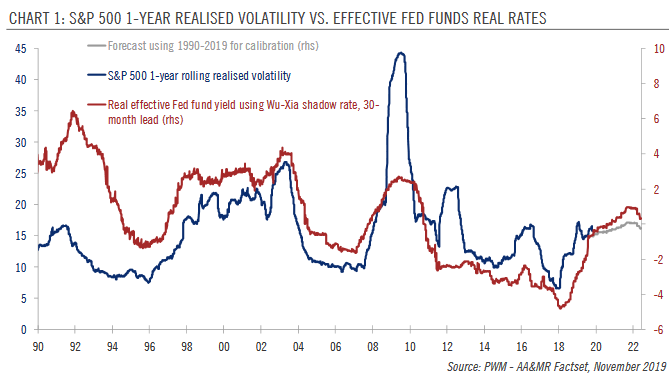

Upward pressure on equity volatility mitigated by fund flows

Whereas inflation is expected to be dormant next year, our expectation of real GDP growth of just 1.3% in the US in 2020 could put upward pressure on equity volatility. Since monetary policy tends to lead volatility by two and a half years, the Fed’s turn toward quantitative tightening in 2017 is also continuing to exert upward pressure on volatility levels for now.

Read More »

Read More »

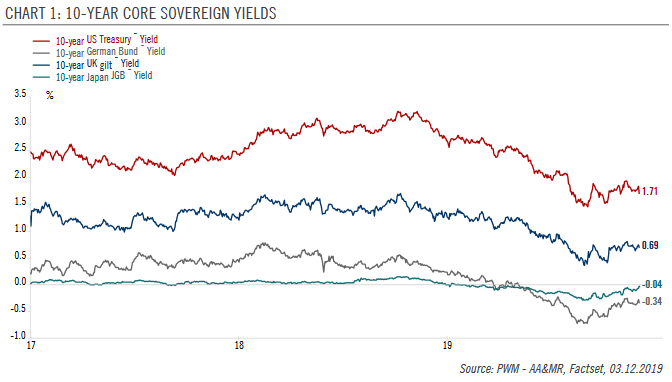

Core sovereign bonds 2020 Outlook

Neutral US Treasuries. We expect the US 10-year yield to fall towards 1.3% in H1 as US growth falters and the US Federal Reserve starts signalling additional rate cuts. However, continued monetary easing and election promises (i.e. fiscal stimulus) could boost inflation expectations in H2, with the 10-year yield ending 2020 at around 1.6% in our central scenario.

Read More »

Read More »

Euro Area 2020 Macro Outlook

After an estimated 1.2% in 2019, we expect GDP growth of 1.0% in the euro area in 2020. Country wise, we expect more manufacturing-intense countries to underperform more domestically driven ones. Thus, we project weak growth of 0.7% in Germany and 0.4% in Italy in 2020, while we expect France and Spain to remain relatively resilient, growing by 1.2% and 1.7%, respectively.

Read More »

Read More »

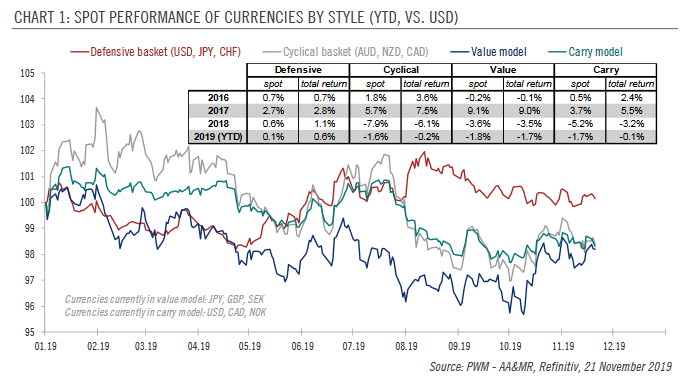

Currencies: do it with style

Our scenario of ongoing global growth moderation and elevated political uncertainties should, we believe, support defensive currencies. We consider a currency ‘defensive’ if it is likely to remain resilient should global risk appetite falter.

Read More »

Read More »

Pictet — Investment Summit

The Pictet Investment Summit is designed as a forum where a range of internal and external experts present their visions of the investment landscape. David Rubinstein, co-founder of the Carlyle Group, was one of the guests of the 2019 edition. In this video, he assesses trends in private equity, including the growing influence of family offices and emerging markets, and reflects on the long relationship between the Carlyle Group and Pictet. This...

Read More »

Read More »

Pictet — Investment Summit

The Pictet Investment Summit is designed as a forum where a range of internal and external experts present their visions of the investment landscape. David Rubinstein, co-founder of the Carlyle Group, was one of the guests of the 2019 edition. In this video, he assesses trends in private equity, including the growing influence of family …

Read More »

Read More »

Steady euro area growth and rise in core inflation

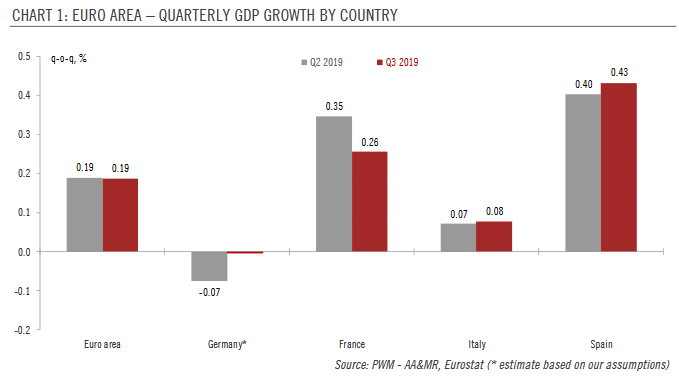

According to Eurostat’s preliminary figures, euro area GDP grew by 0.2% quarter on quarter in Q3, the same pace as in Q2 and in line with our expectations. Country wise, France, Italy and Spain grew at the same pace in Q3 as in Q2. In particular, household and investment spending grew at a solid pace in both France and Spain. The preliminary GDP figure for Germany will not be released until 14 November.

Read More »

Read More »

Pictet — The Entrepreneurs

Innovation and sustainability were high on the agenda at the annual Pictet Entrepreneur’s Summit. These two themes were thoroughly dissected by a stellar panel of international thinkers and doers who spoke about the challenges and opportunities available to entrepreneurs. Experts included ex-Managing Director of Google UK and fintech founder Dan Cobley, the man who turned Patagonia into a multi-billion dollar business, Michael Crooke, and author...

Read More »

Read More »

Pictet — The Entrepreneurs

Innovation and sustainability were high on the agenda at the annual Pictet Entrepreneur’s Summit. These two themes were thoroughly dissected by a stellar panel of international thinkers and doers who spoke about the challenges and opportunities available to entrepreneurs. Experts included ex-Managing Director of Google UK and fintech founder Dan Cobley, the man who turned …

Read More »

Read More »

Pictet Perspectives – Value Stocks start to make a comeback ?

Markets have reached new highs, but looking beneath the surface reveals a more complex picture. Over the last 18 months, investors have ploughed into companies with a growth style bias at the sake of value, pushing the valuation differential between the two styles to an extreme. At this point, it does not require a dramatic rotation to narrow that valuation differential and we are now starting to see renewed investor interest in value-style stocks.

Read More »

Read More »

Pictet Perspectives – Value Stocks start to make a comeback ?

Markets have reached new highs, but looking beneath the surface reveals a more complex picture. Over the last 18 months, investors have ploughed into companies with a growth style bias at the sake of value, pushing the valuation differential between the two styles to an extreme. At this point, it does not require a dramatic …

Read More »

Read More »