Category Archive: 2.) Pictet Macro Analysis

Pictet — Perspectives: Near-Term Investment Themes and Challenges

Markets are pricing in fully several optimistic scenarios, yet there are attractive plays in investment grade credit and equities. Meanwhile, over the summer, we await a clearer picture on how realistic this optimism proves to be over the longer term.

https://perspectives.group.pictet

Read More »

Read More »

Pictet — Perspectives: Near-Term Investment Themes and Challenges

Markets are pricing in fully several optimistic scenarios, yet there are attractive plays in investment grade credit and equities. Meanwhile, over the summer, we await a clearer picture on how realistic this optimism proves to be over the longer term. https://perspectives.group.pictet

Read More »

Read More »

Weekly View – One country, two systems at risk

Last week, German chancellor Merkel delivered a surprise about-face when she and French president Macron announced a proposal for a EUR 500bn recovery fund in the wake of the coronavirus crisis. The unprecedented plan involves the distribution of grants, rather than loans, to member states in economic need.

Read More »

Read More »

Modern Monetary Theory makes inroads following coronavirus crisis

US policymakers’ bold actions in response to the coronavirus bear some traces of the free-wheeling deficits, repressed interest rates and central bank activism (money creation) that form the cornerstones of the Modern Monetary Theory (MMT) playbook.

Read More »

Read More »

House View, May 2020

With leading economies likely facing double-digit declines in GDP in Q1 and Q2, we expect Brent oil in the USD10–20 range in Q2 before reaching a long-term equilibrium of USD18 at year’s end. With consumers tempted to remain cautious, the oil sector in deep difficulty and a big rise in unemployment, we expect dire Q2 GDP figures for the US. We have reduced our GDP forecast for 2020 as a whole to -7.7%.

Read More »

Read More »

Pictet – Multi-Generational Wealth, Gaja (Abridged version)

Five generations after Giovanni Gaja founded his eponymous winery in the Piedmontese town of Barbaresco, the family continues to produce some of Italy’s best vintages. Giovanni’s great grandson, Angelo, revolutionised Italian winemaking by experimenting with foreign grape varieties and employing new oak and a longer ageing process. Angelo’s efforts paid off and, with the help of his children, his uncompromising commitment to quality has helped to...

Read More »

Read More »

Pictet — Multi-Generational Wealth, Gaja (Full version)

Five generations after Giovanni Gaja founded his eponymous winery in the Piedmontese town of Barbaresco, the family continues to produce some of Italy’s best vintages. Giovanni’s great grandson, Angelo, revolutionised Italian winemaking by experimenting with foreign grape varieties and employing new oak and a longer ageing process. Angelo’s efforts paid off and, with the help of his children, his uncompromising commitment to quality has helped to...

Read More »

Read More »

Pictet – Multi-Generational Wealth, Gaja (Abridged version)

Five generations after Giovanni Gaja founded his eponymous winery in the Piedmontese town of Barbaresco, the family continues to produce some of Italy’s best vintages. Giovanni’s great grandson, Angelo, revolutionised Italian winemaking by experimenting with foreign grape varieties and employing new oak and a longer ageing process. Angelo’s efforts paid off and, with the help …

Read More »

Read More »

Pictet — Multi-Generational Wealth, Gaja (Full version)

Five generations after Giovanni Gaja founded his eponymous winery in the Piedmontese town of Barbaresco, the family continues to produce some of Italy’s best vintages. Giovanni’s great grandson, Angelo, revolutionised Italian winemaking by experimenting with foreign grape varieties and employing new oak and a longer ageing process. Angelo’s efforts paid off and, with the help …

Read More »

Read More »

Deflation risks might be on the rise, strategist says

Frederik Ducrozet, strategist at Pictet Wealth Management, outlines what he expects from the ECB on Thursday.

Read More »

Read More »

A reality check on China’s return to work

The recent recovery in industrial activity seems to have stalled, probably because of the collapse in external demand and high levels of vigilance inside China. Since the large-scale coronavirus infection was contained, the Chinese government has been trying hard to get the economy back on track. The end of the lockdown in Wuhan after two in a half months is an important milestone in that respect.

Read More »

Read More »

Central banks to the rescue

While expecting long-term yields to be capped, we remain neutral on US Treasuries. We think peripheral euro area bonds to avoid the levels of stress seen during the sovereign debt crisis.

Read More »

Read More »

Pictet & Mater — Furnishing a sustainable future

Long before environmentalism became a popular concern, Henrik Marstrand created Mater in 2006, a Danish furniture company that prides itself on timeless design with sustainability at its core. Designing and producing all their own pieces, Marstrand’s new line of outdoor chairs and tables was based on original designs from Nanna and Jørgen Ditzel and is made from recycled fishing nets and ropes. This initiative is helping to offset the five million...

Read More »

Read More »

Pictet & Mater — Furnishing a sustainable future

Long before environmentalism became a popular concern, Henrik Marstrand created Mater in 2006, a Danish furniture company that prides itself on timeless design with sustainability at its core. Designing and producing all their own pieces, Marstrand’s new line of outdoor chairs and tables was based on original designs from Nanna and Jørgen Ditzel and is …

Read More »

Read More »

Weekly View – Merkel under pressure

Euro-area growth has hit a slow patch. Following promising signs of having turned a corner, economic data released last week revealed that Q4 growth in the euro area reached its slowest pace since the European debt crisis. German growth was flat for Q4, in line with expectations. As far as Germany’s outlook goes, dark clouds have taken the form of an uncertain political environment and China’s recent weakness.

Read More »

Read More »

Pictet Perspectives — From the last 10 years to the coming one

The end of 2019 marks an opportunity to review not only a year, but a decade in the economy and markets. Central banks certainly dominated the last decade, but corporations also delivered – driving earnings growth that propelled both stock price returns and dividends. 2019 was an exceptional year in markets but earnings growth was flat. We go into 2020 with some reason for continued caution but also grounds for optimism, given several patches of...

Read More »

Read More »

Pictet Perspectives — From the last 10 years to the coming one

The end of 2019 marks an opportunity to review not only a year, but a decade in the economy and markets. Central banks certainly dominated the last decade, but corporations also delivered – driving earnings growth that propelled both stock price returns and dividends. 2019 was an exceptional year in markets but earnings growth was …

Read More »

Read More »

House View, January 2020

Our asset allocation is dominated by a wish to stay diversified in a fragile environment. Continued ‘noise’ around trade is likely to leave markets alternating between disappointment and hope. With this in mind, we have a neutral stance on government bonds and developed-market equities alike, although we still see select opportunities in equities and appreciate the protective function of safe-haven bonds.

Read More »

Read More »

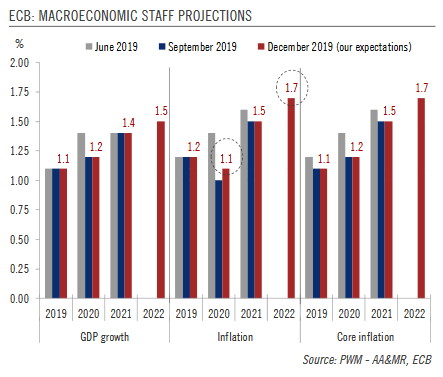

ECB: Preview of the review

We see the ECB remaining on hold throughout next year although we believe it could tweak some of the technical parameters of its toolkit. The first press conference of any new ECB President is an event in itself, and this time will be no different. Christine Lagarde's debut this week will understandably attract a lot of attention as the media and market participants scrutinise both form and substance.

Read More »

Read More »