Category Archive: 2) Swiss and European Macro

Yanis Varoufakis: I have a message for my leftwing comrades

Varoufakis with Kipping and Lederer at the panel discussion “Europa mit links verändern!” at Astra-Kulturhaus Berlin

Read More »

Read More »

Golfschläger-Arten: Diese habe ich im Golfschläger-Set

Driver, Putter, Eisen, Hölzer – wovon redet der Erichsen da heute schon wieder? 😉 Es geht natürlich um die verschiedenen Golfschläger-Arten. Ich stelle Dir heute mein Golfschläger-Set vor und erkläre Dir, welche Golfschläger Du wirklich brauchst: 1. Driver (Holz 1) 2. Fairway-Holz (Holz 3) 3. Rescues/Hybrids 4. Eisen 5-9 5. (Pitching-) Wedges 6. Putter Nach …

Read More »

Read More »

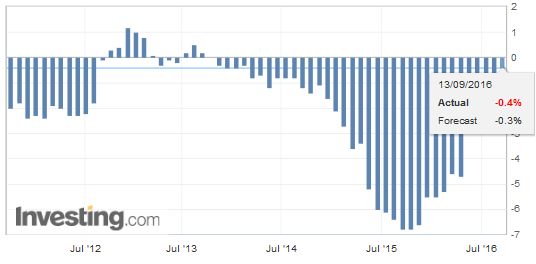

Swiss Producer and Import Price Index, August 2016: -0.3 percent MoM, -0.4 percent YoY

The Producer and Import Price Index fell in August 2016 by 0.3% compared with the previous month, reaching 99.5 points (base December 2015 = 100). This decline is due in particular to lower prices for petroleum products and pharmaceutical products. Compared with August 2015, the price level of the whole range of domestic and imported products fell by 0.4%.

Read More »

Read More »

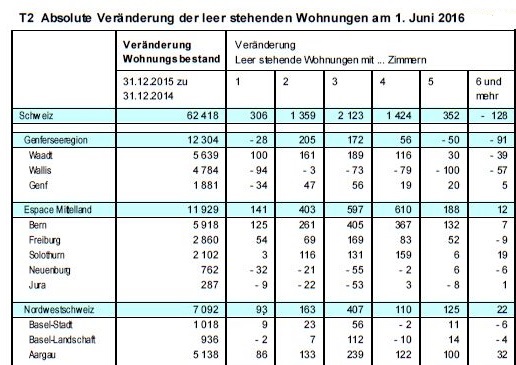

Swiss Real Estate: Empty dwellings back to 2001 levels

On 1 June 2016, some 56,518 dwellings or 1.30% of all dwellings were unoccupied in Switzerland. Some 5436 more dwellings were empty than in the previous year, representing an increase of 11%. These are findings from the empty dwellings census of the Federal Statistical Office (FSO).

Read More »

Read More »

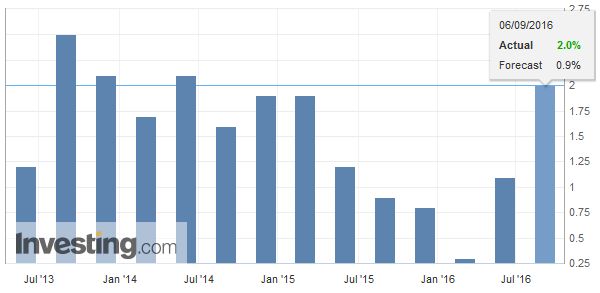

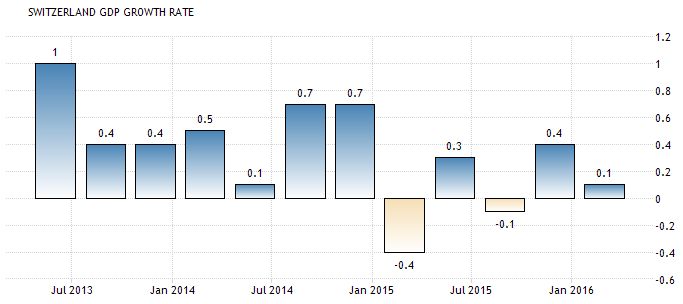

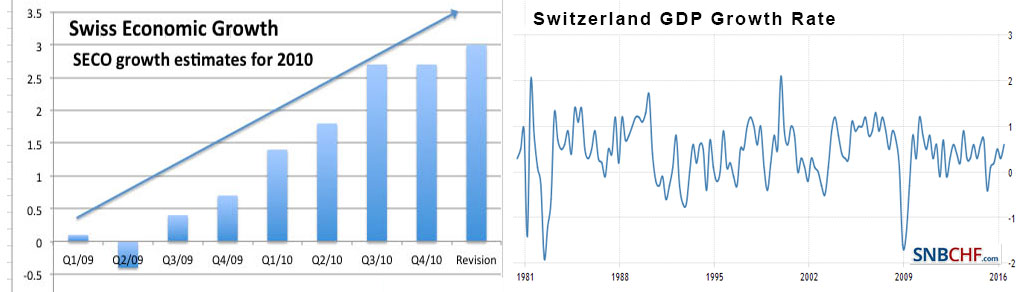

Swiss Q2 GDP: +0.6 percent QoQ, +2.0 percent YoY

Each quarter, the SECO estimates the GDP and its components. The main purpose of these estimations is to provide data that allow for an assessment of the cyclical development of the main macroeconomic aggregats in a timely adequate and credible manner.

Read More »

Read More »

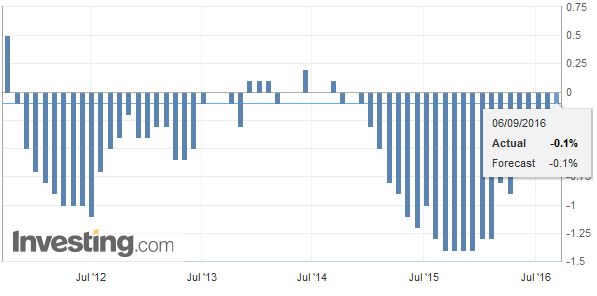

Swiss Consumer Price Index in August 2016: -0.1 percent against 2016, -0.1 percent against last month

We often look at parts of the CPI. For example food inflation is relevant in emerging markets or poorer people in developed nations. Food inflation in Switzerland has risen by 1.3% YoY compared to 0.2% in the U.S., and 1.4% in the eurozone and 1.1% in neighbour Germany. Rents are up +0.2% YoY. Existing Swiss rents are bound to interest rates; therefore they cannot follow the Swiss real estate boom yet.

Read More »

Read More »

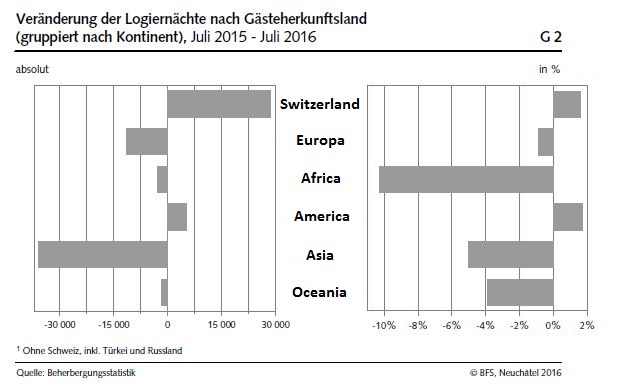

Tourism accommodation statistics in July 2016: Slight decline in overnight stays in July

The Swiss hotel industry registered 4.1 million overnight stays in July 2016, which corresponds to a decrease of 0.4% (-18,000 overnight stays) compared with July 2015. Foreign visitors generated 2.3 million overnight stays, representing a decline of 2.0% (-46,000). Domestic visitors registered 1.8 million overnight stays, i.e. an increase of 1.6% (+29,000). These are provisional results from the Federal Statistical Office (FSO).

Read More »

Read More »

Europe Debates The Burkini: “We Will Colonize You With Your Democratic Laws”

"We will colonize you with your democratic laws." — Yusuf al-Qaradawi, Egyptian Islamic cleric and chairman of the International Union of Muslim Scholars. "Beaches, like any public space, must be protected from religious claims. The burkini is an anti-social political project aimed in particular at subjugating women.

Read More »

Read More »

“Market Economy – Reinvent or Reboot?” with Yanis Varoufakis, Clemens Fuest – Alpbach Forum 2016

Yanis Varoufakis, professor of Economics, former finance minister of Greece and cofounder of Diem25 debates Clemens Fuest, president of IFO (Institut für Wirtschaftsforschung). Discussion includes the political – economic problems of modern Europe, the Greek crisis and its handling by the EU, thoughts on the market economy and universal basic income. Discussion took place in …

Read More »

Read More »

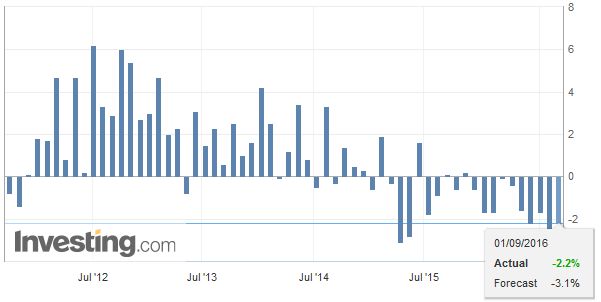

Swiss Retail Sales -2.6 percent nominal (YoY) and -2.2 percent real (YoY)

Turnover in the retail sector fell by 2.6% in nominal terms in July 2016 compared with the previous year. This decrease has been ongoing since January 2015. Seasonally adjusted, nominal turnover rose by 0.4% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

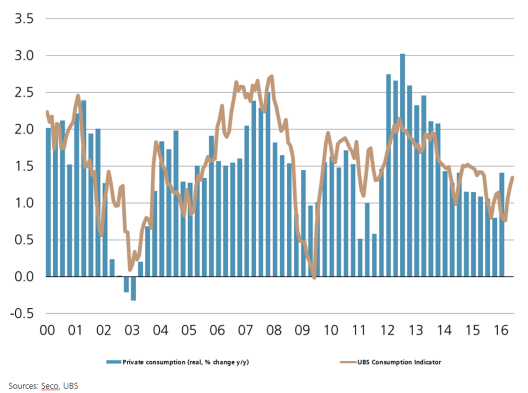

Switzerland UBS Consumption Indicator July: Car buyers turn on cruise control

In July, the UBS consumption indicator rose to 1.32 points from 1.21. A slight downward adjustment of the June figure and above-average car sales generated the increase. However, the disappointing June figures for tourism and sluggish consumer sentiment slightly curbed this upward trend.

Read More »

Read More »

Spain’s Political Deadlock Likely Leads to Third Election

Rajoy is hoping to form a minority government this week. It seems unlikely to succeed, which could lead to an election on Christmas. Regional elections and corruption trials may change Spain's political dynamics.

Read More »

Read More »

Yanis Varoufakis | Buch: “Das Euro Paradox”

Yanis Varoufakis und sein neues Buch: “Das Euro Paradox” ttt 28.08.2016 Quelle: Das Erste Brillanter Theoretiker, radikaler Träumer, berechnender Zocker, Wirtschaftsmathematiker, Motoradfahrer: In seinem neuen Buch tritt Griechenlands Ex-Finanzminister Yanis Varoufakis für eine Rettung Europas ein. ABO NICHT VERGESSEN weitere interessante Links: Konsumterror vs Konsumverzicht Konsumterror vs Konsumverzicht Nico Paech & Co...

Read More »

Read More »

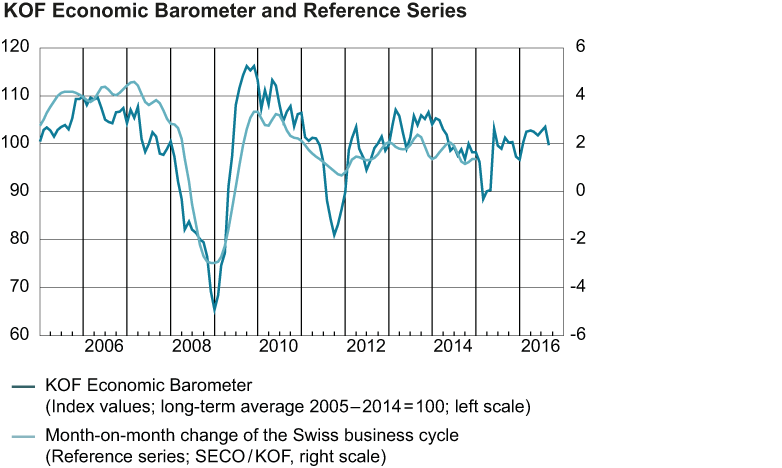

Swiss national accounts 2015: Slow GDP growth in 2015

In 2015 the Swiss economy registered a growth in gross domestic product (GDP) of 0.8% at the previous year's prices (+2.0% in 2014). Taking a slight decrease in the general price level into account, GDP at current prices grew by 0.3% (2014: +1.4%). This modest increase is in keeping with a difficult monetary environment. The gross national income (GNI) at current prices registered an increase of 1.6% following an improved balance of income with...

Read More »

Read More »

Swiss Industrial Production Q2: Minus 1.2 percent YoY, Construction: Minus 4.1 percent YoY

Industrial production in the secondary sector declined 1.6% in 2nd quarter 2016 in comparison with the same quarter a year earlier. Turnover fell by 2.6%.

Read More »

Read More »

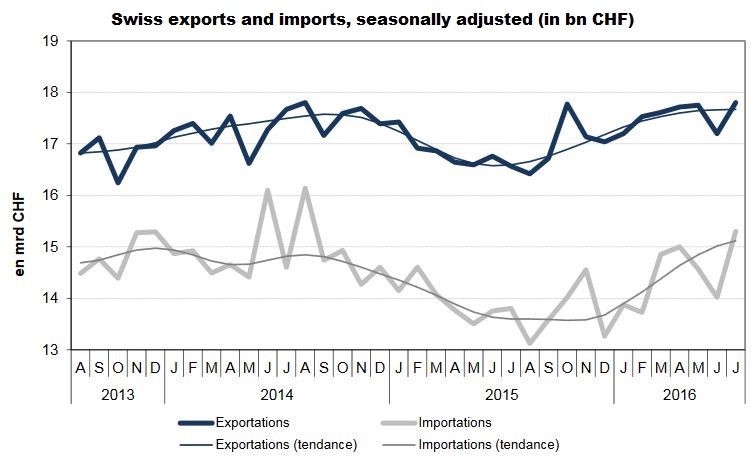

Swiss Exports + 7.9 percent YoY, Imports +11.8 percent. Trade Surplus +2.9 bn CHF, Exporters Increase Prices

We do not like Purchasing Power or Real Effective Exchange Rate (REER). For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity increases, while REER assumes constant productivity in comparison to neighbours. In July 2016, Swiss Exports were up 7.9% YoY (in real terms: + 2.4%) and imports 11.8% YoY (in real terms: + 8.2%). Exporters could even raise prices, as we see in the difference...

Read More »

Read More »

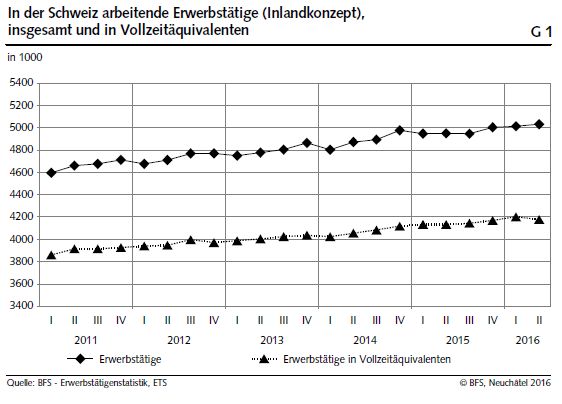

Swiss Labour Force Survey in 2nd quarter 2016: Number of employed persons + 1.6%; unemployment rate (ILO) 4.3%

The number of employed persons in Switzerland rose by 1.6% between the 2nd quarter 2015 and the 2nd quarter 2016. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) increased slightly from 4.2% to 4.3%. The EU's unemployment rate decreased from 9.5% to 8.6%. These are some of the survey results from the Federal Statistical Office (FSO).

Read More »

Read More »