Category Archive: 2) Swiss and European Macro

“Streit um den Wirtschaftskurs – Wer findet den Stein der Weisen?” – Unter den Linden vom 17.11.2014

Zu Gast bei Michaela Kolster sind: – Prof. Peter Bofinger (Wirtschaftswissenschaftler Universität Würzburg, Wirtschaftsweiser) – Carsten Linnemann (Vorsitzender CDU/CSU-Mittelstandsvereinigung)

Read More »

Read More »

STAHL 2014: Interview mit Prof. Marcel Fratzscher (DIW Berlin)

Prof. Marcel Fratzscher, Präsident des DIW Berlin über Investitionen, Infrastruktur und die Bedeutung der öffentlichen Hand. Interview bei STAHL 2014. (Video: www.steeltv.de)

Read More »

Read More »

Graphic animation: our concerns on Latam health

Brazil is driving concerns about the solidity of Latam economic health. This short graphic animation highlights the difference of growth between Brazil and China to illustrate the regional issues in Latin America.

Read More »

Read More »

Eurozone ‘wasted’ two years – Peter Bofinger – BBC HARDtalk

Peter Bofinger of Germany’s Council of Economic Experts has told BBC HARDtalk that no efforts have been made to stimulate Eurozone economies and that the bloc has "wasted two years".

Read More »

Read More »

Eurozone ‘wasted’ two years – Peter Bofinger – BBC HARDtalk

Peter Bofinger of Germany’s Council of Economic Experts has told BBC HARDtalk that no efforts have been made to stimulate Eurozone economies and that the bloc has “wasted two years”. Mr Bofinger described rising resentment in Germany over expectations of bailing out profligate members a “serious challenge”, but added it was “completely unfounded”.

Read More »

Read More »

Wem gehört die Welt? Machtkampf um Ressourcen | Heiner Flassbeck | SWR Tele-Akademie

http://www.tele-akademie.de – Heiner Flassbeck analysiert den globalen Kampf um wirtschaftliche Macht, um Ressourcen, Wissen und Technologie, und er beschreibt die Rolle der Finanzmärkte bei diesen Auseinanderstzungen.

Read More »

Read More »

Standort Berlin mit Dr. Marcel Fratzscher. Teil- 2

1925 wurde das „Deutsche Institut für Wirtschaftsforschung“ (DIW) gegründet und gibt seither fundierte Analysen über die Zustand der deutschen Wirtschaft heraus. Peter Brinkmann spricht mit dem gegenwärtigen Präsidenten des DIW, Prof. Dr. Marcel Fratzscher.

Read More »

Read More »

Standort Berlin mit Prof. Dr. Marcel Fratzscher. Teil – 1

1925 wurde das „Deutsche Institut für Wirtschaftsforschung“ (DIW) gegründet und gibt seither fundierte Analysen über die Zustand der deutschen Wirtschaft heraus. Peter Brinkmann spricht mit dem gegenwärtigen Präsidenten des DIW, Prof. Dr. Marcel Fratzscher.

Read More »

Read More »

Interview: Dr Heiner Flassbeck on the economic need of a wage rise

We speak with Dr Heiner Flassbeck, the former Director of the Division on Globalization and Development Strategies at UNCTAD in Geneva, and, former deputy finance minister of Germany. A prominent economist, Flassbeck has been at the forefront of critiquing myths about the financial crisis, and is an unparalleled expert in the particular challenges of the …

Read More »

Read More »

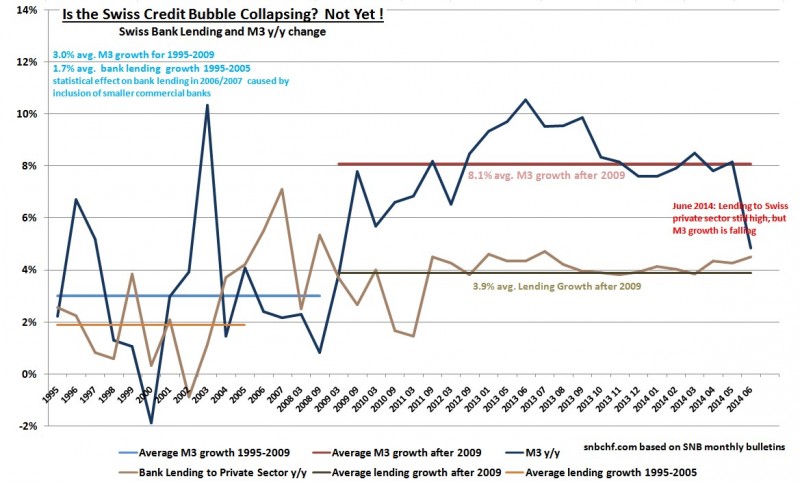

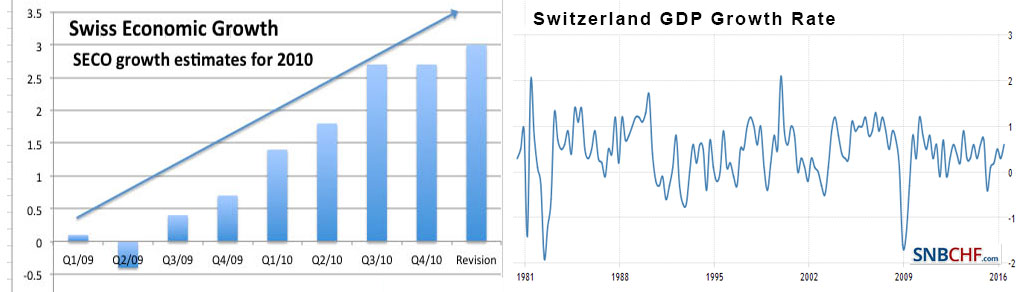

2014: Swiss Credit Bubble Popping? No, Lending to the Swiss Private Sector is even Accelerating!

Despite macro-prudential measures like the countercyclical capital buffer, Swiss credit to the private sector is rising more quickly than previously. On the other side, real estate prices are not increasing so rapidly any more. Global risks let M3 money supply growth slow in June 2014.

Read More »

Read More »

Capitalism Will Hit the Wall Again, Hard – Heiner Flassbeck on RAI (5/5)

Mr. Flassbeck says people must get politically engaged and find an alternative or we will face dictatorship, because today’s capitalism is out of answers

Read More »

Read More »

The Necessity for Higher Wages – Heiner Flassbeck on RAI (4/5)

Mr. Flassbeck, former head of UNCTAD, says we’re going into the Japanese scenario, a stagnation with a kind of deflation, because we have no purchasing power in the hands of the mass of the consumers

Read More »

Read More »

The US Dollar and the Search for a “Reasonable” Capitalist – Heiner Flassbeck on RAI (3/5)

On Reality Asserts Itself, Mr. Flassbeck says the stock market bubble can burst at any moment because everybody knows there is no real growth behind it; then we are really in trouble as the whole effect of stabilization will disappear in one moment

Read More »

Read More »

Racing to a Dead End – Heiner Flassbeck on Reality Asserts Itself (2/5)

Mr. Flassbeck, former head of UNCTAD, says current economic policy is heading back to the 1930s, a race to the bottom, they have no solution at all, we will end up again in trade wars or other wars

Read More »

Read More »

Reaganism and Thatcherism were Intellectually Dishonest – Heiner Flassbeck on RAI (1/5)

On Reality Asserts Itself, Mr. Flassbeck, former director of UNCTAD, discusses growing up in a US dominated Germany and his opposition to the birth of neoliberal economics

Read More »

Read More »