Category Archive: 2) Swiss and European Macro

Pelzig hat den Wirtschafts”weisen” Peter Bofinger zu Gast (11.02.2014)

Bofinger gibt sich ziemlich unwissend zum Freihandelsabkommen mit der USA. Woran mag das wohl liegen?

Read More »

Read More »

Freihandelsabkommen TTIP und Peter Bofinger bei Pelzig hält sich 11.02.2014 – die Bananenrepublik

► Homepage: http://www.Bananenrepublik.tv – Bananenrepublik.tv ► Google+: https://plus.google.com/u/0/106701079280378758319/posts ► Zweiter-Upload-Kanal: http://www.youtube.com/user/Bananenrepublik1 ► Backup-Kanal: http://www.youtube.com/user/diebananenrepublik2 ► Twitter: https://twitter.com/Stimmbuerger – Bananenrepublik ► Quelle:...

Read More »

Read More »

UBS Consumption Indicator Points to 2.5 Percent Swiss GDP Growth in 2014

FacebookShare As usual, the Swiss economy seems to be better than economists thought. After 1.40 still in December, the UBS consumption indicator has risen to 1.81, a value higher than the ones in 2012, when private consumption increased by 2.4%. Similarly as last year, the latest reading contradicts UBS’s own growth forecasts, albeit this year …

Read More »

Read More »

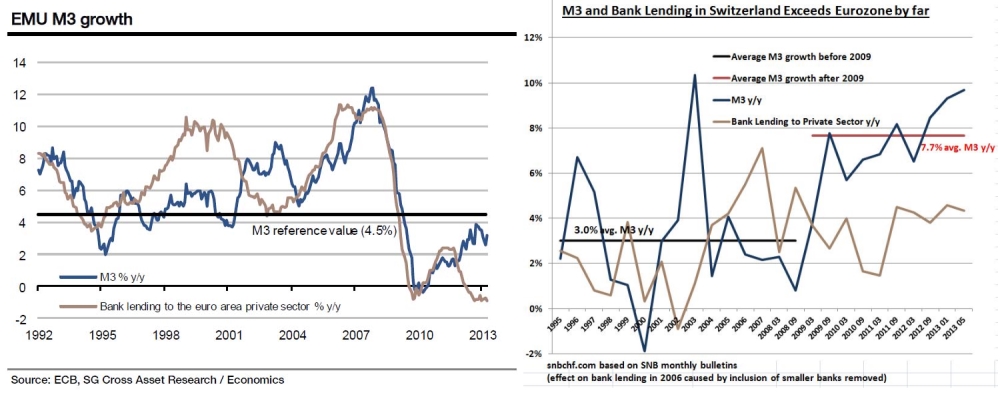

Pros and Cons of the Swiss Countercyclical Capital Buffer

Switzerland is currently living in a big real estate boom. The bubble bursting would imply that banks' collateral in the form of real estate falls in value. Therefore the banks' assets might fall because many home buyers might not be able to repay their mortgage. If a real estate bubble pops, then banks should be better capitalized to absorb such a shock. Therefore the Swiss National Bank introduced macro-prudential measures, like the so-called...

Read More »

Read More »

Prof. Peter Bofinger – CFO-Forum – ZIB

Österreichs exklusiver Treffpunkt für Finanzchefs: Finanzielle Unternehmensführung, Erfahrungen – Analysen – Einschätzungen – Perspektiven Alle Infos zum CFO Forum findest du hier: https://businesscircle.at/finanzen-controlling-rw/konferenz/cfo-forum

Read More »

Read More »

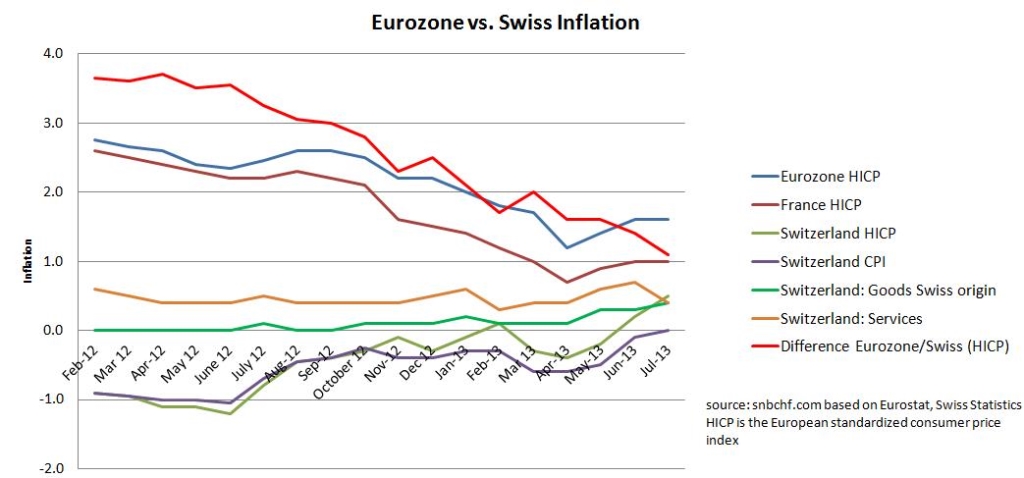

Inflation Difference between Eurozone and Switzerland Narrows to 0.5 percent

Another five months till Swiss inflation is higher? When the European economy starts to expand again, who will hike rates first, the SNB or the ECB? December Update According to Swiss Statistics the inflation rate remained stable at 0.1% y/y, while the inflation measured by the European HICP standard was +0.3% y/y, slightly higher than … Continue reading »

Read More »

Read More »

2013 Posts on Swiss Macro

2013 Posts on Euro Crisis and Euro Macro

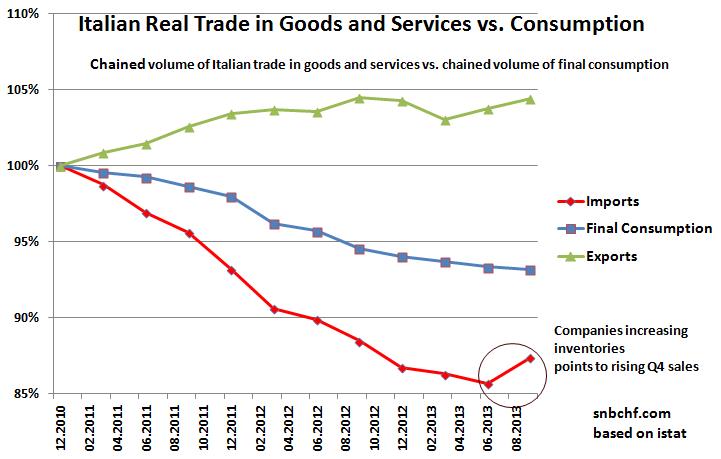

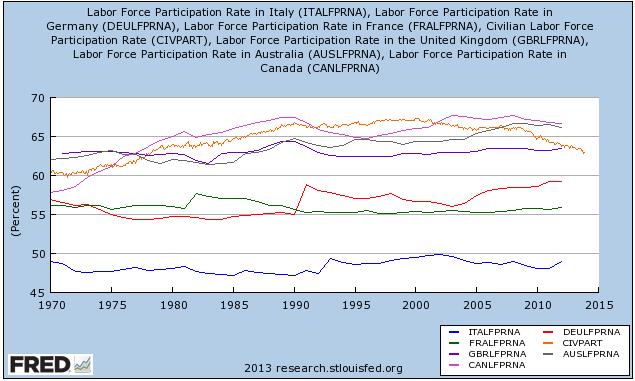

An Upcoming Italian Success Story?

While the mainstream is still talking about potential riots in Italian streets, we rather see positive adjustments in the Italian economy.

Read More »

Read More »

An Upcoming Italian Success Story?

Higher exports show that Italy's economy is trying to become a new German Companies seem to hide their competitiveness. A question remains: Will Italian companies really invest in Italy and create jobs?

Read More »

Read More »

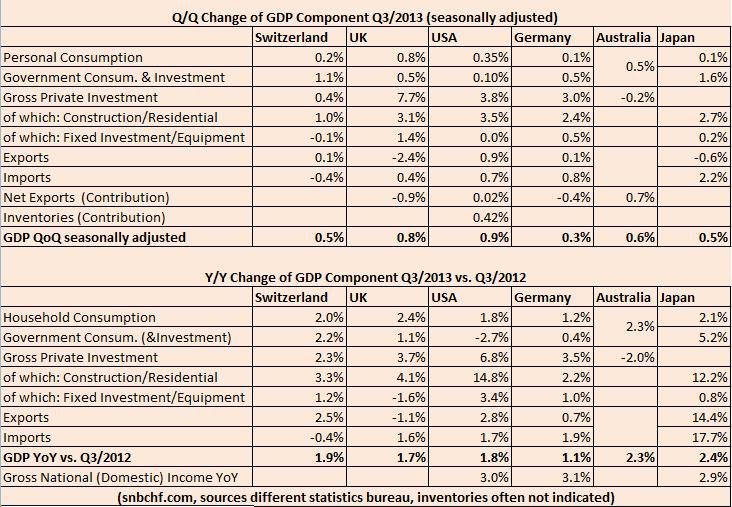

Swiss GDP Details Compared to UK, USA, Germany, Japan and Australia, Q3 2013

The Swiss GDP was again one of the strongest major economies. The quarterly growth rate in the third quarter was 0.5%, the yearly one 1.9%. U.S. GDP improved by 3.6% QoQ annualized. For comparison purposes, our figures are not annualized; hence the equivalent is 0.9% QoQ. In Japan and Switzerland private consumption rose by 0.1% … Continue reading...

Read More »

Read More »

Frank Schäffler zu Gast bei Tele D

http://www.tele-d.ch/index.html In der Sendung “Prominenz zu Gast” des schweizerischen Senders Tele D spricht Frank Schäffler über die FDP, klassischen Liberalismus und die Euro(pa)-Politik.

Read More »

Read More »

Prof. Heiner Flassbeck im Interview mit Unternehmer Positionen Nord

Der ehemalige Chefvolkswirt der UNO-Organisation für Welthandel und Entwicklung (UNCTAD) fordert im Interview mit Unternehmer Positionen Nord den Staat und die Unternehmen hierzulande auf, mehr zu investieren: Gleichzeitig müsse die Wirtschaft die Löhne in Deutschland anpassen. http://www.unternehmerpositionen.de

Read More »

Read More »

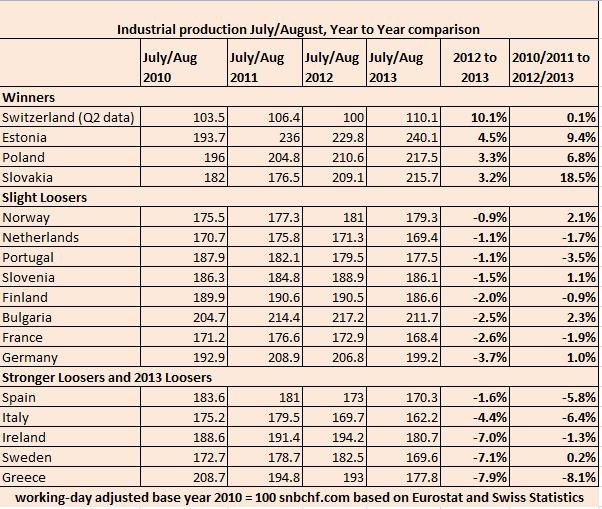

European Industrial Production Still Contracting, Switzerland Expanding Again

Swiss industrial production is rather insensitive to price changes and to the recent slowing of global demand thanks to the concentration on pharmaceuticals and luxury products. Based on Eurostat’s industrial production for July and August , we compared the values from 2010 to 2013 for these two summer months. This aggregated two-months comparison is …

Read More »

Read More »

Sabotage – Jakob Augstein (Ulrike Herrmann Heiner Flassbeck)

Der Kapitalismus gräbt weiter den meisten Menschen das Wasser ab. Aber einigen geht es hingegen besonders gut. Ein Zuwachs von 200.000 Millionären in nur einem Jahr, das verdeutlicht die Tendenz der Umverteilung. Die schleichende Volksenteignung. Jakob Augstein – Sabotage Ulrike Herrmann – Der Sieg des Kapitals Heiner Flassbeck – Handelt jetzt weitere Autoren : Paul …

Read More »

Read More »

Heiner Flassbeck: «Europa braucht einen Neuanfang»

Flassbeck erläutert anhand wissenschaftlicher Fakten anschaulich, wie die deutsche Politik systematisch die Europäische Union zerstört. Vortrag auf dem 17. Potsdamer Kolloquium zur Außenpolitik mit dem Titel: «20 Jahre nach den Verträgen von Maastricht – Die Europäische Union in der Krise?». Potsdam, 11.10.2013. Mehr: http://www.rosalux.de/documentation/46467. Prof. Dr. Flassbeck war bis 2012 Chef-Volkswirt bei der UNO-Organisation für...

Read More »

Read More »