Category Archive: 1) SNB and CHF

Steuerreform holt das Geld dort, wo sich keiner wehrt: Im arbeitenden Mittelstand

Die kommende Abstimmung über die Unternehmenssteuerreform III führt uns einmal mehr vor Augen, wie hoch komplex diese Materie ist. Ein „Normalsterblicher“, also jemand, der sich nicht von Berufes wegen mit Steuerfragen auseinandersetzt, dürfte mit den Abstimmungsunterlagen masslos überfordert sein. Ja, selbst Ökonomen, die Fragen zur Besteuerung studiert haben, dürften bald am Ende ihres Lateins sein.

Read More »

Read More »

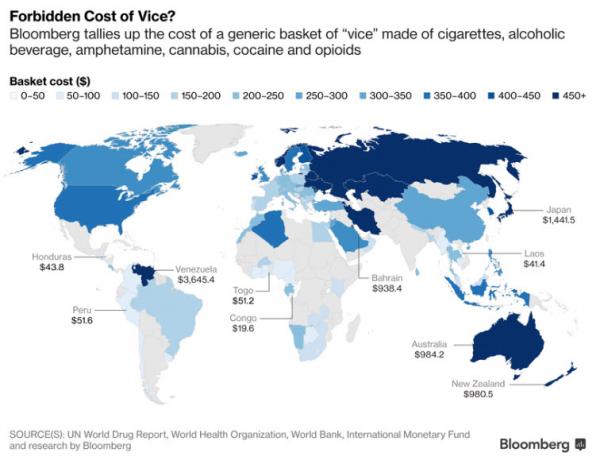

What Vice Costs – The World’s Cheapest (& Most Expensive) Countries For Drugs, Booze, & Cigarettes

Indulging in a weekly habit of drugs, booze and cigarettes can cost you as little as $41.40 in Laos and a whopping $1,441.50 in Japan, according to the Bloomberg Vice Index.

Read More »

Read More »

Swiss franc less overvalued according to latest Big Mac index

On 12 January 2017, the Economist came out with its latest Big Mac index. Also known as the burger benchmark, the index compares the price of a Big Mac around the world. This catchy, if highly incomplete means of comparing the relative purchasing power of different currencies, uses the United States and the US$ as its base. Countries where Big Macs cost less than in the United States (in US$ terms) have weak currencies, and those where they are...

Read More »

Read More »

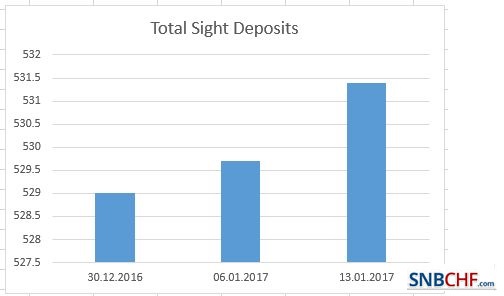

Weekly Sight Deposits and Speculative Positions: Stronger SNB interventions at more expensive EUR

EUR/CHF slightly above the “in-official minimum band” of 1.0680 – 1.07. SNB intervenes for 1.7 bn at higher EUR/CHF rate. Speculators are net short CHF with 14K contracts against USD.

Read More »

Read More »

How Derivatives Markets Responded to the De-Pegging of the Swiss Franc

In a Bank of England Financial Stability Paper, Olga Cielinska, Andreas Joseph, Ujwal Shreyas, John Tanner and Michalis Vasios analyze transactions on the Swiss Franc foreign exchange over-the-counter derivatives market around January 15, 2015, the day when the Swiss National Bank de-pegged the Swiss Franc. From the abstract.

Read More »

Read More »

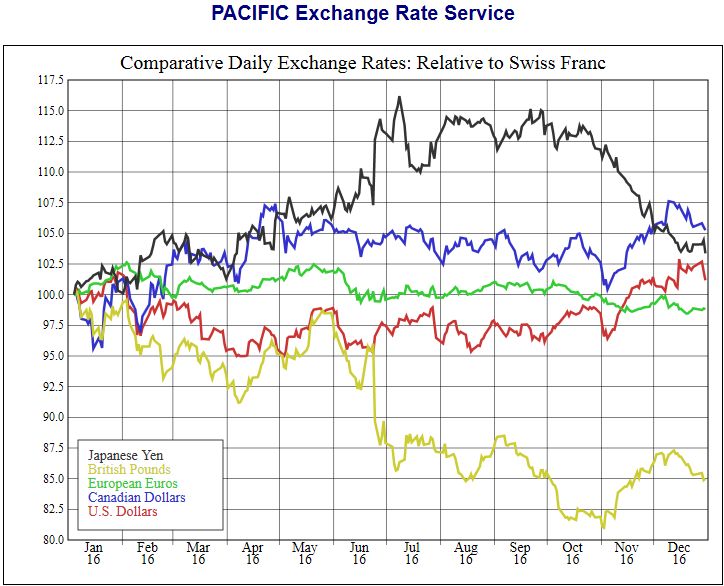

Swiss Franc exchange rates receive double boost from UK uncertainty

The Pound has had its worst day in two months yesterday, with exchange rates against most of its major currencies now reaching a two month low, and Swiss Franc exchange rates reaching down to the much dearer end of the 1.20’s once more.

Read More »

Read More »

SNB announces 24 bn CHF profit for 2016 thanks to rising stock markets.

The Swiss National Bank has announced 24 bn profits from 2016. Profits came from the dollar, yen and Canadian dollar, while the pound retreated by 15%. The EUR/CHF is only slightly weaker, mostly because the SNB actively supported the euro.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: SNB Intervenes, Speculators Short CHF again

EUR/CHF at the "in-official minimum band" of 1.0680 to 1.07. SNB intervenes for 0.7 bn CHF to keep the euro slightly over 1.07. Speculators are net short CHF with 13K contracts against USD, 3K more than last week. This is still far from the post financial crisis record of 26 K contracts. Moreover the net short GBP are increasing again.

Read More »

Read More »

Risk Reward Analysis for Financial Markets

We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble right now due to Central Banks...

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: SNB Intervenes, Speculators Short CHF again

Last week's data: FX: EUR/CHF was between 1.07 and 1.0750. SNB sight deposits: SNB intervenes for 0.7 bn. CHF at the EUR/CHF 1.07 level. CHF Speculative Positions Speculators went net short CHF with 10K contracts, this is still far from the 26.K contracts record.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: SNB intervenes, while Speculators go Long CHF

The Fed has hiked rates and with this fait accomplis speculators sold the news. They closed their short CHF and opened new CHF longs. The SNB, however, intervened again for 0.5 billion CHF.

Read More »

Read More »

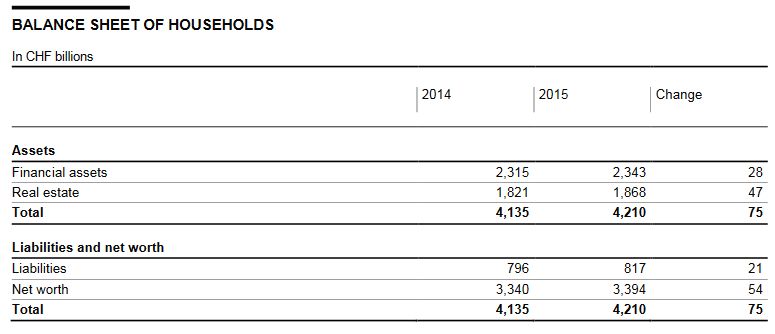

Swiss Financial Accounts, 2015 edition

This year, the Swiss financial accounts, which have been released by the Swiss National Bank since 2005, feature changes affecting both timeliness and presentation.

For the first time, data on the financial accounts are now published within eleven months of the reference date, reducing time to publication by one year. Moreover, the balance sheet of households, previously the subject of the press release on household wealth, is now included in the...

Read More »

Read More »

We Know How This Ends – Part 2

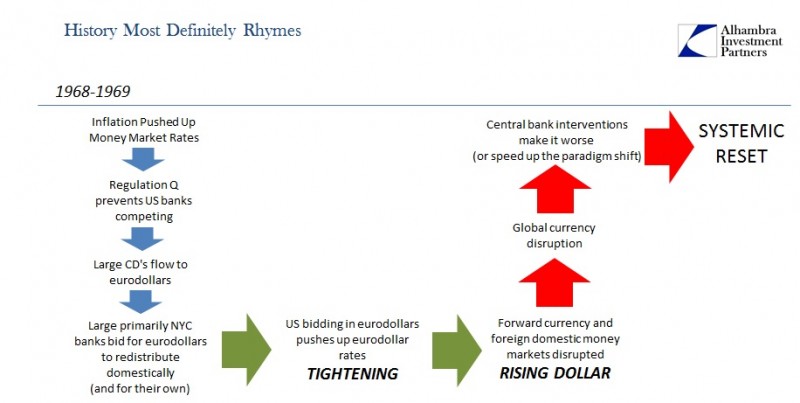

In March 1969, while Buba was busy in the quicksand of its swaps and forward dollar interventions, Netherlands Bank (the Dutch central bank) had instructed commercial banks in Holland to pull back funds from the eurodollar market in order to bring up their liquidity positions which had dwindled dangerously during this increasing currency chaos.

Read More »

Read More »

Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money)

Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle.

Read More »

Read More »

Swiss National Bank further strengthens provisions for currency reserves

The Swiss National Bank uses a strange formula on the basis of economic growth for the provisions for FX losses. It would be much easier to connect this number to the size of the balance sheet, e.g. 10% of the balance sheet.

Read More »

Read More »

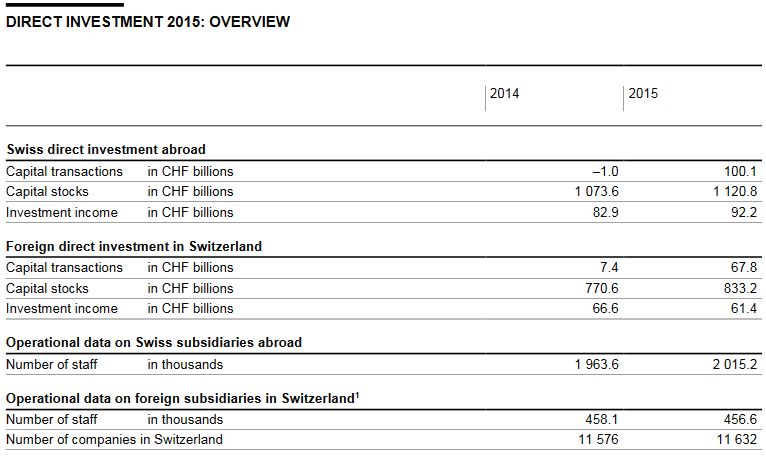

Direct Investments in 2015

Swiss direct investment abroad. Companies domiciled in Switzerland invested CHF 100 billion abroad, compared with disinvestment of CHF 1 billion the year before. Thus, Swiss direct investment abroad was significantly above the average for the past ten years. At CHF 54 billion, over half of the investment was made by finance and holding companies (2014: CHF 3 billion).

Read More »

Read More »

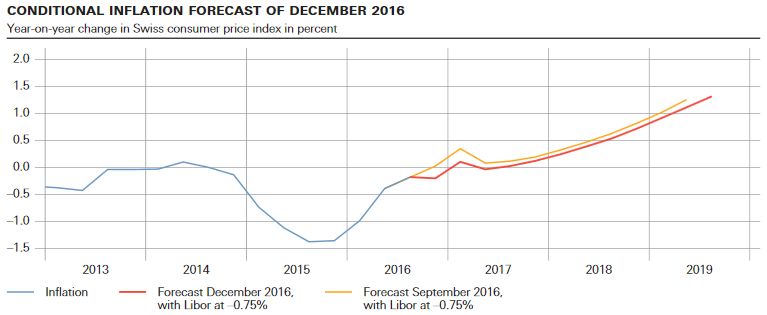

SNB Monetary policy assessment December 2016 and Comments

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at–0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. At the same time, the SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 15.12.2016

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 15.12.2016 00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank – Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse – Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National …

Read More »

Read More »