Category Archive: 1) SNB and CHF

Swiss franc still highly valued, but no policy change

The Swiss franc, investment in arms, and the housing market were some of the issues the government discussed with the chairman of the Swiss National Bank. SNB chairman Thomas Jordan told the government that he sees the Swiss currency as highly valued and warned of the continuing risks of bubbles in the housing market.

Read More »

Read More »

Crypto Updates #42 – Ripple At 20/20, FINMA Restrictions, Euro/ETN Pairing

In this video, we talk about the key developments related to cryptocurrencies and blockchain technology such as Ripple at Money 20/20 US event, FINMA sets restrictions on bank bitcoin trading, first Euro/ETN pairing at Liquid, MoneyGram testing Ripple xRapid internally, RIL executes transaction on blockchain For more details, please visit: News 01: https://bit.ly/2D6lLti News 02 …

Read More »

Read More »

Die SNB hat den Währungskrieg selbst angezettelt – und schon wieder eine Schlacht verloren

Die SNB befürchtet einen Handelskrieg, der in einen Währungskrieg münden und schliesslich zu einer grossen Depression führen könnte. Wir alle wissen, dass nach der grossen Depression der Weltkrieg kam. Die Ökonomen und Zentralbanker sind also aufs äusserste gefordert. Eine exakte ökonomische Analyse hat höchste Priorität.

Read More »

Read More »

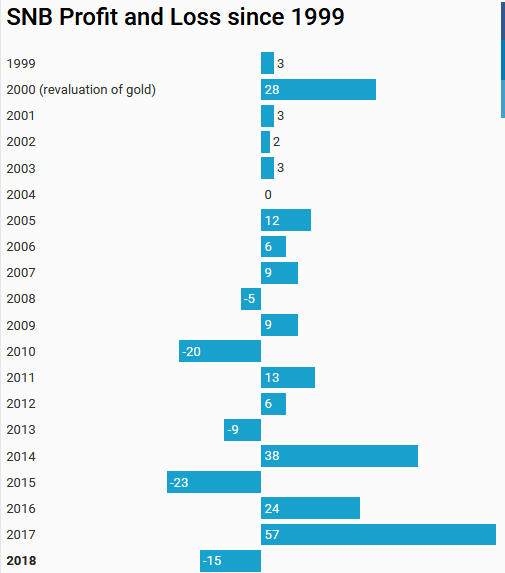

SNB reports a loss of CHF 7.8 billion for third quarter of 2018

The Swiss National Bank (SNB) reports a loss of CHF 7.8 billion for the first three quarters of 2018. A valuation loss of CHF 3.7 billion was recorded on gold holdings. The loss on foreign currency positions amounted to CHF 5.3 billion. The profit on Swiss franc positions was CHF 1.5 billion.

Read More »

Read More »

Crypto Updates #19 – Cryptojacking In India, Crypto Analysis, FINMA Licence, Spank Chain News

In this video, we talk about the latest developments in blockchain technology and cryptocurrencies, such as, cryptojacking in India, cryptocurrency fatigue, Crypto Fund wins FINMA licence, and Spank Chain smart contract compromised. For complete news, visit the links below: News 01: https://coincrunch.in/2018/10/07/cryptojacking-alert-over-30000-routers-countless-computers-compromised-in-india-but-there-is-a-fix/ News 02:...

Read More »

Read More »

Rückenwind für die SNB

Die Nationalbank hat die Schweizer Zahlungsbilanz für das zweite Quartal veröffentlicht. Damit bietet sich erstmals die Gelegenheit, nachzuprüfen, ob die viel zitierten Europaängste Fluchtkapital ins Land gespült haben. Zur Erinnerung: Im März wurde in Italien ein neues Parlament gewählt, die den beiden Europagegnern und Anti-Establishment-Formationen Movimento 5 Stelle und Lega eine Mehrheit bescherten.

Read More »

Read More »

SNB appoints new delegate for regional economic relations for Central Switzerland

With effect from 1 October 2018, Gregor Bäurle will assume the function of Swiss National Bank (SNB) delegate for regional economic relations for the Central Switzerland region. He succeeds Walter Näf, who is taking on a new position, representing the SNB in the Swiss delegation to the OECD in Paris as of 1 January 2019.

Read More »

Read More »

Third Karl Brunner Distinguished Lecture, 20.09.2018

Third Karl Brunner Distinguished Lecture, 20.09.2018

00:00 Introductory remarks by Ulrich Weidmann, Vice President for Human Resources and Infrastructure, ETH Zurich

05:15 Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank

15:50 Lecture by Otmar Issing, Former Member of the Board, European Central Bank

Read More »

Read More »

Third Karl Brunner Distinguished Lecture, 20.09.2018

Third Karl Brunner Distinguished Lecture, 20.09.2018 00:00 Introductory remarks by Ulrich Weidmann, Vice President for Human Resources and Infrastructure, ETH Zurich 05:15 Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank 15:50 Lecture by Otmar Issing, Former Member of the Board, European Central Bank

Read More »

Read More »

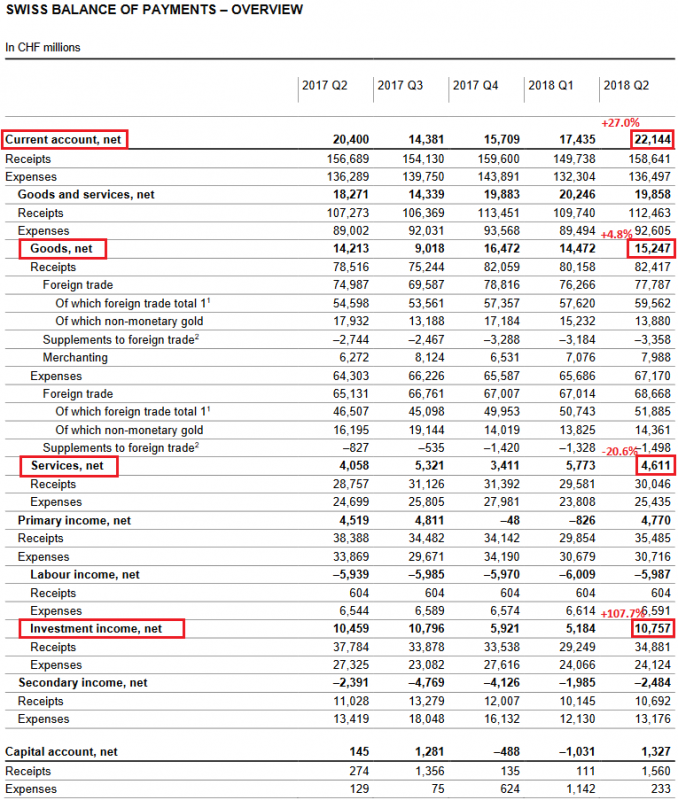

Swiss Balance of Payments and International Investment Position: Q2 2018

Key figures: Current Account: Up 27.0% against Q1/2018 to 22.1 bn. CHF, Goods Trade Balance: Up 4.8% against Q1/2018 to 15.2 bn., Services Balance: Minus 20.6% to 4.6 bn., Investment Income: Plus 107.7% to 10.7 bn. CHF.

Read More »

Read More »

Le Conseil fédéral se moque des personnes âgées!

Le Conseil fédéral se distingue par 2 points tout compte fait complémentaires. Le premier est son soutien indéfectible à la politique expansionniste et ruineuse de la BNS, dont il a la responsabilité au plan constitutionnel. Celle-ci mobilise les richesses du pays, puis les convertit en monnaies étrangères, pour enfin les investir dans des actifs plus ou moins pourris, plus ou moins risqués, voire plus ou moins condamnés.

Read More »

Read More »

Das Bad im Geldhaufen

Die Schweizerische Nationalbank hält die Schleusen im Kampf gegen die Frankenstärke weiterhin offen. Dies macht die Zentralbank indes zunehmend anfällig für politische Einflussnahme und Begehrlichkeiten. Als Carl Barks nach dem Zweiten Weltkrieg die Comicfigur Dagobert Duck erschuf, dachte er kaum an die Schweiz.

Read More »

Read More »

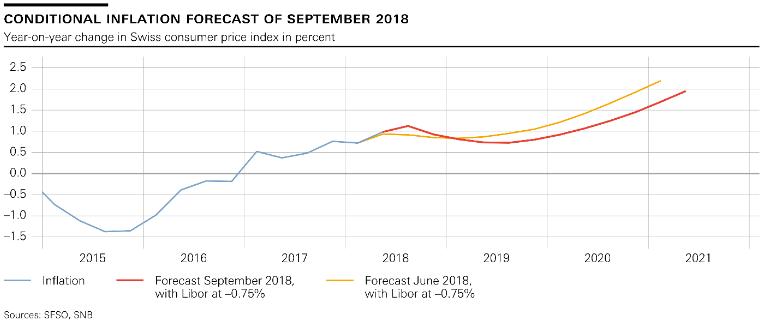

Monetary Policy Assessment of 20 September 2018

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

Unsere Nationalbank befeuert Dax und Wallstreet statt SMI

Im Januar 2010 betrugen die Devisenanlagen der Schweizerischen Nationalbank (SNB) 94 Milliarden Franken. Innerhalb der nächsten fünf Monate, also bis Mai 2010, explodierten diese auf 238 Milliarden. Das entspricht einem Plus von 150 Prozent (Faktor 2.5x). Was war geschehen?

Read More »

Read More »

BNS. Peuple suisse, tu peux trembler pour ton épargne et ta retraite! LHK

Le financement du bilan de la BNS se fait en grande partie par les liquidités des banques cantonales et les Raiffeisen. Va-t-elle nous rendre un jour nos économies? LHK

Les forcenés de la printing press: le plus forcené ce n’est pas celui que l’on croit, non c’est la Banque Nationale Suisse!

Total du bilan par rapport à la taille du GDP.

Les forcenés de la printing press: la BNS!

Cette entrée a été publiée dans Autres...

Read More »

Read More »

Credit Suisse Scolded by Finma for Rewarding Rogue Banker

Sep.17 — Credit Suisse Group AG was scolded by Switzerland’s financial regulator, but escaped any real penalties for its failure to properly oversee a former wealth manager convicted of fraud. Bloomberg’s Peggy Collins reports on “Bloomberg Daybreak: Americas.”

Read More »

Read More »

Der Nationalbank sind die Hände gebunden

EZB-Präsident Mario Draghi konstatierte letzte Woche zufrieden, dass die aktuellen Turbulenzen in einzelnen Staaten auch dort bleiben und nicht andere Länder anstecken. Seine Kollegen in der Nationalbank, die diese Woche ihren geldpolitischen Entscheid fällen, dürften das etwas anders sehen.

Read More »

Read More »

Inflation ist nicht Inflation

Das südamerikanische Land Venezuela führt gerade vor, was geschehen kann, wenn die Inflation ausser Kontrolle gerät. Der Internationale Währungsfonds rechnet bis Ende Jahr mit einer Teuerung von 1 Million Prozent. Eine solche Inflation wird etwa erreicht, wenn sich das Preisniveau rund alle vier Wochen verdoppelt. Wenn sich Geld in einem solchen Ausmass entwertet, verliert es jeden Nutzen, denn dann kann es seine Funktionen als Mittel zur...

Read More »

Read More »

Die SNB-Zeitbombe tickt, die NZZ nickt

„Die Devisenreserve der SNB sind keine Zeitbombe, die uns einmal um die Ohren fliegt, sondern eine Art Volksvermögen“. Das behauptet die SNB-freundliche NZZ am Sonntag. Das Blatt bedient ein SNB-Klischee nach dem anderen und hat den Ernst der Lage unserer Schweizerischen Nationalbank (SNB) offensichtlich nicht begriffen.

Read More »

Read More »