Category Archive: 1) SNB and CHF

SNB Monetary policy assessment of 15 March 2018

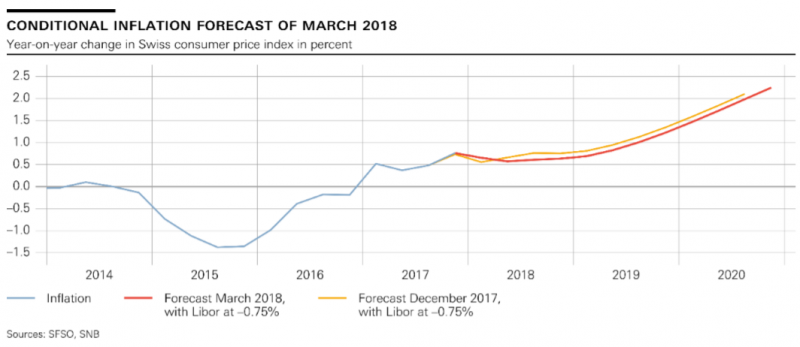

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

Too early for Switzerland’s central bank to change policy…

At its latest quarterly monetary policy assessment unveiled today, the Swiss National Bank (SNB) maintained its accommodative monetary policy. The target range for the 3-month Libor was kept between -1.25% and -0.25%, the interest rate on sight deposits with the SNB was maintained at a record low of -0.75%, and the central bank reiterated its willingness to intervene in the foreign exchange market if needed.

Read More »

Read More »

FINMA Guidelines for ICOs | Fabien Gillioz & Alexandre de Boccard | Token Estate

Fusion had the pleasure of hosting TokenEstate, for a presentation concerning the Launch of FINMA regulations concerning ICOs, the fast evolving field of Cryptosecurities and regulated instruments intermediated through the blockchain. In this talk, Fabien Gillioz, and Alexandre de Boccard, Partners at Ochsner & Associés, will discuss the recent FINMA’s ICO guidelines. This meetup was …

Read More »

Read More »

ICO Regulation in Switzerland in a Nutshell

Dr. Andreas Glarner, Partner at the MME Crypto Team, provides a high level overview on how Switzerland’s regulator FINMA assesses ICOs / TGEs based on the guidelines recently published. Learn about the different token models (payment/currency, utility, asset) and their regulatory treatment during the different stages of your project. Further, understand which ones qualify as …

Read More »

Read More »

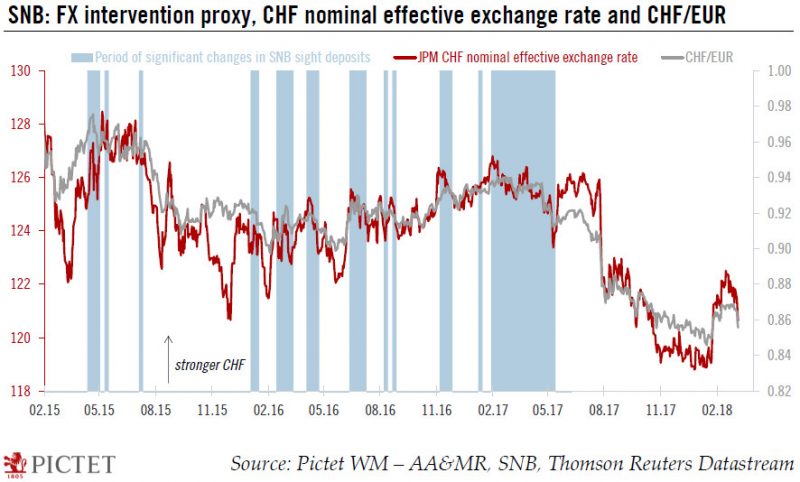

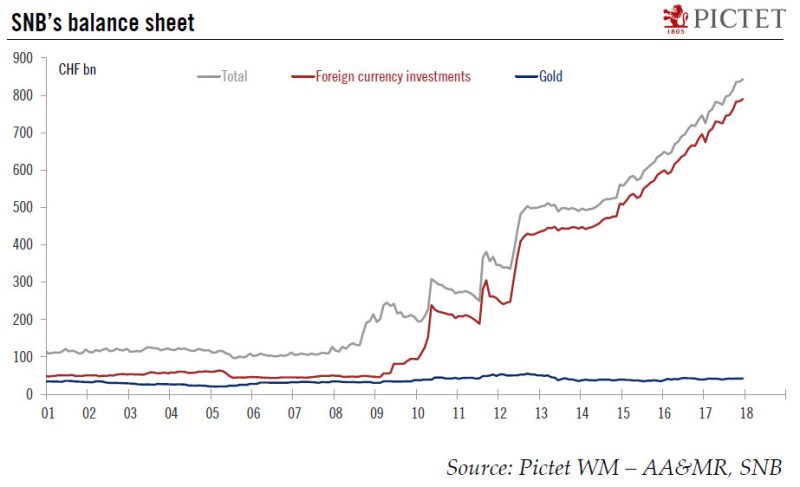

Europe chart of the week – SNB FX intervention

In the wake of the financial crisis, the Swiss National Bank (SNB) increased massively the monetary base to provide liquidity and limit the Swiss franc’s appreciation. The expansion in the monetary base can essentially be seen in the form of an increase in sight deposits held by domestic Swiss banks at the SNB.

Read More »

Read More »

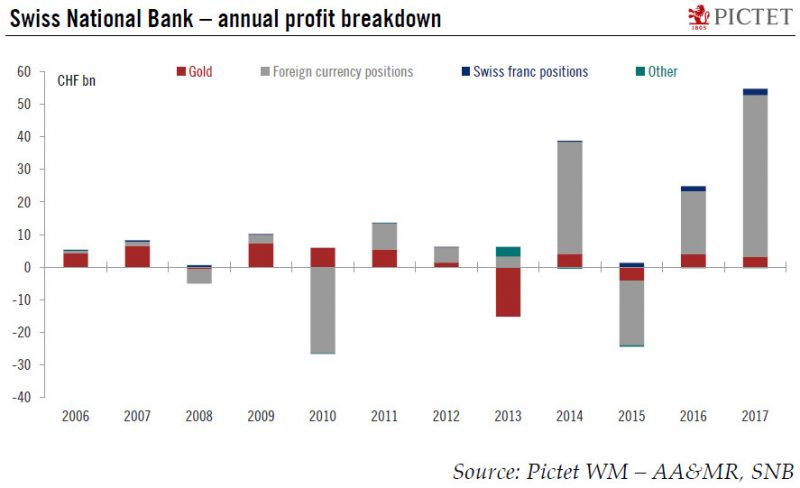

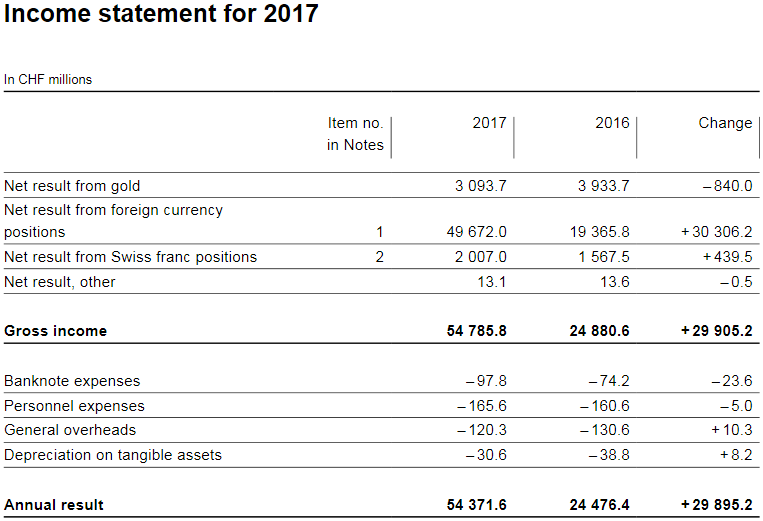

SNB confirms record profit for 2017

The Swiss National Bank (SNB) published its 2017 annual result today. The SNB confirmed a profit of CHF54.4bn in 2017. This was more than double the 2016 figure (CHF24.5bn) and its biggest profit ever. Earnings from the SNB’s foreign currency positions amounted to CHF49.7bn, its gold holdings increased in value by CHF3.1bn and its Swiss positions by CHF2bn (see Chart below).

Read More »

Read More »

SNB reports a profit of CHF 54.4 billion for 2017

The Swiss National Bank (SNB) reports a profit of CHF 54.4 billion for the year 2017 (2016: CHF 24.5 billion). The profit on foreign currency positions amounted to CHF 49.7 billion. A valuation gain of CHF 3.1 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 2.0 billion.

Read More »

Read More »

Swiss Regulator FINMA: AML, Securities Laws To Apply To Some ICOs

Swiss Regulator FINMA: AML, Securities Laws To Apply To Some ICOs Adam Reese February 16, 2018 10:20 PMFebruary 16, 2018 10:20 PMSwitzerland’s FINMA has issued guidelines stating that some ICOs will be subject to securities regulation and others to anti-money launde… ************************************* Thank fof watching. Don’t forget subscriber my channel.

Read More »

Read More »

CRYPTO NEWS #061 || Bittrex, Etherecash (ECH), Switzerland (FINMA), Credits ICO, Atari, GARMAN .

IMPORTANT Updates BITTREX EXCHANGE, ETHERECASH ECH, SWITZERLAND FINMA, CREDIT ICO, ATARI GAMING COMPANY, GARMAN SURVEY, U.S. STATES. ❤ Donation for humanity ❤ Paytm – 9568219897 Bitcoin Address- 18Dp4b8FqfJdBwrasSDN9fsCPobH67UVZU Ethereum Address- 0xC6C4966A3Cd0029273c0089841dB677D2E5942Db Bitcoin Cash- 1JV86mqjdVsiKDeVY1qxz9cUPTZ9SFfN7m ?Make Account on Top Exchnages? Binance Exchnage- https://goo.gl/Tpwsyk Cryptopia Exchange –...

Read More »

Read More »

ICO – Le Linee GUIDA Ufficiali della FINMA Svizzera

ICO – Le Linee GUIDA Ufficiali della FINMA Svizzera Quante volte ti sei chiesto ?”COME fare una #ICO da ZERO?”? Nei #VIDEO precedenti puoi trovare i vari STEP MA in questo video ti chiarisco i ? PUNTI salienti della #GUIDA della #FINMA che puoi trovare nella versione integrale qui: https://goo.gl/pTcTnN Dopo aver ? VISTO il …

Read More »

Read More »

Favoritisme de la BNS: l’horlogerie suisse supplantée par Apple

La grande nouvelle du jour est que Apple aurait vendu plus de montrer dans le monde que toute l’horlogerie suisse réunie. Ces chiffres sont tout de même à relativiser fortement, car ils sont le fruit d’analyse de marché, diffusés par le CEO de Apple lui-même….En rouge, l’industrie horlogère suisse dans sa totalité face à Apple en bleu. Ainsi, selon ces chiffres, Apple aurait vendu 8 millions de montres contre 6,8 pour l’ensemble de l’industrie...

Read More »

Read More »

SNB-Jordan verkündet Kommunistisches – und lädt zum Gratis-Buffet

Es geht um die Sache und Institution – nicht um eine Person. Die Schweizerische Nationalbank (SNB) und ihr Chef Thomas Jordan sind aber mittlerweile dermassen eng miteinander verflochten, dass eine getrennte Beurteilung gar nicht mehr möglich ist. Thomas Jordan ist zum Gesicht der SNB und diese eine „One-Man-Show“ geworden.

Read More »

Read More »

Currency swap agreement between the Swiss National Bank and the Bank of Korea

The Swiss National Bank (SNB) and the Bank of Korea (BOK) will enter into a bilateral swap agreement. The agreement will be signed on 20 February 2018 in Zurich by the Chairman of the SNB Governing Board, Thomas Jordan, and the Governor of the BOK, Juyeol Lee. The swap agreement enables Korean won and Swiss francs to be purchased and repurchased between the two central banks, up to a limit of KRW 11.2 trillion, or CHF 10 billion.

Read More »

Read More »

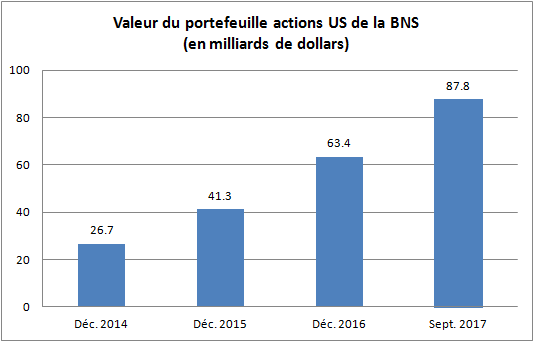

Favoritisme délibéré ou perte de contrôle? La politique d’investissement chaotique de la Banque nationale suisse

Favoritisme délibéré ou perte de contrôle ? La politique d’investissement chaotique de la Banque nationale suisse. Je peux vous assurer que nos spécialistes en investissement connaissent parfaitement leur métier (Fritz Zurbrügg). La BNS n’a aucun spécialiste qui peut dire ‘il faut prendre le titre A plutôt que le titre B’ (Jean-Pierre Danthine). Nous décidons de nos placements avec le concours d’un prestataire externe.

Read More »

Read More »

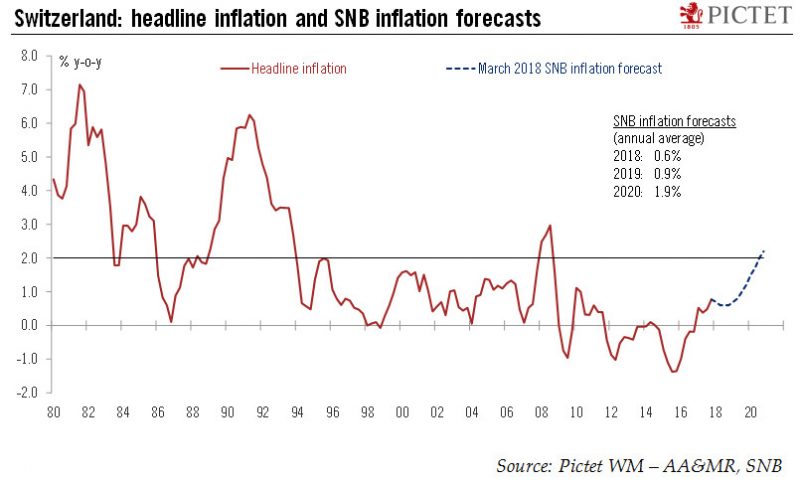

When will the SNB start the process of policy normalisation?

When the Swiss National Bank (SNB) scrapped its currency floor three years ago, its monetary policy strategy was clear: to fight Swiss franc appreciation. It did so verbally, by calling the currency “significantly overvalued”, and physically, by implementing a negative interest rate and intervening in the foreign exchange market as necessary. Three years on, the interest rate on sight deposits at the SNB remains unchanged at a record low of -...

Read More »

Read More »

Budget busting burgers – Swiss franc still the most overvalued

The Economist has just published its January 2018 Big Mac index, a light-hearted measure of whether currencies are under or overvalued. The underlying assumption is that a Big Mac is the same whether bought in Kiev or Chur, so any price difference must be due to the exchange rate.

Read More »

Read More »

Thomas Jordan, SNB-Präsident, und Axel Weber, UBS-Präsident, im «ECO Talk»

10 Jahre nach der Finanzkrise: Können wir wieder Vertrauen haben? 2008 bebte die Weltwirtschaft – mit Folgen für Angestellte, für Unternehmen, für ganze Länder. Das Image von Banken hat beispiellos gelitten und hat die Akteure des Finanzsystems in die Öffentlichkeit rücken lassen. Wie agiert man, wenn Verantwortung und Misstrauen gleichermassen gross sind? Wie stellt man …

Read More »

Read More »

La BNS vend des euros et achète des dollars

Entre la fin de l’année 2016 et la fin du 3ème trimestre 2017 (chiffres disponibles), les dirigeants de la BNS ont accru le volume des devises détenues par l’établissement de 65 milliards de francs environ. En 9 mois seulemen. Selon eux, ces investissements se justifient par le franc suisse qui serait trop fort face à l’euro. Et pour l’affaiblir, il faut acheter de l’euro, mécanisme qui expliquerait la croissance du bilan.

Read More »

Read More »

SNB Rejects Vollgeld and Questions ‘Reserves for All’

In the NZZ, Peter Fischer reports that SNB president Thomas Jordan rejects the Vollgeld initiative and stops short of endorsing the ‘reserves for all’ proposal.

Read More »

Read More »

Matías Salord: Trading USDCOP, USDMXN y USDCLP

Fecha de emisión: 03 agosto 2017. Ponente: Matías Salord. En esta sesión semanal, nuestro analista Matías Salord les hablará del panorama económico y del mercado de las principales divisas. SHARE AND SUBSCRIBE FOR MORE VIDEO– –Подпишись на канал– police fail / ДТП / cops crash / polizei unfall Street Race in Russia, Moscow [Уличные . … Continue reading »

Read More »

Read More »

-638453232816314704.png)