Category Archive: 1) SNB and CHF

SNB to cut rates in early 2020 as global economy sours – UBS

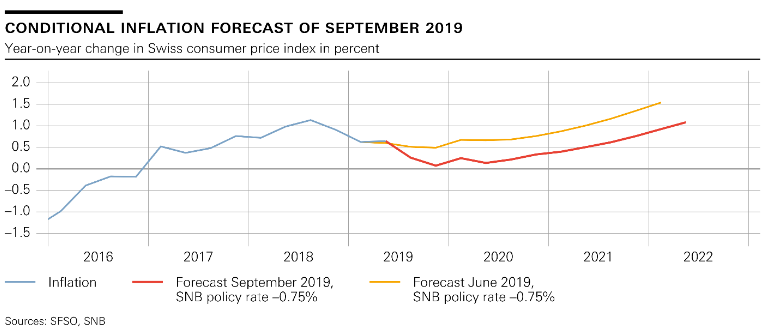

In the latest note to the clients, the UBS Economist Alessandro Bee indicated that he sees the Swiss National Bank (SNB) cutting interest rates next year. “Both the European Central Bank and the Federal Reserve to “react to recession risks” with more rate cuts.

Read More »

Read More »

AUD/CHF Technical Analysis: Bears seeking a break to channel bottoms, below 61.8 percent Fibo

Bulls target risk back to the top of the channel and recent highs of 0.6750. Bears seek a break of trendline support and a resumption of the downside within the bearish channel. AUD/CHF has been resilient against the odds, considering the risk-off tone in markets were otherwise, the CHF usually performs.

Read More »

Read More »

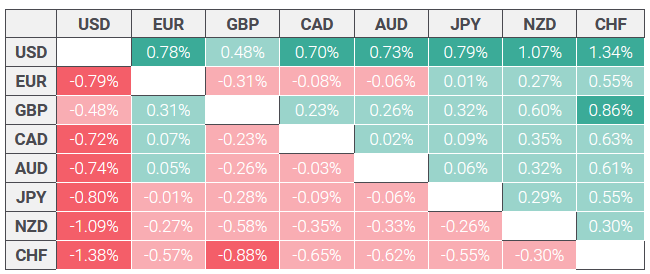

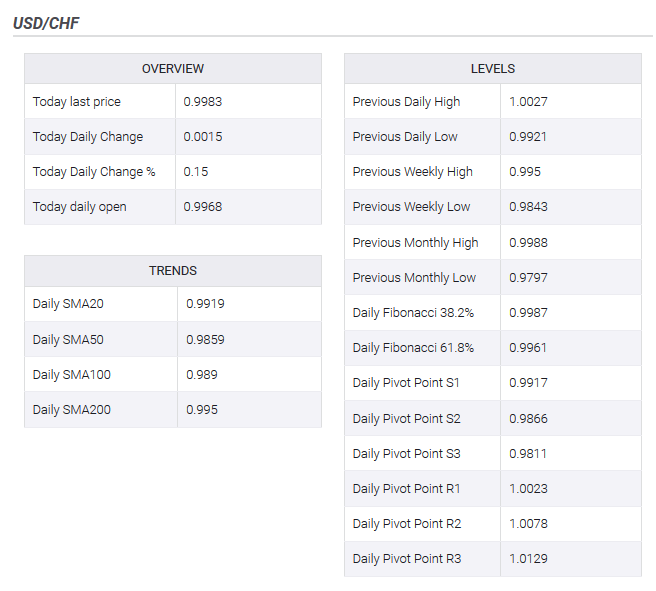

USD/CHF capped again by 1.0025, retreats below parity

Swiss Franc flat versus US Dollar, down against its European rivals. Another weak economic report from the US keeps the Greenback and markets under pressure. The USD/CHF pair again was capped by the 1.0025/30 area and pulled back. Near the end of the session it is hovering around 0.9980/85 after falling to 0.9950.

Read More »

Read More »

USD/CHF technical analysis: Bulls trying to defend multi-week old ascending trend-channel

Fading safe-haven demand undermined the CHF demand and extended some support. Bears await a sustained weakness below short-term ascending channel support. The USD/CHF pair struggled to register any meaningful recovery and remained well within the striking distance of near three-week lows set in the previous session, coinciding with the lower end of a multi-week-old ascending trend-channel.

Read More »

Read More »

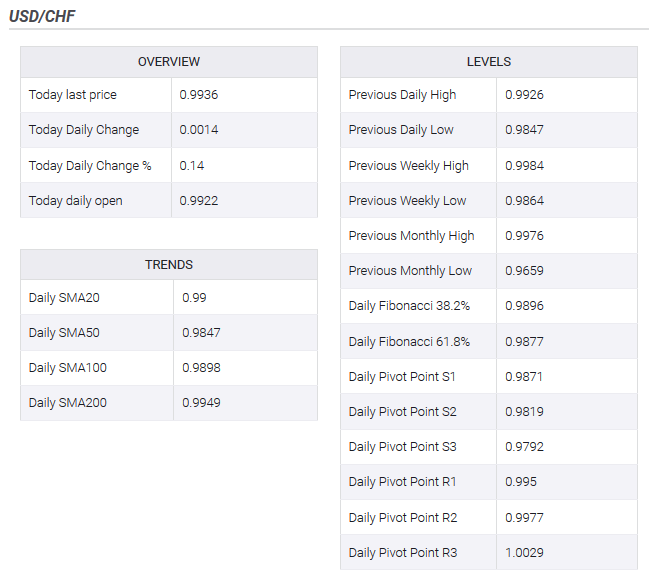

USD/CHF consolidates gains above 0.9900, limited by 0.9950

US Dollar rises versus Swiss Franc for the second-day in-a-row. USD/CHF testing key 200-day simple moving average and 0.9950. The USD/CHF rose on Thursday, holding firm above 0.9900. The pair peaked on European hours at 0.9947 and then pulled back finding support at 0.9900. The bounced back to the upside unable to challenge daily highs and is trading at 0.9930.

Read More »

Read More »

Fourth Karl Brunner Distinguished Lecture, 19.09.2019

00:00 Introductory remarks by Ulrich Weidmann, Vice President for Human Resources and Infrastructure, ETH Zurich

04:05 Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank

17:05 Lecture by Raghuram Rajan, University of Chicago, Former Governor of the Reserve Bank of India

Read More »

Read More »

Fourth Karl Brunner Distinguished Lecture, 19.09.2019

00:00 Introductory remarks by Ulrich Weidmann, Vice President for Human Resources and Infrastructure, ETH Zurich 04:05 Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank 17:05 Lecture by Raghuram Rajan, University of Chicago, Former Governor of the Reserve Bank of India

Read More »

Read More »

The SNB Is a Passive Clearing House Rather Than an Active Currency Manipulator

This post is a long excursion to make two simple points: The SNB is IMHO just acting in a passive way as a clearing house for (massive) capital inflows. It is not actively managing the exchange rate. A rate of increase of sight deposits of 2.5bn per week (100bn p.a.) is not extraordinary considering the need to recycle a current account surplus of 80bn p.a.

Read More »

Read More »

CHF: Possible reversal? – Deutsche Bank

Deutsche bank analysts suggest that at current spot levels, risk-reward favours longs in EUR/CHF. “While Brexit and trade war outcomes look like coin tosses, the impact is likely to be asymmetric as the SNB caps the left tail. While a relief rally would be fully accommodated, they would likely intervene heavily and cut the policy rate in the event of no deal.”

Read More »

Read More »

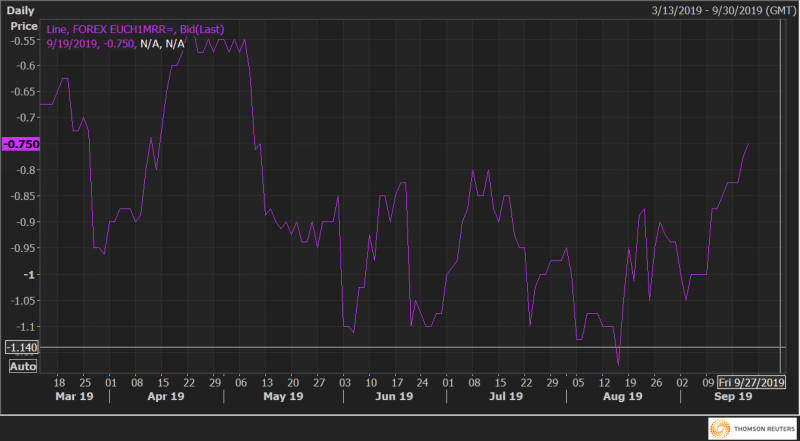

EUR/CHF risk reversals hit highest since May on call demand

EUR/CHF risk reversals have jumped to the levels last seen in May. Risk reversals indicate the demand for call options is rising. Risk reversals on EUR/CHF (EURCHF1MRR), a gauge of calls to put, jumped to the highest level since May on Friday, indicating the investors are adding bets to position for a rally in the common currency.

Read More »

Read More »

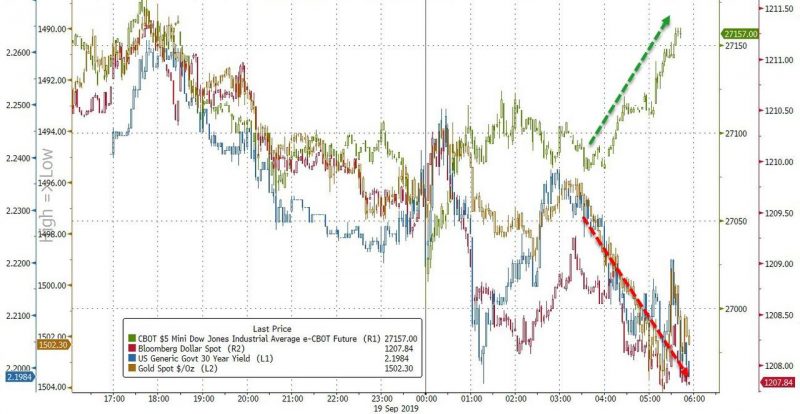

A “Hawkish Cut”? Traders’ Sleepless Nights Dominated By Indecision & Confusion

The avalanche of central bank meetings is rapidly winding down. We’ve had cuts, holds and a raise. The surprises have been minimal. Yet it didn’t prevent the inevitable knee-jerk reactions in the market. In truth, put together as a whole, we are no wiser nor better or worse off. I count that as a success. Especially because there was no projection of panic in any of the decisions.

Read More »

Read More »

AUD/CHF technical analysis: Bears looking for a run to a 50 percent mean reversion

AUD/CHF is in the midst of a sell-off which could extend beyond a 38.2% retracement for a 50% reversion. A subsequent pull-back, however, to the resistance and another sell-off will likely make for a high probability set up. AUD/CHF is in the midst of a sell-off which could extend beyond a 38.2% retracement of the August lows to September highs, located at 0.6715, and target the 50% retracement at 0.6674 (meeting the 2019 lows) should the markets...

Read More »

Read More »

Switzerland’s international investment position: Focus article ‘Breakdown of changes in stocks’ and extension of data offering

The Swiss National Bank has today published a focus article on its data portal entitled ‘Switzerland’s international investment position – breakdown of changes in stocks’ (data.snb.ch, Resources, International economic affairs, Focus articles).

Read More »

Read More »

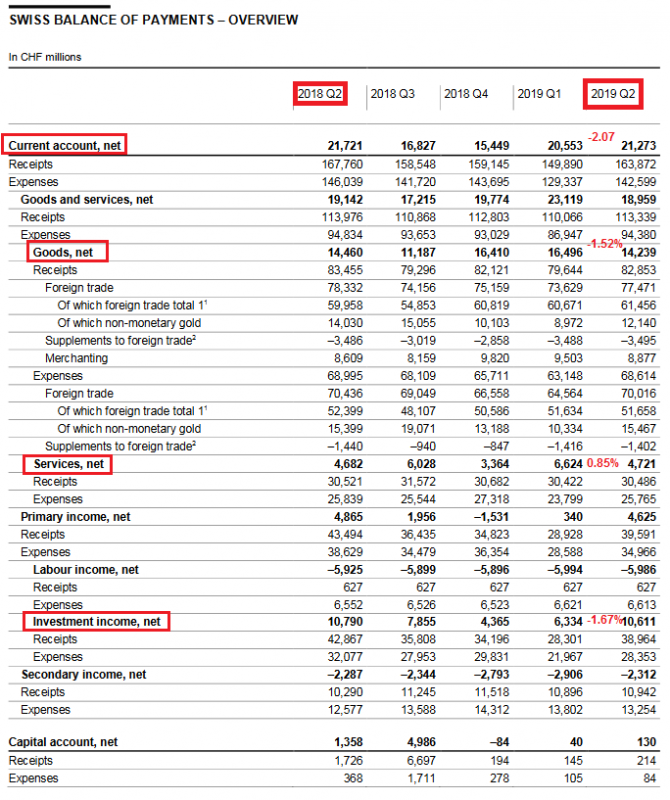

Swiss Balance of Payments and International Investment Position: Q2 2019

The assets side of the financial account registered a total net acquisition of CHF 11 billion (Q2 2018: net reduction of CHF 30 billion). Other investment contributed CHF 7 billion to this net acquisition (Q2 2018: net reduction of CHF 36 billion), in part because the SNB increased its foreign claims in connection with repo transactions.

Read More »

Read More »

SNB leaves policy rate unchanged at -0.75 percent

SNB announces its latest monetary policy decision - 19 September 2019. Sight deposits rate unchanged at -0.75%Willing to intervene and will remain active in FX market as necessaryExpansionary monetary policy continues to be necessary.

Read More »

Read More »

Schweizerische Nationalbank – Weshalb die SNB ihre Munition nicht verpulvern wird

Noch vor wenigen Wochen galt es am Markt bereits mehrheitlich als ausgemacht, dass die Schweizerische Nationalbank am Donnerstag den Leitzins von minus 0,75 Prozent auf minus 1 Prozent weiter absenken wird. Ich konnte die Marktmeinung nie nachvollziehen. Der Wind hat nun tatsächlich gedreht. Eine weitere Absenkung der Zinsen scheint nun so gut wie ausgeschlossen.

Read More »

Read More »

Morgan Stanley forecasts a surprise 25 basis point cut from the SNB

The Swiss National Bank needs to respond to the strong currency and lower rates from the ECB, according to Morgan Stanley. The consensus for Thursday's meeting is no change from -0.75% but Morgan Stanley and UBS are two firms that are forecasting a surprise 25 bps cut.

Read More »

Read More »

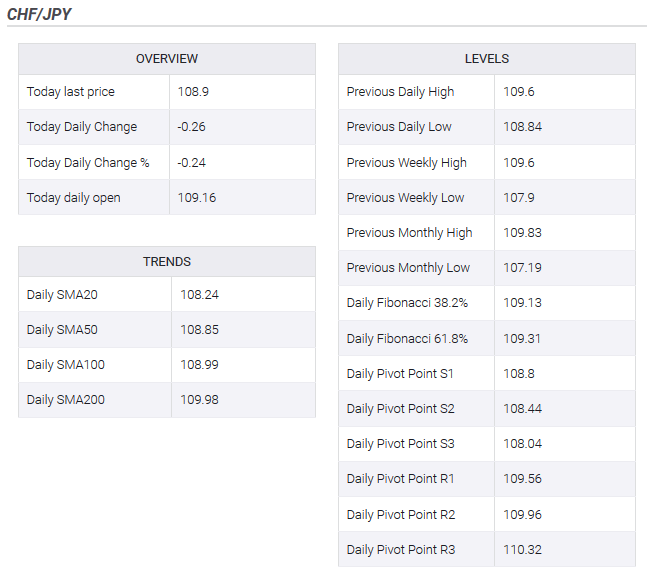

CHF/JPY: Eyes on central banks and geopolitics

This week the BoJ will hold its regular policy meeting. Global uncertainty, linked to the trade war and Brexit, has strengthened the value of the Swiss franc and Yen. CHF/JPY is struggling to maintain the upside as the Yen picks up a safe haven bid, anchored on geopolitical developments following a textbook risk-off response in global financial markets following the strike on Saudi Arabia’s oil facilities over the weekend.

Read More »

Read More »

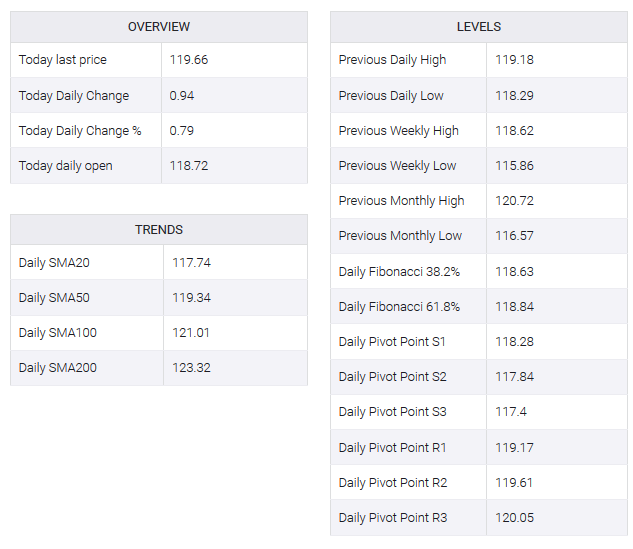

EUR/JPY rallies the hardest vs EUR/CHF as CHF/JPY spikes following ECB

EUR/JPY rallies hard following hawkish ECB cut and trade war optimism. EUR/JPY tracking positive sentiment in financial and commodity markets. While the trade war tensions seem to be easing, with stocks climbing and risk appetite returning in droves to financial and commodity markets, EUR/JPY is up 0.79% on the US session so far following what has been perceived as a hawkish rate cut from the European Central Bank earlier today.

Read More »

Read More »

-637049959004970218-800x353.png)

-638453232816314704.png)