Category Archive: 9a.) Real Investment Advice

Why Letting Big Banks Go Bankrupt Won’t Destroy the Economy

Letting big banks go bankrupt during the financial crisis could have been a better move! Find out why in this eye-opening video. 💰 #Finance #Economy

Watch the entire show here: https://cstu.io/4ea134

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Sellable Rally Or “Buy The Dip”

Inside This Week's Bull Bear Report Failure At The 200-DMA Last week, we noted that the market performance, while distressing as of late, has been well within regular correctionary market cycles from a historical perspective. To wit: "While Trump's tariffs and bearish headlines currently dominate investors' psychology, we must remember that corrections are a normal …

Read More »

Read More »

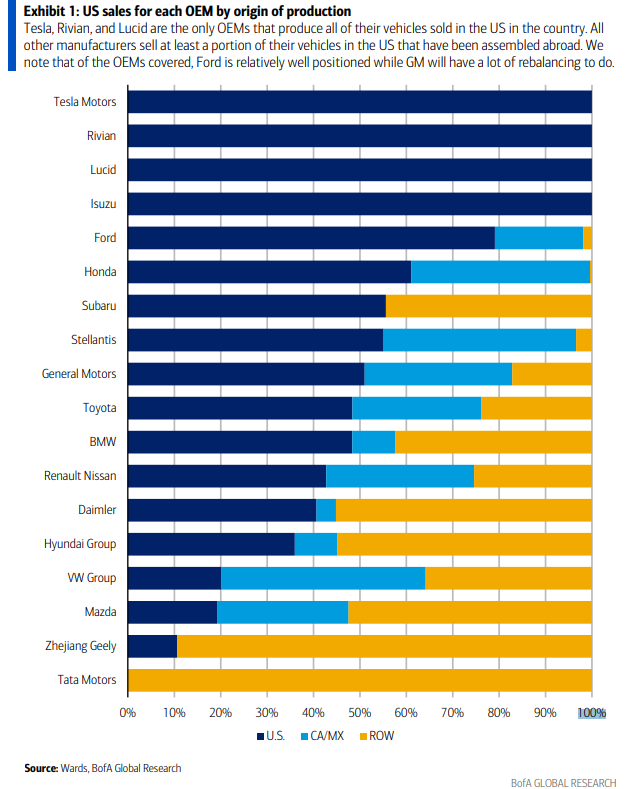

Auto Tariffs Impact Automakers Differently

Despite what some may think, the impact of the new 25% auto tariffs will not necessarily benefit all US auto companies to the detriment of their foreign counterparts. For example, as we share below courtesy of Bank of America, Ford produces about 80% of their US-sold cars in the US. However, GM and Stellantis, the …

Read More »

Read More »

Stagflation Panic: A Misdiagosed Media Spin

Following the latest Federal Reserve meeting, there was a massive surge in media headlines stating "stagflation." The media's stagflation panic is unsurprising as it elicits memories of the late 1970s during the Arab oil embargo. Of course, a "stagflation" is excellent fodder for clicks and views as it scares the “bejeebers” out of people. Over the last …

Read More »

Read More »

The Wealth Dissipation Effect

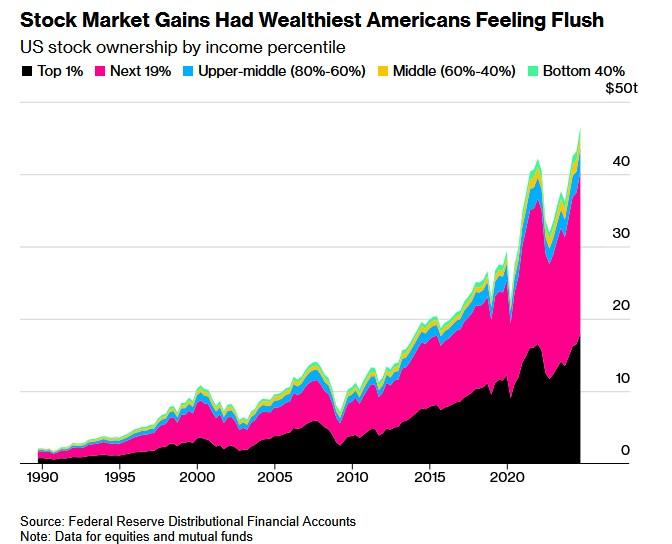

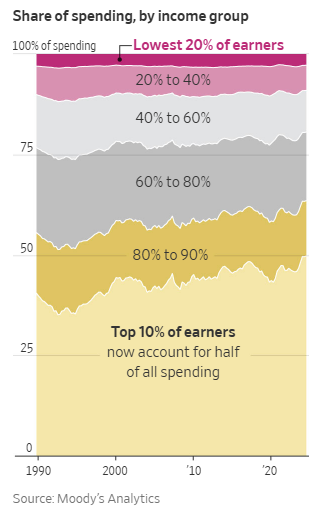

Ben Bernanke popularized the wealth effect theory during the financial crisis in 2008. In his words, "higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending." Moreover, he argued this would create a "virtuous circle" of increased spending, higher incomes, and further economic growth. Since then, the Fed has …

Read More »

Read More »

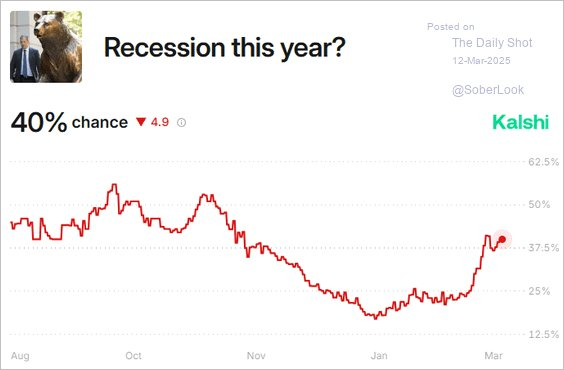

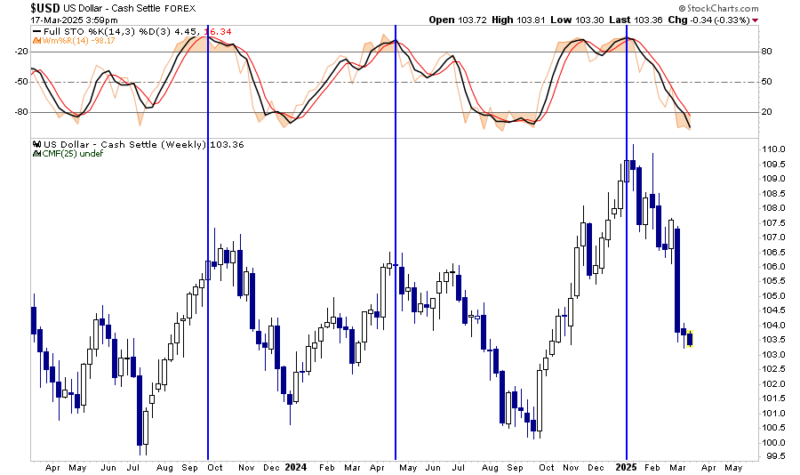

3-26-25 Is the Risk of Recession Rising?

Is the risk of recession rising? Consumer sentiment is flagging following last week's market correction. Investors cannot dismiss sentiment and money flows. Everything that drives the market gets down to earnings. The next round of earnings reports will commence in a couple of weeks. It appears the Dollar has bottomed, and markets are setting up for a rally short term. Lance and Danny address misinformation about recession vs stagflation; there...

Read More »

Read More »

3-24-25 Is The Correction Over?

Markets are wrapping up the final week of March, dealing with the uncertainty of the on-again, off-again tariffs. Manager are prepping for the end of the quarter, and will be rebalancing portfolios that are under-weight in stocks; the corporate buy back window is closed, removing a source of buyers. The markets' sharp 10% decline over three weeks appears to have abated, momentum is about to trigger a MACD buy signal; money flows are turning...

Read More »

Read More »

The Key to Lower Inflation May Start with Stock Prices

The key to lower inflation may start with the stock market and feed into the economy rather than vice versa. The wealth effect describes the behavioral phenomenon where individuals' perceived wealth changes impact their spending decisions.

Read More »

Read More »

A Comprehensive Guide to Retirement Income Strategies for a Secure Future

Planning for retirement is about more than just saving—it’s about ensuring a steady income stream that lasts throughout your retirement years. Without a well-structured plan, you could risk outliving your savings or facing financial hardship due to inflation, taxes, or unexpected expenses. This guide will walk you through retirement income strategies to help you achieve sustainable retirement income while balancing withdrawals, taxes, and long-term...

Read More »

Read More »

Is The Correction Over?

Inside This Week's Bull Bear Report Is A Bottom Beginning To Form? Last week, we noted that the market performance, while distressing as of late, has been well within regular correctionary market cycles from a historical perspective.

Read More »

Read More »

Retail Sales Are Better Than Advertised

Within the headline retail sales figure is a lesser-followed data point called the retail sales control group. Following the trend of both figures is important because although the headline figure receives more attention, the control group is the measure that feeds into the GDP calculation.

Read More »

Read More »

U.S. Recession Risks Not As High As The Media Suggests

U.S. recession risks have been a headline over the last few weeks as the markets sold off. "Goldman Sachs and Moody’s Analytics in recent days joined forecasters raising alarm about the increased likelihood of an economic downturn.

Read More »

Read More »

The Role of Dividend Investing in Generating Passive Income for Retirement

Building a secure retirement requires a reliable stream of income that can support your lifestyle without depleting your savings too quickly. A dividend investing strategy offers a way to generate passive income in retirement, providing consistent cash flow while preserving capital. In this article, we’ll explore how dividend-paying stocks can help retirees create sustainable income, …

Read More »

Read More »

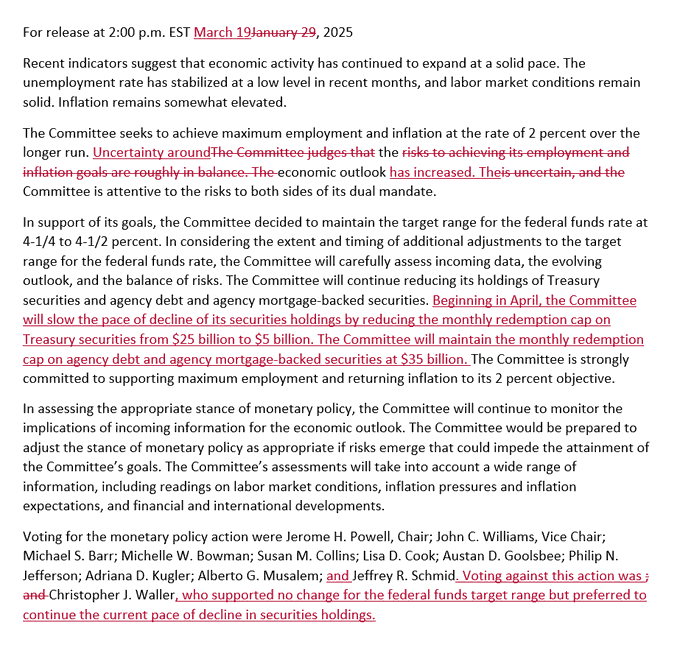

The FOMC Shifts To A Dovish Tone

As the market widely expected, the FOMC left the Fed Funds rate unchanged. However, the statement summarizing the meeting now includes an economic growth warning- "uncertainty around the economic outlook has increased." Moreover, they are reducing the amount of monthly QT. The roll-off of Treasury securities will fall to only $5 billion monthly, down from …

Read More »

Read More »

3-19-25 Recession or Slowdown?

UCLA issues its first "Recession Watch" since the 1950's as the media hype ramps up ("If it bleeds, it leads.") Fed meeting preview: No rate cut expectations, but comments regarding Quantitative Tightening will be key for markets. Tuesday's sell off part of the process of markets' finding a bottom. Bonds continue to provide a hedge against stocks. Lance and Danny discuss Lance's demise and how to provide important instructions...

Read More »

Read More »

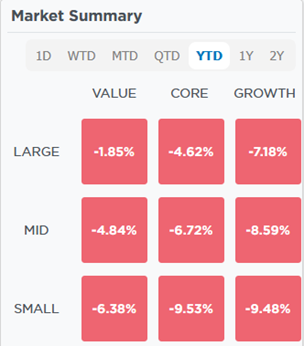

Growth To Value: Which Rotation Is Next?

The Magnificent Seven and many other large-cap growth stocks were among the winners in 2024. However, in 2025, investors are shunning the largest market cap growth and highest-beta stocks and moving into value, particularly large-cap value. Shifting investor preferences to large-cap value from large-cap growth and high beta provides an excellent example of sector and …

Read More »

Read More »

The Sentiment Bark Is Worse Than The Market’s Bite

The old saying that the bark is worse than the bite is a good description of the current state of the stock market and investors' sentiment. The following quote from a recent Commentary and our most recent article (summarized and linked below) point to the unusually poor sentiment. The AAII retail investor survey is now …

Read More »

Read More »

Managing Risk in Volatile Investments with a 5 Percent Portfolio Strategy

📈 Understanding recoverable losses and position sizing based on volatility! 💡 #StockMarket #InvestingTips #Finance101 📊

Watch the entire show here: https://cstu.io/954f75

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Transportation Stocks Continue To Lead Markets Lower

In our Commentary last week, we noted that Delta shares were down over ten percent due to their weak economic outlook. Per our Commentary- "Delta’s CEO offered similar caution: The outlook has been impacted by the recent reduction in consumer and corporate confidence caused by increased macro uncertainty, driving softness in Domestic demand. He also …

Read More »

Read More »

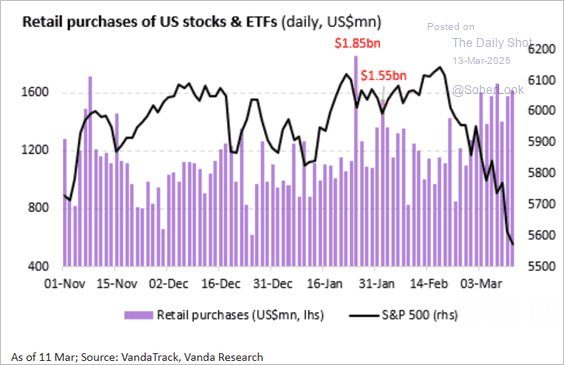

Retail Investor Buys The Dip Despite Bearish Sentiment

It has been an interesting correction. The average retail investor was "buying the dip" despite having an extremely bearish outlook. This is an interesting point because, as shown, the retail investor used to be considered a "contrarian indicator" as they were prone to be driven by emotional behaviors that led them to "buy high and sell low." …

Read More »

Read More »