Category Archive: 9a.) Real Investment Advice

Passive Fingerprints Are All Over This Crazy Market

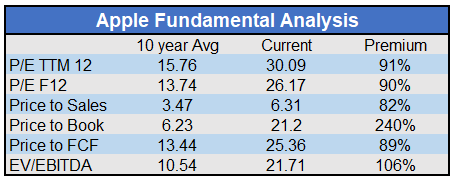

Passive Fingerprints Are All Over This Crazy Market. Apple’s stock is up over 20% since the market peak in February. Without a doubt, Apple, the company, is worse off due to the crisis and global recession. Revenue and earnings will be inferior to what Wall Street had forecast at lower stock prices. Valuations, shown below, are now astronomical.

Read More »

Read More »

The Fed Is Trapped In QE As Interest Rates Can’t Rise Ever Again.

Since the onset of the pandemic, the Fed has entered into the most aggressive monetary campaign. Its goal was to bolster asset markets to restore confidence in the financial system. However, the trap is the Fed is in a position where they can never stop QE as interest rates can’t rise ever again.

Read More »

Read More »

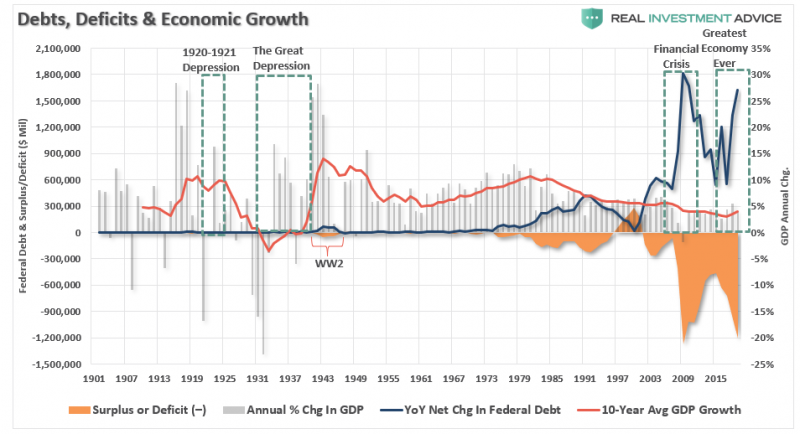

The Theory Of MMT Falls Flat When Faced With Reality (Part II)

If you missed Part-1 of our series on the “Theory Of MMT Falls Flat When Faced With Reality,” start there. In Part-2, we complete our analysis of the theory and the potential ramifications. The premise of our discussion was this recent explanation of “Modern Monetary Theory” by Stephanie Kelton.

Read More »

Read More »

(5/29/20) Financial Fitness Friday (Full Show)

Market Commentary; Economic effects of Pandemic; 42% of Layoffs will be permanent job losses; wages no longer “sticky;” CARES Act is here to stay; Math Can Save Your Household: Ratio’s & Radical Downsizing; resetting expenses; assume you’re not going to get a raise; What if Unemployment hits 6% w 4% inflation? Why not allow business …

Read More »

Read More »

How Math Can Save You (5/29/20)

As we continue to assess the economic damage inflicted by the COVID-19 pandemic, adjusting household budgets to the reality of our situation will be key to financial survival. RIA Advisors Director of Financial Planning, Richard Rosso, CFP w Certified Financial Planner, Danny Ratliff, CFP, expound on household ratios, and what downsizing could look like for …

Read More »

Read More »

The Real Investment Show Best Clips for Week of 5/25/20

Life in these United States these days consists of staying home and finding even more, creative ways to utilize what’s on hand: This week we covered the dilemma of working, or not; received a primer in 2008 GDP drops vs today’s 30% vaccum, how not to be stupid, and another learning experience, courtesy of the …

Read More »

Read More »

(5/28/20) Why We’re Fed-up with The Fed (Full Show)

Power outages & Cherry Cobbler; Watching the economic numbers as the recovery begins; Michael Lebowitz on Baseball players’ salary cuts, shortened season, optics; What’s happening in America; NFL Status; Initial uptick in economic activity from pent-up demand: Is it repeatable? Amount of outstanding debt & size of Fed response; Pedro da Costa commentaries; the Fed’s …

Read More »

Read More »

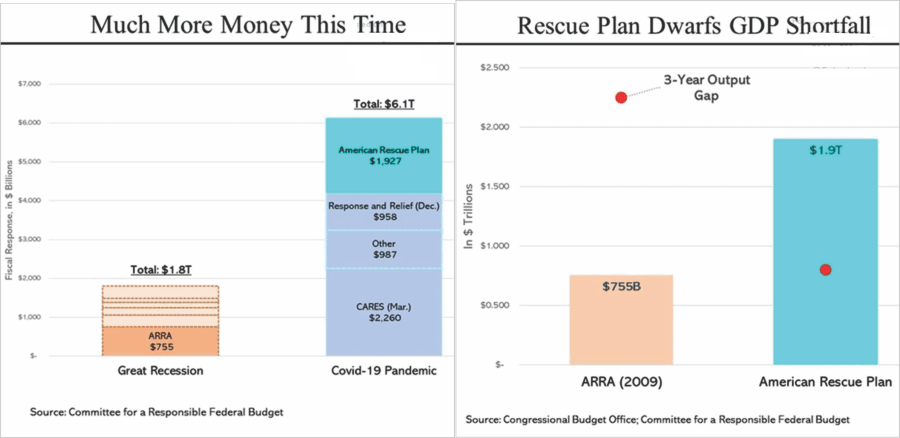

Life in America (5/28/20)

It’s just scandalous that professional athletes and team owners must accept 50% pay cuts, dropping their income from $300-million to only $150-million. That’s rough. RIA Advisors Chief Investment Strategist, Lance Roberts, w Portfolio Manager, Michael Lebowitz, discuss life in America in a post-COVID economy–which will make the 4% GDP drop in 2008 look like a …

Read More »

Read More »

The Pedro da Costa Interview (5/26/20)

Consumer behavior will be key as America begins to re-open for business in a post-COVID world. RIA Advisors Chief Investment Strategist, Lance Roberts, w Economic Policy Institute Director, Pedro da Costa, discuss what’s next for the economy, the role of the Federal reserve, and what their advice to Jerome Powell would be going forward. Subscribe …

Read More »

Read More »

(5/27/20) Financial Planning Corner (Full Show)

The Recessionary Outcomes of COVID-19; Consumer psychology & media narratives; Big deviation between markets & economy; Media Scares; listener e-mail: Dr. J.: Seasonal Flu vs COVID-19; take precautions, continue to live; Let’s not be stupid; Working–or not–during COVID-19; Whether to Tap Your 401k; Needs, Wants, Wishes; Fallacies of Borrowing from 401k’s; MLB Salary Squabble; Buying …

Read More »

Read More »

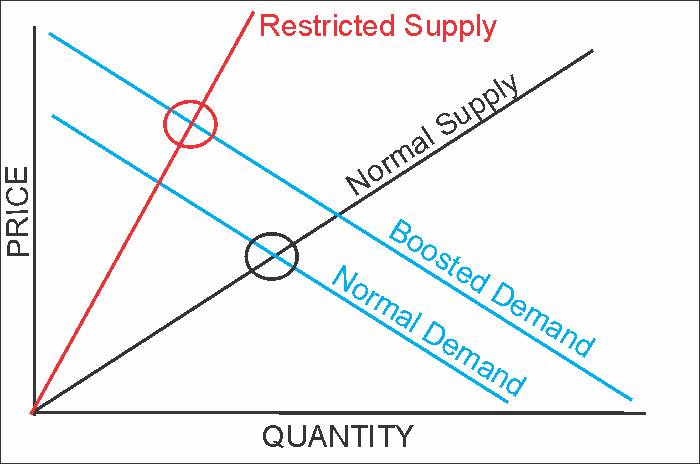

Working–or Not–During COVID-19 (5/27/20)

Has the world gone mad, as we pay workers MORE to stay home than to go out and get a job? RIA Advisors Chief Investment Strategist, Lance Roberts, w Certified Financial Planner, Danny Ratliff, CFO, explore the ramifications of working during the coronavirus pandemic, and the implications for retirement planning. Subscribe to our Newsletter at …

Read More »

Read More »

(5/26/20) Technically Speaking Tuesday (Full Show)

Social Distancing on Memorial Day; restarting the return to “normal;” why economy may not come back as before; Science Fiction portrayals of history, dystopian future; European Commission recommendation to eat insects (while the rich consume beef): globalist agenda, save the planet, widen the wealth gap; wealth transfers; Social Distancing, Media shaming, Save the Planet; Hopes …

Read More »

Read More »

Getting Back to Normal (5/26/20)

Don’t know what “normal” is going to look like, but a post-Covid world is going to be different than before. RIA Advisors Chief Investment Strategist, Lance Roberts, compares society’s response to the Coronavirus vs influenza, and how we may have already begun to repeat the same policy mistakes that have created the current economic climate. …

Read More »

Read More »

Technically Speaking: Defining the Market Using Long-Term Analysis (5/26/20)

Was March’s decline a bear market’s tracks, or just a correction? RIA Advisors Chief Investment Strategist, Lance Roberts, lays out the evidence…and the charts..in this mental exercise. Subscribe to our Newsletter at https://realinvestmentadvice.com

Read More »

Read More »

ENCORE: Living in Communist America (5/25/20)

On this Memorial Day, we re-run a rant from Lance Roberts wherein he questions the direction of our Nation, the hypocrisy of the Press, and just how much we’re comfortable in giving up. Is this what our soldiers died for? Subscribe to our Newsletter at https://realinvestmentadvice.com

Read More »

Read More »

(5/22/20) Financial Fitness Friday (Full Show)

Global economy is so bad, China’s not even reporting GDP lies; The M-word; Houston’s missing Oilers, Astrodome, KLOL Radio; Retiring at 65–Pipe Dream or Reality? How Things Have Changed under COVID-19: Drive-by Graduations; Masks in Schools; Gen-Z’s flexibility to adapt to change; Webinar Replay tease; Debt-to-Income Ratio Reality; Financial Rules: Total Mortgage Debt Ratios; Houses …

Read More »

Read More »

Financial Guardrails – Debt to Income Ratio (5/22/20)

One of the financial rules we adhere to is how much house you can REALLY afford. RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Certified Financial Planner, Danny Ratliff, CFP, run the math on debt to income realities. Subscribe to our Newsletter at https://realinvestmentadvice.com

Read More »

Read More »

The Real Investment Show Best Clips for Week of 5/18/20

Are you ready to go back to work? We never left–and this week tracked down The Money, you know, The Money…examined how we operate in Crisis Mode, and determined whether Ayn Rand was right about our doomed society, and the particular conundrum that plagues the Federal Reserve. Subscribe to our Newsletter at https://realinvestmentadvice.com

Read More »

Read More »

(5/21/20) Fed Money Moves at the Speed of Light (Full Show)

Market Response to Fed Minutes’ release; definitions of Bear and Bull markets; Newsroom/”America Isn’t Great Anymore;” The importance of Capitalism = economic prosperity; Michael Lebowitz – Fed’s light-speed activities; Why recessions are needed; The Fed’s problems: Liquidity Continuance and Credit Markets; Record Levels of Corporate Debt, slowed economic growth; Why Companies should be allowed to …...

Read More »

Read More »

The Federal Reserve’s Conundrum 5/21/20

Here’s a puzzle: The Federal Reserve needs a crisis in order to continue to apply Quantitative Easing; it has made certain liquidity commitments. It’s chief concern, however, is how credit markets operate. RIA Advisors Chief Investment Strategist, Lance Roberts, w Portfolio Manager, Michael Lebowitz, CFA, examine the angles, and why it really would be best, …

Read More »

Read More »