Category Archive: 9a.) Real Investment Advice

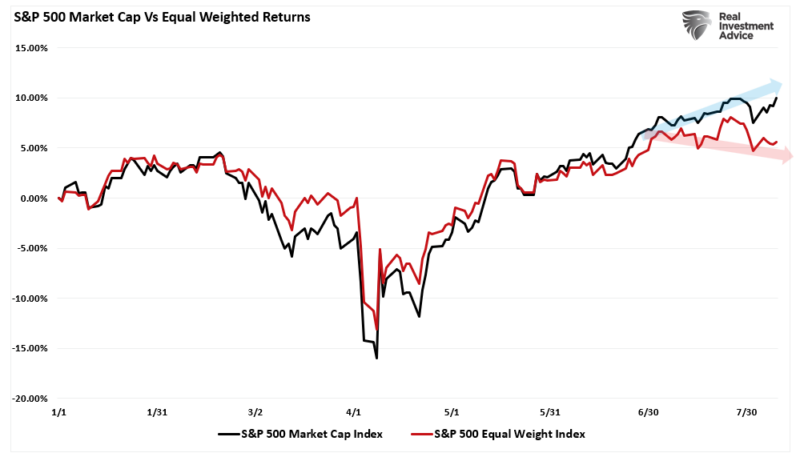

Significant Rotations Hidden By Calm Markets

The market seas are calm, but beneath the surface, there is some intense churning, or in market terminology, significant stock rotations. Over the last week, the Dow, S&P 500, and Nasdaq were relatively flat. Such gives the appearance of a low volatility, typical late August market with little going on. However, beneath the calm of …

Read More »

Read More »

8-21-25 The Impact of Lower Interest Rates on Housing

Incredibly, new home prices are actually less expensive than exiting homes; and no one is selling, and no one is buying. Imagine the impact if interest rates were to be lower to spur more home sales...

RIA Advisors Senior Financial Advisor, Danny Ratliff, CFP, w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

-------

Read the article Danny & Michael mention on our website, and sign up for Lance's...

Read More »

Read More »

8/21/25 Speculative Frenzy – Fading or Re-fueling?

Markets are showing signs of a speculative frenzy once again—but is the fire burning out or just getting started?

Danny Ratliff & Michael Lebowitz break down the latest stock market speculation, shifts in investor sentiment 2025, and the risks of a potential market bubble forming. We’ll look at how speculative trading trends are driving prices higher, what this means for long-term investors, and where financial market volatility could take...

Read More »

Read More »

Retirement Income in Overvalued Markets.

Financial planning industry thought leader Michael Kitces, CFP®, CLU®, ChFC®, RHU, REBC, and professor of retirement income at the American College, Wade D. Pfau, Ph.D., CFA, penned a seminal work for the Journal of Financial Planning titled Reducing Retirement Risk with a Rising Equity Glide Path. Their work and several tips can help with retirement income …

Read More »

Read More »

What to Expect From a Personalized Financial Planning Experience

Financial planning is not one-size-fits-all. Your goals, responsibilities, and lifestyle are all unique to you. Your financial strategy is no different. Building wealth, or preparing for retirement? Life transitions like these require some help from personalized financial planning instead of a run-of-the-mill algorithm. Find clarity, confidence, and a strategy that involves YOU with RIA Advisors. …

Read More »

Read More »

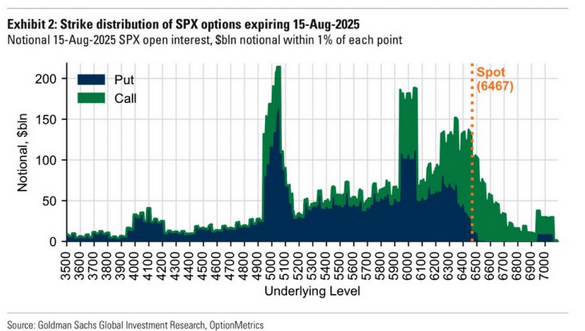

OPEX Overload: How 3 Trillion In Expirations Can Move Markets

Nearly $3 trillion of notional stock options expire on Friday's open expiration (OPEX day). Over half of the OPEX volume is in S&P 500 options, with the remainder in single stock options. The graph below provides details on the split between puts and calls, and the strike prices and open interest of the options. Almost …

Read More »

Read More »

8-20-25 The Rest of the World Must See Our Economic Future as Blindingly Bright

Our conversation with Real Clear Markets Editor, John Tamny, on the economic health of the US as evidenced by $37-Trillion in debt the rest of the world continues to clamor to buy.

Watch the entire interview on our YouTube channel:

Chief Investment Strategist, Lance Roberts, CIO, w John Tamny, Editor/Real Clear Markets

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's...

Read More »

Read More »

8-20-25 John Tamny – Money is Ruthless

Lance Roberts interviews John Tamny, author, economist, and editor of RealClearMarkets. Tamny’s provocative new book, Deficit Delusion, reframes how we think about debt and growth. He makes a bold case: Trump-style protectionism and fear-driven immigration policies are economically self-defeating—even for conservatives.

Trade is the greatest foreign policy mankind has ever devised, plus it's great for workers as is any scenario that expands the...

Read More »

Read More »

UPS Is At Pandemic Lows: Value Or Value Trap?

Shares of UPS are around the same price they were in March 2020, when the pandemic shut down economic activity. At the time, the global economy was decimated. In unprecedented fashion, the unemployment rate skyrocketed from 3.5% to 14.8% in one month. While the economic impact was tremendous, there was no relief in sight. The …

Read More »

Read More »

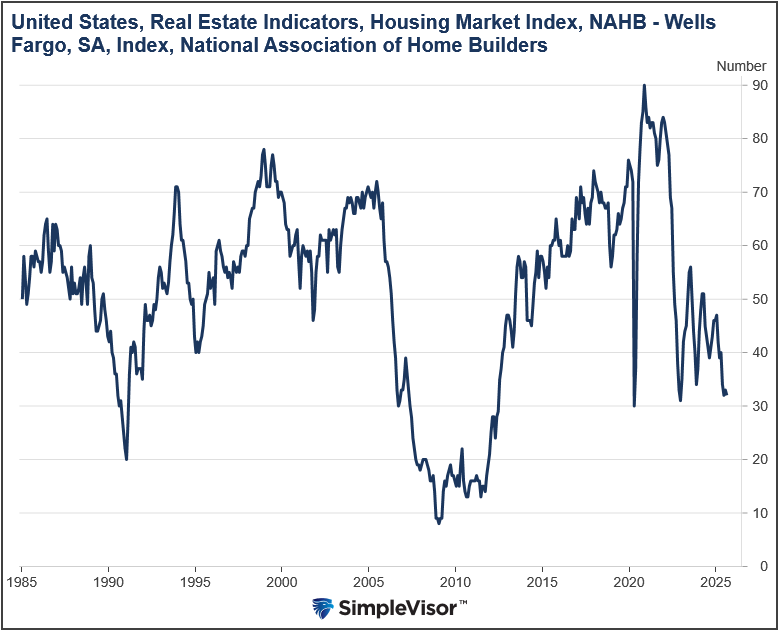

Homebuilders Are Pessimistic But Buffett Likes Them

In Warren Buffett’s Berkshire Hathaway's latest SEC disclosures, the company reported buying a nearly $1 billion stake in homebuilders Lennar (LEN) and D.R. Horton (DHI). The purchases signal anticipation of a housing market rebound, possibly piqued by the possibility of the Fed starting a rate-cutting regime. However, while Buffett appears confident of the new home …

Read More »

Read More »

8-19-25 How Small Habits Drain Your Budget

You'd be surprised at how much money you could save by cutting out those little, everyday habits that sap your earnings. Saving $500/month is $6k a year towards your personal nest egg!

Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a...

Read More »

Read More »

8/19/25 Do You Really Need a Local Financial Advisor? Why Location Doesn’t Matter Anymore

Do you really need a local financial advisor to manage your money? Geography doesn’t matter anymore when it comes to building wealth and securing your financial future.

Lance previews this week's Jackson Hole consortium; what will Jerome Powell Infer?

Lance Roberts & Jonathan Penn cover the conundrum of local vs virtual financial advisors; how college students are lured by credit card offers, and the dangers of credit accounts. This leads to a...

Read More »

Read More »

Will Powell Turn Dovish In Jackson Hole?

The Jackson Hole Economic Symposium, hosted by the Federal Reserve Bank of Kansas City, is an annual event in which central bankers from the Fed and around the world gather with policymakers, economists, and financial market participants to discuss economic issues.

Read More »

Read More »

How to Build a Multi-Generational Wealth Strategy That Lasts

Creating wealth is a remarkable accomplishment, but preserving it across generations is a different challenge altogether. Families who want to build a lasting impact must go beyond investment portfolios. They need a clear, cohesive plan to pass on not just money, but purpose, values, and financial confidence.

Read More »

Read More »

8/18/25 Ten Rules for Navigating Excessive Market Bullishness

Are investors too optimistic right now?

Lance Roberts breaks down ten rules for navigating excess market bullishness so you can protect your portfolio while still participating in market gains. Also in today's show: Lance's assessment of earnings season so far, and the role Nvidia will play in determining market moods. We've got a special interview segment planned for Wednesday's (8/20) show [Premier link is below]; Lance reveals yet another saga...

Read More »

Read More »

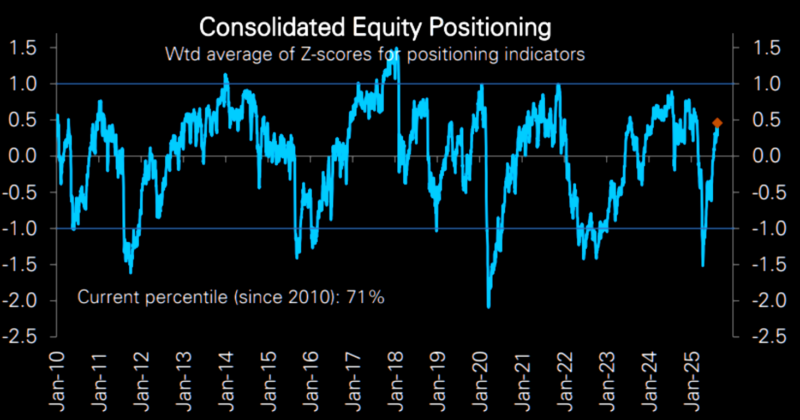

Excess Bullishness & 10-Rules To Navigate It

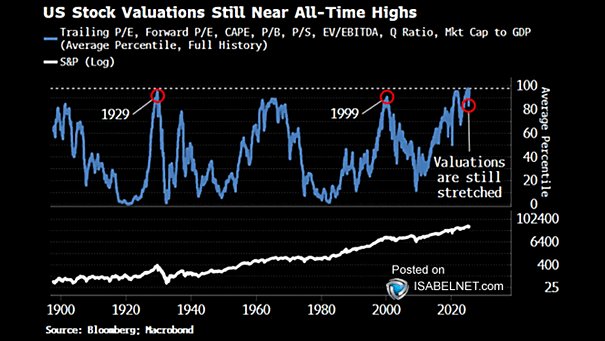

There is little doubt that excess bullishness has invaded the general market psyche. Just a couple of months following the market decline in March and April, where sentiment turned exceedingly bearish, the S&P 500 hovers near its highs. Furthermore, analysts are rushing to raise price targets to 7,000 or more.

Read More »

Read More »

Euro Stocks Are In Vogue: Do Valuations Justify The Rotation?

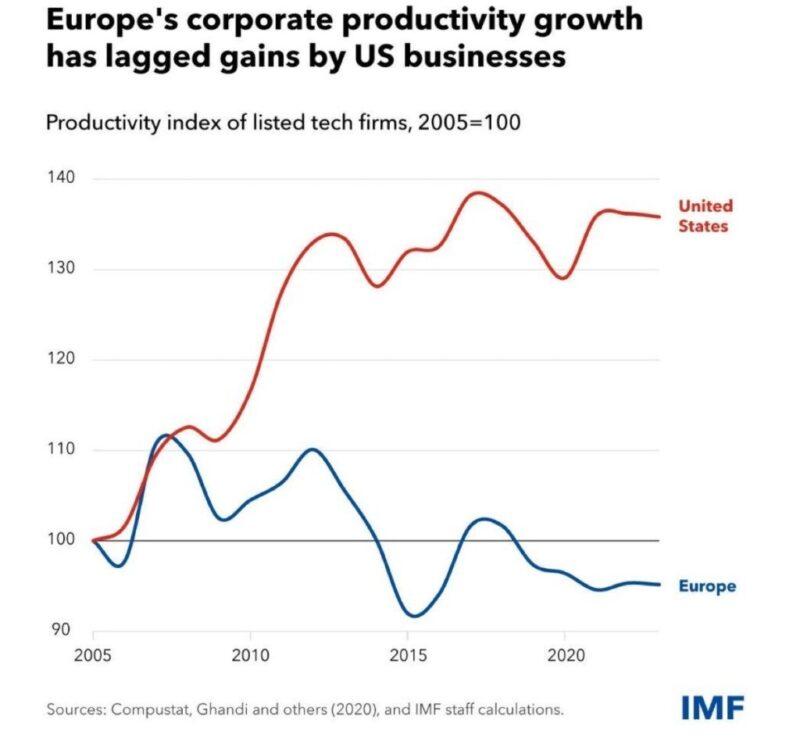

Since 2015, the performance of the S&P 500 has been more than double that of stocks from the Euro STOXX 50 (FEZ) and the iShares developed markets ETF (EFA). However, recently the tide has turned, and the Euro and broader foreign stock indices are beating the S&P 500.

Read More »

Read More »

Inflation Data Sends Markets To New Highs

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

8-15-25 The Importance of Financial Alignment in Marriage

One of the most important decisions in life is whom to marry; a compatible financial mindset can affect a lifetime of wealth.

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Senior Financial Advisor, Jonathan McCarty, CFP

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live...

Read More »

Read More »

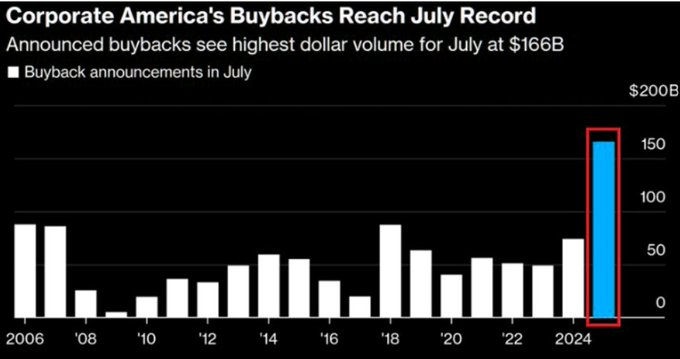

Insider Selling Reveals Fallacy Of Buyback Theory

Mainstream commentary repeats a simple refrain: “Buybacks return capital to shareholders.” The logic sounds convincing. A company reduces its outstanding shares, giving each shareholder a larger slice of the earnings pie. But as I’ve discussed in past work like “Stock Buybacks Aren't Bad, Just Misused,” the reality is more complex. If corporate buybacks were an …

Read More »

Read More »