Category Archive: 6a) Gold & Monetary Metals

5 Key Ways to Prosper in the Coming Systemic Crisis

Time To Take Power and Control Back From The System

1. Diversify Your Investments and Savings

2. Invest and Own Gold and Silver in Safest Ways

3. Avoid Excessive Debt or Leverage

4. Prepare For Investment Opportunities

5. Invest In Your Education. Learn and Grow

Topics considered are

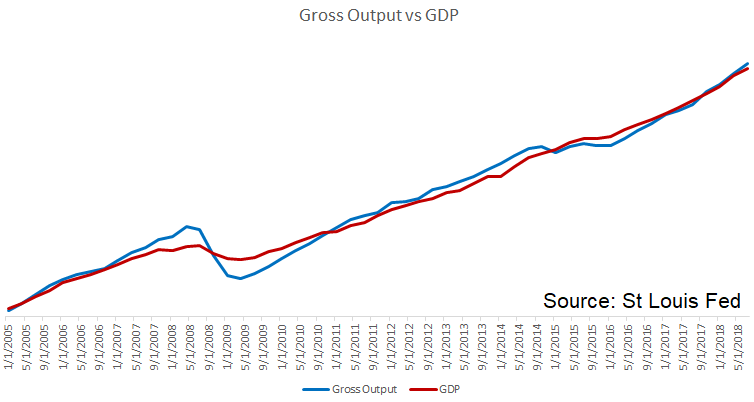

- Political, financial, economic and monetary systems are failing and will likely collapse

- Our human built economic systems are dependent on the...

Read More »

Read More »

5 Ways to Prosper in the Coming Crisis

5 Ways to Prosper in the Coming Crisis – Goldnomics Podcast (Epis. 11) In the 11th Episode of The Goldnomics Podcast Mark O’Byrne and Stephen Flood are interviewed by Dave Russell as they discuss 5 ways to prosper in the coming systemic crisis. There are many risks facing us and Brexit, while important, is just … Continue...

Read More »

Read More »

Cryptocurrencies accepted by Switzerland’s biggest online retailer

Switzerland’s largest online shop, Digitec Galaxus, has announced it will start accepting payments in bitcoin and other cryptocurrencies. The company, which saw turnover of close to a billion francs last year, is by far the largest Swiss retailer to date to take this step. The move may go some way to answering the question posed by many bitcoin holders: “I have cryptocurrencies, now what do I do with them?”

Read More »

Read More »

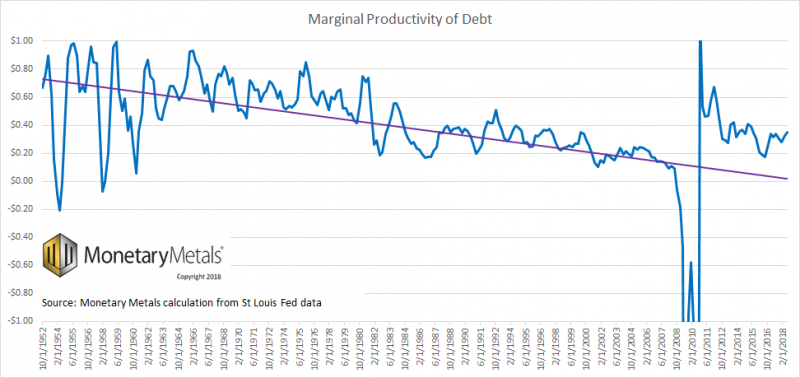

Marc Faber – Huge Asset Bubble Will Be Deflated

Legendary contrarian investor Dr. Marc Faber warns, “When I started to work in 1970 on Wall Street, the stock market capitalization of the U.S. as a percentage of GDP . . . was between 25% and 30%. Now, the stock market capitalization alone is 150% of GDP, and when you add the bonds to it, … Continue reading »

Read More »

Read More »

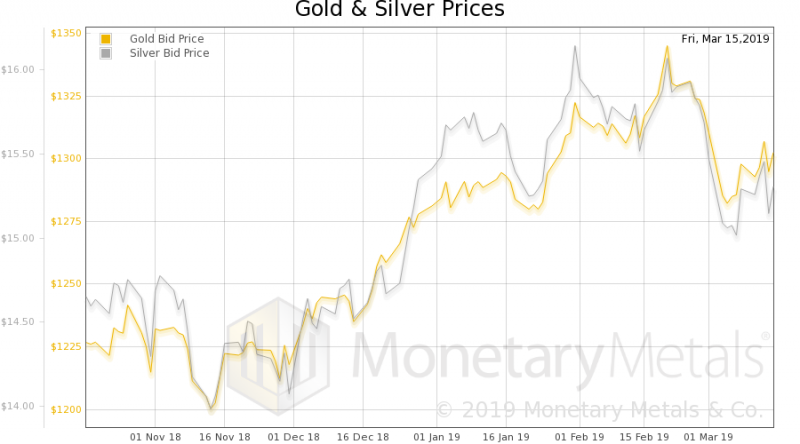

Sprott Money News Weekly Wrap-up – 3.15.19

Eric Sprott discusses the week that was in precious metals and looks ahead to a volatile week next.

Read More »

Read More »

XRP Rally Inevitable , Ripple And Marc Faber Buys Bitcoin

Get A Ledger Hard Wallet For Safe Digital Asset Storage http://bit.ly/2HKGIcO Get A CoolWallet Hard Wallet For Safe Storage: https://bit.ly/2UUYFvd Enter Uphold $500K Giveaway: http://bit.ly/2RFt7ZA Get Cinnamon For Your Coffee Here: https://bit.ly/2UEYIMx Digital Asset Investor Website http://thedai.io _____________________________________________ XRP Donations Welcome And Appreciated Address: rEb8TK3gBgk5auZkwc6sHnwrGVJH8DuaLh Destination Tag...

Read More »

Read More »

#571 Gesetzenwurf für Bitcoin Transparenz, Ethereum kein Wertpapier & Marc Faber kauft BTC

http://bitcoin-informant.de/2019/03/13/571-gesetzenwurf-fuer-bitcoin-transparenz-ethereum-kein-wertpapier-marc-faber-kauft-btc Hey Krypto Fans, willkommen zur Bitcoin-Informant Show Nr. 571. Heute geht’s um folgende Themen: Gesetzentwurf will Bitcoin und Co. gänzlich transparent machen, US-Börsenaufsicht: Ethereum wird nicht als Wertpapier eingestuft & Investor Marc Faber kauft BTC. 1.) Gesetzentwurf will Bitcoin und Co. gänzlich...

Read More »

Read More »

Sprott Money News Weekly Wrap-Up – 3.8.19

Eric Sprott discusses the latest US jobs numbers as well as other global factors that are driving gold and silver prices.

Read More »

Read More »

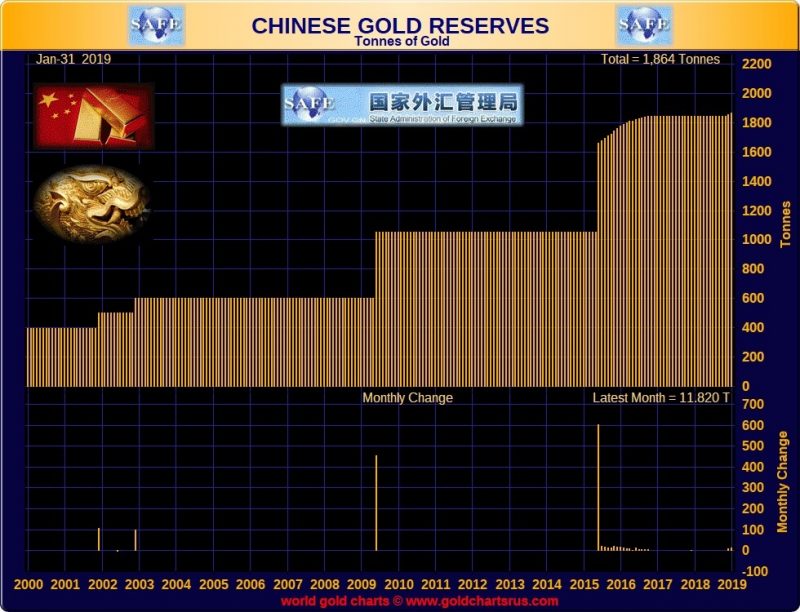

China Gold Reserves Rise To 60.26 Million Ounces Worth Just $79.5 Billion

China increased its gold reserves for a third straight month in February, data from the People’s Bank of China (PBOC) showed this morning.

The value of China’s gold reserves rose slightly to $79.498 billion in February from $79.319 billion at the end of January, as the central bank increased the total amount of gold reserves to 60.260 million fine troy ounces from 59.940 million troy ounces.

Read More »

Read More »

Gerald Celente Reveals Triggers for World Economic Blowup, Gold Breakout

Read the full transcript here: https://www.moneymetals.com/podcasts/2019/03/01/gerald-celente-gold-breakout-001724 Buy gold online: https://www.moneymetals.com/buy/gold Later in today’s program Gerald Celente, the top trends forecaster in the world joins me to tell us why the world’s central banks bought a record amount of gold in 2018 and also about what type of wildcard events may trigger a new economic crisis. …

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 3.1.19

Eric Sprott discusses the current pullback in precious metal prices and looks ahead to what will be an eventful month of March.

Read More »

Read More »

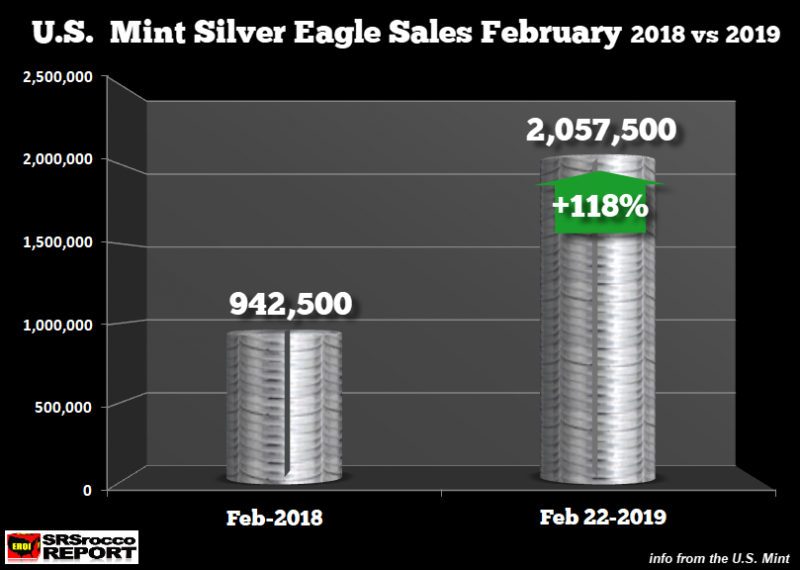

U.S. Mint Suspends Silver Bullion Coin Sales After Sales Double In February

U.S. Mint suspends silver bullion coin sales after sales double in February. Silver investment demand for American Eagles (one ounce) silver bullion coins depletes West Point Mint inventories. U.S. Mint suspended sales of American Eagle (1 oz) coins on Feb. 21 because it had no coins left to sell.

Read More »

Read More »

Swiss private banking giant dips toes into crypto scene

One of Switzerland’s largest banks, Julius Baer, has entered the cryptoassets world by announcing a partnership with budding crypto bank start-up SEBA. While other Swiss banks, such as Vontobel, Falcon and Swissquote, are already active in the space, Julius Baer’s entrance has attracted particular attention.

Read More »

Read More »

Sprott Money News Ask The Expert – Chris Howard of The Royal Mint

Chris Howard is Executive Director in charge of the bullion division at The Royal Mint in the U.K.

Read More »

Read More »

Sprott Money News Weekly Wrap-Up 2 22 19

Eric Sprott discusses the volatile week in gold and silver prices and looks ahead to what will continue to be an exciting year for the precious metals.

Read More »

Read More »