Category Archive: 6a) Gold & Monetary Metals

Trump, Gold, & QE4: An Interview with Marc Faber

Welcome to this week’s edition of Follow the Money Weekly Radio! PODCAST: Trump, Gold, & QE4: An Interview with Marc Faber HOST: Jerry Robinson (Economist/Author) SHOW DATE: 1/19/2016 In this week’s broadcast, Jerry Robinson provides his signature commentary on current market sentiment amid the incoming Trump Administration, and is joined by Marc Faber, Editor and …

Read More »

Read More »

Sound Money and Your Personal Finances

Sound money principles can serve to help grow the economy and restrain government. The political class, however, doesn’t particularly want to restrain itself. Washington, D.C. is addicted to the easy money policies that have enabled $20 trillion in national debt accumulation and tens of trillions more in unfunded liabilities.

Read More »

Read More »

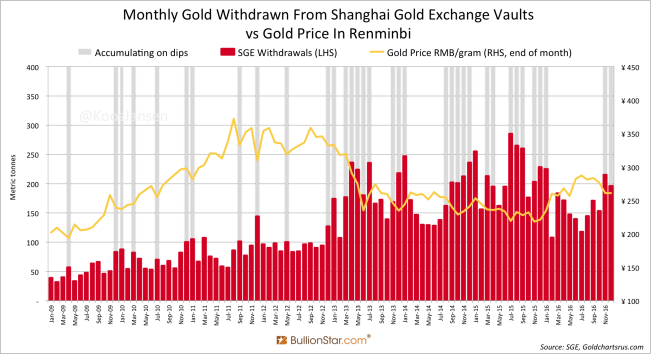

How The West Has Been Selling Gold Into A Black Hole

In December 2016 Chinese wholesale gold demand, measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), accounted for 196 tonnes, down 9 % from November. December was still a strong month for SGE withdrawals due to the fact the gold price trended lower before briefly spiking at the end of the month, and the Chinese prefer to buy gold when the price declines (see exhibit 1).

Read More »

Read More »

David Smith: Turning Points Appear Suddenly, So You Must Be Prepared…

David Smith of The Morgan Report and MoneyMetals.com columnist joins Money Metals Exchange to share his thoughts on the metals market action so far in 2017. He’ll also offer a stern warning for those who try to get cute with the timing of a purchase and lays out the potential harm of putting off what you …

Read More »

Read More »

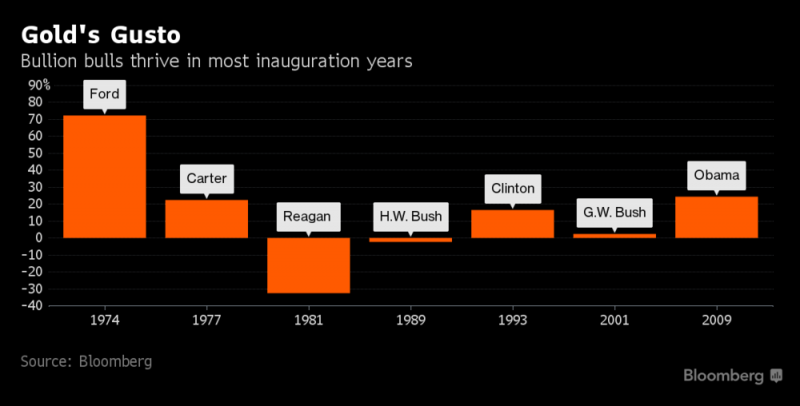

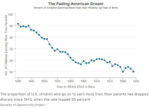

Gold’s average gains in inauguration years of 15 percent since 1974

Gold’s average gains in inauguration years of 15% since 1974. First year of new President frequently a time of increased uncertainties and risks. Gold rose 30% in the 12 months after Obama inauguration. Massive political uncertainty. President’s conflict with the CIA. ‘Strong dollar policy’ to end as U.S. has $120 trillion plus debt. Trump inherits Bush and Obama’s humongous debt.

Read More »

Read More »

Declassified CIA Memos Reveal Probes Into Gold Market Manipulation

The CIA recently released a series of declassified 1970s memos relating to the gold market and the newly created SDR. These memos give new insight how the CIA viewed the gold market, the perceived manipulation of gold and the potential for the SDR to become a gold substitute in the international monetary system.

Read More »

Read More »

Sprott Money News Ask the Expert January 2017 – Keith Neumeyer

Keith Neumeyer, president and CEO of First Majestic Silver, joins us to field questions from Sprott Money customers.

Read More »

Read More »

Pension Funds Need Gold before It’s Too Late

Tens of millions of Americans and their employers pour money into pension plans each month, counting on those funds to grow and to be there when needed at retirement. But a time bomb awaits. The bulk of U.S. pension funds are dangerously underfunded, and the assets are often invested in securities that have bleak prospects for providing income that keeps up with a general decline in purchasing power.

Read More »

Read More »

Keith Neumeyer Damage Inflicted by Precious Metals Manipulation Is in the Multi Billions

Keith Neumeyer, founder and CEO of First Majestic Silver and outspoken voice on the manipulation that’s occurring in the futures market for silver, weighs on the Deutsche Bank market rigging case, gives us his outlook for the metals under a Trump presidency and explains how silver’s gains in the future may end making the recent …

Read More »

Read More »

Florian Homm im Gespräch mit Marc Faber (10.1.2017, english)

? Börsenbrief: https://www.florianhommlongshort.ch/ Marc Faber on the latest economic situation, the Clinton Clan, refugees and Fed policy.

Read More »

Read More »

Frank Holmes Gold Rally Extremely Likely in January and February

Frank Holmes, CEO of U.S. Global Investors and author of the book The Goldwatcher: Demystifying Gold Investing tells us where he thinks gold is headed in the near term, gives us a 2017 outlook for the metals and tells us why he believes the next 100 days will be very key in the financial markets. …

Read More »

Read More »

India’s Monetary & Fiscal Policies Will Be Pro-Growth | Marc Faber

Catch Marc Faber in an exclusive conversation with ET NOW’s Tanvir Gill, as he speaks about his outlook for 2017. Subscribe To ET Now For Latest Updates On Stocks, Business, Trading | ► http://goo.gl/5XreUq Subscribe Now To Our Network Channels :- Times Now : http://goo.gl/U9ibPb The NewsHour Debate : http://goo.gl/LfNgFF To Stay Updated Download the …

Read More »

Read More »