Category Archive: 6a) Gold & Monetary Metals

Gold To Benefit from Rising Inflation and Higher Than “Official” China Gold Demand

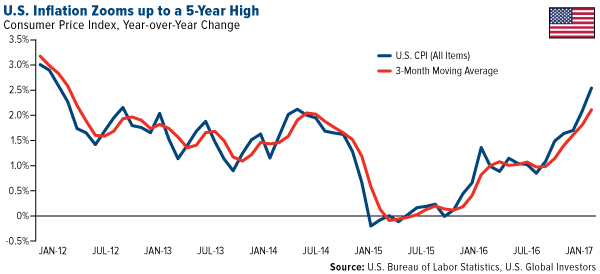

Frank Holmes joins Lawrie Williams, Koos Jansen and many others in questioning the “official” Chinese gold demand numbers. Real gold demand is likely much higher than the official numbers. Inflation just got another jolt, rising as much as 2.5 percent year-over-year in January, the highest such rate since March 2012. Led by higher gasoline, rent and health care costs, consumer prices have now advanced for the sixth straight month.

Read More »

Read More »

Russia Gold Buying Returns – Buys One Million Ounces In January

Russia Gold Buying Returns – Adds Substantial One Million Ounces To Reserves In January. Russia gold buying returned in January with the Russian central bank buying a very large 1 million ounces or 37 metric tonnes of gold bullion. The increase in the gold reserves came after Russia did not buy a single ounce in December – a move seen as potentially a signal or an olive branch to the U.S. and the incoming Trump administration.

Read More »

Read More »

Greenspan Says Gold “Ultimate Insurance Policy” as has “Grave Concerns About Euro”

“The eurozone isn’t working …” warns Greenspan, “I view gold as the primary global currency” said Greenspan, “Significant increases in inflation will ultimately increase the price of gold”, “Investment in gold now is insurance…”

Read More »

Read More »

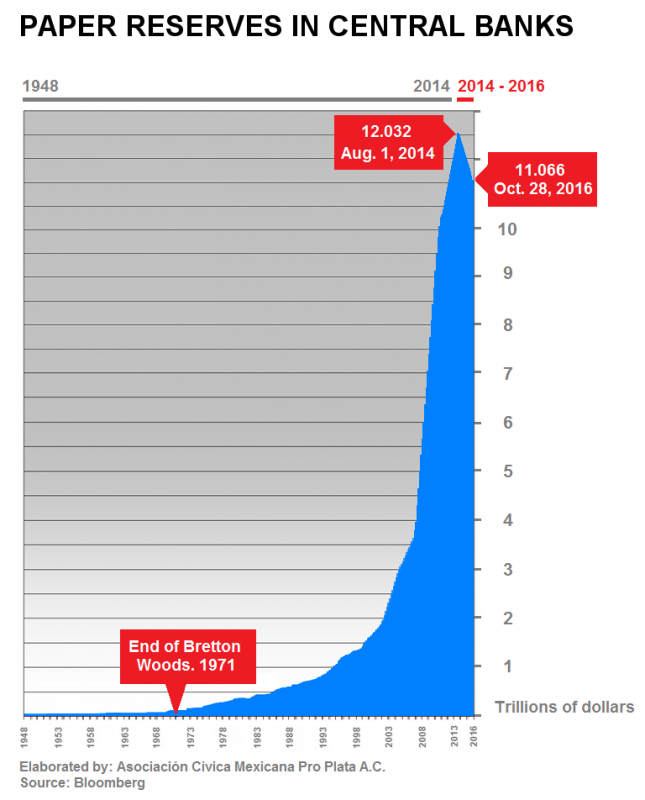

If It Didn’t Abandon The Gold Standard, U.S. Empire Would Have Collapsed…

The U.S. will never go back on a gold standard. The notion that a U.S. Dollar backed by gold would solve our financial problems is pure folly. Why? Because, if the U.S. Empire didn’t abandon the gold standard in 1971, it would have collapsed decades ago. Unfortunately, some of the top experts in the precious metals community continue to suggest that revaluing gold much higher, to say…. $15,000-$50,000 an ounce, would bring confidence back into the...

Read More »

Read More »

Gold Is Undervalued Say Leading Money Managers

Gold is undervalued according to a record number of fund managers. Last time gold was considered undervalued, the price surged. BAML surveyed 175 money managers with $543 billion in assets under management. 34% of investors believe protectionism is the biggest threat to markets. Gold viewed as the best protectionist investment by a third of investors.

Read More »

Read More »

Expect Asian Markets To Outperform US Market: Marc Faber

Marc Faber, Author, Gloom, Boom & Doom Report states that he expects the Asian markets to outperform US market.

Read More »

Read More »

China Net Imported 1,300t Of Gold In 2016

For 2016 international merchandise trade statistics point out China has net imported roughly 1,300 tonnes of gold, down 17 % from 2015. The importance of measuring gold imports into the Chinese domestic gold market – which are prohibited from being exported – is to come to the best understanding on the division of above ground reserves in and outside the Chinese domestic market.

Read More »

Read More »

What is Good for the Dollar is Bad for Gold

The Dollar Index is powering ahead, moving higher for the eighth consecutive session. Over the past 100 sessions, gold and the Dollar Index move in the opposite direction more than 90% of the time. The technical condition of gold is deteriorating.

Read More »

Read More »

Marc Faber on Emerging Economies outperformance

Emerging Markets will out perform the US stocks over the next 10 years. Other topics include Donald Trump, India, China economy and MORE….

Read More »

Read More »

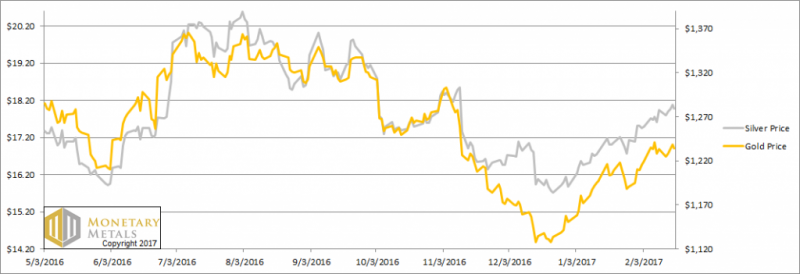

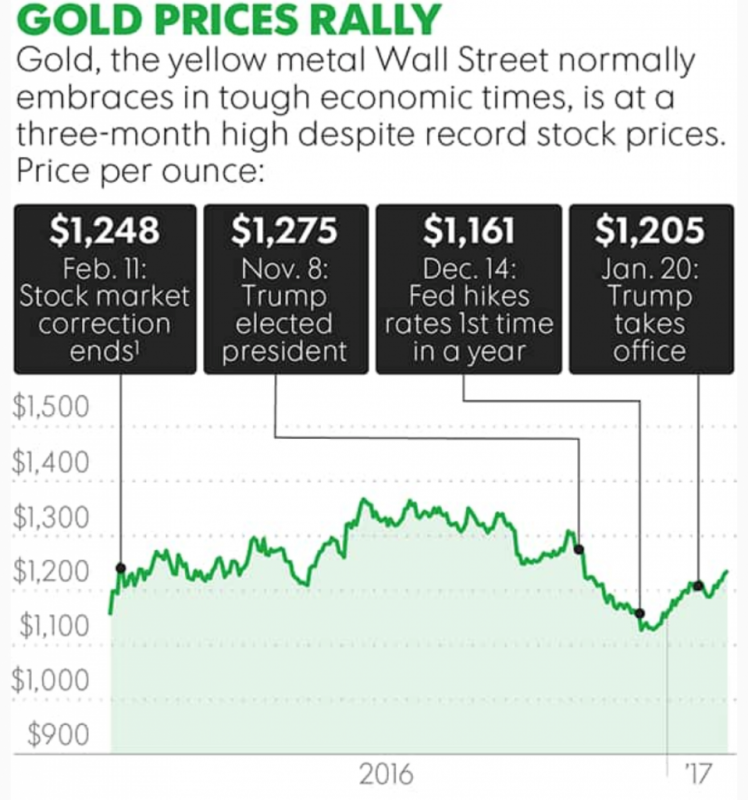

Gold Prices Up 6 percent YTD As Trump ‘Honeymoon’ Ends

Gold prices continued to shine this week reaching $1,244.70 per ounce and and has posted gains in five of the last six weeks. This week it reached a new three-month high – it’s highest since the Trump win and has climbed over 6% this year, beating the gains made in the same period in 2016.

Read More »

Read More »

RTD Ep:60 “Q.E. Four Is Almost Guaranteed” – Dr. Marc Faber (GloomBoomDoom)

Subscribe and share the RTD interviews and news articles… Thanks for watching this interview with Dr. Marc Faber, economist, author, & investor at Gloomboomdoom.com. Share your thoughts below and give us a thumbs up if you enjoyed this conversation. Get more great educational interviews at RTD UNIVERSITY. The best monetary and financial education not available …

Read More »

Read More »

Sprott Money and Questrade Webinar – Jan 2017

This presentation describes the benefits of having a self-directed investment account for RRSP and other Canadian products as well as the process of setting it up.

Read More »

Read More »

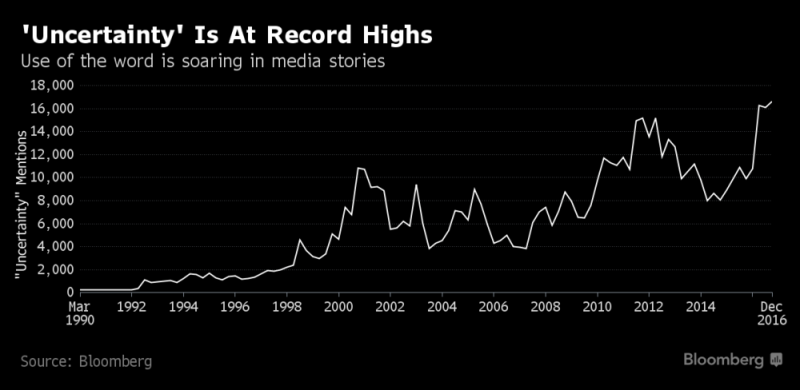

Gold Prices Rising As “World Has Never Been More Uncertain”

Gold prices rising & up 6.6% YTD. Signal “impending market volatility”. World has never been more uncertain (see chart). Fear in Wall Street versus Fear in Washington. Price of ‘plunge protection’ rising even as VIX remains low. Smart money diversifying into gold. Important to watch rising gold and rising bond yields. Gold may prove the “tell”.

Read More »

Read More »

Börsenguru Marc Faber: Aktien, Rohstoffe, Immobilien – so investieren!

Der Schweizer Börsenexperte Marc Faber hätte zwar Donald Trump gewählt, ein Fan sei er aber nicht. Für Investments in den USA ist er skeptisch. Europäische Finanztitel und Immobilien findet Faber hingegen interessant, sagt er im Gespräch mit Inside Wirtschaft-Chefredakteur Manuel Koch. Im ausführlichen Interview verrät Marc Faber, wie Anleger sich jetzt verhalten sollten.

Read More »

Read More »

When Government Acts, “Unintended Consequences” Follow

In 1850, French economist Frédéric Bastiat published an essay that is misunderstood, or more often, unread, titled, “That Which is Seen, and That Which is Not Seen.” Bastiat brilliantly introduced the idea of opportunity cost and, through the parable of the broken window, illustrated the destructive effects of unintended consequences.

Read More »

Read More »

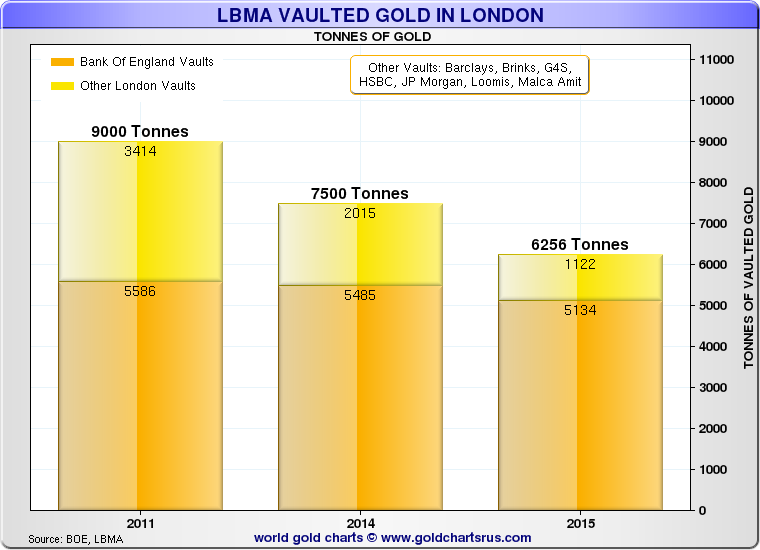

Gold Bullion Banks To “Open Vaults” In Transparency Push

London Gold Bullion Banks To “Open Vaults” In Transparency Push. London’s gold bullion market, which is centuries old, is said to be seeking transparency with plans to reveal how much gold bullion is held in vaults in and around London city according to gold bullion banks.

Read More »

Read More »

Dr. Marc Faber Sees Fiscal Stimulus Necessitating Monetary Stimulus To Keep Interest Rates Repressed

FRA is joined by Marc Faber to discuss his outlook on 2017, particularly the effects of current events in the US, India, and China. Click here for the full summary: http://financialrepressionauthority.com/2017/02/05/the-roundtable-insight-dr-marc-faber-sees-fiscal-stimulus-necessitating-monetary-stimulus-to-keep-interest-rates-low/

Read More »

Read More »