Category Archive: 6a) Gold & Monetary Metals

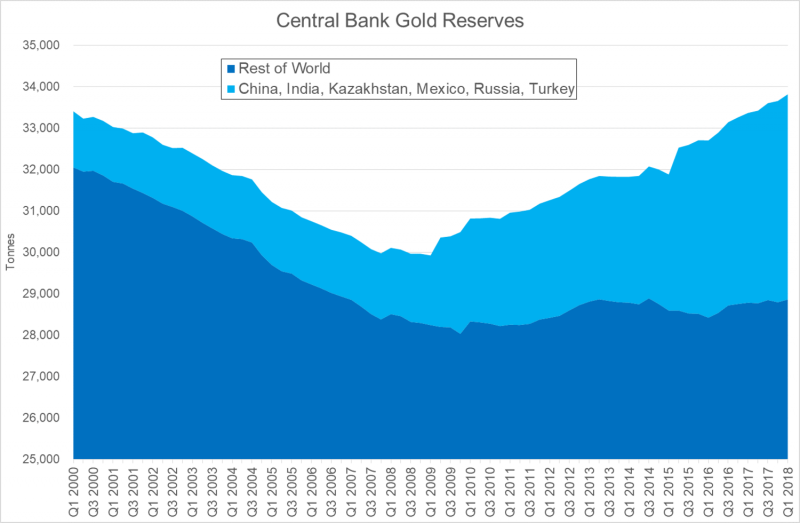

Central Banks Positivity Towards Gold Will Provide Long Term “Support To Gold Prices”

– There has been a recent change for the better in central bank attitudes to gold. – There has been “net gold demand by central banks – approx. 500 tonnes per year – as a source of return, liquidity and diversification”. – Policy shift to maintaining stable gold holdings reflects central bank concerns about financial markets and geopolitics. – Little in the current global economic and political environment to support any reason to change in this...

Read More »

Read More »

Seasonality in Cryptocurrencies – An Interesting Pattern in Bitcoin

The last time we discussed Bitcoin was in May 2017 when we pointed out that Bitcoin too suffers from seasonal weakness in the summer. We have shown that a seasonal pattern in Bitcoin can be easily identified. More than a year has passed since then and readers may wonder why we have not addressed the topic again.

Read More »

Read More »

Bron Suchecki Q&A

The Pick sits down with precious metals analyst Bron Suchecki before the Precious Metals Investment Symposium on the 3rd and 4th of October. The Pick is Australasia’s premier resource sector new platform. It is backed by some of the regions most connected journalists, content creators and digital specialist. It is more than a news site … Continue...

Read More »

Read More »

Silver Guru – David Morgan – Silver and Gold Will Surge in the Coming Currency Collapse

Silver Guru – David Morgan, joins Mark O’Byrne for Episode 8 of the Goldnomics Podcast. Talking about silver and gold and how they will perform as the current fiat monetary system collapses under the pressure of money printing, quantitative easing, trade wars and geopolitical tensions. Listen to the full episode or skip directly to one …

Read More »

Read More »

MARC FABER – Cryptos Give Warning Signals

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / ETHERIUM / CRYPTOCURRENCY / LITECOIN /FINANCIAL CRASH / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2018

Read More »

Read More »

Sprott Money news Weekly Wrap-Up 9.21.18

Eric Sprott discusses the week that was in precious metals and looks ahead to next week’s FOMC meeting.

Read More »

Read More »

Trump’s Backdoor Power Play to Rein In the Fed

“Just run the presses – print money.” That’s what President Donald Trump supposedly instructed his former chief economic adviser Gary Cohn to do in response to the budget deficit. The quote appears in Bob Woodward’s controversial book Fear: Trump in the White House.

Read More »

Read More »

Sprott Money News Ask the Expert September 2018 – Ned Naylor-Leyland

Precious metal fund manager Ned Naylor-Leyland joins us to discuss the current status of gold, silver and the mining shares.

Read More »

Read More »

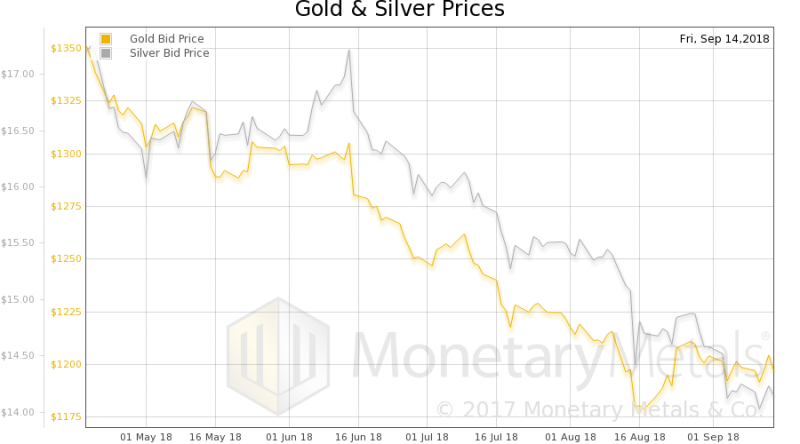

Silver Is ‘Undervalued’ Relative to Stocks, Bonds, Gold – GoldCore

– Silver is ‘undervalued’ relative to stocks, bonds and gold: GoldCore. – Silver at $14/oz is cheap relative to gold with gold-silver ratio over 85. – Silver drops to 32-month lows prompting sellout of Silver Eagle coins at U.S. Mint. – U.S. Mint said “recent increased demand” prompted a “temporary sell out” of its American Silver Eagle bullion coins as investors see silver coins as a bargain.

Read More »

Read More »

Silver Guru – David Morgan – This Is When Fiat Currencies Will Collapse.

Today we are bringing you an excerpt from the upcoming episode 8 of the Goldnomics Podcast where I talk with our special guest Silver Guru, David Morgan. – “Every fiat currency in history has failed and this one is failing” warns ‘Silver Guru’ David Morgan – “I do not think we can go another 5 …

Read More »

Read More »

Marc Faber – Central Banks Could End Up Owning Every Asset In a Country

SBTV’s latest guest is Dr Marc Faber, editor of the Gloom, Boom & Doom Report. We discuss the signs showing that the US is an empire in decline and how the next financial crisis will impact asset owners. Despite the video difficulties in this episode, Dr. Faber doesn’t disappoint and delivers a great interview on …

Read More »

Read More »

La curiosa teoría económica de Marc Faber

La curiosa teoría económica de Marc Faber. El tipo se llama Marc Faber. Es analista de inversiones, propietario de la empresa de consultoria y gestión Marc Faber Limited y editor de GloomBoomDoom. En junio de 2017, cuando Donald Tramp estudiaba lanzar un proyecto de ayuda a la economía americana, Marc Faber escribía en su blog …

Read More »

Read More »

Sprott Money News Weekly Wrap-Up 9 14 18

Eric Sprott discusses the latest data on the U.S. economy, the trend in the U.S. dollar and a possible floor for precious metal prices.

Read More »

Read More »

BREXIT To Contribute To London Property Bubble Bursting

Mark O’Byrne, Research Director of GoldCore.com considers the growing and unappreciated risks from Brexit to the London property market – Brexit in conjunction with severe price unaffordability, rising interest rates and global economic uncertainty is leading to sharp price falls in London home prices – London home prices have fallen five months in a row …

Read More »

Read More »