Category Archive: 5.) The United States

Who Will Live in the Suburbs if Millennials Favor Cities?

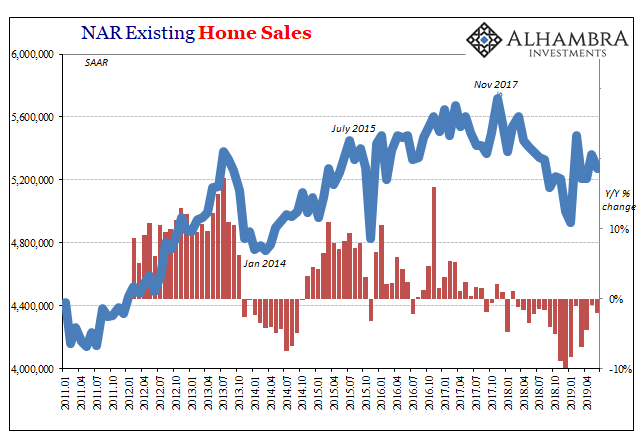

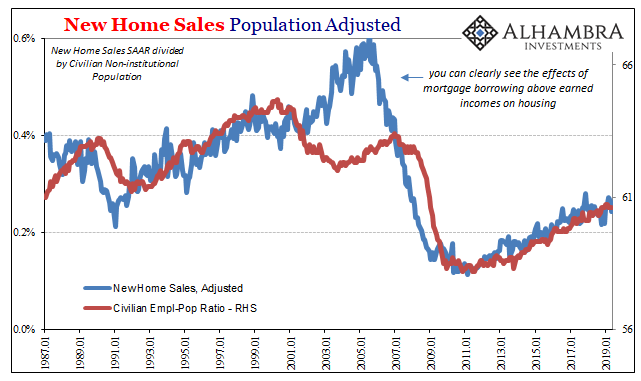

Who's going to pay bubble-valuation prices for the millions of suburban homes Baby Boomers will be off-loading in the coming decade as they retire/ downsize?Longtime readers know I follow the work of urbanist Richard Florida, whose recent book was the topic of Are Cities the Incubators of Decentralized Solutions?(March 14, 2017).

Read More »

Read More »

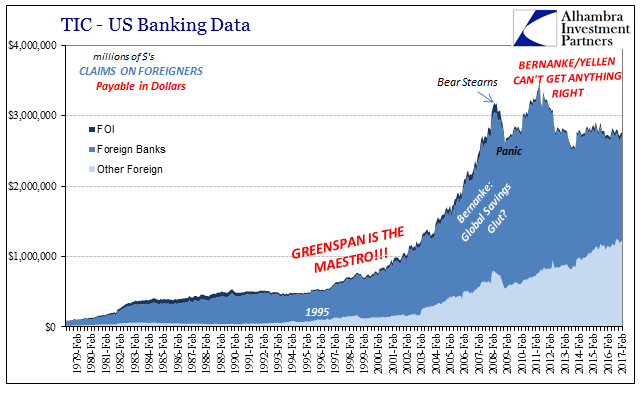

To The Asian ‘Dollar’, And Then What?

The Bretton Woods system was intentionally set up to funnel monetary convertibility through official channels. The primary characteristic of any true gold standard is that any person who wishes can change paper claims into hard money. It was as much true in any one country as between those bound by the same legal framework (property).

Read More »

Read More »

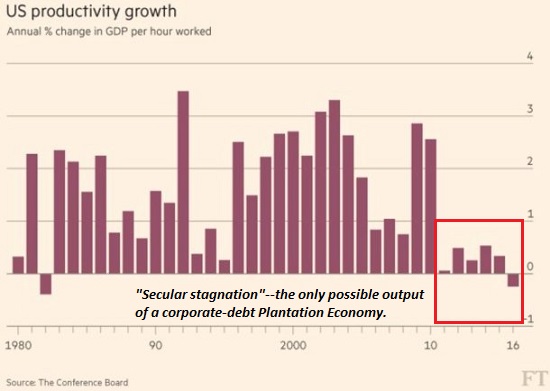

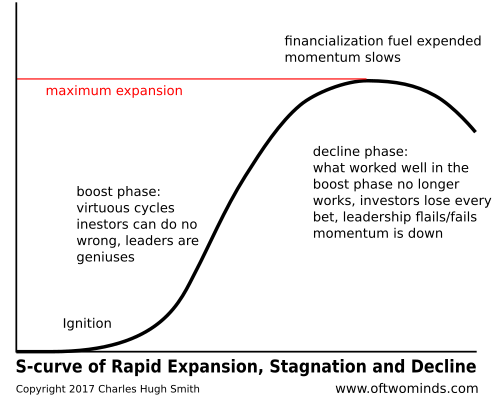

Our State-Corporate Plantation Economy

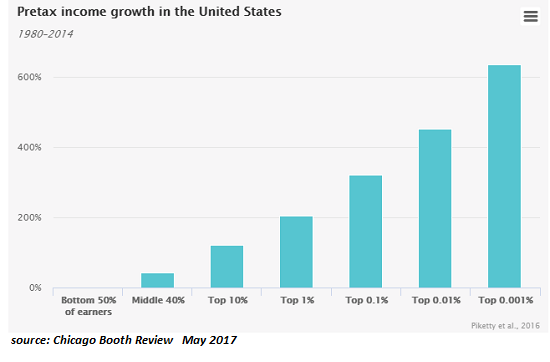

I have often discussed the manner in which the U.S. economy is a Plantation Economy, meaning it has a built-in financial hierarchy with corporations at the top dominating a vast populace of debt-serfs/ wage slaves with little functional freedom to escape the system's neofeudal bonds.

Read More »

Read More »

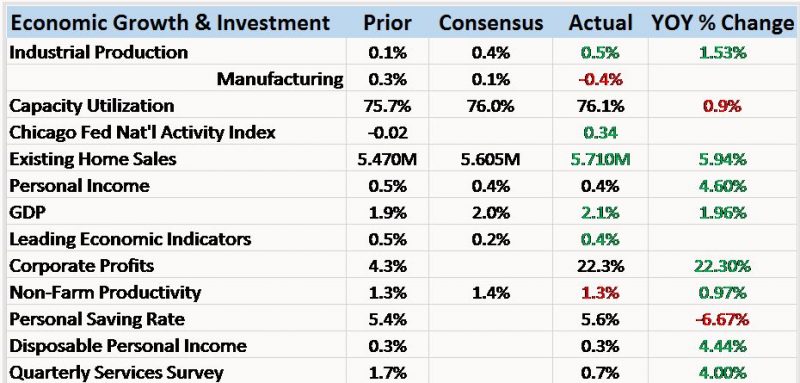

Bi-Weekly Economic Review

It wasn’t a very good two weeks for economic data with the majority of reports disappointing. Most notable I think is that the so called “soft data” is starting to reflect reality rather than some fantasy land where President Trump enacts his entire agenda in the first 100 days of being in office. Politics is about the art of the possible and that is proving a short list for now.

Read More »

Read More »

Money In America

In 1830, France was once more swept up in revolution, only this time at the end of it was installed one king to replace another. Louis-Phillipe became, in fact, France’s last king as a result of that July Revolution. The country was trying to make sense of its imperial past with the growing democratic sentiments of the 19th century.

Read More »

Read More »

Marx, Orwell and State-Cartel Socialism

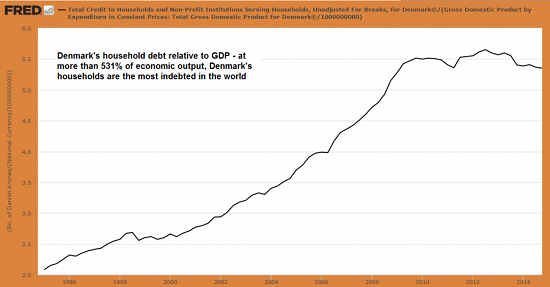

When "socialist" states have to impose finance-capital extremes that even exceed the financialization of nominally capitalist economies, it gives the lie to their claims of "socialism." OK, so our collective eyes start glazing over when we see Marx and Orwell in the subject line, but refill your beverage and stay with me on this.

Read More »

Read More »

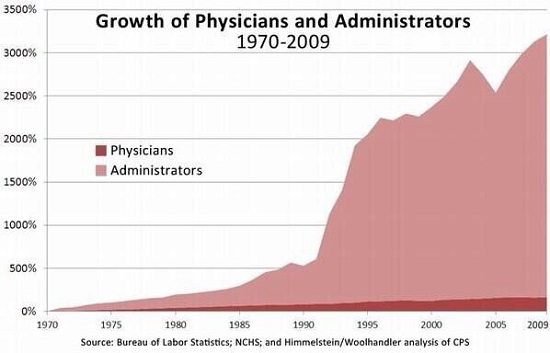

Our Intellectual Bankruptcy: The “Religion” of Economics, UBI and Medicare For All

1. Mainstream neo-classical/ Keynesian economics. As economist Manfred Max-Neef notes in this interview, neo-classical/ Keynesian economics is no longer a discipline or a science--it is a religion. It demands a peculiar faith in nonsense: for example, the environment--Nature-- is merely a subset of the economy.

Read More »

Read More »

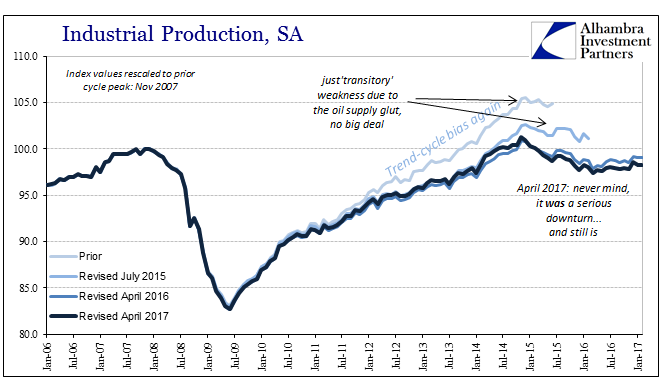

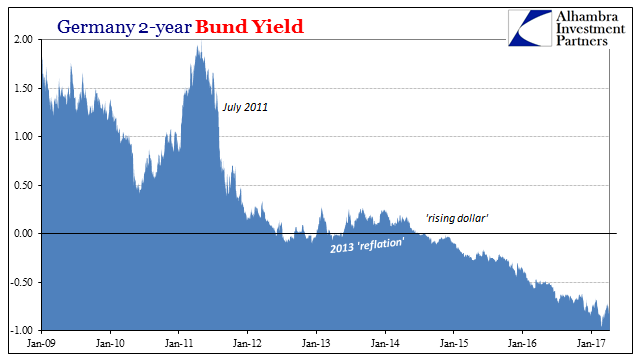

New Patterns of Disturbance

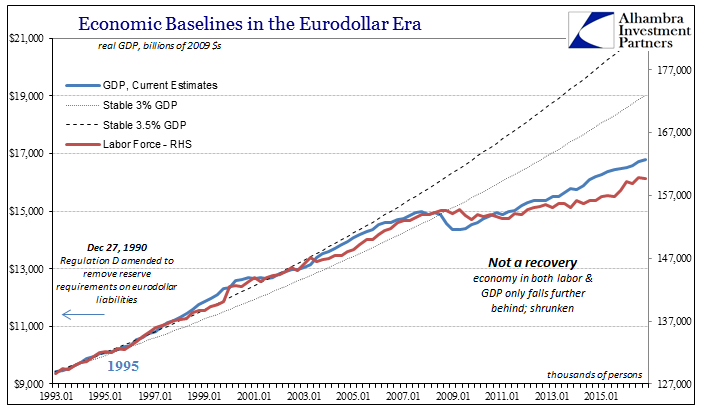

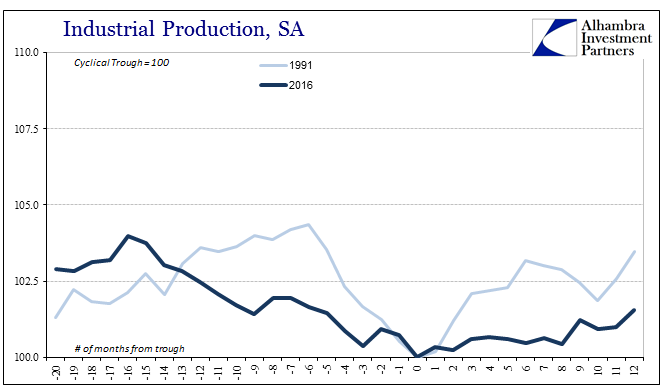

Having finally established that the economy of the “rising dollar” was appreciably worse than first estimated, we can turn our attention back toward figuring out what that means for the near future and beyond. According to the latest estimates for Industrial Production, growth has returned but in the same weird asymmetric sort of way that is actually common for the past decade. Year-over-year IP expanded by 1.5% in March 2017, the highest growth...

Read More »

Read More »

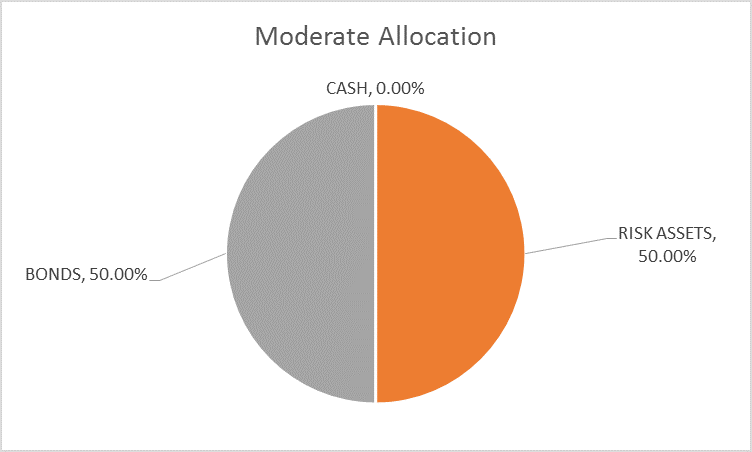

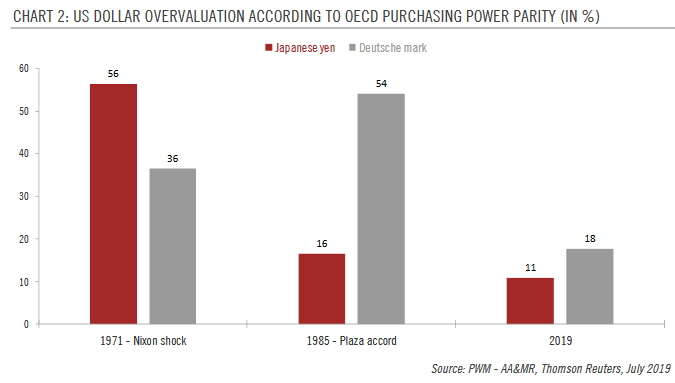

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50.

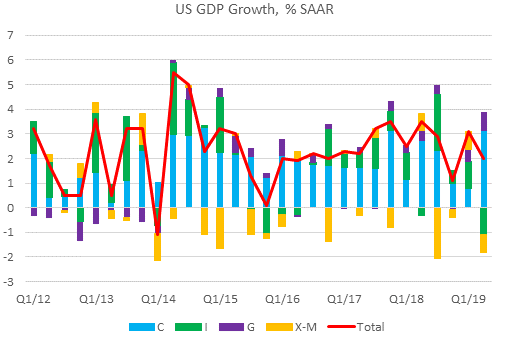

The performance of markets in the first quarter of the year was a bit schizophrenic. Stocks performed well which one might interpret as a reflection of improving economic growth prospects. Certainly President Trump and his proxies were quick to take credit but unfortunately for the new...

Read More »

Read More »

Now You Tell Us

As we move further into 2017, economic statistics will be subject to their annual benchmark revisions. High frequency data such as any accounts published on or about a single month is estimated using incomplete data. It’s just the nature of the process. Over time, more comprehensive survey results as well as upgrades to statistical processes make it necessary for these kinds of revisions.

Read More »

Read More »

The Left’s Descent to Fascism

The Left is morally and fiscally bankrupt, devoid of coherent solutions, and corrupted by its embrace of the Corporatocracy. History often surprises us with unexpected ironies. For the past century, the slide to fascism could be found on the Right (conservative, populist, nationalist political parties).

Read More »

Read More »

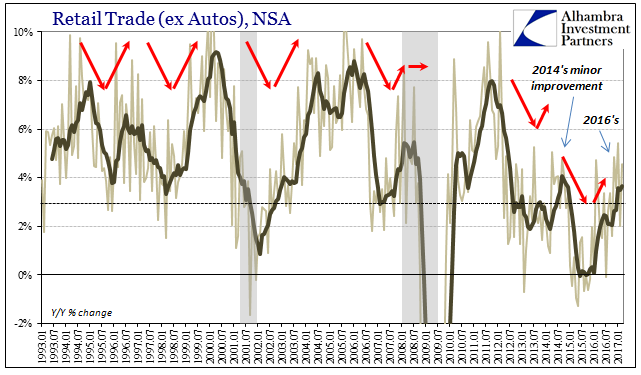

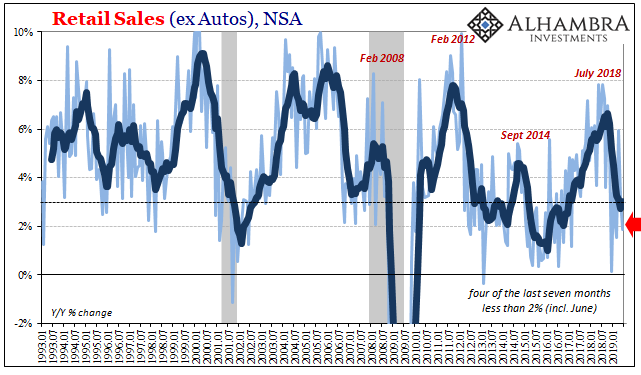

The Expanded Retail Sales Gap

Retail sales growth in February 2017 was going to be low by virtue of its comparison to February 2016 and the extra day in that month. The Census Bureau’s autoregressive models are supposed to normalize just these kinds of calendar irregularities so that we can make something close to apples to apples comparisons. The seasonally-adjusted estimate for February, however, was calculated to be less than the one for January 2017, therefore suggesting...

Read More »

Read More »

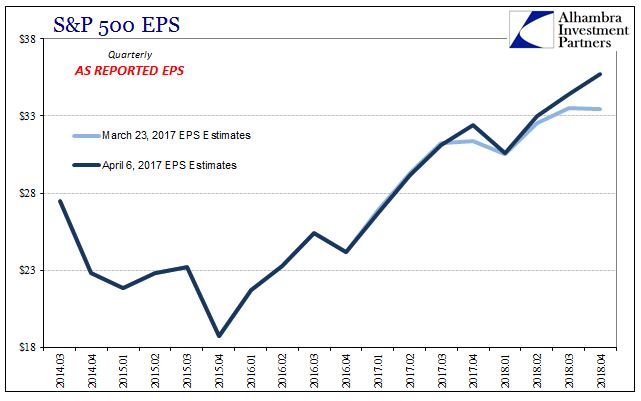

Earnings per Share: Is It Other Than Madness?

As earnings season begins for Q1 2017 reports, there isn’t much change in analysts’ estimates for S&P 500 companies for that quarter. The latest figures from S&P shows expected earnings (as reported) of $26.70 in Q1, as compared to $26.87 two weeks ago. That is down only $1 from October, which is actually pretty steady particularly when compared to Q4 2016 estimates that over the same time plummeted from $29.04 to $24.16. At $26.70, that would...

Read More »

Read More »

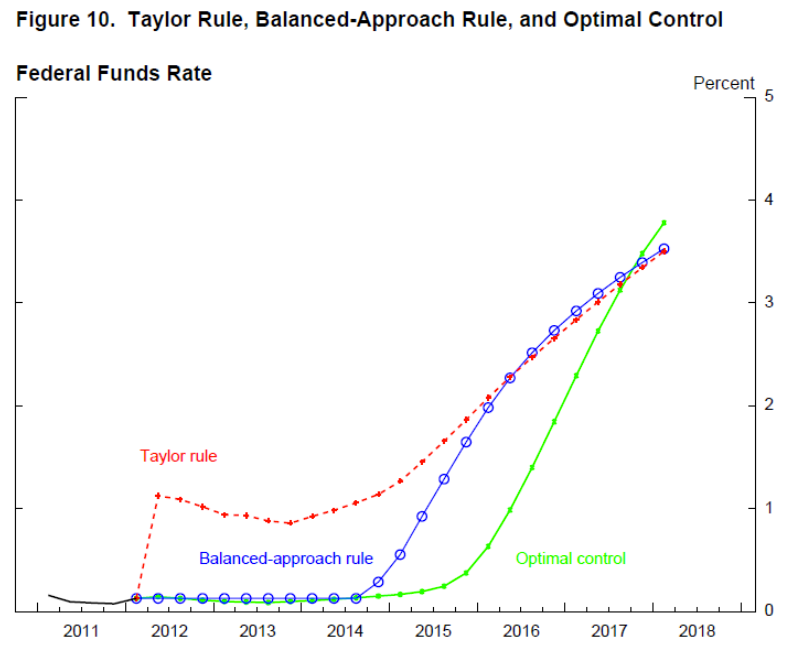

Optimal Lunacy

In June 2012, Janet Yellen, then the Vice Chairman of the Federal Reserve, addressed an audience in Boston with what for the time seemed like a radical departure. It was the latest in a string of them, for conditions throughout the “recovery” period never did quite seem to hit the recovery stride. Because of that, there was constant stream of trial balloons suggesting how the Federal Reserve might try to overcome this economic inertia.

At that...

Read More »

Read More »

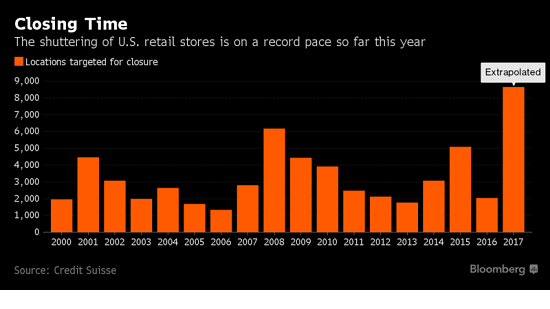

Millennials Are Abandoning the Postwar Engines of Growth: Suburbs and Autos

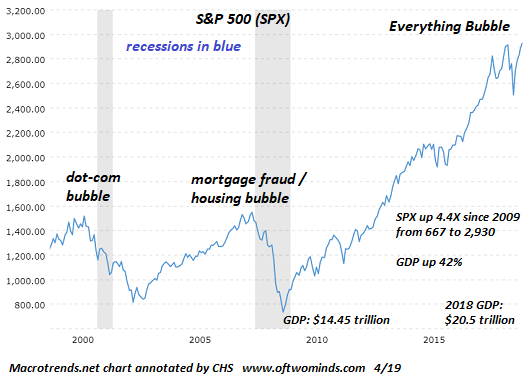

Where's the growth going to come from as the dominant generation makes less, borrows less, spends less, saves more and turns away from long commutes, malls and suburban living and abandons the worship of private vehicles?

Read More »

Read More »

Who’s Playing The Long Game–and What’s Their Game Plan?

When we speak of The Long Game, we speak of national/alliance policies that continue on regardless of what political party or individual is in office. The Long Game is always about the basics of national survival: control of and access to resources, and jockeying to diminish the power and influence of potential adversaries while strengthening one's own power and influence.

Read More »

Read More »

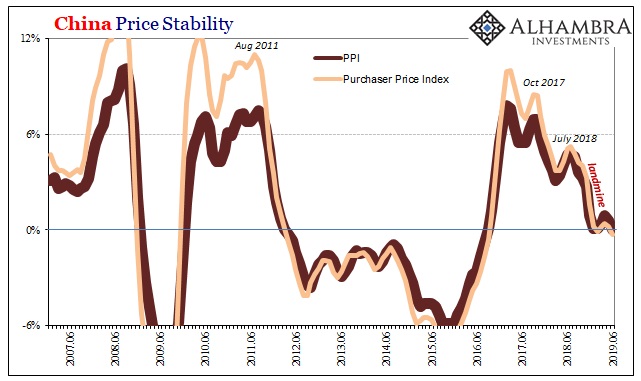

The Global Burden

Bundesrepublik Deutscheland Finanzagentur GmbH (German Finance Agency) was created on September 19, 2000, in order to manage the German government’s short run liquidity needs. GFA took over the task after three separate agencies (Federal Ministry of Finance, Federal Securities Administration, and Deutsche Bundesbank) had previously shared responsibility for it.

Read More »

Read More »

Bi-Weekly Economic Review

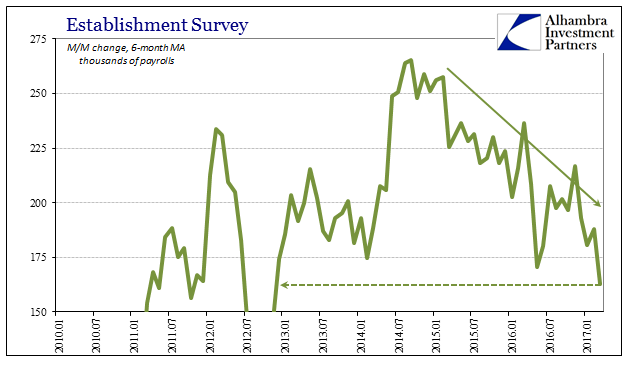

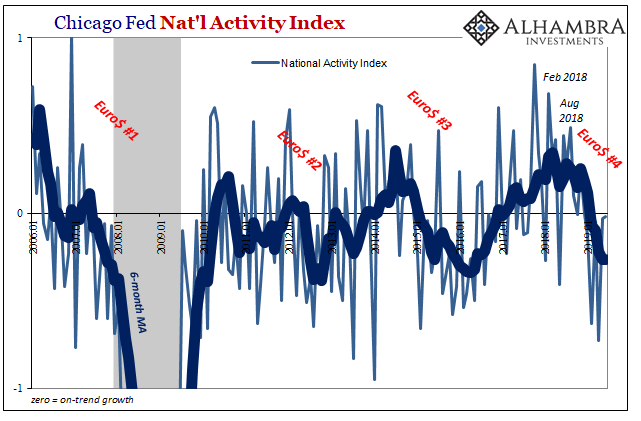

It is hard not to notice that the chart above has a lot less red in it than it has in some time. That is true of the month to month data as well as the year over year changes. There has been a widely reported gap between so called soft data – surveys and polls – and the hard data – actual economic activity reports. Bulls say the gap is there because the soft data always leads the hard data.

Read More »

Read More »

It Was And Still Is The Wrong Horse To Bet

The payroll report disappointed again, though it was deficient in ways other than are commonly described. The monthly change is never a solid indication, good or bad, as the BLS’ statistical processes can only get it down to a 90% confidence interval, and a wide one at that. It means that any particular month by itself specifies very little, except under certain circumstances.

Read More »

Read More »

US Jobs: Who Carries The Burden of Proof?

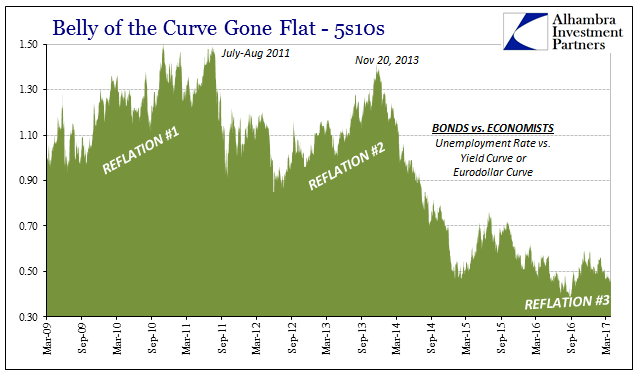

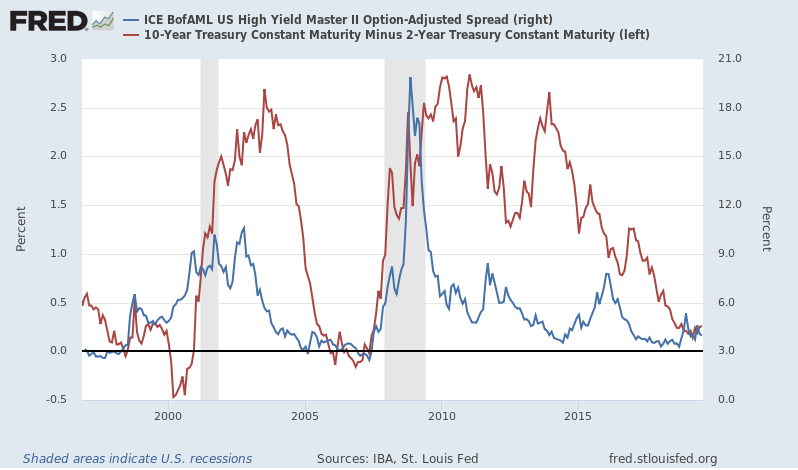

The idea that interest rates have nowhere to go but up is very much like saying the bond market has it all wrong. That is one reason why the rhetoric has been ratcheted that much higher of late, particularly since the Fed “raised rates” for a third time in March. Such “hawkishness” by convention should not go so unnoticed, and yet yields and curves are once more paying little attention to Janet Yellen.

Read More »

Read More »