Category Archive: 5.) The United States

America Needs a New National Strategy

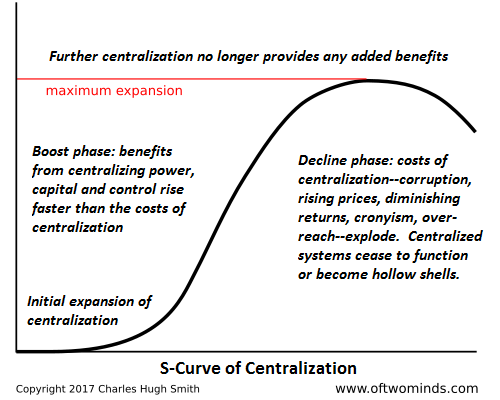

A productive national Strategy would systemically decentralize power and capital rather than concentrate both in the hands of a self-serving elite. If you ask America's well-paid punditry to define America's National Strategy, you'll most likely get the UNESCO version: America's national strategy is to support a Liberal Global Order (LGO) of global cooperation on the environment, trade, etc. and the encouragement of democracy, a liberal order that...

Read More »

Read More »

Monthly Macro Monitor – November 2018

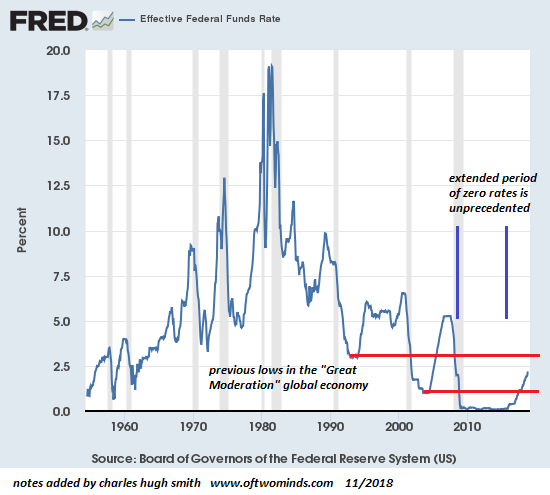

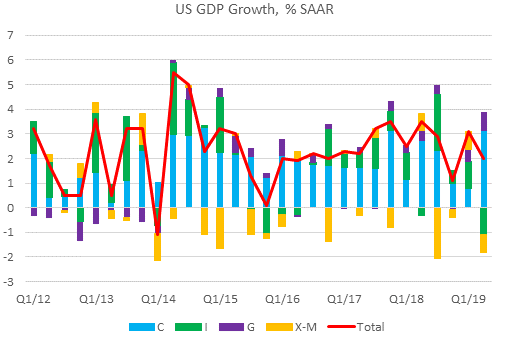

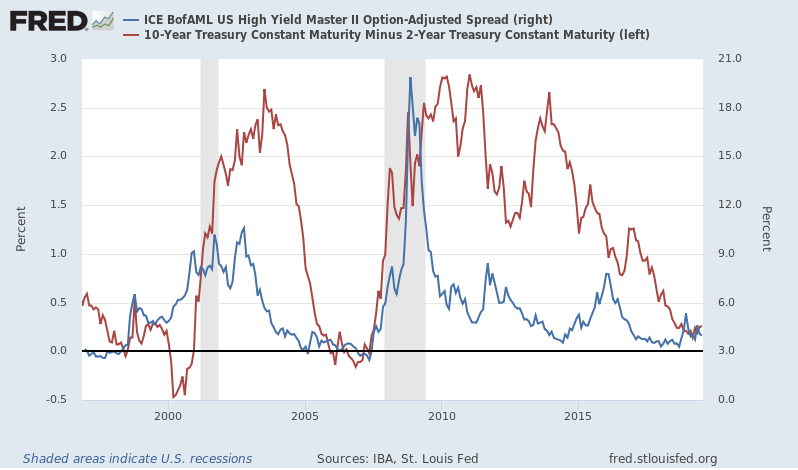

Is the Fed’s monetary tightening about over? Maybe, maybe not but there does seem to be some disagreement between Jerome Powell and his Vice Chair, Richard Clarida. Powell said just a little over a month ago that the Fed Funds rate was still “a long way from neutral” and that the Fed may ultimately need to go past neutral.

Read More »

Read More »

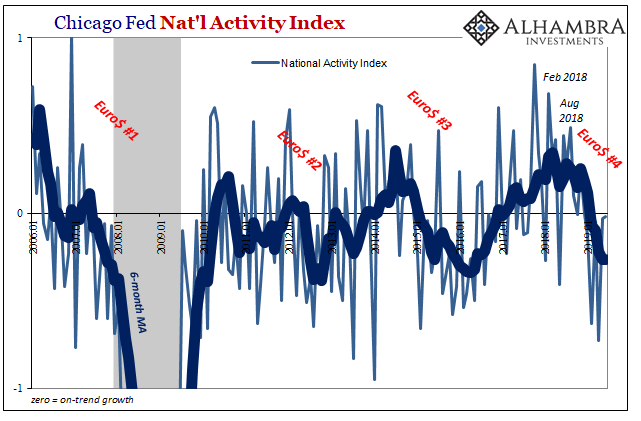

The Direction Is (Globally) Clear

It is definitely one period that they got wrong. Still, IHS Markit’s Composite PMI for the US economy has been one of the better forward-looking indicators around. Tying to real GDP, this blend of manufacturing and services sentiment has predicted the general economic trend in the United States pretty closely. The latter half of 2015 was the big exception.

Read More »

Read More »

Does the Market Need a Heimlich Maneuver?

For all we know, the panic selling is Wall Street's way of forcing the Fed's hand: stop with the rates increases already or Mr. Market expires. Markets everywhere are gagging on something: they're sagging, crashing, imploding, blowing up, dropping and generally exhibiting signs of distress.

Read More »

Read More »

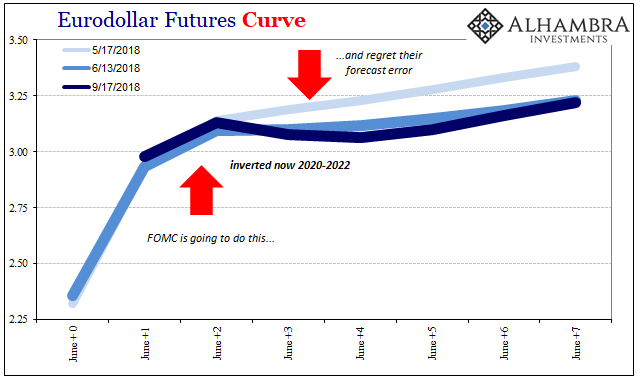

Eurodollar Futures: Powell May Figure It Out Sooner, He Won’t Have Any Other Choice

For Janet Yellen, during her somewhat brief single term she never made the same kind of effort as Ben Bernanke had. Her immediate predecessor, Bernanke, wanted to make the Federal Reserve into what he saw as the 21st century central bank icon. Monetary policy wouldn’t operate on the basis of secrecy and ambiguity. Transparency became far more than a buzzword.

Read More »

Read More »

Does Any of This Make Sense?

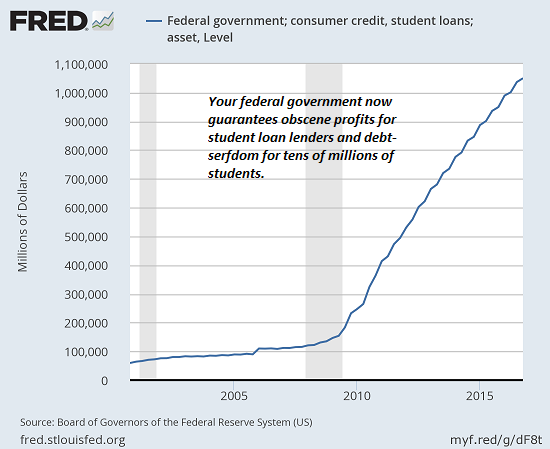

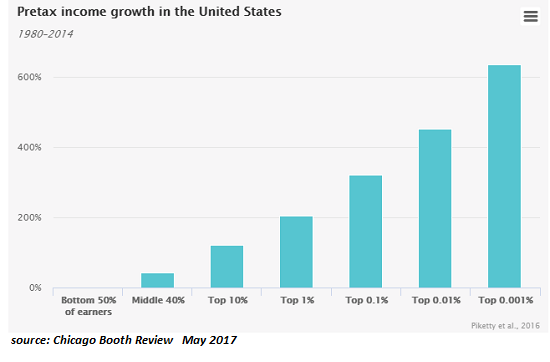

Does any of this make sense? No. But it's so darn profitable to the oligarchy, it's difficult to escape debt-serfdom and tax-donkey servitude. We rarely ask "does this make any sense?" of things that are widely accepted as beneficial-- or if not beneficial, "the way it is," i.e. it can't be changed by non-elite (i.e. the bottom 99.5%) efforts.

Read More »

Read More »

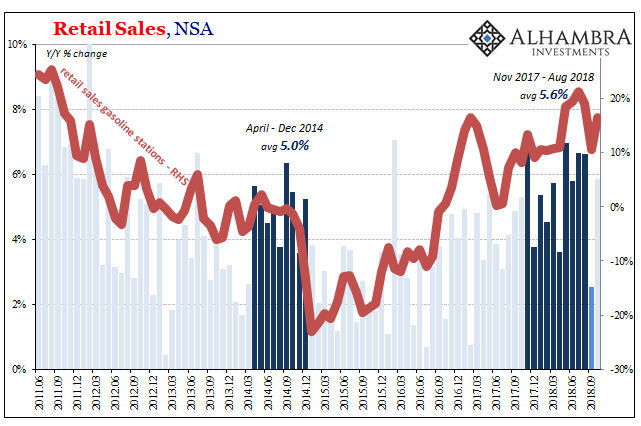

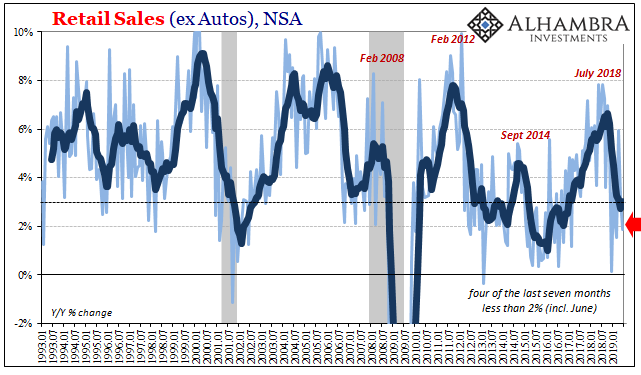

Retail Sales Marked By Revisions

Retail sales rebounded 0.8% in October 2018 from September 2018, but it’s the downward revisions to the prior months that are cause for attention. The estimates for particularly September were moved sharply lower. Total retail sales two months ago had been figured last month at $485.8 billion (unadjusted) originally, but are now believed to have been just $483.0 billion.

Read More »

Read More »

The Implicit Desperation of China’s “Social Credit” System

Other governments are keenly interested in following China's lead. I've been pondering the excellent 1964 history of the Southern Song Dynasty's capital of Hangzhou, Daily Life in China on the Eve of the Mongol Invasion, 1250-1276 by Jacques Gernet, in light of the Chinese government's unprecedented "Social Credit Score" system, which I addressed in Kafka's Nightmare Emerges: China's "Social Credit Score".

Read More »

Read More »

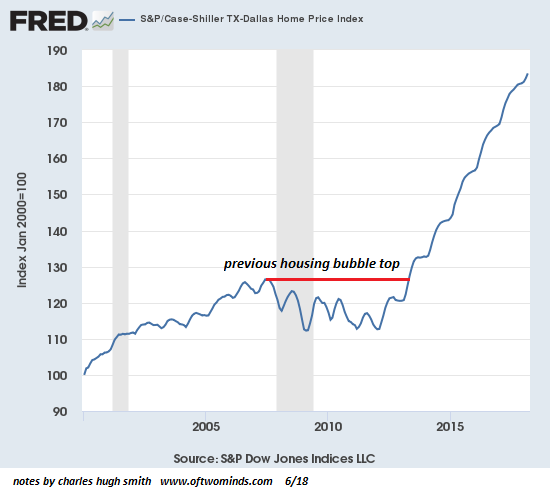

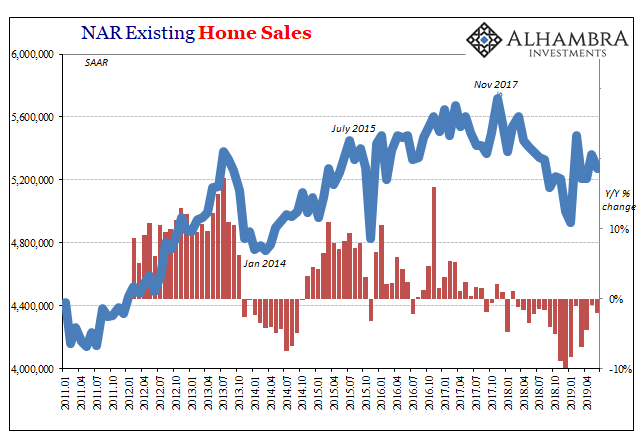

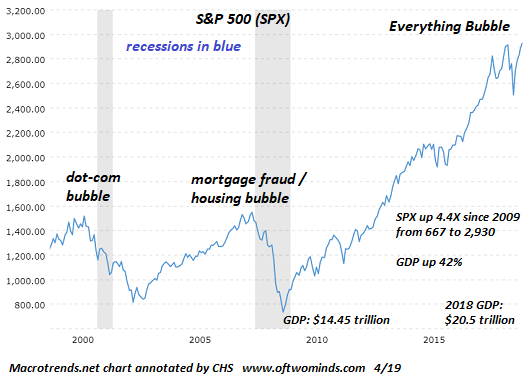

Understanding the Global Recession of 2019

Isn't it obvious that repeating the policies of 2009 won't be enough to save the system from a long-delayed reset? 2019 is shaping up to be the year in which all the policies that worked in the past will no longer work. As we all know, the Global Financial Meltdown / recession of 2008-09 was halted by the coordinated policies of the major central banks, which lowered interest rates to near-zero, bought trillions of dollars of bonds and iffy assets...

Read More »

Read More »

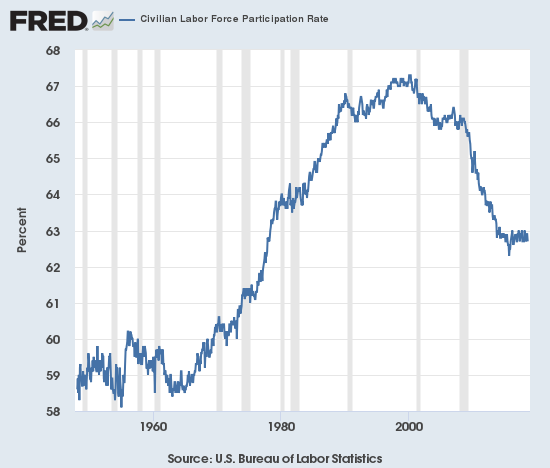

Why Are so Few Americans Able to Get Ahead?

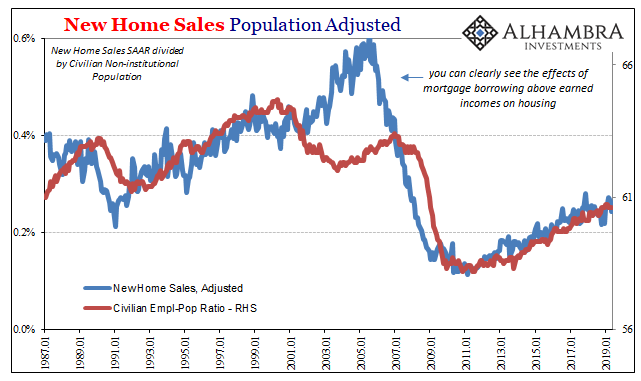

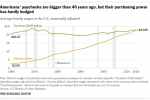

Our entire economy is characterized by cartel rentier skims, central-bank goosed asset bubbles and stagnating earned income for the bottom 90%. Despite the rah-rah about the "ownership society" and the best economy ever, the sobering reality is very few Americans are able to get ahead, i.e. build real financial security via meaningful, secure assets which can be passed on to their children.

Read More »

Read More »

Is This “The Most Important Election of our Lives” or Just Another Distraction?

The problem isn't polarization; the problem is neither flavor of the status quo is actually solving any of the nation's most pressing system problems. As I write this at 5 pm (Left Coast) November 6, the election results are unknown. While various media are trumpeting this as "the most important election of our lives," the less eyeball-catching, emotion-triggering reality is this election is nothing but another distraction.

Read More »

Read More »

Turn Off, Tune Out, Drop Out

An unknown but likely staggeringly large percentage of small business owners in the U.S. are an inch away from calling it quits and closing shop. Timothy Leary famously coined the definitive 60s counterculture phrase, "Turn on, tune in, drop out" in 1966. (According to Wikipedia, In a 1988 interview with Neil Strauss, Leary said the slogan was "given to him" by Marshall McLuhan during a lunch in New York City.)

Read More »

Read More »

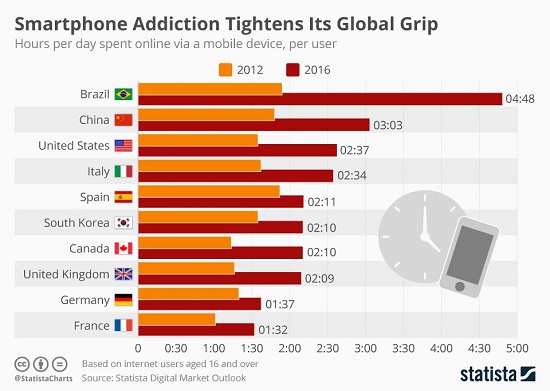

What’s Behind the Erosion of Civil Society?

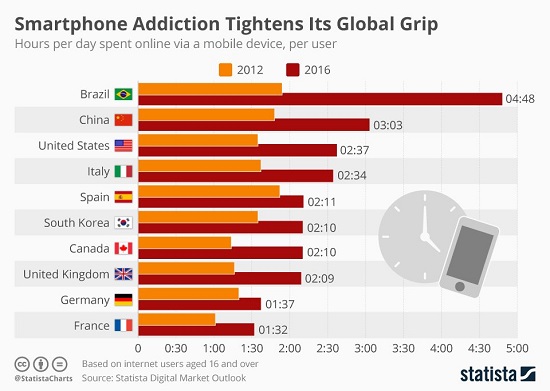

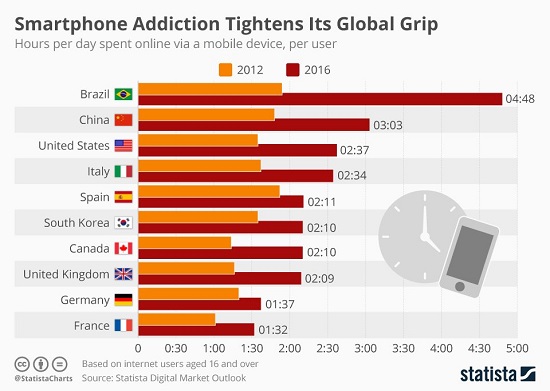

Rebuilding social capital and social connectedness is not something that can be done by governments or corporations. As the mid-term elections are widely viewed as a referendum of sorts, let's set aside politics and ask, what's behind the erosion of our civil society? That civil society in the U.S. and elsewhere is fraying is self-evident.

Read More »

Read More »

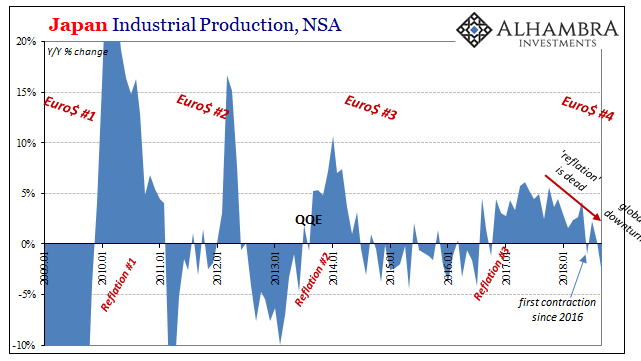

China Now Japan; China and Japan

Trade war stuff didn’t really hit the tape until several months into 2018. There were some noises about it back in January, but there was also a prominent liquidation in global markets in the same month. If the world’s economy hit a wall in that particular month, which is the more likely candidate for blame? We see it register in so many places. Canada, Europe, Brazil, etc.

Read More »

Read More »

Bloomberg Interview with Jeffrey Snider

Why Eurodollars Might Be Key to the Market Sell-Off (Podcast). There’s a huge market out there that doesn’t get much attention: Eurodollars. These have nothing to do with the euro-dollar exchange rate. Instead, eurodollars are U.S. dollar-denominated deposits at foreign banks and overseas branches of American banks.

Read More »

Read More »

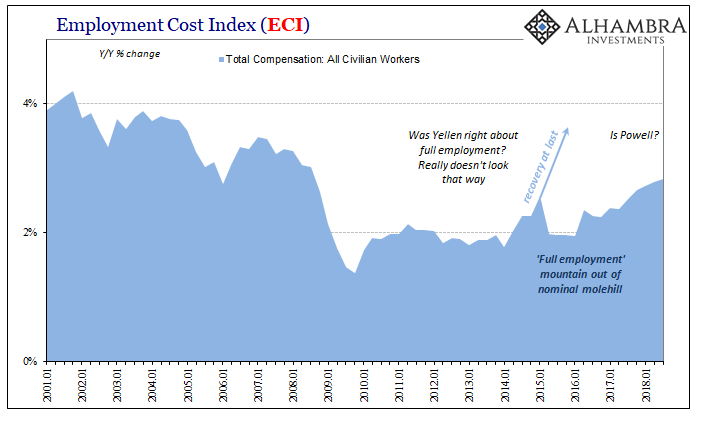

Another ‘Highest In Ten Years’

Upon the precipice of the Great “Recession”, US workers were cushioned to some extent by what economists call sticky wages. Before the Great Depression, as well as during it, companies would attempt to deal with looming economic contraction by cutting pay rates before workers.

Read More »

Read More »

Why Is Social Media So Toxic?

The desire to improve our social standing is natural. What's unnatural is the toxicity of doing so through social media. It seems self-evident that the divisiveness that characterizes this juncture of American history is manifesting profound social and economic disorders that have little to do with politics. In this context, social media isn't the source of the fire, it's more like the gasoline that's being tossed on top of the dry timber.

Read More »

Read More »

Globalization Has Hollowed Out Rural America

What do we make of an economy in which a handful of bubblicious urban areas are magnets for jobs and capital while rural communities have been hollowed out? The short answer is that this progression of urbanization has been one of the core dynamics of civilization for thousands of years: opportunities are greater in cities, and so people move from rural areas with few opportunities to cities with greater opportunities.

Read More »

Read More »

What’s the Real Meaning of the Stock Market Swoon?

Economy has reached peak earnings so there's no fundamentals-driven upside left. Bond yields are now high enough to dampen enthusiasm for inherently risky stocks. Central banks curtailing / ending their quantitative easing programs have reduced liquidity in the financial system. US markets are catching up to the rest of the world's market slump.

Read More »

Read More »