Category Archive: 5) Global Macro

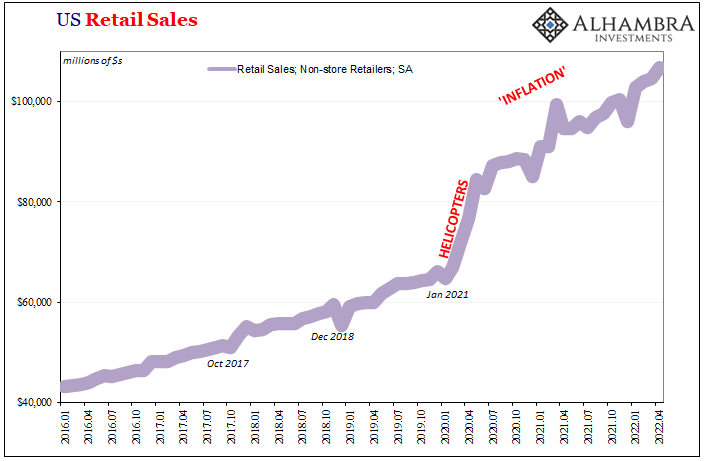

Shipping Around Retail ‘Inflation’

This whole “inflation” scenario isn’t really that difficult to piece together, effect from cause. Sure, Jay Powell’s trying to nuke it by hiking the federal funds rate, but no one really uses fed funds and the problem isn’t the unsecured cost of borrowing bank reserves (not money) that are literally overflowing.

Read More »

Read More »

The Epidemic Nobody Talks About: Burnout

Burnout makes everyone uncomfortable, so it's largely a silent epidemic. Epidemics are not just biological in origin. A strong case can be made that a silent epidemic has been sweeping the nation for years, an epidemic few acknowledge: burnout.

Read More »

Read More »

Looking Back At Chaotic March Through TIC

March ended up being a pretty wild ride. Lost amidst the furor over Russia’s invasion of Ukraine, the month began with a couple clear “collateral days. T-bill rates along with repo fails echoed that same shortfall before the yield curve then joined the eurodollar futures curve being inverted.

Read More »

Read More »

T-bills Targeted Target

Yesterday’s market “volatility” spilled (way) over into this morning’s trading. It ended up being a very striking example, perhaps the clearest and most alarming yet, of a scramble for collateral. The 4-week T-bill, well, the chart speaks for itself:During past scrambles, such as those last year, they didn’t look like this. They would hit, stick around for an hour, maybe a bit longer, and then clear up as collateral books get balanced in repo like...

Read More »

Read More »

Could Ethiopia’s war in Tigray spark conflict with Sudan? | The Economist

Recent events have revived a century-old border dispute between Ethiopia and Sudan over al-Fashaga—a fertile region that both countries claim as their own. Could these tensions throw the entire region into conflict?

00:00 - The border dispute: Sudan and Ethiopia

00:58 - The history of the dispute

02:33 - How does Abiy Ahmed worsen tensions

03:55 - Trouble in Tigray

04:38 - The return of civil war in Ethiopia

05:07 - Sudan reclaims al-Fashaga...

Read More »

Read More »

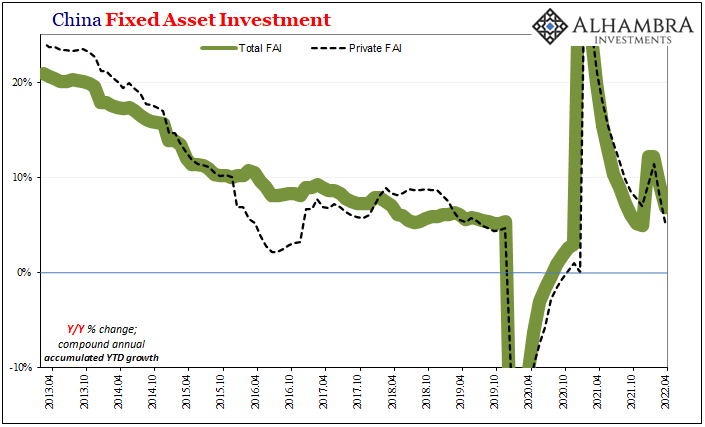

Synchronized Not Coronavirus

There is an understandable tendency to just write off this weekend’s disastrous Chinese data as nothing more than pandemic politics. After all, it has been Emperor Xi’s harsh lockdowns spreading like wildfire across China rather than any disease (why it has been this way, that’s another Mao-tter).

Read More »

Read More »

Crude Contradictions Therefore Uncertainty And Big Volatility

This one took some real, well, talent. It was late morning on April 11, the crude oil market was in some distress. The price was falling faster, already down sharply over just the preceding two weeks. Going from $115 per barrel to suddenly less than $95, there was some real fear there.But what really caught my attention was the flattening WTI futures curve.

Read More »

Read More »

Ukraine conflict: Russian-controlled territories vs Ukraine’s counter-offensive | WION Originals

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world.

Read More »

Read More »

War in Ukraine: the emerging global food crisis | The Economist

The impact of the war in Ukraine is spreading across the world — global food supplies are now threatened. The Economist’s experts consider the consequences, and discuss how the addition of Finland and Sweden will change the NATO alliance.

0:00 - War in Ukraine: the global impact

1:30 - How Ukraine's agriculture is adapting to the war

2:20 - The world depends on Ukrainian and Russian exports

4:22 - The war’s impact on global supply chains

5:10 -...

Read More »

Read More »

Checking In On Five Long-Term Cycles

The decline phase of S-Curves can be gradual or a cliff-dive. Way back in 2007 I charted five long-wave cycles that I reckoned consequential: 1. Public debt (accumulating federal deficits)

2. Inflation 3. Oil (energy) 4. Interest rates 5. Speculative fever

Read More »

Read More »

Curveballs in the Housing Bubble Bust

All these curveballs will further fragment the housing market. Oh for the good old days of a nice, clean housing bubble and bust as in 2004-2011: subprime lending expanded the pool of buyers, liar loans and loose credit created speculative leverage, the Federal Reserve provided excessive liquidity and the watchdogs of the industry were either induced (ahem) to look away or dozed off in a haze of gross incompetence.

Read More »

Read More »

Weekly Market Pulse: TANSTAAFL

TANSTAAFL is an acronym for “There ain’t no such thing as a free lunch”. It has been around a long time – Rudyard Kipling used it in an essay in 1891 – but it was popularized by Robert Heinlein’s 1966 book, “The Moon is a Harsh Mistress”.

Read More »

Read More »

Herd on the Street

The casino has become complex and there are no easy answers or predictable paths.

The Wall Street herd had it easy from 2009 to 2021. Life was simple and life was good: markets were easy to predict.

Read More »

Read More »

Peak Inflation (not what you think)

For once, I find myself in agreement with a mainstream article published over at Bloomberg. Notable Fed supporters without fail, this one maybe represents a change in tone. Perhaps the cheerleaders are feeling the heat and are seeking Jay Powell’s exit for him?

Read More »

Read More »

Gravitas: Leaked paper hints at Russia’s economic collapse

A leaked paper from the Russian finance ministry said the country's GDP will contract by 12%. The economic crisis could force Putin to rethink his war strategy. Palki Sharma tells you more.

Read More »

Read More »

The Financial Quarterback Josh Jalinski guest Jeffrey Snider

Jeffrey Snider, Head of Global Research at Alhambra Investments. He is not an economist, which is probably why he's been able to develop a working model of the global monetary system.

Read More »

Read More »

Synchronizing Chinese Prices (and consequences)

It isn’t just the vast difference between Chinese consumer prices and those in the US or Europe, China’s CPI has been categorically distinct from China’s PPI, too. That distance hints at the real problem which the whole is just now beginning to confront, having been lulled into an inflationary illusion made up from all these things.

Read More »

Read More »

Gravitas: Will Russia invade Finland next?

Finland's leaders have agreed to seek NATO membership 'without delay'. Russia has vowed to retaliate if Finland's membership bid is accepted. Will Putin invade Finland next?

Read More »

Read More »

Pressure grows on Europe to secure alternative gas supply | Russia sanctions Gazprom subsidiaries

Pressure on Europe to secure alternative gas supplies increased on Thursday as Moscow imposed sanctions on European subsidiaries of state-owned Gazprom a day after Ukraine stopped a major gas transit route.

Read More »

Read More »

Gravitas LIVE: Will Putin attack Finland next? Russia ending “current phases of war” | Palki Sharma

Gravitas LIVE: Will Putin attack Finland next? Russia ending “current phases of war” | Palki Sharma

- Will Putin attack Finland next?

- Russia ending “the current phases of war”

Read More »

Read More »