Category Archive: 5) Global Macro

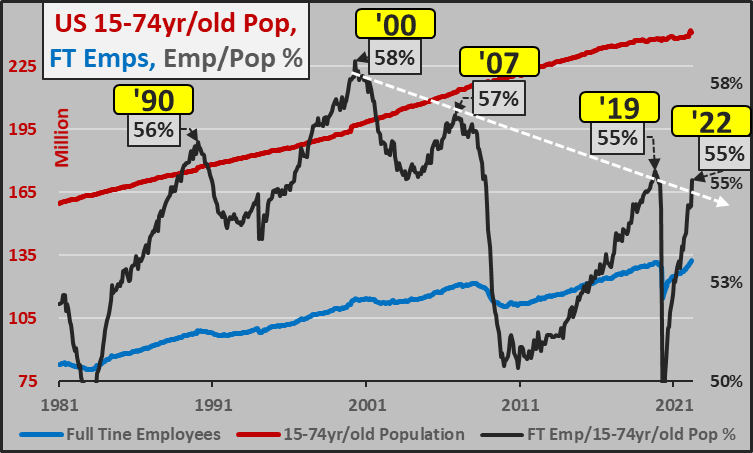

What Happens When the Workforce No Longer Wants to Work?

Workers are voting with their feet, and that's difficult to control. When values and expectations change, everything else eventually changes, too. What happens when the workforce no longer wants to work? We're about to find out. As with all cultural sea changes, macro statistics don't tell the full story.

Read More »

Read More »

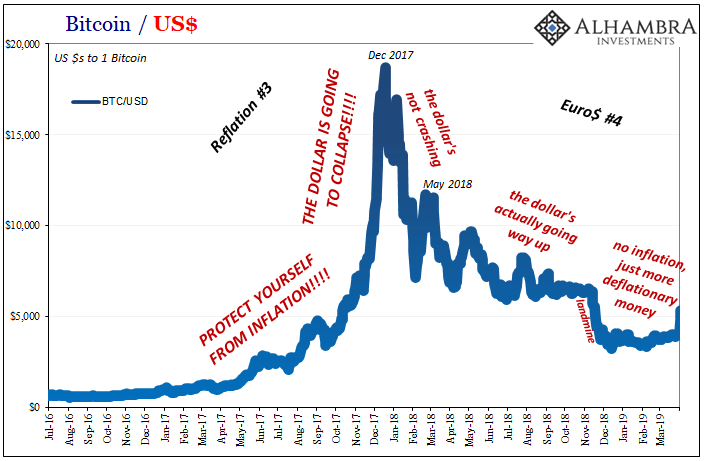

It’s Not Nothing, It’s Everything (including crypto)

Markets got aggressive long before the FOMC did. Everything, and I mean everything, has been trending the other way. Jay Powell says inflation risks are most pressing when markets have consistently priced the opposite for a whole lot longer.

Read More »

Read More »

Prices As Curative Punishment

It wasn’t exactly a secret, though the raw data doesn’t ever tell you why something might’ve changed in it. According to the Bureau of Economic Analysis, confirmed by industry sources, US new car sales absolutely tanked in May 2022.

Read More »

Read More »

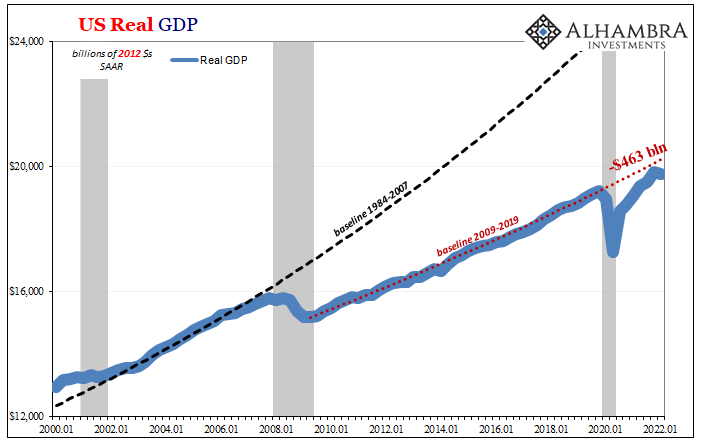

Update The Conflict of Interest Rate(s)

What changed? For over a month, the Treasury market had the Fed and its rate hiking figured out. Rising recession risks had been confirmed by almost every piece of incoming data, including, importantly, labor data.

Read More »

Read More »

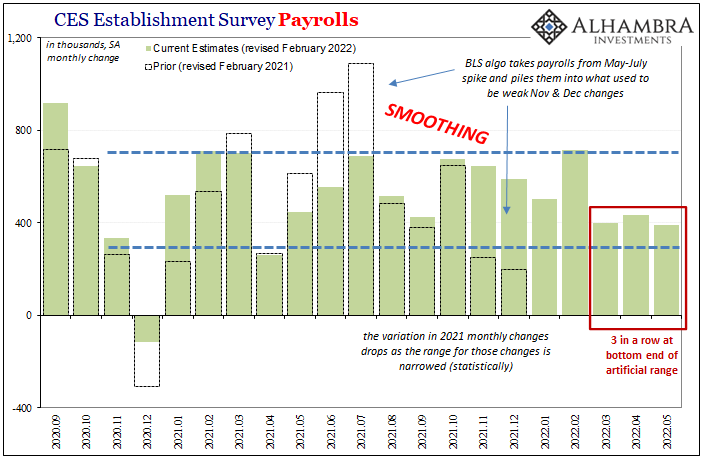

Simple Economics and Money Math

The BLS’s most recent labor market data is, well, troubling. Even the preferred if artificially-smooth Establishment Survey indicates that something has changed since around March. A slowdown at least, leaving more questions than answers (from President Phillips).

Read More »

Read More »

“Inflation” Not Inflation, Through The Eyes of Inventory

It isn’t just semantics, nor some trivial, egotistical use of quotation marks. There is an actual and vast difference between inflation and “inflation.” And in the final results, that difference isn’t strictly or even mainly about consumer prices.Who cares, most people wonder. After all, what does it really matter why prices are going up so far?

Read More »

Read More »

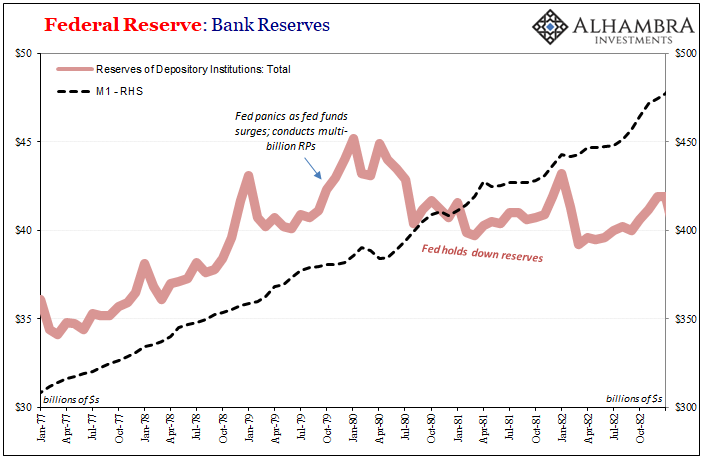

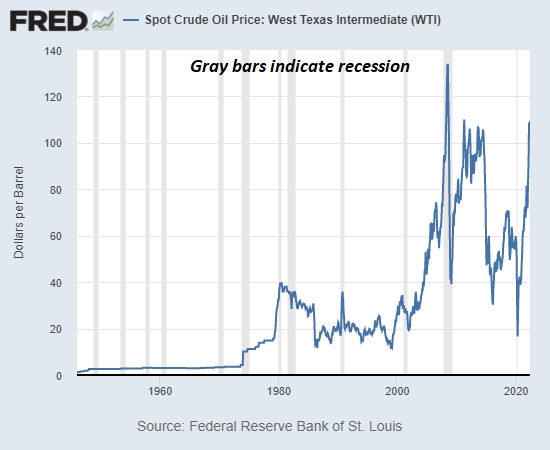

A Volcker Pan Recession

The Volcker Myth is simple because there isn’t math for it just voodoo economics (to borrow George HW Bush’s phrase). In theory, the FOMC finally realized after more than a decade of currency devastation and its economic, financial, and social consequences, hey, inflation and money.

Read More »

Read More »

How does raising interest rates control inflation? | The Economist

When central banks raise interest rates, the impact is felt far and wide. Mortgages become more expensive, house prices might fall and unemployment can rise. So why do central banks do it? This film tells you why.

00:00 - Why should you care about rising interest rates?

00:45 - What are interest rates?

01:36 - What do central banks do?

02:14 - Why do central banks raise interest rates?

03:12 - How do raised interest rates affect consumers?

04:30 -...

Read More »

Read More »

There’s No Stopping a Recessionary Reckoning

If there was only one causal factor nudging the economy into recession, it might be a mild, brief recession. But with all five conditions in confluence, this recession will be unlike any other. Recessions reliably arise from the confluence of these conditions. Note that any one condition can trigger a recession, but no one condition guarantees a recession.

Read More »

Read More »

Sky High Inflation May Mean Another Hefty Social Security Increase in 2023

In 2022, Social Security recipients got a 5.9% cost-of-living adjustment (COLA). That was the largest increase in 40 years. The COLA coming in 2023 may be even bigger.

Read More »

Read More »

May Payrolls (and more) Confirm Slowdown (and more)

May 2022’s payroll estimates weren’t quite the level of downshift President Phillips had warned about, though that’s increasingly likely just a matter of time. In fact, despite the headline Establishment Survey monthly change being slightly better than expected, it and even more so the other employment data all still show an unmistakable slowdown in the labor market.

Read More »

Read More »

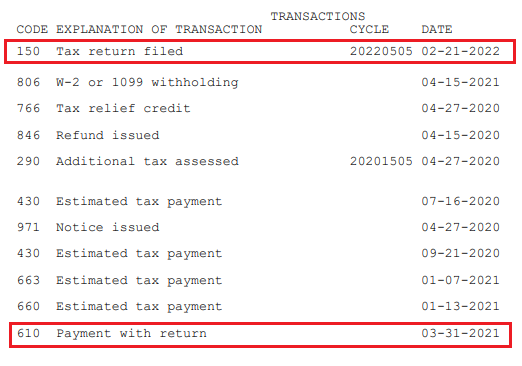

"Pay-to-Play" for the Rest of Us

The more kafkaesque quagmires you've slogged through, the more you hope "pay-to-play for the rest of us" beomes ubiquitous. You know how "pay-to-play" works: contribute a couple of million dollars to key political players, and then get your tax break, subsidy, no-bid contract, etc., slipped into some nook or cranny of the legislative process that few (if any) will notice because the legislation is hundreds of pages long or a "gut and replace" magic...

Read More »

Read More »

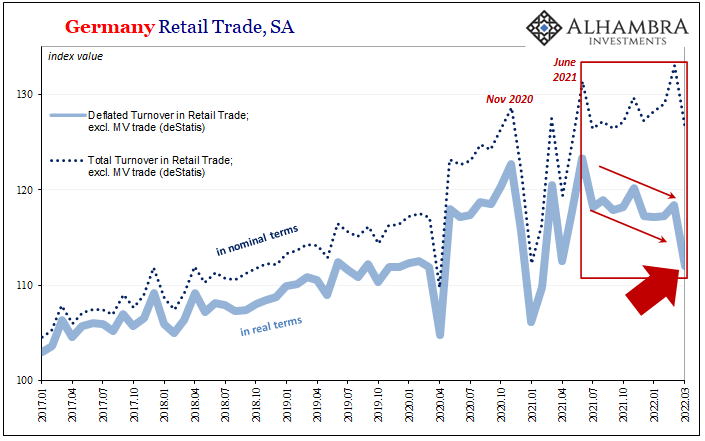

No Pandemic. Not Rate Hikes. Doesn’t Matter Interest Rates. Just Globally Synchronized.

The fact that German retail sales crashed so much in April 2022 is significant for a couple reasons. First, it more than suggests something is wrong with Germany, and not just some run-of-the-mill hiccup. Second, because it was this April rather than last April or last summer, you can’t blame COVID this time.

Read More »

Read More »

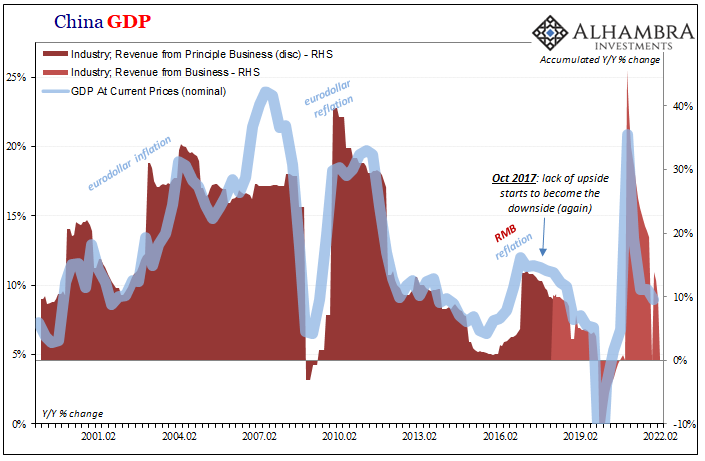

Follow China’s True Line

It’s a broken a record, the macro stylus stuck unable to move on, just skipping and repeating the same spot on the vinyl. Since Xi Jinping’s lockdowns broke it, as it’s said, when Xi is satisfied there’s zero COVID he’ll release the restrictions and that will fix everything. The economy will go right back to good, like flipping a switch.

Read More »

Read More »

Biden vows to stand by Ukraine, major U-turn by US on weapon decision | Latest English News | WION

US President Joe Biden published an op-ed to clarify his strategy of support for Ukraine, under military attack from Russia. President Biden also took a major U-turn on his decision to not send certain type of weapons like longer-range rocket systems.

Read More »

Read More »

ADP Front-Runs BLS and President Phillips

It’s gotten to the point that pretty much everyone is now aware of the risks. Public surveys, market behavior, on and on, hardly anyone outside politics thinks the economy is in a good place. Gasoline, sentiment, whatever, Euro$ #5 in total is much more than what’s shaping up inside the American boundary. Globally synchronized of which the US is proving to be a close part.

Read More »

Read More »

Ukraine grain production to drop 40 per cent over Russian invasion, says UGA | Latest English News

The Ukrainian Grain Association (UGA) has said that county's wheat harvest is expected to fall by 40 percent, as the Russian invasion has sent prices soaring and sparked fears of a global food crisis.

Read More »

Read More »

Who’s Going to Fix What’s Broken?

When nobody cares that systems have broken down and there is no will or interest in fixing essential systems, there is no happy ending. Who fixes systems when they break down? The answer appears to be: nobody.

Read More »

Read More »

Can’t Blame COVID For This One

Late in March 2021, then-German Chancellor Angela Merkel announced a reverse. Several weeks before that time, Merkel’s federal government had reached an agreement with the various states to begin opening the country back up, easing more modest restrictions to move daily life closer to normal.

Read More »

Read More »

More seek gun training in Taiwan as Ukraine invasion fuels China fears | Latest English News | WION

Amid a ragging war between Russia and Ukraine Taiwanese have started taking shooting lessons. From tour guides to tattoo artists, people in Taiwan are picking up rifles for the first time in their lives.

Read More »

Read More »