Category Archive: 5) Global Macro

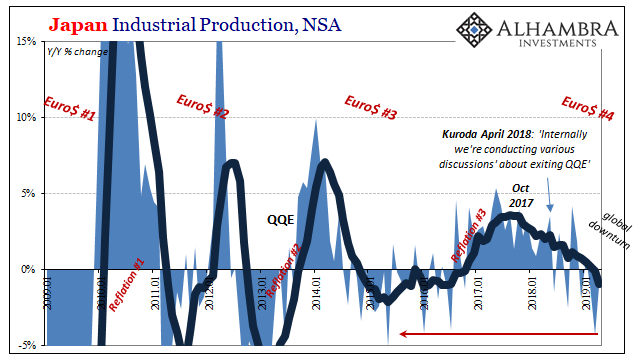

Japan’s Bellwether On Nasty #4

One reason why Japanese bond yields are approaching records like their German counterparts is the global economy indicated in Japan’s economic accounts. As in Germany, Japan is an outward facing system. It relies on the concept of global growth for marginal changes. Therefore, if the global economy is coming up short, we’d see it in Japan first and maybe best.

Read More »

Read More »

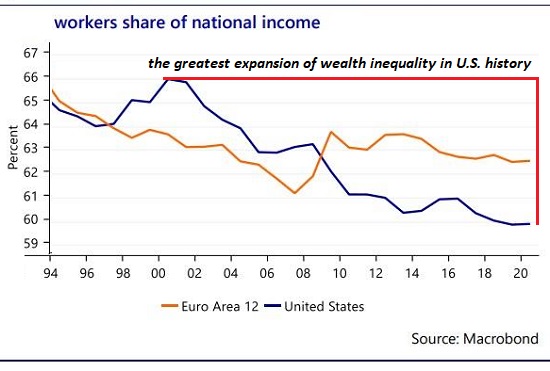

The Human Cost of “Recovery”: We’re Burning Out

The asymmetries are piling up and we're cracking under the weight. Judging by the record-high stock market and the record-low unemployment rate, the "recovery" has reached new heights of prosperity. Academics and think-tankers viewing the global economy from 40,000 feet are brimming with policies to bring the remaining laggards into the booming economy.

Read More »

Read More »

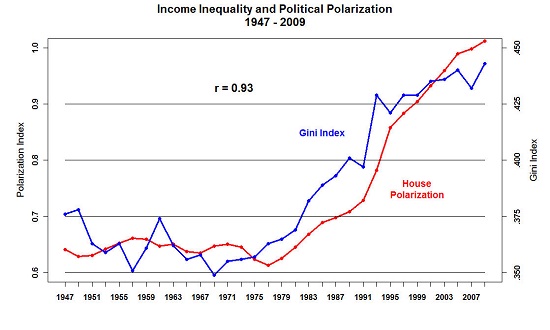

The Lessons of Rome: Our Neofeudal Oligarchy

Our society has a legal structure of self-rule and ownership of capital, but in reality it is a Neofeudal Oligarchy. The Inheritance of Rome: Illuminating the Dark Ages 400-1000 is not an easy, breezy read; its length and detail are daunting. The effort is well worth it, as the book helps us understand how the power structures of societies change over time in ways that may be largely invisible to those living through the changes.

Read More »

Read More »

The Fed’s Casino Is Giving Away Free Gambling Chips (But Only to the Super-Rich)

The rest of us eat our losses, either all at once or in bitter bites as we trudge through the financial wasteland left after bubbles burst. The news that the Federal Reserve Casino is giving away free gambling chips triggered a frenzied rush that trampled the bears, including poor Yogi:

Read More »

Read More »

Dear Central Bankers: Prepare to be Swept Away in the Next Wave of Populism

The political moment when the "losers" connect their discontent and decline with central bankers is approaching. The Ruling Elites' Chattering Classes still haven't absorbed the key lesson of the 2016 U.S. presidential election.

Read More »

Read More »

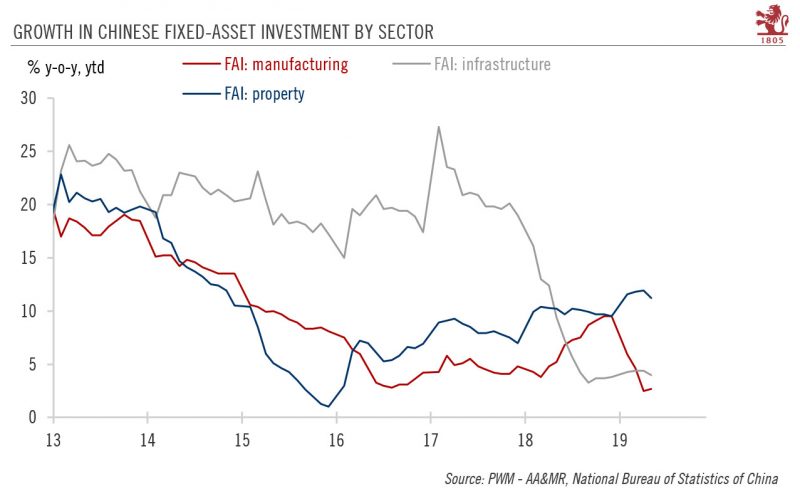

China looks to new policies to boost infrastructure spending

To stabilise growth, the Chinese government will likely put more focus on infrastructure investment. A new policy announced recently could give a further boost to this sector.Activity data in May point to continued weakness in Chinese economic momentum, with growth in both fixed-asset investment and industrial production slowing last month.

Read More »

Read More »

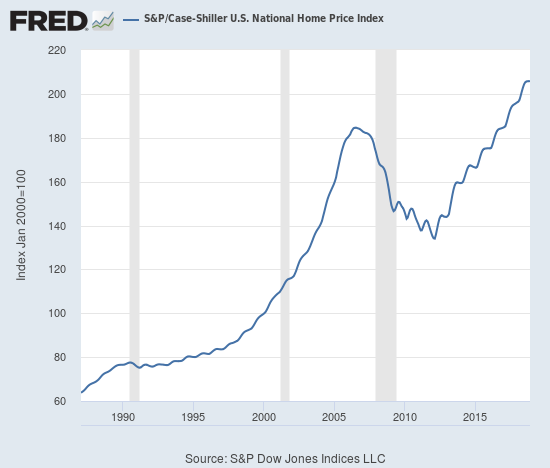

How Much of Your “Wealth” Is Hostage to Bubbles and Impossible Promises?

All asset "wealth" in credit-asset bubble dependent economies is contingent and ephemeral. A funny thing happens to "wealth" in a bubble economy: it only remains "wealth" if the owner sells at the top of the bubble and invests the proceeds in an asset which isn't losing purchasing power.

Read More »

Read More »

Misplaced Pride: Most of the “Middle Class” Is Actually Working Class

If we look at these charts, it looks like only the top 10%, or perhaps the top 20% at best, might qualify as "middle class" by the metrics described below. The conventional definition of working class is based on income and education:the working class household earns between $30,000 and $69,000 annually, and the highest education credential in the household is a two-year community college degree or trade certification.

Read More »

Read More »

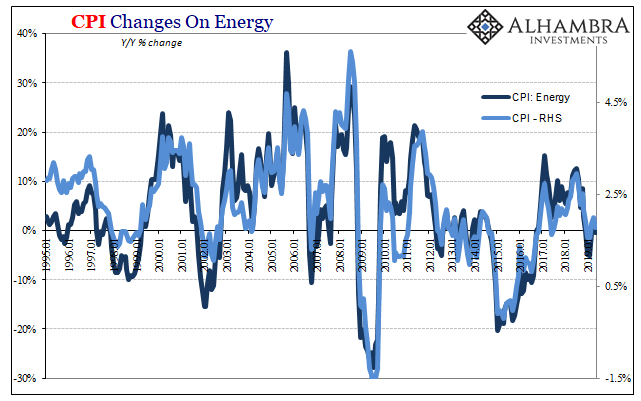

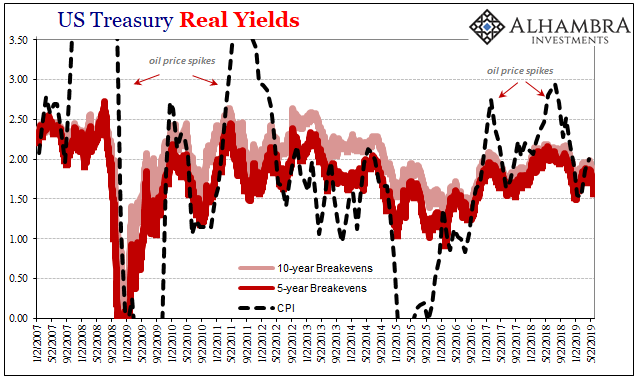

When Verizons Multiply, Macro In Inflation

Inflation always brings out an emotional response. Far be it for me to defend Economists, but their concept is at least valid – if not always executed convincingly insofar as being measurable. An inflation index can be as meaningful as averaging the telephone numbers in a phone book (for anyone who remembers what those things were).

Read More »

Read More »

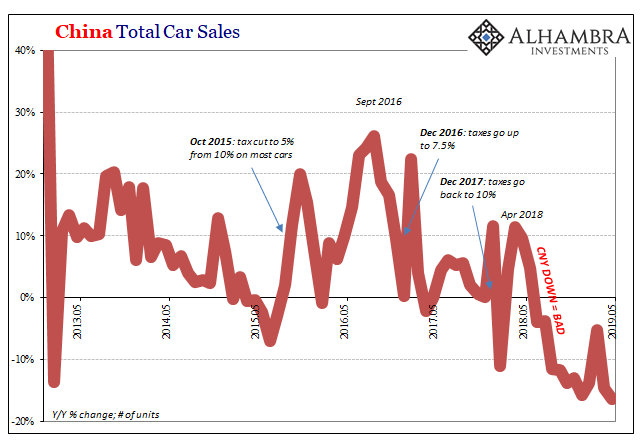

Dimmed Hopes In China Cars, Too

As noted earlier this week, the world’s two big hopes for the global economy in the second half are pinned on the US labor market continuing to exert its purported strength and Chinese authorities stimulating out of every possible (monetary) opening. Incoming data, however, continues to point to the fallacies embedded within each.

Read More »

Read More »

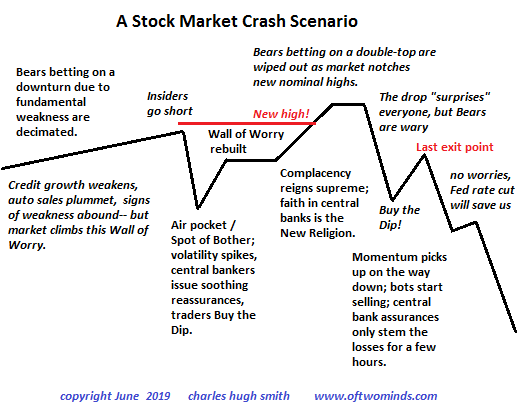

A Stock Market Crash Scenario

Herds get spooked and run. That's the crash scenario in a nutshell. We have all been trained by a decade of central bank saves to expect any stock market swoon will soon be reversed by central bank sweet talk and/or rate cuts.

Read More »

Read More »

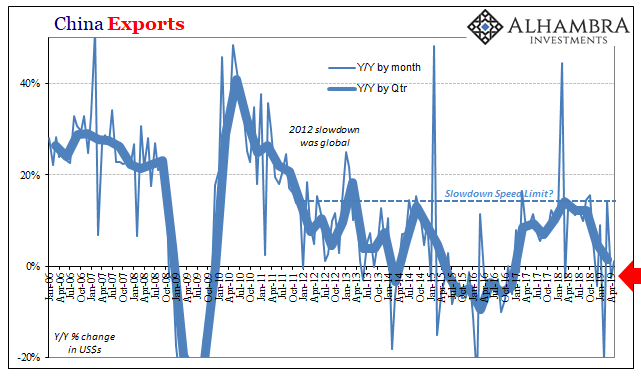

Commodities And The Future Of China’s Stall

Commodity prices continued to fall last month. According to the World Bank’s Pink Sheet catalog, non-energy commodity prices accelerated to the downside. Falling 9.4% on average in May 2019 when compared to average prices in May 2018, it was the largest decline since the depths of Euro$ #3 in February 2016.

Read More »

Read More »

What Would It Take to Spark a Rural/Small-Town Revival?

Recent research supports the idea that this under-the-radar migration is already under way. The decline of rural regions and small towns is a global phenomenon, and the causes are many but boil down to two primary dynamics: 1. Cities and megalopolises (aggregations of cities, suburbs and exurbs) attract capital, infrastructure, markets and talent, and these are the engines of job creation.

Read More »

Read More »

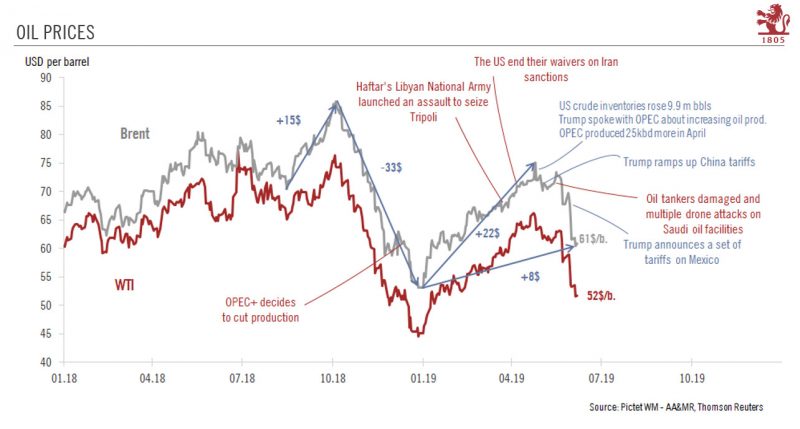

Oil prices are reeling

The escalation in trade tensions, the dimming of global growth prospects and a surge in US export capacity have pushed us to lower our oil forecasts.The recent plunge in prices suggests that oil is acting like a leading indicator of global economic growth, reflecting investors’ concerns that lasting trade disputes will dent future growth and risk pushing the world economy into recession.

Read More »

Read More »

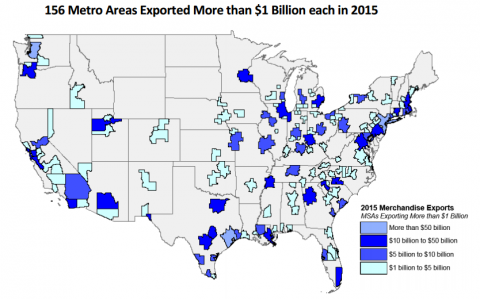

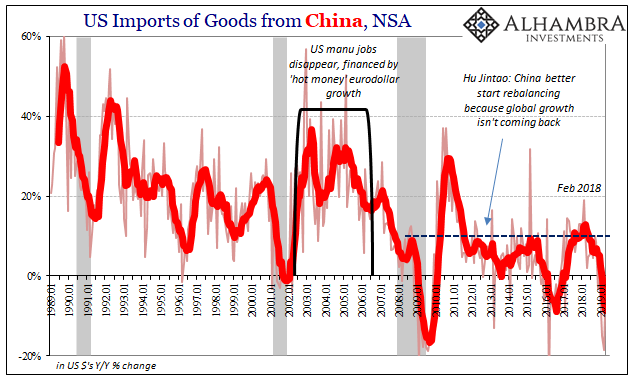

All Of US Trade, Both Ways, And Much, Much More Than The Past Few Months

The media quickly picked up on Jay Powell’s comments this week from Chicago. Much less talked about was why he was in that particular city. The Federal Reserve has been conducting what it claims is an exhaustive review of its monetary policies. Officials have been very quick to say they aren’t unhappy with them, no, no, no, they’re unhappy with the pitiful state of the world in which they have to be applied.

Read More »

Read More »

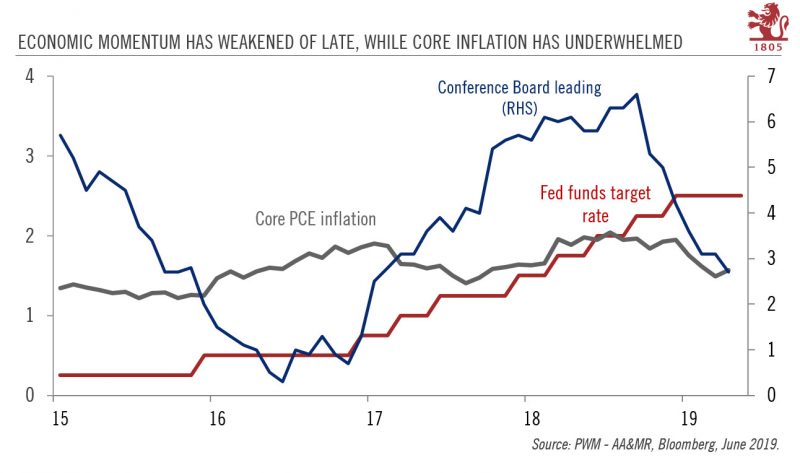

Janus Powell

Again, who’s following who? As US Treasury yields drop and eurodollar futures prices rise, signaling expectations for lower money rates in the near future, Federal Reserve officials are catching up to them. It was these markets which first took further rate hikes off the table before there ever was a Fed “pause.”

Read More »

Read More »

Monthly Macro Monitor – June 2019 (VIDEO)

Alhambra Investments CEO reviews economic charts from the past month and his opinion of what they mean.

Read More »

Read More »

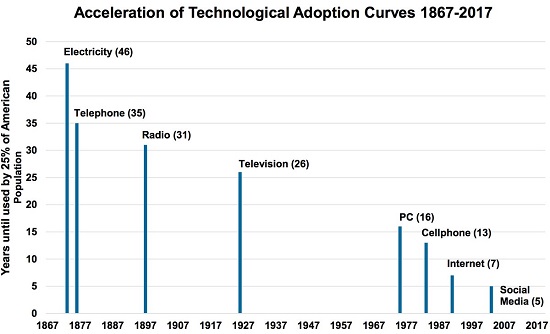

Is the Tech Bubble Bursting?

There are two other trends that don't attract quite the media attention that soaring profits do. Is the decade-long tech bubble finally popping? Tech bulls are overlooking the fundamental reality that the drivers of Big tech's phenomenal growth--financialization and expansion into mobile telephony-- are both losing momentum.

Read More »

Read More »

A dovish Fed could become even more so

Trade, inflation expectations and economic data could well spark ‘insurance’ rate cuts by the Fed in the coming months.We now believe that the Federal Reserve (Fed) could deliver two ‘insurance’ rate cuts of 25bps in coming months (up to now, we expected rates to be on hold in 2019-2020). We see three drivers that could dictate the exact timing of these cuts:

Read More »

Read More »

A Quiet Revolution Is Brewing

Politics as practiced in a bygone era of stability no longer offers any solutions to these profound disruptions. I recently read a fascinating history of the social, political and economic context of the American Revolution: The Radicalism of the American Revolution by Gordon Wood.

Read More »

Read More »