Category Archive: 5) Global Macro

The Global Repricing of Assets Can’t Be Stopped

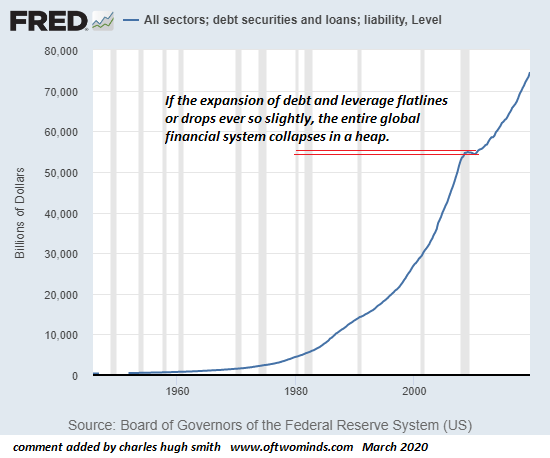

All bubbles pop, period. The financial elites are pushing a narrative that asset prices, sales and profits will all return to January 2020 levels as soon as the Covid-19 pandemic fades. Get real, baby. Nothing is going back to January 2020 levels. Rather than the "V-shaped recovery" expected by Goldman Sachs et al., the crash in asset prices will eventually gather momentum.

Read More »

Read More »

Is GFC2 Over?

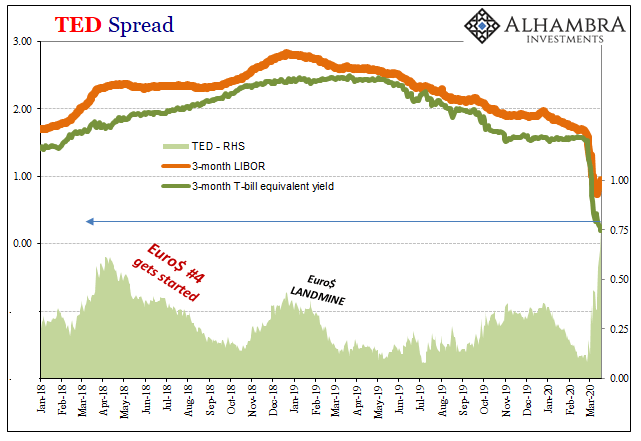

Is it over? That’s the question everyone is asking about both major crises, the answer is more obvious for only the one. As it pertains to the pandemic, no, it is not. Still the early stages. The other crisis, the global dollar run? Not looking like it, either.

Read More »

Read More »

Covid-19 Helicopter Money: Go Big Now or Go Home

This is why it's imperative to go big now, and make plans to sustain the most vulnerable households and small employers not for two weeks but for six months--or however long proves necessary. That governments around the world will be forced to distribute "helicopter money" to keep their people fed and housed and their economies from imploding is already a given.

Read More »

Read More »

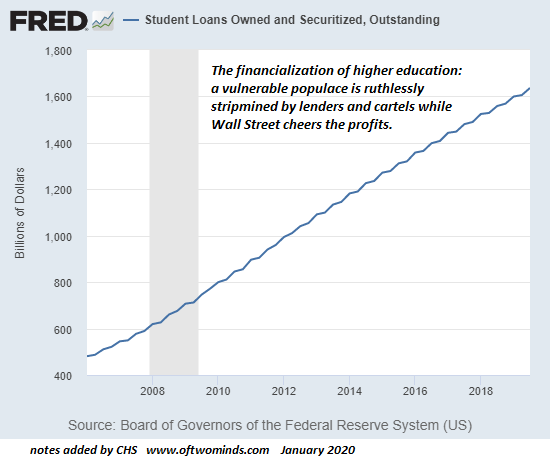

The Covid-19 Dominoes Fall: The World Is Insolvent

Subtract their immense debts and they have negative net worth, and therefore the market value of their stock is zero. To understand why the financial dominoes toppled by the Covid-19 pandemic lead to global insolvency, let's start with a household example. The point of this exercise is to distinguish between the market value of assets and net worth, which is what's left after debts are subtracted from the market value of assets.

Read More »

Read More »

EM Preview for the Week Ahead

Market sentiment is likely to open this week on an upswing after the Fed’s emergency rate cut and expanded QE were announced Sunday afternoon local time. Yet as we have seen time and again this past couple of weeks, added stimulus has had little lasting impact on markets as the virus numbers continue to worsen. Europe is now reporting more daily cases than China did at its peak. We remain negative on EM until the global growth outlook becomes...

Read More »

Read More »

Goodbye to All That: The Demise of Globalization and Imperial Pretensions

The decline phase of the S-Curve is just beginning. Globalization and Imperial Pretensions have been decaying for years; now the tide has turned definitively against them. The Covid-19 pandemic didn't cause the demise of globalization and Imperial Pretensions; it merely pushed the rickety structures over the edge.

Read More »

Read More »

Dollar Firms, Equities Sink Ahead of ECB Decision as US Fails to Deliver

President Trump spoke to the nation last night and did little to calm markets; reports suggest that the Democrats are working on a bill. Fed easing expectations are intensifying. The ECB decision will be out at 845 AM ET; over the past 17 ECB decision days, the euro has finished lower in 11 of them.

Read More »

Read More »

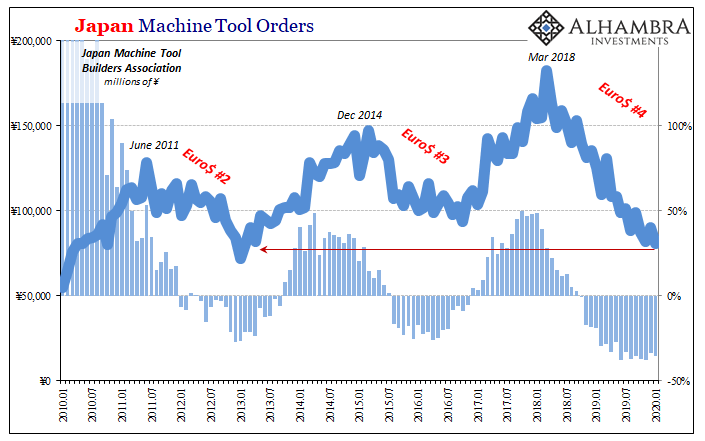

What Happens When Central Banks Buy Stocks (ETFs)? Well, We Already Know

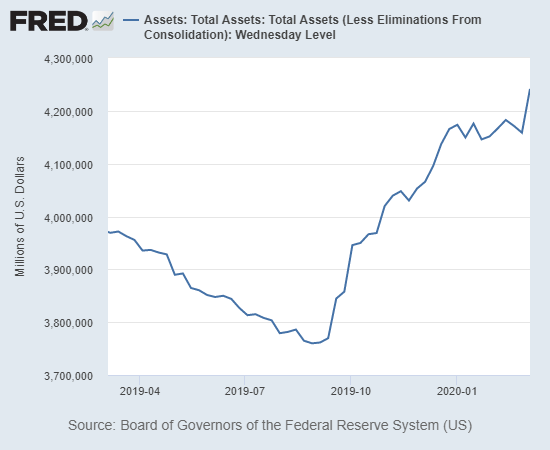

Can we please dispense with all notions that monetary policy works? Specifically balance sheet expansion via any scale asset purchase programs. Nowhere has that been more apparent than Japan. Go back and reread all the promised benefits from BoJ’s Big Bang QQE that were confidently written in 2013. The biggest bazooka ever conceived has fallen short in every conceivable way.

Read More »

Read More »

And Then Came the Lawsuits: Pandemic in a Litigious Society

This is the upside of hyper-litigiousness: prevention is prioritized as the most effective means of limiting future liability. Never mind prevention or vaccines; the big question is "who can we sue after this blows over to rake in millions of dollars?" Yes, this is pathetic, tragic, perverse and evil, but that's reality in a hyper-litigious society like the U.S.

Read More »

Read More »

(Almost) Everything Sold Off Today

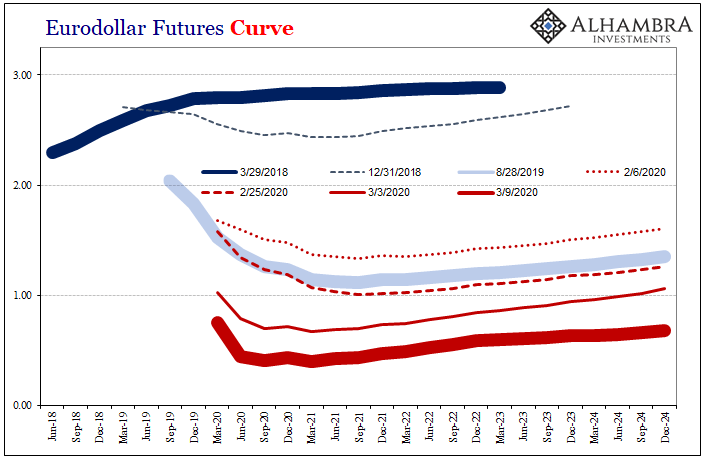

The eurodollar curve’s latest twist exposes what’s behind the long end. To recap: big down day in stocks which, for the first time in a while, wasn’t accompanied by massive buying in longer maturity UST’s. Instead, these were sold, too. Rumors of parity funds liquidating were all over the place, which is consistent with this curve behavior.

Read More »

Read More »

Dollar Soft as BOE Surprises Ahead of UK Budget

The dollar is stabilizing but remains vulnerable to disappointment as markets await details of US fiscal measures. US reports February CPI; Joe Biden moved closer to clinching the Democratic nomination. BOE delivered a surprise 50 bp rate cut to 0.25% and initiated a new lending scheme; UK government releases its budget today; UK reported weak data.

Read More »

Read More »

ECB Preview, March 11

Christine Lagarde will chair her third ECB meeting Thursday. She faces growing risks of recession but also widespread skepticism within the ECB regarding the efficacy of negative rates. Markets have priced in several rate cuts this year. Here, we discuss what measures the ECB may take this week.

Read More »

Read More »

Low Rates As Chaos, Not ‘Stimulus’

Basic recession economics says that when you end up with too much of some commodity, too much inventory that you can’t otherwise sell, you have to cut the price in order to move it. Discounting is a feature of those times. What about a monetary panic? This might sound weird, but same thing.

Read More »

Read More »

Is this the Beginning of a Recession?

As I sit here Monday evening with the Dow having closed down 2000 points and the 10-year Treasury yield around 0.5%, the title of this update seems utterly ridiculous. With the new coronavirus still spreading and a collapse in oil prices threatening the entire shale oil industry, recession is now the expected outcome. Most observers seem to question only the potential length and depth of the coming downturn.

Read More »

Read More »

Dollar Firm as Global Financial Markets Calm

Global financial markets are finally seeing a measure of calm return; local Chinese media is sounding more confident that the situation is now under control. The White House will announce fiscal measures today; five states hold primaries and one holds a caucus with 352 total pledged delegates up for grabs.

Read More »

Read More »

What the Fed Can Do: Print and Buy, Buy, Buy

Everyone with a pension fund or 401K invested in stocks better hope the Fed becomes the buyer of last resort, and soon. Much has been written about what the Federal Reserve cannot do: it can't stop the Covid-19 pandemic or reverse the economic damage unleashed by the pandemic.

Read More »

Read More »

Drivers for the Week Ahead

Risk-off sentiment continues to build as the coronavirus spreads. Fed easing expectations continue to intensify; February inflation readings for the US will be reported this week. The ECB meets Thursday and markets are split; the stronger euro is doing the eurozone economy no favors. The UK has a heavy data release schedule Wednesday; UK government also releases its budget that day.

Read More »

Read More »

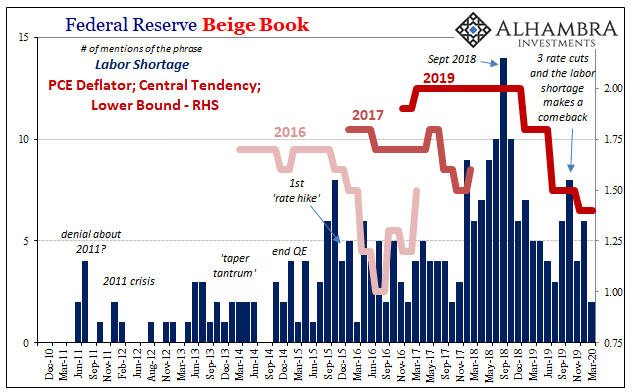

Like Repo, The Labor Lie

The Federal Reserve has been trying to propagate two big lies about the economy. Actually, it’s three but the third is really a combination of the first two. To start with, monetary authorities have been claiming that growing liquidity problems were the result of either “too many” Treasuries (haven’t heard that one in a while) or the combination of otherwise benign technical factors.

Read More »

Read More »

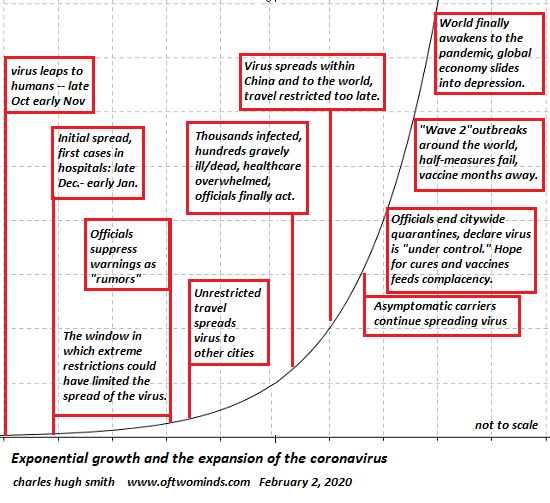

The Gathering Storm: Could Covid-19 Overwhelm Us in the Months Ahead?

Either the science is wrong and the complacent will be proven correct, or the science is correct and the complacent will be wrong. The present disconnect between the science of Covid-19 and the status quo's complacency is truly crazy-making, as we face a binary situation: either the science is correct and all the complacent are wrong, or the science is false and all the complacent are correct that the virus is no big deal and nothing to fret about.

Read More »

Read More »

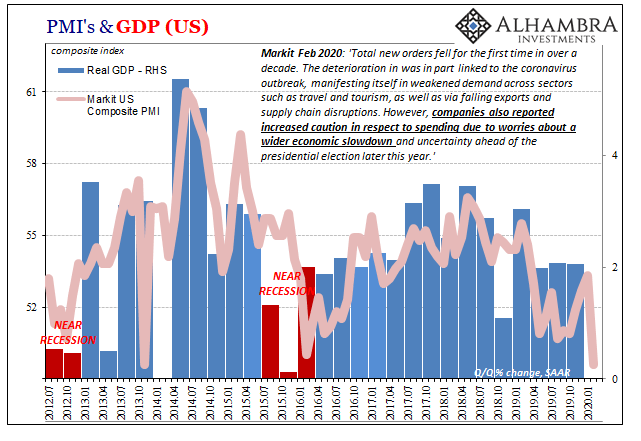

Take Your Pick of PMI’s Today, But It’s Not Really An Either/Or

Take your pick, apparently. On the one hand, IHS Markit confirmed its flash estimate for the US economy during February. Late last month the group had reported a sobering guess for current conditions. According to its surveys of both manufacturers and service sector companies, the system stumbled badly last month, the composite PMI tumbling to 49.6 from 53.3 in January.

Read More »

Read More »