Category Archive: 5) Global Macro

Dollar Stalls as Market Sentiment Improves

The virus news stream remains mixed; oil remains at center stage with still extreme volatility. The White House and House Democrats struck a deal on a new aid package worth $484 bln. Canada reports March CPI; Mexico delivered a surprise 50 bp cut to 6.0% yesterday afternoon.

Read More »

Read More »

The Greenspan Bell

What set me off down the rabbit hole trying to chase modern money’s proliferation of products originally was the distinct lack of curiosity on the subject. This was the nineties, after all, where economic growth grew on trees. Reportedly. Why on Earth would anyone purposefully go looking for the tiniest cracks in the dam?

Read More »

Read More »

Dollar Firm as Equities and Oil Start the Week Under Pressure

The lockdown vs. opening debate continues in just about every country; the dollar is consolidating recent gains. Reports suggest the White House and House Democrats are nearing a deal on another aid package worth nearly $500 bln; the extra fiscal stimulus will add to downward ratings pressure on the US.

Read More »

Read More »

Overcapacity / Oversupply Everywhere: Massive Deflation Ahead

The price of a great many assets will crash, out of proportion to the decline in demand. Oil is the poster child of the forces driving massive deflation: overcapacity / oversupply and a collapse in demand. Overcapacity / oversupply and a collapse in demand are not limited to the crude oil market; rather, they are the dominant realities in the global economy.

Read More »

Read More »

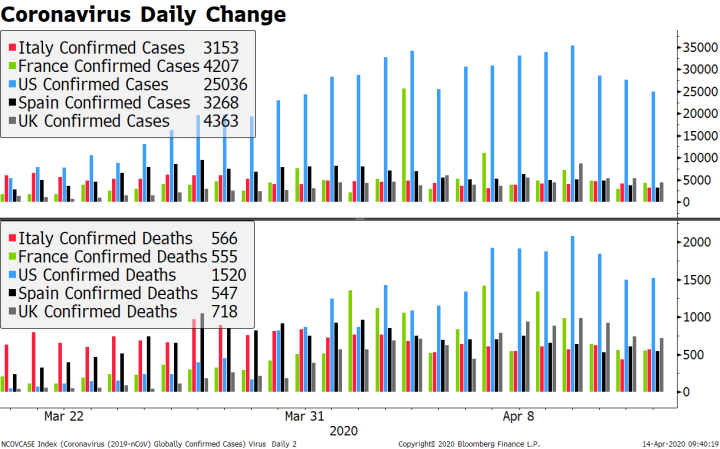

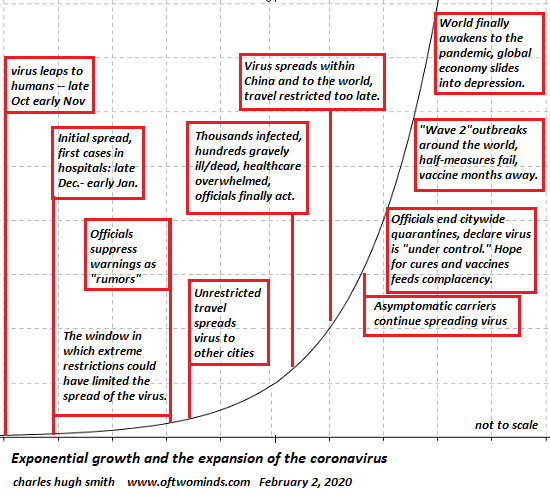

Between a Rock and a Hard Place: Pandemic and Growth

There is no way authorities can limit the coronavirus and restore global growth and debt expansion to December 2019 levels. Authorities around the world are between a rock and a hard place: they need policies that both limit the spread of the coronavirus and allow their economies to "open for business." The two demands are inherently incompatible, and so neither one can be fulfilled.

Read More »

Read More »

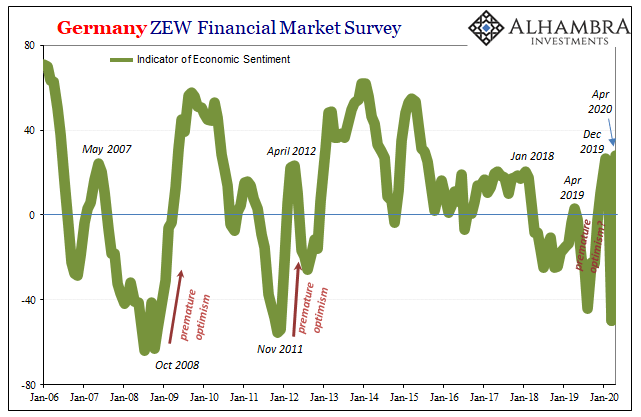

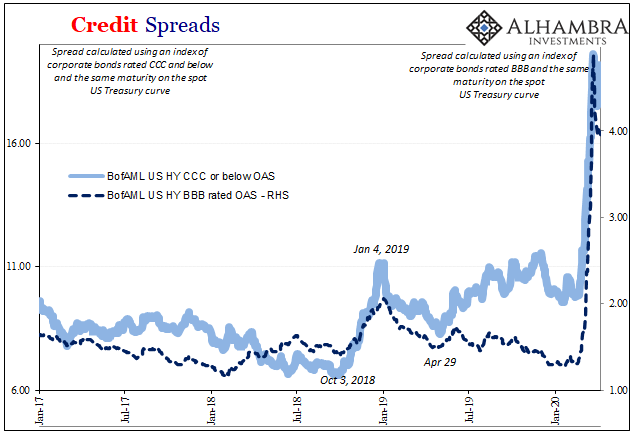

The Global Engine Is Still Leaking

An internal combustion engine that is leaking oil presents a difficult dilemma. In most cases, the leak itself is obscured if not completely hidden. You can only tell that there’s a problem because of secondary signs and observations.If you find dark stains underneath your car, for example, or if your engine smells of thick, bitter unpleasantness, you’d be wise to consider the possibility.

Read More »

Read More »

Dollar Firm in Thin Holiday Trading

The virus news stream is mostly positive today; yet risk assets are starting the week under some modest pressure. The dollar took a hit last week but we think it will recover; some US data releases from Good Friday are worth repeating. With most of Europe closed today, the news stream from the region is very light; oil prices could not extend their gains today after OPEC+ finalized output cuts over the weekend.

Read More »

Read More »

Dollar Under Modest Pressure as Europe Returns from Holiday

The tug of war between extending vs. softening lockdowns continues. The dollar remains under modest pressure but we think it will eventually recover; Bernie Sanders has endorsed Joe Biden. Europe reopens from holiday today but the news stream remains light; South Africa surprised with an emergency 100 bp rate cut.

Read More »

Read More »

There’s No Going Back, We Can Only Go Forward

What I see is a global collapse of intangible capital that is invisible to most people. It's only natural that the conventional expectation is a return to the pre-pandemic world is just a matter of time. Whether it's three months or six months or 18 months, "the good old days" will return just as if we turned back the clock.

Read More »

Read More »

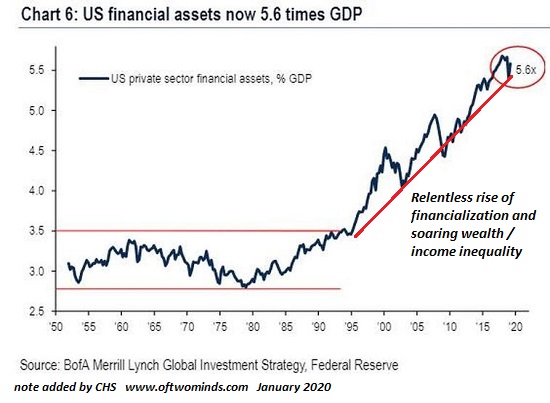

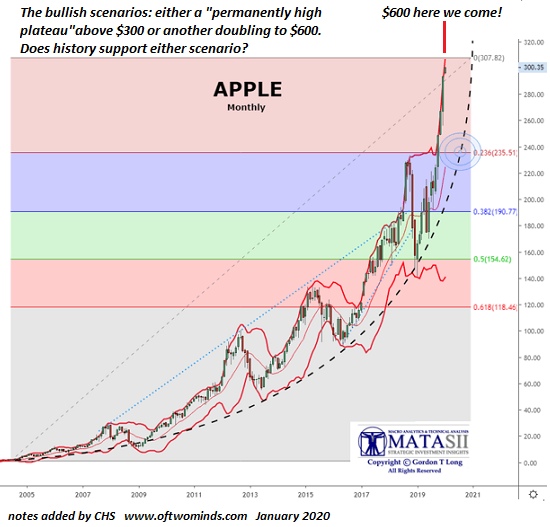

Buy The Tumor, Sell the News

The fictitious valuation of the stock market will eventually re-connect with reality in a violent decline. No, buy the tumor, sell the news (tm) is not a typo: the stock market is a lethal tumor in our economy and society.

Read More »

Read More »

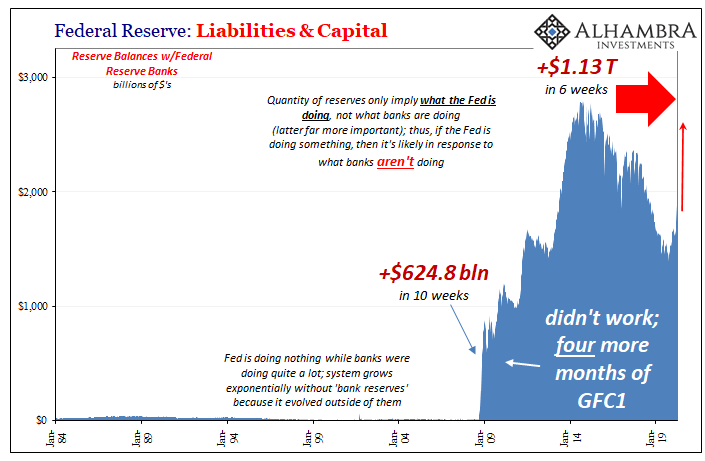

The Real Diseased Body

Another day, another new Federal Reserve “bailout.” As these things go by, quickly, the details become less important. What is the central bank doing today? Does it really matter?For me, twice was enough. All the way back in 2010 I had expected other people to react as I did to QE2. If you have to do it twice, it doesn’t work.

Read More »

Read More »

The World Has Changed More Than We Know

Put another way: eras end. While the mainstream media understandably focuses on the here and now of the pandemic, some commentators are looking at the long-term consequences. Here is a small sampling: While each of these essays offers a different perspective, let's focus on the last two: Ugo Bardi's essay on Hyperspecialization and the technological responses described in the MIT Technology Review essay.

Read More »

Read More »

Lessons from Singapore?

Singapore has been hailed for its quick response to the coronavirus that limited initial infections, but the outlook is shifting. Despite their early success, they will have to revert to a lockdown. Can Singapore’s experience offer any lessons for European and the US policymakers?

Read More »

Read More »

Dollar Firm as Europe Fails to Deliver

The dollar is stabilizing; reports suggest the White House is developing a plan to reopen the US economy sooner rather than later. Both Hong Kong and Singapore just tightened restrictions on gathering and movement. FOMC minutes for the March 15 decision will be released today.

Read More »

Read More »

Fragile, Not Fortified

On Sunday, Argentina’s government announced it was postponing payment on any domestically-issued debt instruments denominated in foreign currencies. That means dollars, just not Eurobonds. At least not yet. In response, ratings agencies such as Fitch declared the maneuver a distressed debt exchange.In other words, technically a default.

Read More »

Read More »

Restricted Market Trading Comments

With many markets still under lockdown and some going out on Easter holidays this week, we continue to see amended trading hours. The most notable change has been in India with a reduction in trading hours, while in Nigeria we saw a small amount of liquidity being released by the Central Bank of Nigeria (CBN). Below are our updates for the week.

Read More »

Read More »

It’s Hard To See Anything But Enormous Long-term Cost

The unemployment rate wins again. In a saner era, back when what was called economic growth was actually economic growth, this primary labor ratio did a commendable job accurately indicating the relative conditions in the labor market. You didn’t go looking for corroboration because it was all around; harmony in numbers for a far more peaceful and serene period.

Read More »

Read More »

Dollar Mixed, Equities Higher as Virus News Stream Improves

It was a relatively good weekend in virus-related news; measures of implied volatility continue to trend lower. The dollar is trying to build on its recent gains; investors continue to try and gauge just how bad the US economy will get hit. The outlook for oil prices remains highly uncertain and volatile.

Read More »

Read More »

If Lockdown Is a Needless Over-Reaction, Then Why Did China Lockdown Half its Economy?

Recall that the initial deaths and related costs are only the first-order effects; policy makers have to consider the second-order effects. Everyone who reckons that the lockdown is needless and more destructive than the pandemic that triggered it has to answer this question: then why did China lockdown half its economy?

Read More »

Read More »

EM Preview for the Week Ahead

EM may get a little support from a potential OPEC+ deal to limit oil. Even if a deal is struck, the impact is likely to be fleeting as the global growth outlook remains terrible. We remain negative on EM for the time being.

Read More »

Read More »