Category Archive: 5) Global Macro

How gene editing could reduce the cost of cosmetics

The cosmetics business has exploited natural resources for centuries. With consumers now demanding more sustainable products, gene-editing technology could give the industry a makeover—and make cosmetics cheaper.

00:00 - Could gene editing make cosmetics more sustainable?

01:01 - Hunting sharks for skincare

02:58 - How does synthetic biology work?

05:39 - What is the environmental cost of plant-based cosmetics?

07:45 - Can engineered microbes...

Read More »

Read More »

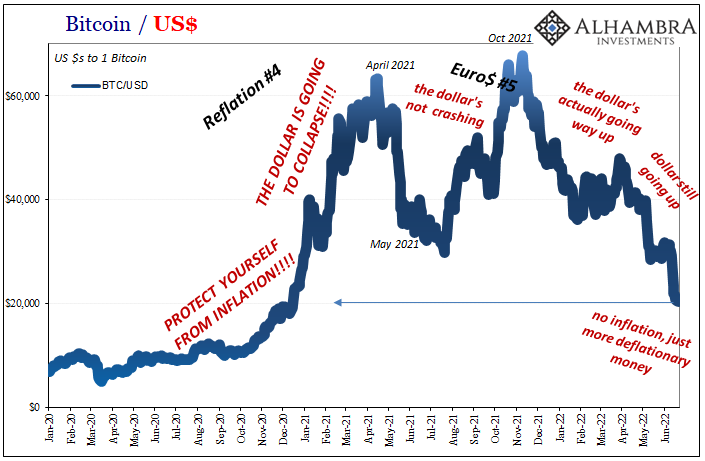

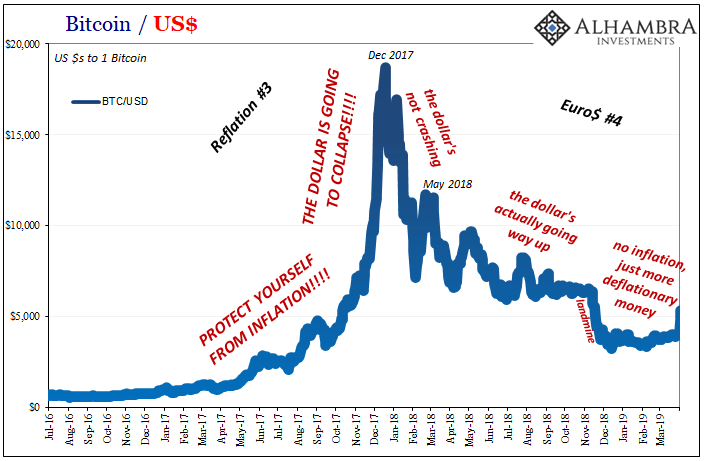

Everything Hitting The Global (eurodollar) Wall

Over the weekend, Bitcoin tumbled again. Reaching an ultra-ugly low of $17,641 (before retracing back above $20k), even the self-styled premier digital “store of value” has thrown in the towel. As I wrote last week, winter isn’t coming it is here.

Read More »

Read More »

The Difference Between a Forecast and a Guess

Every forecast or guess has one refreshing quality: one will be right and the rest will be wrong. What's the difference between a forecast and a guess? On one level, the answer is "none": the future is unknown and even the most informed forecast is still a guess.

Read More »

Read More »

Angry April TIC Zeroed In On China’s CNY and Japan’s JPY

If the March gasoline/oil spike hit a weak global economy really hard and caused what more and more looks like a recessionary shock, a(n un)healthy part of it was the acceleration of Euro$ #5 concurrently rippling through the global reserve system.

Read More »

Read More »

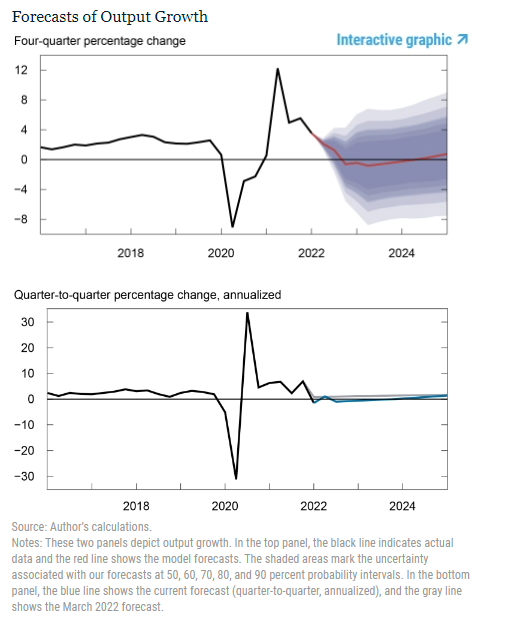

Sorry Chairman Powell, Even FRBNY Now Has To Forecast Serious and Seriously Rising Recession Risk

At his last press conference, Federal Reserve Chairman Jay Powell made a bunch of unsubstantiated claims, none of which were called out or even questioned by the assembled reporters. These rituals are designed to project authority not conduct inquiry, and this one was perhaps the best representation of that intent. Powell’s job is to put the current predicament in the best possible light, starting by downplaying the current predicament.

Read More »

Read More »

Could Retail “Bagholders” Spark a Rally “Smart Money” Will Be Forced to Chase?

There would be some deliciously karmic justice in the "dumb money" driving a rally that forced the "smart money" to cover their shorts and chase the rally that shouldn't even be happening.

Read More »

Read More »

Alien life: are we about to find it?

The thought of finding alien life has fascinated people since the time of the ancient Greeks—but developments in astrobiology could be about to turn this possibility into reality. How do you hunt for life beyond Earth—and might this be the decade when we find it?

00:00 - Is there life beyond Earth?

00:56 - How has the search for life evolved?

02:36 - What signs of life are scientists looking for?

03:48 - What are biosignatures?

04:28 - How to find...

Read More »

Read More »

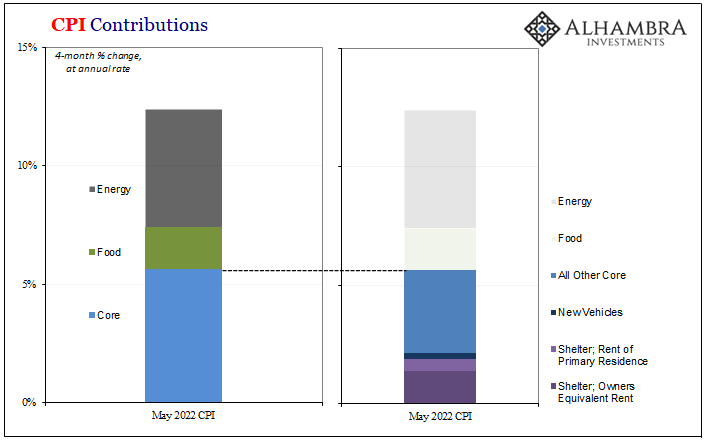

Curve Inversion 101: US CPI Politics Up Front, China PPI Down(ing) The Back

While the world fixated on the US CPI, it was other “inflation” data from across the Pacific that is telling the real economic story. Having conflated the former with a red-hot economy, the fact American consumer prices aren’t tied to the actual economic situation has been lost in the shuffle of the FOMC’s hawkishness, with markets obliged to price wrong-way Jay.

Read More »

Read More »

War in Ukraine: is Putin ill? | The Economist

Speculation about Vladimir Putin’s health has intensified since the start of the war in Ukraine—including rumours of blood cancer, Parkinson’s and paranoia. Could the Russian dictator be seriously ill?

00:00 - Is Putin sick?

00:52 - What’s driving the speculations of Putin’s ill health?

03:24 - What do the rumours suggest about Putin's power?

04:16 - The future of the Kremlin

Sign up to our daily newsletter for the latest coverage:...

Read More »

Read More »

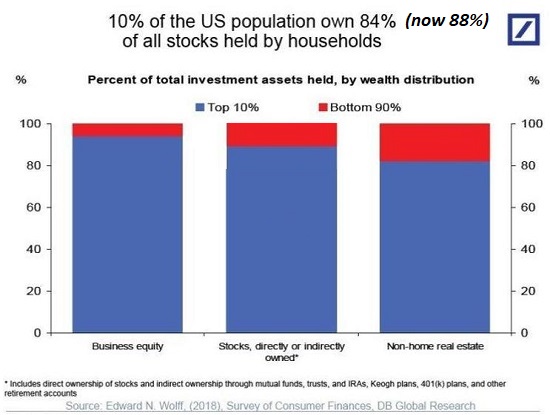

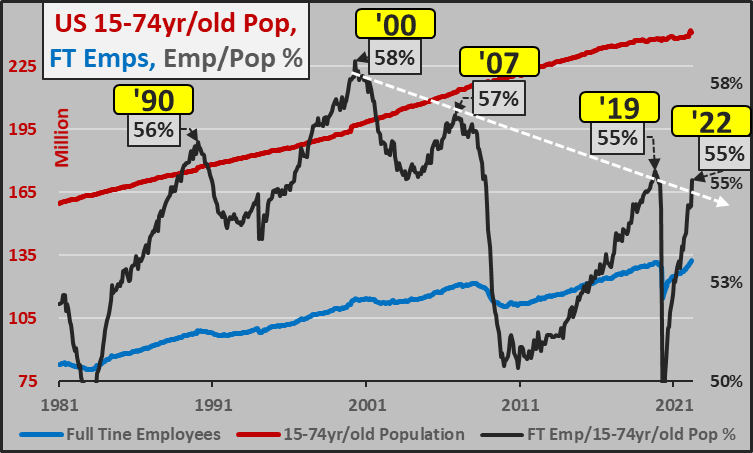

What Happens When the Workforce No Longer Wants to Work?

Workers are voting with their feet, and that's difficult to control. When values and expectations change, everything else eventually changes, too. What happens when the workforce no longer wants to work? We're about to find out. As with all cultural sea changes, macro statistics don't tell the full story.

Read More »

Read More »

It’s Not Nothing, It’s Everything (including crypto)

Markets got aggressive long before the FOMC did. Everything, and I mean everything, has been trending the other way. Jay Powell says inflation risks are most pressing when markets have consistently priced the opposite for a whole lot longer.

Read More »

Read More »

Prices As Curative Punishment

It wasn’t exactly a secret, though the raw data doesn’t ever tell you why something might’ve changed in it. According to the Bureau of Economic Analysis, confirmed by industry sources, US new car sales absolutely tanked in May 2022.

Read More »

Read More »

Update The Conflict of Interest Rate(s)

What changed? For over a month, the Treasury market had the Fed and its rate hiking figured out. Rising recession risks had been confirmed by almost every piece of incoming data, including, importantly, labor data.

Read More »

Read More »

Simple Economics and Money Math

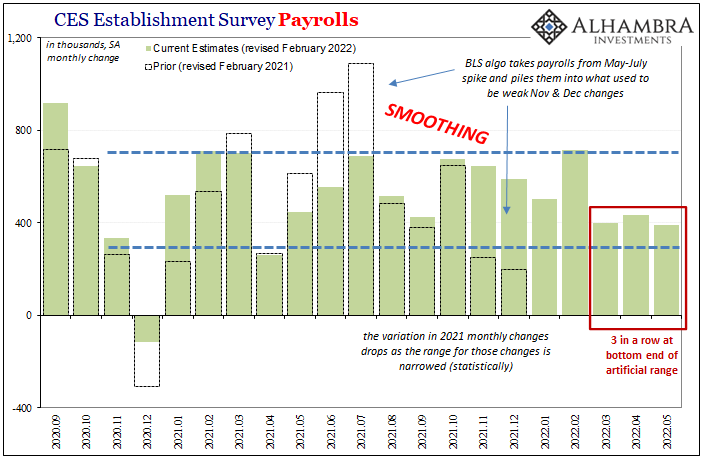

The BLS’s most recent labor market data is, well, troubling. Even the preferred if artificially-smooth Establishment Survey indicates that something has changed since around March. A slowdown at least, leaving more questions than answers (from President Phillips).

Read More »

Read More »

“Inflation” Not Inflation, Through The Eyes of Inventory

It isn’t just semantics, nor some trivial, egotistical use of quotation marks. There is an actual and vast difference between inflation and “inflation.” And in the final results, that difference isn’t strictly or even mainly about consumer prices.Who cares, most people wonder. After all, what does it really matter why prices are going up so far?

Read More »

Read More »

A Volcker Pan Recession

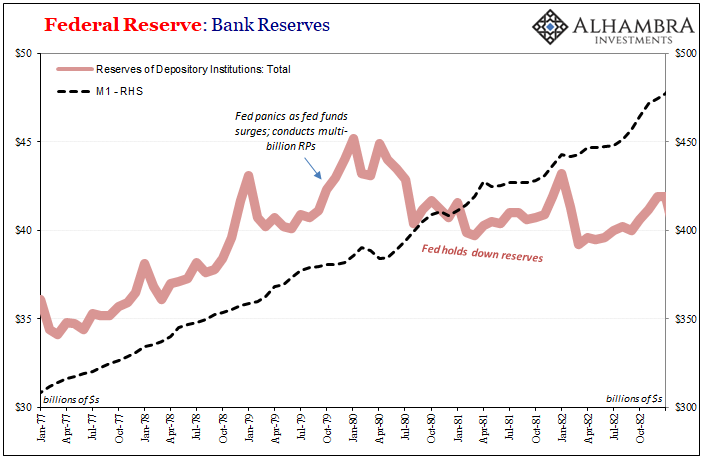

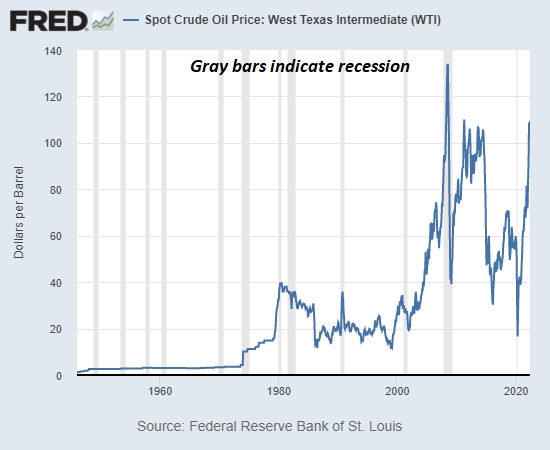

The Volcker Myth is simple because there isn’t math for it just voodoo economics (to borrow George HW Bush’s phrase). In theory, the FOMC finally realized after more than a decade of currency devastation and its economic, financial, and social consequences, hey, inflation and money.

Read More »

Read More »

How does raising interest rates control inflation? | The Economist

When central banks raise interest rates, the impact is felt far and wide. Mortgages become more expensive, house prices might fall and unemployment can rise. So why do central banks do it? This film tells you why.

00:00 - Why should you care about rising interest rates?

00:45 - What are interest rates?

01:36 - What do central banks do?

02:14 - Why do central banks raise interest rates?

03:12 - How do raised interest rates affect consumers?

04:30 -...

Read More »

Read More »

There’s No Stopping a Recessionary Reckoning

If there was only one causal factor nudging the economy into recession, it might be a mild, brief recession. But with all five conditions in confluence, this recession will be unlike any other. Recessions reliably arise from the confluence of these conditions. Note that any one condition can trigger a recession, but no one condition guarantees a recession.

Read More »

Read More »

Sky High Inflation May Mean Another Hefty Social Security Increase in 2023

In 2022, Social Security recipients got a 5.9% cost-of-living adjustment (COLA). That was the largest increase in 40 years. The COLA coming in 2023 may be even bigger.

Read More »

Read More »