Category Archive: 5) Global Macro

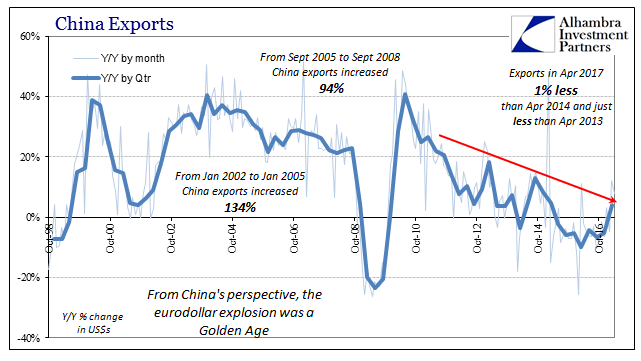

Lackluster Trade, China April Edition

China’s trade statistics for April 2017 uniformly disappointed. They only did so, however, because expectations are being calibrated as if the current economy is actually different. It is instead merely swinging between bouts of contraction and low-grade growth, but so low-grade it really doesn’t qualify as growth.

Read More »

Read More »

Charles Hugh Smith On How Financial Repression Is Affecting Millennial Generation Values

Today’s topic is the millennial generation and how financial repression has resulted in asset bubbles that ultimately have affected the millennials in terms of their values and how they view the economy and life. As well as what they’re facing in terms of the housing market and the job situation. Click here for the full …

Read More »

Read More »

How to win a bid to host the Olympics

Tessa Jowell brought the idea of London hosting the Olympic games to the table. She shares with us her tips on how to win the race to stage the greatest show on earth. Click here to subscribe to The Economist on YouTube: http://econ.st/2zF0LIE On the 16th May the International Olympic Committee’s evaluation group will visit …

Read More »

Read More »

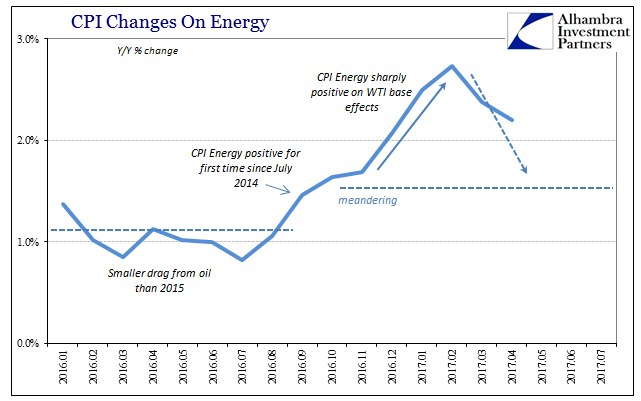

Inflation Is Oil, But Inflation Is Much More Than Consumer Prices

The average annual change in the WTI benchmark price was in April about 25%. That was still a sizable increase year-over-year, and just marginally less than March’s average of 33%. For calculated inflation rates, it represents the last of the base effects that have to this point made it appear as if economic improvement was possibly serious.

Read More »

Read More »

The CEO of Lloyd’s of London discusses how to run a successful business through diverse thought

Dame Inga Beale is the first openly bisexual chief executive of Lloyd’s of London. She’s a champion of diversity in the boardroom because it can help companies connect to a wider market and bring greater financial returns Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Industry leaders like Inga Beale have acknowledged the …

Read More »

Read More »

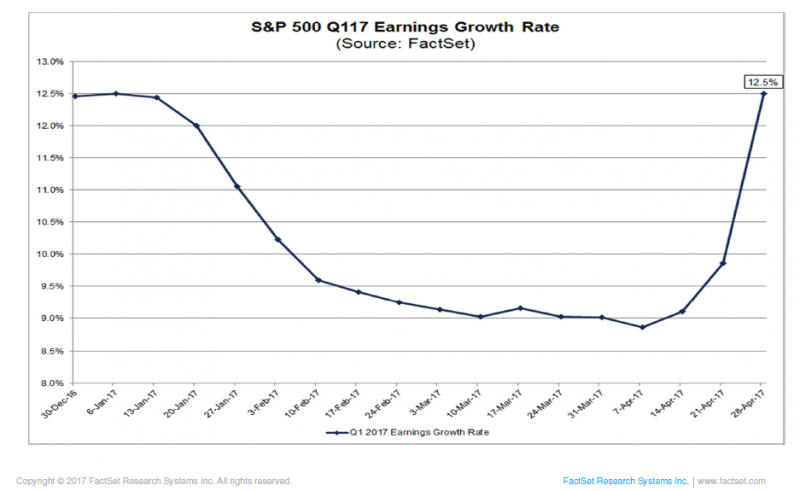

Earnings Update – The Proof of the Pudding is in the Eating

The first quarter just seemed to zoom by this year, bringing continued optimism (or, animal spirits if you prefer) to the stock market and leaving even higher valuations in its wake. The Standard & Poor’s 500 Index returned an impressive 6.07% for the quarter, on the tail of the previous five consecutive quarters of positive performance.

Read More »

Read More »

Charles Hugh Smith: Millennials Will Change The Economy Forever

Get Immediate Access to our Exclsuive Crypto Report At: http://www.wealthresearchgroup.com/bi… Get Immediate Access To Wealth Research Group’s Complete Junior Stocks Manual AT: http://www.wealthresearchgroup.com/go… Get Immediate Access to Our Exclusive Report On The New Cryptocurrency Following Bitcoin Footsteps AT: http://www.wealthresearchgroup.com/bi… Get our Full Analysis on Gold, Silver & Mining here:...

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended last week on a firmer note, helped by lower US rates and softer than expected CPI and retail sales data. Stabilizing commodity prices also helped EM. Yet these supportive conditions seem unlikely to persist, and we remain defensive on EM.

Read More »

Read More »

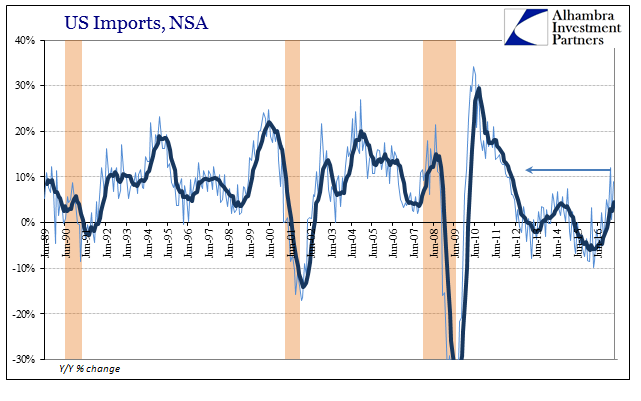

Lackluster Trade

US imports rose 9% year-over-year (NSA) in March 2017, after being flat in February and up 12% in January. For the quarter overall, imports rose 7.3%, a rate that is slightly more than the 2013-14 comparison. The difference, however, is simply the price of oil.

Read More »

Read More »

Emerging Markets: What Has Changed

Moon Jae-in was elected president of South Korea. Philippine President Duterte named Nestor Espenilla as central bank governor. Nigerian President Buhari traveled to London for a follow-up to the initial medical visit earlier this year. Market expectations for 2018 inflation in Brazil rose for the first time in more than a year. Peru's central bank unexpectedly started the easing cycle with a 25 bp cut to 4.0%.

Read More »

Read More »

The Wrong People Have An Innate Tendency To Stand Out

I don’t think Milton Friedman would have made much of chess player. For all I know he might have been a grand master or something close to that rank, but as much as his work is admirable it invites too the whole range of opposite emotion. He was the champion libertarian of the free market who rescued economics from the ravages of New Deal socialism, but in doing so he simply created the avenue for where Economics of that kind could be transposed...

Read More »

Read More »

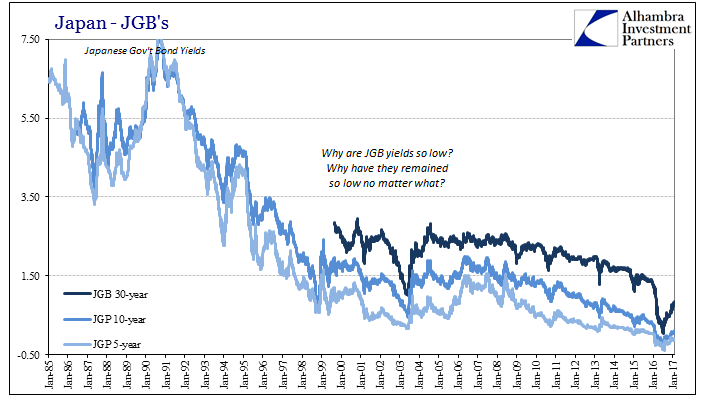

Noose Or Ratchet

losing the book on Q4 2016 balance sheet capacity is to review essentially forex volumes. The eurodollar system over the last ten years has turned far more in this direction in addition to it becoming more Asian/Japanese. In fact, the two really go hand in hand given the native situation of Japanese banks.

Read More »

Read More »

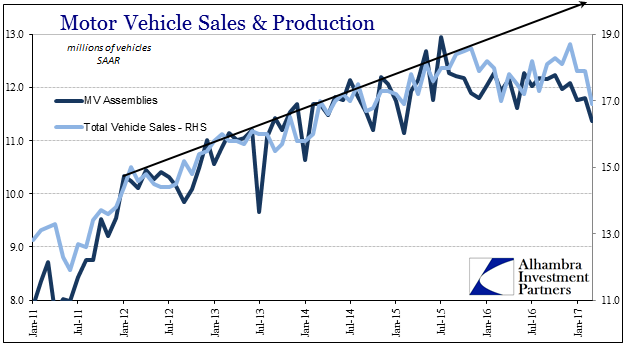

Auto Pressure Ramps Up

The Los Angeles Times today asked the question only the mainstream would ask. “Wages are growing and surveys show consumer confidence is high. So why are motor vehicle sales taking a hit?” Indeed, the results reported earlier by the auto sector were the kind of sobering figures that might make any optimist wonder.

Read More »

Read More »

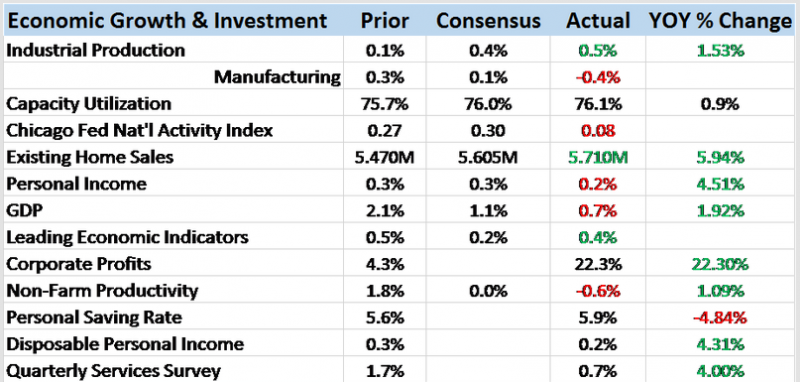

Bi-Weekly Economic Review

The economic reports since the last economic update were generally less than expected and disappointing. The weak growth of the last few years had been supported by autos and housing while energy has been a wildcard. When oil prices fell, starting in mid-2014 and bottoming in early 2016, economic growth suffered as the shale industry retrenched.

Read More »

Read More »

How many countries in the world are fully democratic?

What makes a democracy? Members of the public discuss what constitutes a democratic country, and how many true democracies exist. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like …

Read More »

Read More »

Emerging Markets Preview

EM FX got some limited traction as the week closed, helped by stabilizing commodity prices. However, oil, copper, and iron ore have all broken important technical levels that suggest further weakness ahead. We also think the FOMC and jobs data support our view that the next Fed hike will be in June. This backdrop should keep EM on the defensive this week.

Read More »

Read More »

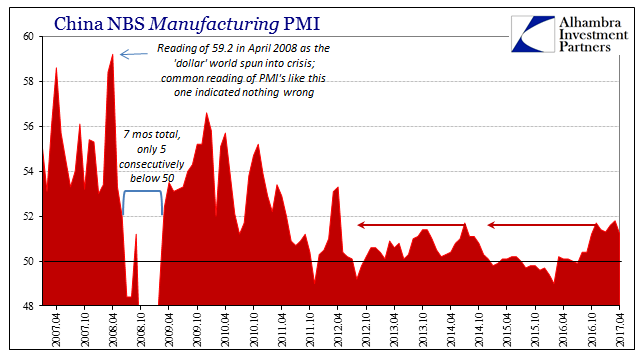

China: Blatant Similarities

Declines in several of the world’s PMI’s in April have furthered doubts about the global “reflation.” But while many disappointed, some sharply, it isn’t just this one month that has sown them. In China, for example, both the manufacturing and non-manufacturing sentiment indices declined to 6-month lows.

Read More »

Read More »

Emerging Markets: What has Changed

Relations between China and North Korea appear to be worsening. The THAAD missile shield has been deployed earlier than expected in South Korea. An amendment to India’s Banking Regulation Act gives the RBI more power to address bad loans. Tensions are rising between Czech Prime Minister Sobotka and Finance Minister Babis. Brazil pension reform bill was passed 23-14 in the lower house special committee.

Read More »

Read More »

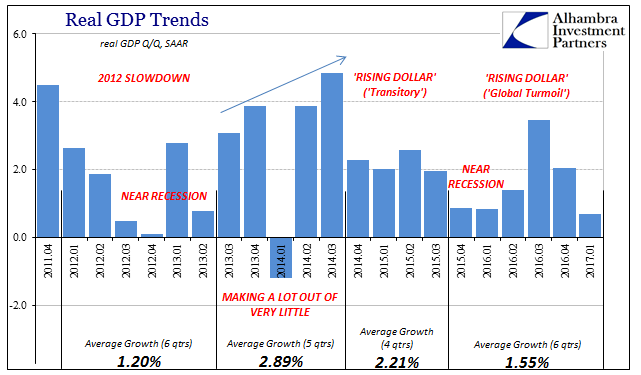

This Is Not Expansion

Back in October, the Bureau of Economic Analysis released GDP figures that suggested what those behind “reflation” had hoped. After a near miss to start 2016, the economy had shaken off the effects of “transitory” weakness, mainly manufacturing and oil, poised to perform in a manner consistent with monetary policy rhetoric.

Read More »

Read More »