Category Archive: 5) Global Macro

China Imports and Exports: The Ghost Recovery

To the naked eye, it represents progress. China has still an enormous rural population doing subsistence level farming. As the nation grows economically, such a way of life is an inherent drag, an anchor on aggregate efficiency Chinese officials would rather not put up with.

Read More »

Read More »

Emerging Markets: What has Changed

Pakistani Prime Minister Nawaz Sharif may face trial on corruption charges. Turkey will reportedly pay $2.5 bln for a Russian missile defense system. Nigeria said it was willing to cap its oil production to support OPEC efforts to cut global supply. Former Brazilian President Lula was sentenced to nine and half years in prison on corruption charges. S&P downgraded Chile one notch to A+ with a stable outlook.

Read More »

Read More »

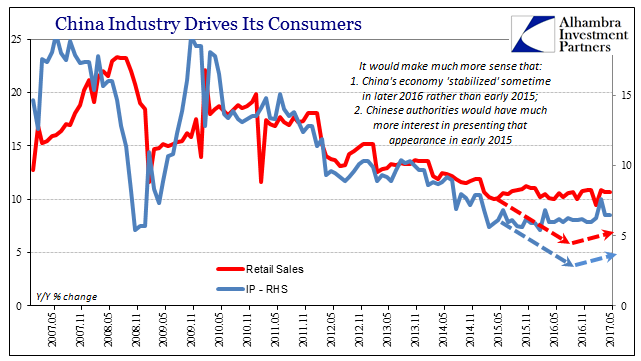

Competing CPI,PPI, Industrial Production and Retail Sales: No Luck China, Either

Former IMF chief economist Ken Rogoff warned today on CNBC that he was concerned about China. Specifically, he worried that country might “export a recession” to the rest of Asia if not the rest of the world. I’m not sure if he has been paying attention or not, but the Chinese economy since 2012 has been doing just that to varying degrees often just shy of that level.

Read More »

Read More »

The World If…humans could control weather | The Economist

What if people could control the weather? It wouldn’t be all sunshine and blue skies—there would likely be much disagreement. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like …

Read More »

Read More »

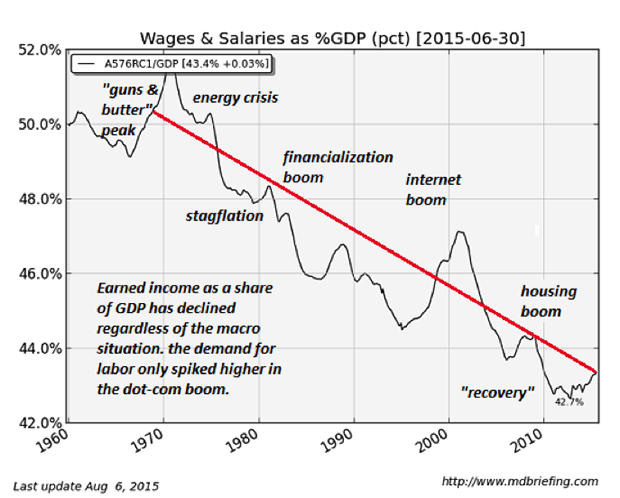

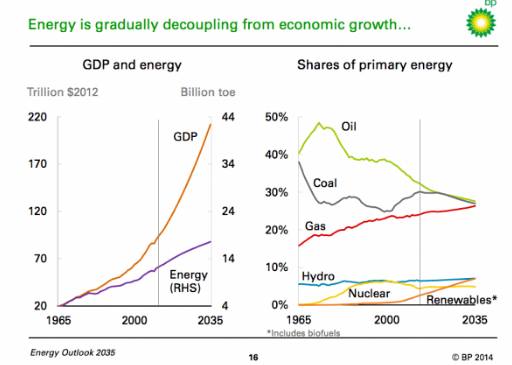

The Inevitability Of DeGrowth

Debt-dependent consumption in a world in which wages stagnate for the bottom 90% and energy costs increase as demand outstrips supply is a system with only one possible end-point: collapse. Even though we don't know precisely how the future will unfold, we know a few things: Of the 7.5 billion humans on the planet, virtually every individual wants to enjoy a high-energy consumption “middle-class” lifestyle.

Read More »

Read More »

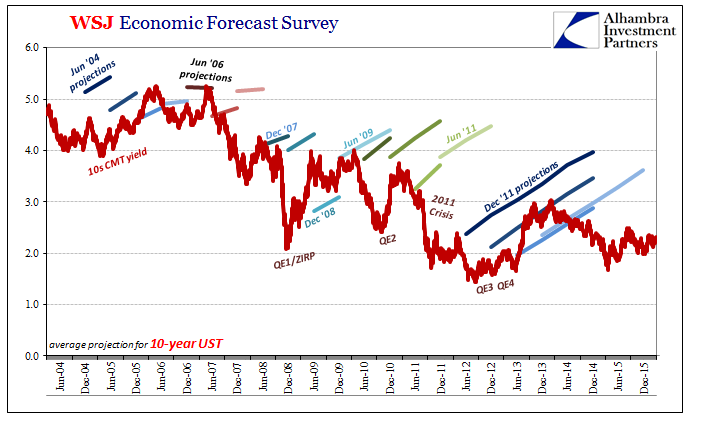

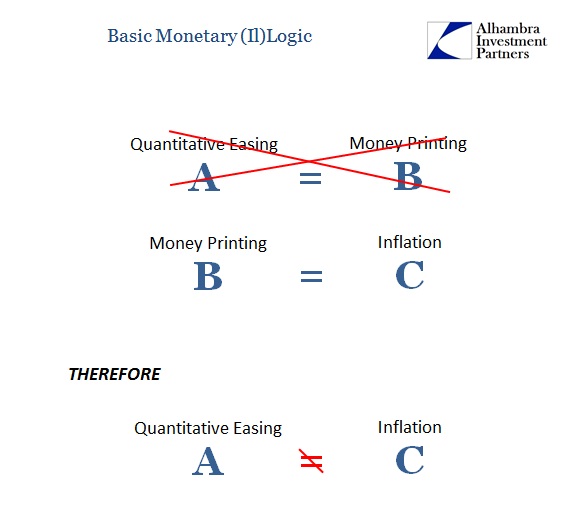

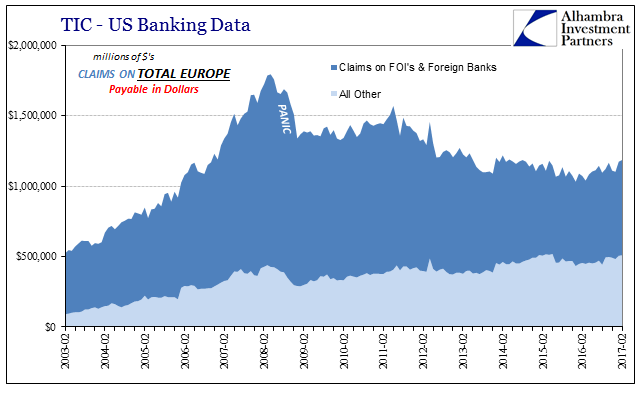

US Federal Funds, Bond Market and WSJ Economic Survey: The Hidden State of Money

Correctly interpreting the bond market is more than just how and when to invest your money in UST’s. Not that it isn’t useful in such a money management capacity, but interest rates starting at the risk-free tell us a lot about what is wholly unseen. There is simply no way to directly observe inside an economy what is taking place at all levels and in all transactions. We try to estimate as best we can in the aggregate, but the real economy works...

Read More »

Read More »

We Need a New American (Social) Revolution

The solution is a new decentralized way of living that bypasses the chokepoints of centralized political and financial power. I'm going to tell a story here using charts--a story that leads to one conclusion: we need a New American Social Revolution.

Read More »

Read More »

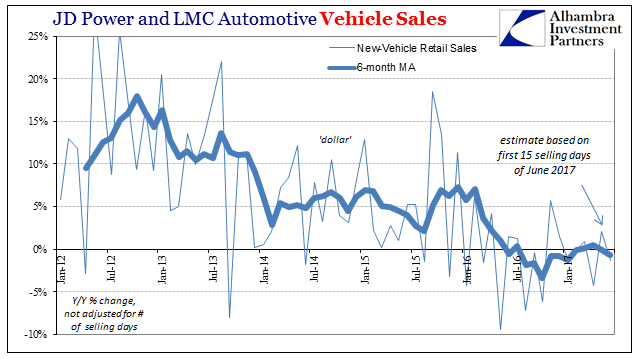

Vehicle Sales, Consumer Price Index and Average Weekly Hours: More Than Minor Auto Potential

According to Edmunds.com, in June 2017 the average length of a new vehicle loan has been stretched to a record 69.3 months. JD Power says that incentives last month were running at more than 10% of MSRP, the eleventh time over the past twelve months where manufacturers have so heavily discounted. And yet, the auto industry would have us believe that the problem is one of fleet sales rather than of consumers.

Read More »

Read More »

Which countries allow an option other than male or female on passports? | The Economist

Eight countries allow citizens to apply for a passport without choosing a specific gender. Can you guess which? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist …

Read More »

Read More »

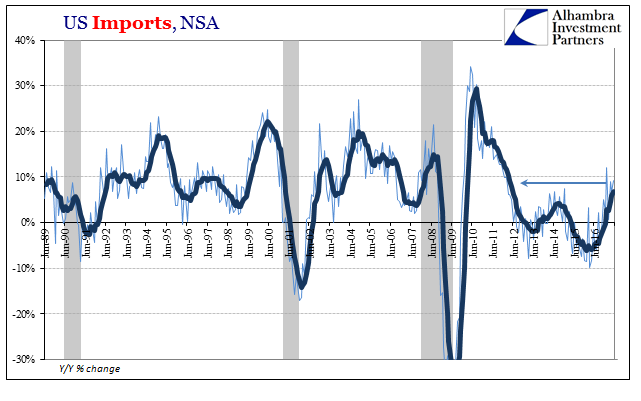

US Imports, Exports and Trade Stalls, Too

US imports rose year-over-year for the seventh straight month, but like factory orders and other economic statistics there is a growing sense that the rebound will not go further. The total import of goods was up 9.3% in May 2017 as compared to May 2016, but growth rates have over the past five months remained constrained to around that same level. It continues to be about half the rate we should expect given the preceding contraction.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX closed last week on a firm note, as the stronger than expected US jobs gain was mitigated by lower than expected average hourly earnings. Still, we believe that global liquidity conditions will continue to move against EM, as the Fed continues tightening and others join in.

Read More »

Read More »

Global Manufacturing PMI’s, Inflation and CPI: Some Global Odd & Ends

When it comes to central bank experimentation, Japan is always at the forefront. If something new is being done, Bank of Japan is where it happens. In May for the first time in human history, that central bank’s balance sheet passed the half quadrillion mark.

Read More »

Read More »

Emerging Markets: What has Changed

The US confirmed North Korea's claims that it tested an intercontinental ballistic missile. The Pakistani rupee was devalued, prompting a new central bank governor to be named. Vietnam’s central bank cut interest rates for the first time since March 2014. Egypt’s central bank surprised markets with a 200 bp hike to 18.75%. South Africa's ruling ANC reportedly proposed that SARB be state-owned. Petrobras announced two separate cuts to fuel prices.

Read More »

Read More »

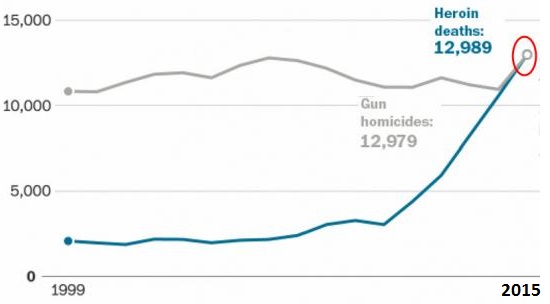

The Real Cause of the Opioid Epidemic: Scarcity of Jobs and Positive Social Roles

The employment rate for males ages 25-54 has been stairstepping down for 30 years, but it literally fell off a cliff in 2009. We all know there is a scourge of addiction and premature death plaguing the nation, a scourge that is killing thousands and ruining millions of lives: the deaths resulting from the opioid epidemic (largely the result of "legal" synthetic narcotics) are mounting at an alarming rate: We also know that the proximate cause of...

Read More »

Read More »

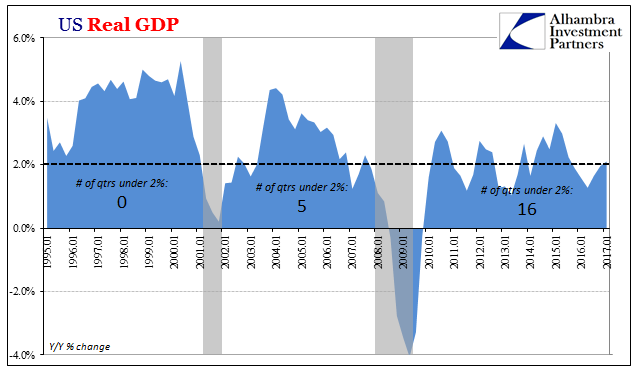

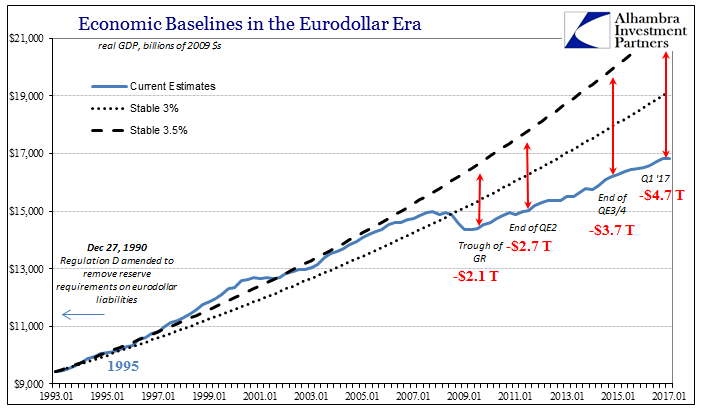

U.S. Gross Domestic Products: Near Record Expansion (Really Reduction)

Real GDP in the US was revised up to 1.41% quarter-over-quarter (annual rate), still the fourth of the last six to be less than 1.5%. While economists and policymakers have taken to judging the economy by its downside, that is only because the extent of the global problem is revealed by complete absences of an upside. The occasional decent quarter doesn’t come close to making up for the more plentiful disappointing ones, let alone to still resolve...

Read More »

Read More »

KAL draws… Donald Trump and Kim Jong Un

Kim Jong Un is in the wrestling ring with Donald Trump and Xi Jinping in KAL’s depiction of this week’s stories. The Economist’s editorial cartoonist explains why. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ Check out …

Read More »

Read More »

Pending Home Sales: Home Attitude Adjustments

The National Association of Realtors (NAR) reported today that pending home sales declined for the third straight month. As with so many other accounts, it’s not really the downside that is relevant but how instead there has been little to no growth for quite some time now. The NAR’s index value, which is how the organization reports the level of pending sales, was 108.5 in May 2017. That’s up 42% from the low in 2010, but also slightly less than...

Read More »

Read More »

Maybe Deep Dissatisfaction Has A Point

To complete a trifecta, maybe someone could interview Alan Greenspan about rational exuberance. The last of the latest Fed Chairmen, Janet Yellen, purports today that the next financial crisis will not be in “our lifetimes.” The issue, however, isn’t even crisis so much as credibility. Given that she and the rest of them had no idea about the last one until it was almost over, we might be forgiven for rejecting her thesis outright – and it having...

Read More »

Read More »

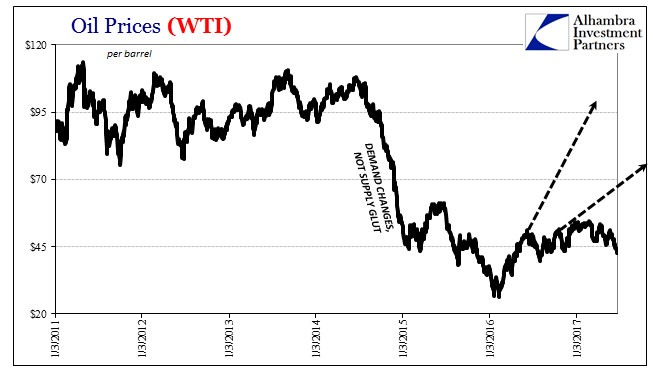

Oil Prices and Manufacturing PMI: No Backing Sentiment

When the price of oil first collapsed at the end of 2014, it was characterized widely as a “supply glut.” It wasn’t something to be concerned about because it was believed attributable to success, and American success no less. Lower oil prices would be another benefit to consumers on top of the “best jobs market in decades.”

Read More »

Read More »

Weird Obsessions

People often ask why I care so much about China. In some ways the answer is obvious, meaning that China is the world’s second largest economy (the largest under certain methods of measurement). Therefore, marginal changes in the Chinese economy are important to understanding our own global situation.

Read More »

Read More »