Category Archive: 5) Global Macro

The 5 Steps to World Domination

You don't need an army to achieve World Domination; all you need is enough cheap credit to buy up everything that generates the highest value and/or income.

Read More »

Read More »

Emerging Market: Preview of the Week Ahead

EM FX ended last week on a strong note, buoyed by perceived dovishness from Yellen at the Jackson Hole symposium. However, US jobs data this Friday could test the market’s convictions. Within EM, data are likely to support our view that EM central banks can retain their largely dovish posture into 2018.

Read More »

Read More »

Which is the most expensive city to live in as a foreigner? | The Economist

We asked people in Hong Kong which city they thought was the most expensive to live in as a foreigner. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like …

Read More »

Read More »

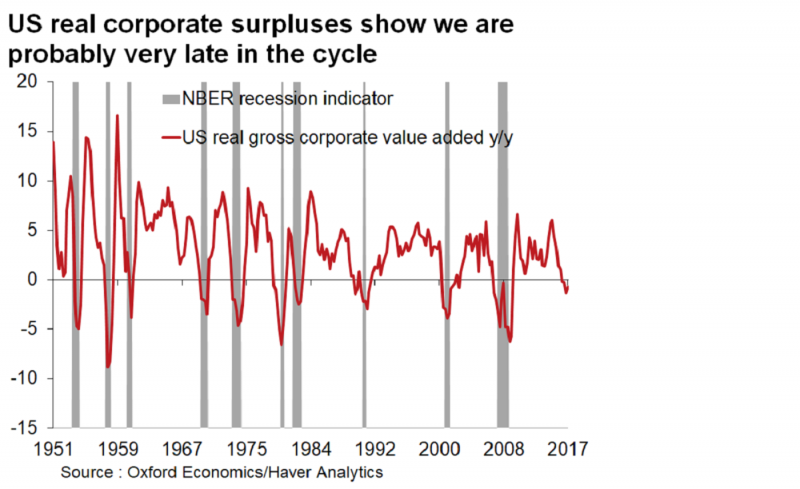

More Noise Than Signal

A number of people have forwarded this Bloomberg article – Wall Street Banks Warn Downturn Is Coming – to me over the last couple of days. That fact alone is probably a good argument to ignore it but I can’t help but read articles like this if for no other reason than to know what the crowd is thinking.

Read More »

Read More »

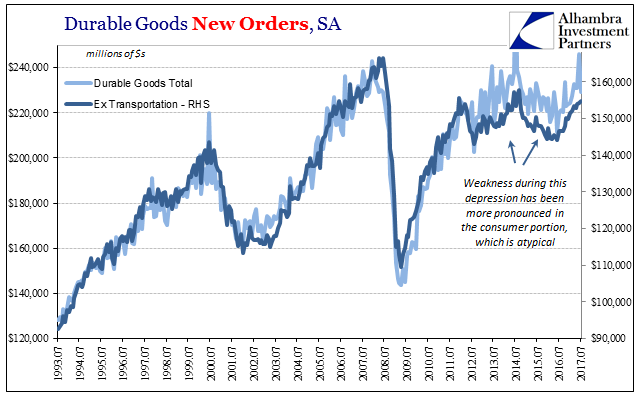

United States Durable Goods In July; Rinse, Repeat

The Census Bureau reported today updated estimates for Durable Goods in July 2017. Quite frankly, nothing has changed so minimal commentary is all that is required. The aircraft anomaly from last month faded, leaving total new orders of $229.2 billion (seasonally-adjusted). That is less than in May before the Boeing surge, and less even than estimated order volume in March 2017.

Read More »

Read More »

Did the Economy Just Stumble Off a Cliff?

This is more intuitive than quantitative, but my gut feeling is that the economy just stumbled off a cliff. Neither the cliff edge nor the fatal misstep are visible yet; both remain in the shadows of the intangible foundation of the economy: trust, animal spirits, faith in authorities' management, etc.

Read More »

Read More »

We Need a Social Revolution

In the conventional view, there are two kinds of revolutions: political and technological. Political revolutions may be peaceful or violent, and technological revolutions may transform civilizations gradually or rather abruptly—for example, revolutionary advances in the technology of warfare.

Read More »

Read More »

Amber Heard: Why being called a “bitch” in Hollywood isn’t all bad | The Economist

Amber Heard is one of Hollywood’s brightest stars. Ahead of Women’s Equality Day she talks about the dark secret of gender bias in Tinsel Town Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Amber Heard is an actress with credits including “Magic Mike XXL”, “The Danish Girl” and “Justice League”. She is also …

Read More »

Read More »

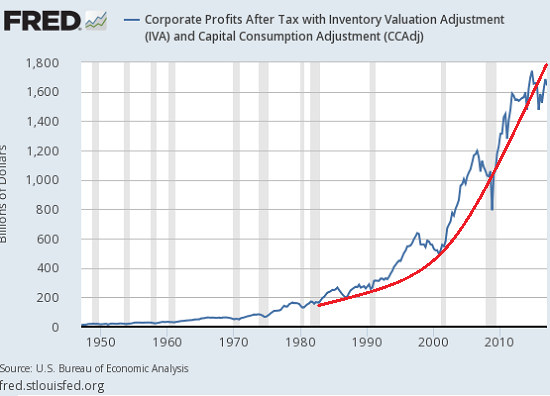

Questions

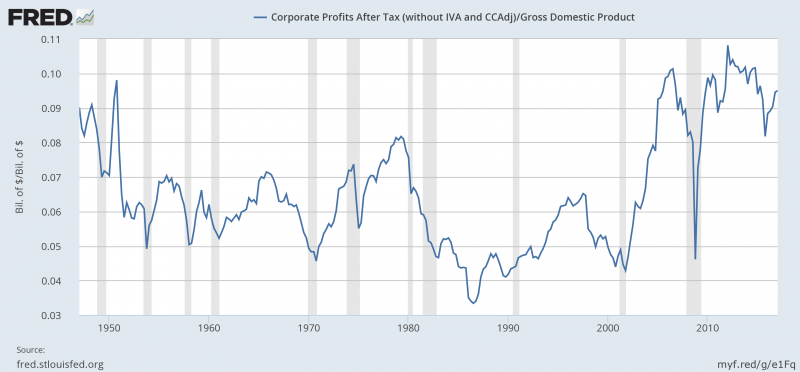

Why are profit margins persistently high? With decent earnings this quarter, corporate profits as a % of GDP will approach (maybe exceed) 10% again. That is abnormally high compared to the period 1960 to 2000. Margins actually started to rise in the mid-80s but really accelerated after 2000 and outside of the 2008 crisis have remained high. Why?

Read More »

Read More »

United States: The Fed Tries To Tighten By Rates, But The System Instead Tightens By Repo

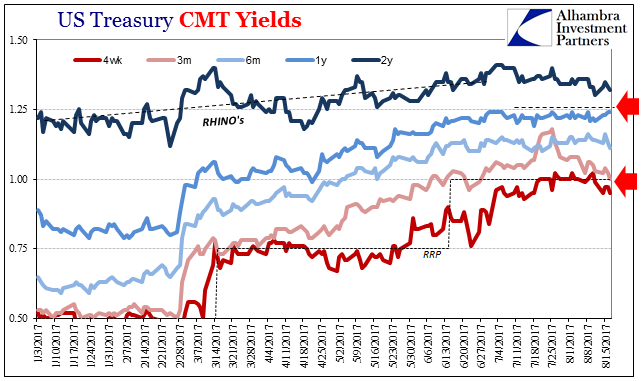

The Fed voted for the first federal funds increase in almost a decade on December 15, 2015. It was the official end of ZIRP, and though taking so many additional years to happen, to many it marked the start of recovery. The yield on the 2-year Treasury Note was 98 bps that day.

Read More »

Read More »

London: An Insiders Guide | The Economist

Throw away the tourist guide and hear about London’s best experiences from those who know the city best: its locals Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like …

Read More »

Read More »

United States: Lack Of Industrial Momentum Is (For Now) Big Auto Problems

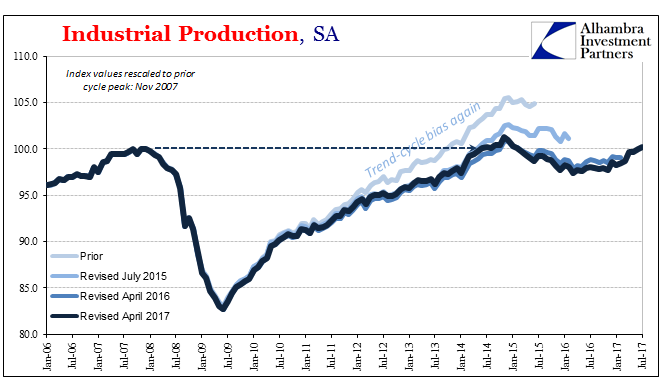

Industrial Production disappointed in the US last month, dragged down by auto production. Despite the return of an oil sector tailwind, IP was up just 2.2% year-over-year in July 2017 according to Federal Reserve statistics. It marks the fourth consecutive month stuck around 2% growth. The lack of further acceleration is unusual in the historical context, especially following an extended period of contraction.

Read More »

Read More »

Bangladesh: a country where blogging can get you killed | The Economist

Secular writers and bloggers are being hacked to death in the streets of Bangladesh for sharing their views online. But the government seems to tolerate the violence. WARNING: UPSETTING CONTENT Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: …

Read More »

Read More »

Global Asset Allocation Update: No Upside To Credit

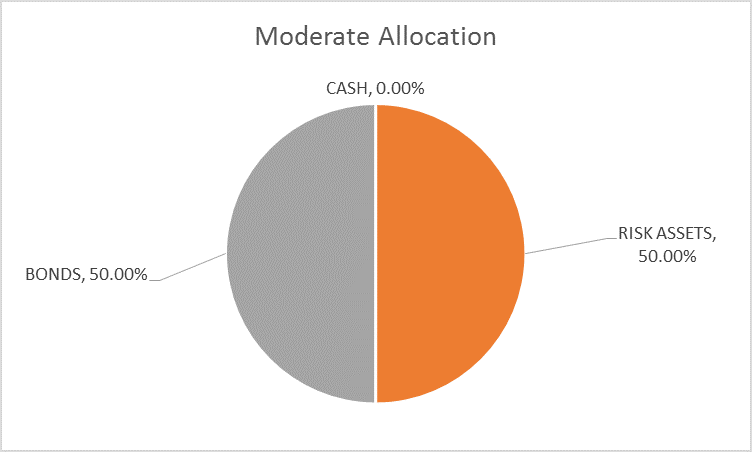

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand.

Read More »

Read More »

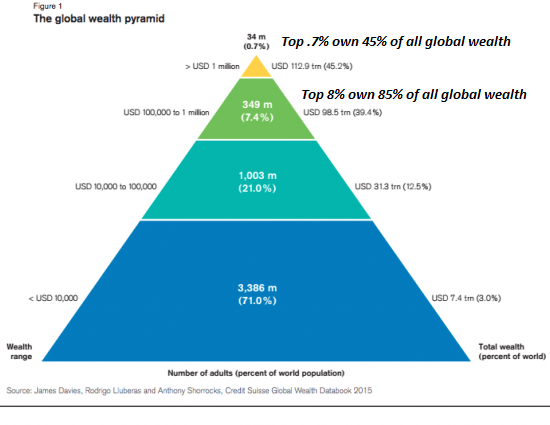

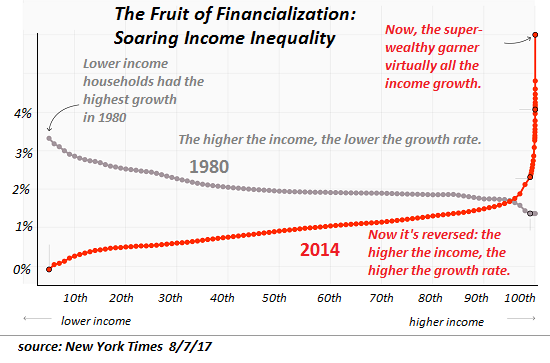

Why We’re Doomed: Our Economy’s Toxic Inequality

Why are we doomed? Those consuming over-amped "news" feeds may be tempted to answer the culture wars, nuclear war with North Korea or the Trump Presidency. The one guaranteed source of doom is our broken financial system, which is visible in this chart of income inequality from the New York Times: Our Broken Economy, in One Simple Chart.

Read More »

Read More »

United States: Still No Up

The Asian flu of the late 1990’s might have been more accurately described as the Asian dollar flu. It was the first major global test of the mature eurodollar system, and it was a severe disruption in the global economy. It doesn’t register as much here in the United States because of the dot-com bubble and the popular imagination about Alan Greenspan’s monetary stewardship in general.

Read More »

Read More »

L’impact de la délocalisation de la production sur la balance commerciale US.

Dans la série sur la balance des paiements et les zooms sur les balances commerciales, voici l’évolution de la balance commerciale américaine. Nous voyons clairement qu’elle était neutralisée à 0 durant l’ère où les devises du monde devaient être arrimées, selon les Accords de Bretton Woods, au dollar qui lui-même était partiellement couvert par l’or.

Read More »

Read More »

Data Dependent: Interest Rates Have Nowhere To Go

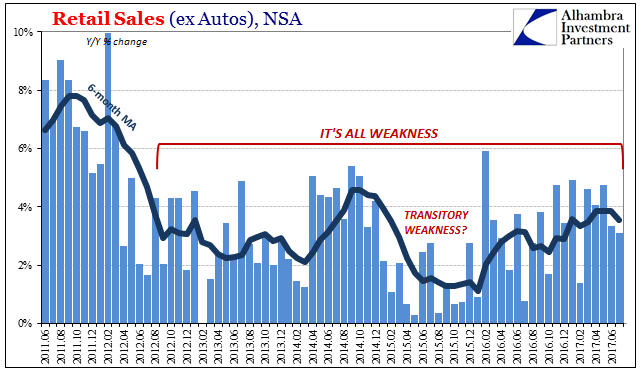

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession.

Read More »

Read More »

Could virtual reality be the future for rollercoaster rides? | The Economist

Could Virtual reality be the future for rollercoaster rides? Passengers are taken into a virtual world, wearing VR headsets while on a ride. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 The virtual reality ride faced a real challenge: how to stop passengers feeling sick? Any difference between what a passenger sees and …

Read More »

Read More »

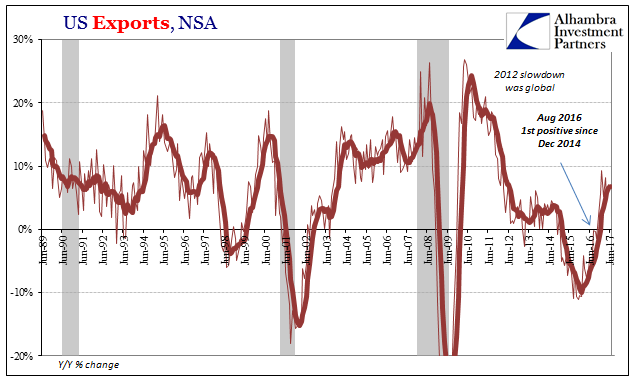

U.S. Export/Import: Losing Economic Trade

The oil effect continued to recede in late spring for more than just WTI prices or inflation rates. US trade on both sides, inbound and outbound, while still positive has stalled since the winter.

Read More »

Read More »