Category Archive: 5) Global Macro

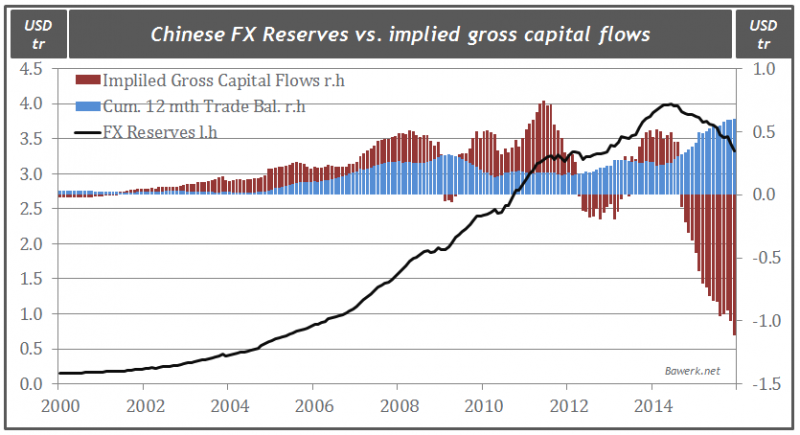

China’s 3 trillion dollar mistake

When looking at the current state of the Chinese economy it is important to note what happened leading up the ongoing predicament. By managing the USD/CNY exchange rate the Chinese factory worker was essentially funding excess consumption in the Unit...

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space, UAE (+6.2%), Indonesia (+4.0%), and Qatar (+1.8%) have outperformed this week, while Hong Kong (-2.0%), Czech Republic (-1.9%), and Hungary (-1.2%) have underperformed. To put this in better context, MSCI EM fell -0.1% this w...

Read More »

Read More »

The drone business

From agriculture to construction, drones and their pilots are popping up everywhere. Future Works features the people doing tomorrow’s jobs today. The series examines the impact of new technology in creating new jobs—and transforming existing ones. It looks beyond the gadgets to reveal what it’s like to work in the emerging industries of the future. …

Read More »

Read More »

Emerging Market Preview: Week Ahead

As we suspected, the current EM bounce still has some legs. The BOJ’s surprise easing helped EM and risk end on last week on a strong note, and we expect that to carry over into this week. Within EM, we will start to see the first readings for January. The biggest risk perhaps is the … Continue reading »

Read More »

Read More »

Drone Rangers: how the technology can catch poachers and save lives

They never leave the ground—but these are the pilots of the future… Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Future Works features the people doing tomorrow’s jobs today. The series examines the impact of new technology in creating new jobs—and transforming existing ones. It looks beyond the gadgets to reveal what it’s …

Read More »

Read More »

Can drones save the rhino?

In 2014, poachers slaughtered over 800 rhinos in Kruger National Park. But policing an area the size of New Jersey is not easy. Can drone pilots help to stop the killing? Future Works features the people doing tomorrow’s jobs today. The series examines the impact of new technology in creating new jobs—and transforming existing ones. … Continue...

Read More »

Read More »

Reflections on a revolution: Egypt, five years on

In January 2011, protesters packed Egypt’s streets to call for change. They succeeded in toppling the government, but little has changed for the better Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Check out Economist Films: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist on Facebook: https://www.facebook.com/TheEconomist/ Follow The...

Read More »

Read More »

Emerging Market Preview: Week Ahead

Singapore reports December CPI Monday, and is expected at -0.7% y/y vs. -0.8% in November. It then reports December IP Tuesday, and is expected at -6.8% y/y vs. -5.5% in November. Q4 unemployment will be reported Thursday. With deflation risks per...

Read More »

Read More »

Arrested and jailed for driving in Saudi Arabia | The Economist

Our Middle East correspondent speaks to Loujain al-Hathloul and Fahad Albutairi, a married couple, about Loujain’s arrest and incarceration for driving as a woman in Saudi Arabia Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Check out Economist Films: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist on Facebook: …

Read More »

Read More »

On the front line of the Saudi-Yemen conflict | The Economist

Saudi Arabia insists it is winning the war against Houthi rebels in Yemen. Someone should tell the rebels. Click here to subscribe to The Economist on YouTube: https://econ.st/2t0Pmye, Saudi Arabia has been waging an air campaign against Houthi rebels fighting a bloody civil war in neighbouring Yemen. It is supporting forces loyal to deposed president …

Read More »

Read More »

Delhi: the city with the most polluted air | The Economist

The World Health Organisation ranks Delhi as the world’s most polluted big city. Authorities have tried reducing the number of cars on the city’s roads to improve air quality. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy The greater Delhi area has a population around 25 million people and is home to 2.9 …

Read More »

Read More »

An interview with a Saudi female councillor | The Economist

Our editor-in-chief, Zanny Minton Beddoes, speaks to Huda Al-Jeraisy, one of Saudi Arabia’s newly elected female councillors, about her political goals and the position of women in Saudi life. Click here to subscribe to The Economist on YouTube: https://econ.st/2Fzn4ON Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: https://econ.st/2Fzez6w …

Read More »

Read More »

Being a refugee in winter

As temperatures approach freezing and migrants continue to cross into Europe in record numbers, many are getting sick. Some European governments are not doing enough

Read More »

Read More »

Can virtual reality treat PTSD? | The Economist

Explore the virtual world set to open up in 2016 – from health care to shopping, VR is about to move beyond entertainment and become a serious business. Click here to subscribe to The Economist on YouTube: http://econ.st/2F8I0jB By the end of 2016 there’ll be nearly 8 billion mobile phone connections on our planet. One …

Read More »

Read More »

Regenerating Shakespeare

From former Doctor Who David Tennant to British hip-hop star Akala – find out how the anniversary of Shakespeare’s death is being used to breath new life into his work.

Read More »

Read More »

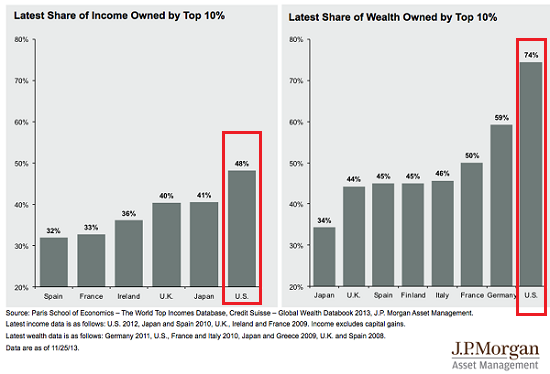

Honey, I Shrunk the Middle Class: Perhaps 1/3 of Households Qualify

If it takes more than $126,000 to fund a qualitatively defined middle class lifestyle, what sense does it even make to call this "middle"? The Pew Research Center's recent report The American Middle Class Is Losing Ground: No longer the majority and falling behind financially made a media splash, as it reported that less than 50% of adults are members of the Great American Middle Class.

Read More »

Read More »

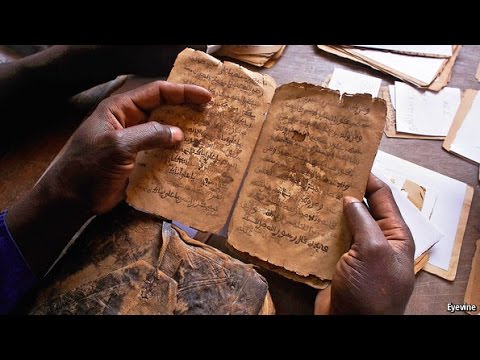

Faith’s archivists: Hand-written to hard disk

The Benedictine monks in Minnesota began backing up the world’s ancient Christian texts during the Cold War. Today, they are preserving the Islamic manuscripts of Timbuktu

Read More »

Read More »

Cleaning the ocean of plastic | The Economist

Read more here: https://goo.gl/yP3azU Plastic pollution is devastating marine wildlife and risking human infertility, birth defects and cancer. Find out why our unlikely saviour could be a 21 year old from Holland. Click here to subscribe to The Economist on YouTube: http://econ.st/2F8I0jB One of the year’s big environmental concerns will be an issue that much …

Read More »

Read More »

The World in 2016

Watch some of the biggest stories of the year ahead – before they happen. Early access to our latest film, featuring behind-the-scenes access to China’s Olympic training camps, former Doctor Who star David Tennant, the biggest environmental problem you’ve never heard of, therapeutic virtual reality and much more. Click here to subscribe to The Economist …

Read More »

Read More »