Category Archive: 5) Global Macro

A Race To The Potential Behind Bitcoin

The timing just never seems to fall in our favor. If we had had this conversation ten years ago as would have been appropriate, then this evolution might have fell perfectly in our collective laps. Just as the global financial system, really the international, interbank monetary system of the eurodollar, was crashing all around us, the genesis block of the Bitcoin blockchain was hard coded.

Read More »

Read More »

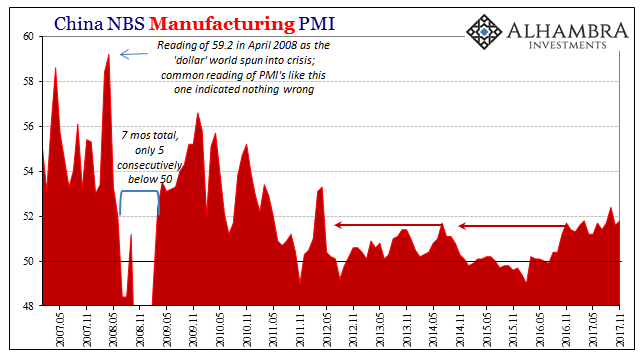

Three Years Ago QE, Last Year It Was China, Now It’s Taxes

China’s National Bureau of Statistics reported last week that the official manufacturing PMI for that country rose from 51.6 in October to 51.8 in November. Since “analysts” were expecting 51.4 (Reuters poll of Economists) it was taken as a positive sign. The same was largely true for the official non-manufacturing PMI, rising like its counterpart here from 54.3 the month prior to 54.8 last month.

Read More »

Read More »

A Radical Critique of Universal Basic Income

This critique reveals the unintended consequences of UBI. Readers have been asking me what I thought of Universal Basic Income (UBI) as the solution to the systemic problem of jobs being replaced by automation.To answer this question, I realized I had to start by taking a fresh look at work and its role in human life and society. And since UBI is fundamentally a distribution of money, I also needed to take a fresh look at our system of money.

Read More »

Read More »

Less Retail Jobs, More Amazon Robots: Get Used To It

When it comes to job creation in the United States, President Trump will be displeased to hear the latest findings from Quartz: 170,000 fewer retail jobs in 2017 - and 75,000 more Amazon robots. In November, we explained that while everyone likes to point the finger at Amazon, America’s retail apocalypse can’t be tied to just one catalyst (see: A Look At America’s Retail Apocalypse In Charts), however, fierce competition in the industry has induced...

Read More »

Read More »

What Is Money? (Yes, We’re Talking About Bitcoin)

What is money? We all assume we know, because money is a commonplace feature of everyday life. Money is what we earn and exchange for goods and services. Everyone thinks the money they’re familiar with is the only possible system of money—until they run across an entirely different system of money.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX closed on a firm note, though most currencies were down for the entire week. TRY and ZAR outperformed, but we do not think that will be sustained. FOMC meeting this week will provide some event risk for EM.

Read More »

Read More »

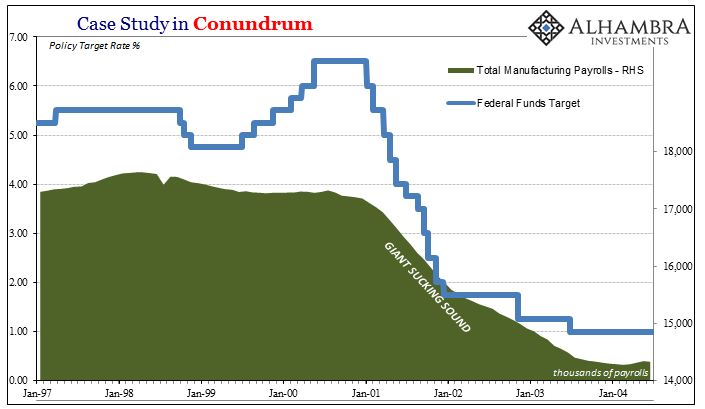

Giant Sucking Sound Sucks (Far) More Than US Industry Now

There are two possibilities with regard to stubbornly weak US imports in 2017. The first is the more obvious, meaning that the domestic goods economy despite its upturn last year isn’t actually doing anything positive other than no longer being in contraction. The second would be tremendously helpful given the circumstances of American labor in the whole 21st century so far. In other words, perhaps US consumers really are buying at a healthy pace,...

Read More »

Read More »

Reduced Trade Terms Salute The Flattened Curve

The Census Bureau reported earlier today that US imports of foreign goods jumped 9.9% year-over-year in October. That is the second largest increase since February 2012, just less than the 12% import growth recorded for January earlier this year.

Read More »

Read More »

Emerging Markets: What Changed

China eased curbs on coal use for heating in the northern provinces to cope with colder weather. Poland announced a cabinet shuffle. Poland’s lower house approved the controversial judicial reform bill. President Trump announced that the US recognizes Jerusalem as Israel’s capital. Brazil COPOM was more dovish than expected after cutting rates 50 bp to 7.0%. Chile central bank cut its 2017 and 2018 inflation forecasts and shifted to a more dovish...

Read More »

Read More »

Foreign aid: who gives the most, and where does it go? | The Economist

Rich countries are giving more in foreign aid than ever before. But which countries are the most generous? Click here to subscribe to The Economist on YouTube: http://econ.st/2AAzFCG Rich countries are giving away more in aid than at any other time on record. In 2016 more than $140bn was distributed around the world. According to …

Read More »

Read More »

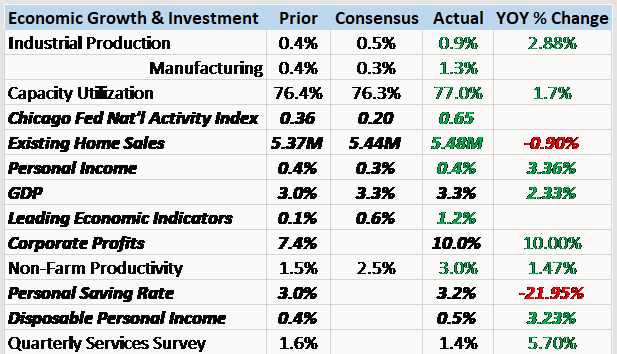

Bi-Weekly Economic Review: Who You Gonna Believe?

We’ve had a pretty good run of data recently and with the tax bill passing the Senate one would expect to see markets react positively, to reflect renewed optimism about economic growth. We have improving economic data on pretty much a global basis. It isn’t a boom by any stretch of the imagination but there is no doubt that the rate of change has recently been more positive.

Read More »

Read More »

North Korea’s nuclear threat in 2018 | The Economist

North Korea claims it can now launch missiles that can hit anywhere in mainland America. But in 2018 could the war of words between Kim Jong Un and Donald Trump spiral into nuclear catastrophe? Click here to subscribe to The Economist on YouTube: http://econ.st/2AAPWW3 In April 2018, North Korea will hold a national celebration to …

Read More »

Read More »

Shows Where To Invest When Almost Everything Is A Bubble CHARLES HUGH SMITH

Please click above to subscribe to my channel Thanks for watching! Financial News Silver News Gold Bix Weir RoadToRoota Road To Roota Kyle Bass Realist . Subscribe & More Videos: Thank for watching, Please Like Share And SUBSCRIBE!!! #jimrickards, #maneco64. Please Click Below to SUBSCRIBE for More Special Reports Videos Thanks for watching! Please click …

Read More »

Read More »

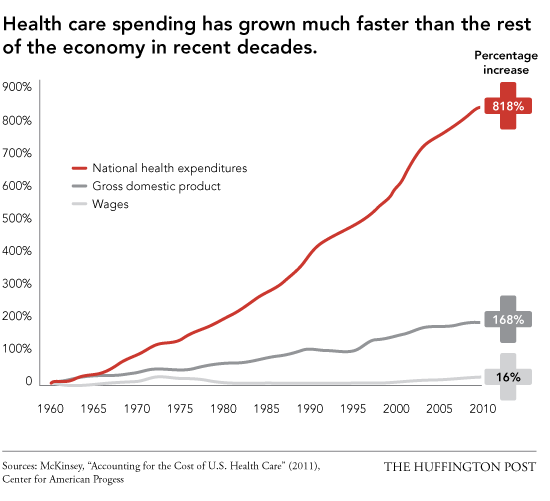

The Cost Basis of our Economy is Spiraling Out of Control

What will it take to radically reduce the cost basis of our economy? If we had to choose one "big picture" reason why the vast majority of households are losing ground, it would either be the stagnation of income or the spiraling out of control cost basis of our economy, that is, the essential foundational expenses of households, government and enterprise.

Read More »

Read More »

A plan for Palestine’s peace and prosperity | The Economist

Can Palestine become a prosperous and peaceful region? Munib al-Masri is the richest Palestinian in the world and he has a four-point plan to rebuild his homeland. Click here to subscribe to The Economist on YouTube: http://econ.st/2ATg55H This man is known as “The Godfather of Palestine’. He’s a self made billionaire. Munib al-Masri is the …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended the week on a mixed note. US jobs data may refocus market attention on Fed tightening. Most EM inflation readings this week are expected to show easing price pressures, supporting a dovish EM central bank outlook. The major exceptions are Mexico and Turkey, whose central banks may be forced to tighten policy in the coming weeks.

Read More »

Read More »

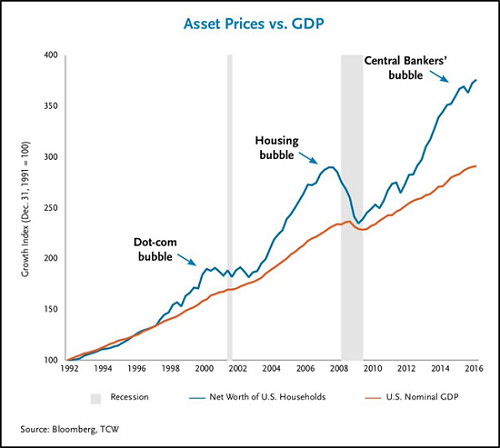

Stock Market 2018: The Tao vs. Central Banks

The central banks claim omnipotent financial powers, and their comeuppance is overdue. will be the first to admit that invoking the woo-woo of the Tao as the reason to expect a reversal of the stock market in 2018 smacks of Bearish desperation. With everything coming up roses in much of the global economy, there is precious little foundation for calling a tumultuous end to the global Bull Market other than variations of nothing lasts forever.

Read More »

Read More »

Did Anyone Do Even a Minimal Check on the Sensationalist Bitcoin Electrical Consumption Story?

Check the context before uncritically accepting sensationalist conclusions. Let's start with a primer on how to write a sensationalist story that can be passed off as "journalism:" 1. Locate credible-sounding data that can be de-contextualized, i.e. sensationalized. 2. Present the data as "fact" rather than data that requires verification by disinterested researchers.

Read More »

Read More »

Charles Hugh Smith Insights On Bitcoin and Cryptocurrencies

Click here for the full transcript with slides: http://financialrepressionauthority.com/2017/12/02/the-roundtable-insight-charles-hugh-smith-insights-on-bitcoin-and-cryptocurrencies/

Read More »

Read More »

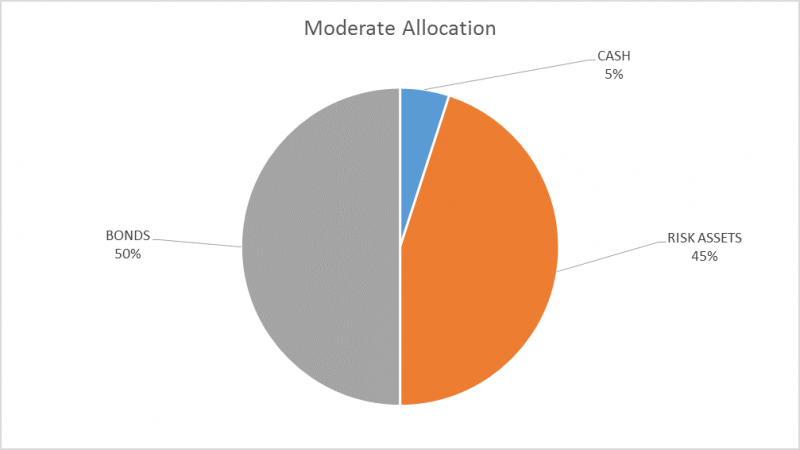

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash.

Read More »

Read More »