Category Archive: 5) Global Macro

Emerging Markets: Preview of the Week Ahead

EM ended Friday under renewed selling pressures, and capped off a mostly softer week. COP, THB, and TWD were the best performers last week, while TRY, RUB, and ZAR were the worst. Despite a widely expected 25 bp hike, this week’s FOMC meeting still has potential to weigh on EM.

Read More »

Read More »

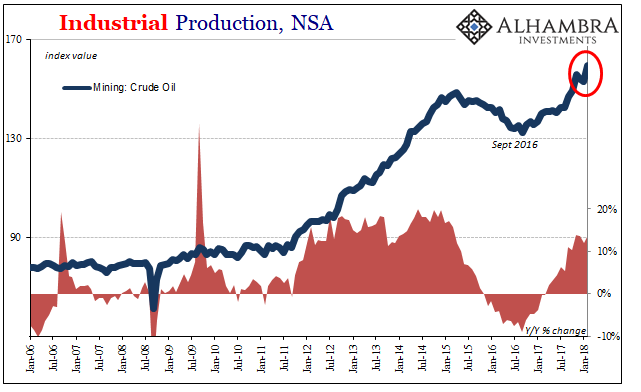

US Industry Experiences The Full 2014 Again in February

In February 2018, it was like old times for the US industrial sectors. Prior to the 2015-16 downturn, the otherwise moribund economy did produce two genuine booms. The first in the auto sector, the other in energy. Without them, who knows what the no-recovery recovery would have looked like. They were for the longest time the only bright spots.

Read More »

Read More »

Bi-Weekly Economic Review

Bob Williams and Joseph Y. Calhoun talks about Bi-Weekly Economic Review for March 15, 2018.

Read More »

Read More »

Emerging Markets: What Changed

Hong Kong may impose a tax on unsold apartments as an effort to increase supply and cool off the housing market. Bank of Israel’s MPC had a split vote last month for the first time in three years. South Africa President Ramaphosa said the ANC wants Julius Malema of the opposition EFF to rejoin the party. Former South Africa President Zuma will face trial on 16 criminal charges.

Read More »

Read More »

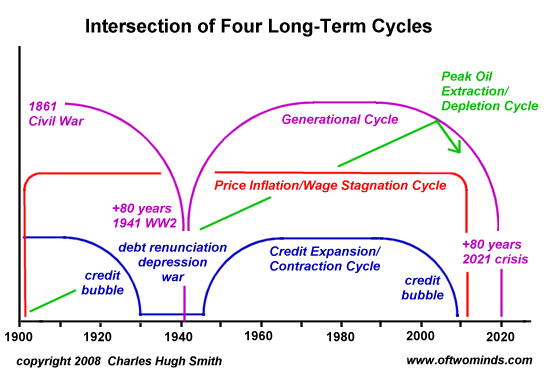

Checking In on the Four Intersecting Cycles

Correspondent James D. recently asked for an update on the four intersecting cycles I've been writing about for the past 10 years. Here's the chart I prepared back in 2008 of four long-term cycles: 1. Generational (political/social).2. Price inflation/wage stagnation (economic). 3. Credit/debt expansion/contraction (financial). 4. Relative affordability of energy (resources).

Read More »

Read More »

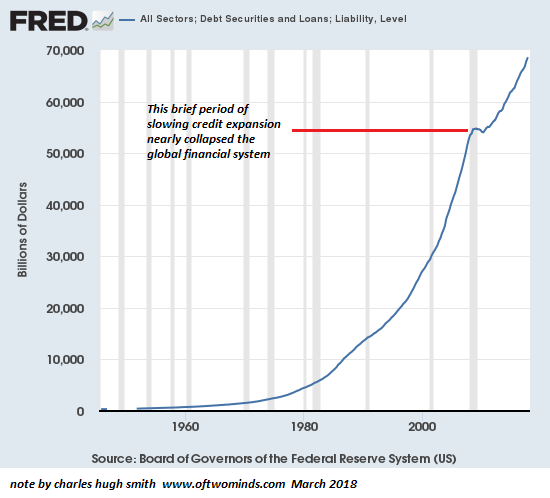

How Much Longer Can We Get Away With It?

Alas, fakery isn't actually a solution to fiscal/financial crisis.. This chart of "debt securities and loans"--i.e. total debt in the U.S. economy--is also a chart of the creation and distribution of new money, as the issuance of new debt is the mechanism in our financial system for creating (or "emitting" in economic jargon) new currency: when a bank issues a new home mortgage, for example, the loan amount is new currency created out of the...

Read More »

Read More »

Charles Hugh SMITH: ALERT USAS DAY OF ECONOMIC RECKONING 2017

Please click above to subscribe to my channel Thanks for watching! clif high halfpasthuman.com fighting against buttheads is our hobby no censorship predictive linguistics web bots woo woo. Please Click Below to SUBSCRIBE for More Special Report Radio Subscribe vesves More Videos: Thank for watching, Please Like Share And SUBSCRIBE!!! #dollarcollapse2017,. ALERT ! ! ! …

Read More »

Read More »

Putin’s games with the West | The Economist

As presidential elections take place in Russia, chess grandmaster Garry Kasparov talks about the games President Putin is playing with the West. Click here to subscribe to The Economist on YouTube: http://econ.st/2GBpCOs Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://econ.st/2GDXPxf Check out The Economist’s full video catalogue: …

Read More »

Read More »

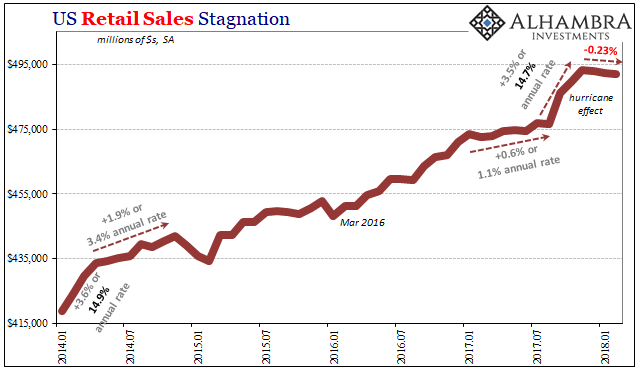

Three Months Now of After-Harvey Retail Sales; or, The Boom Narrative Goes Boom

If indeed this inflation hysteria has passed, its peak was surely late January. Even the stock market liquidations that showed up at that time were classified under that narrative. The economy was so good, it was bad; the Fed would be forced by rapid economic acceleration to speed themselves up before that acceleration got out of hand in uncontrolled consumer price gains. On February 1, the Atlanta Fed’s GDPNow tracking model was moved up to...

Read More »

Read More »

Rex Tillerson, “You’re fired!”, Cartooned | The Economist

After Rex Tillerson’s firing, our cartoonist KAL imagines how President Donald Trump might make foreign-policy decisions. Click here to subscribe to The Economist on YouTube: http://econ.st/2GBpCOs Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://econ.st/2GDXPxf Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist on Facebook: …...

Read More »

Read More »

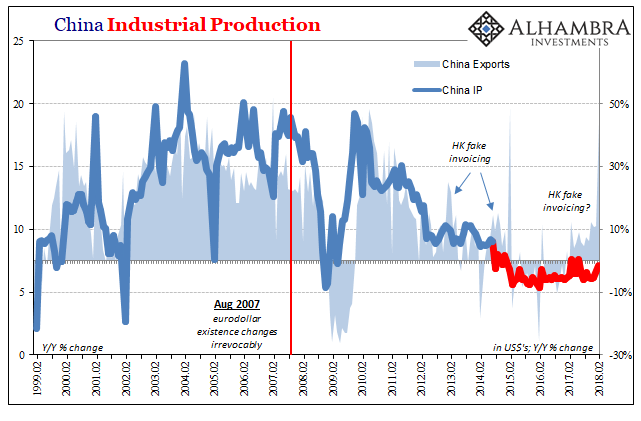

China’s Questionable Start to 2018

The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week).

Read More »

Read More »

Les banques centrales financées par les banques commerciales

Vincent Held continue à présenter des extraits dans cette 3ème et dernière vidéo. Les 3 vidéos se trouvent sur le site de Planètes 360. Cette vidéo fait suite à celle sur le marché REPO.

Read More »

Read More »

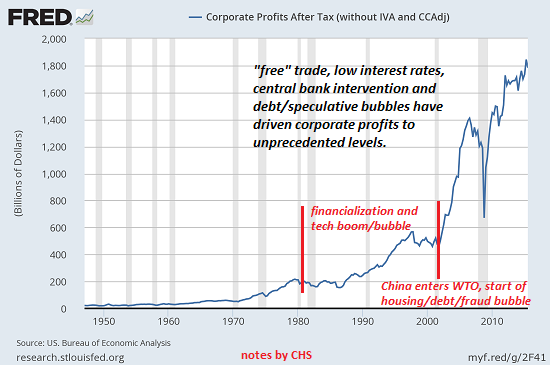

There is No “Free Trade”–There Is Only the Darwinian Game of Trade

Rising income and wealth inequality is causally linked to globalization and the expansion of Darwinian trade and capital flows. Stripped of lofty-sounding abstractions such as comparative advantage, trade boils down to four Darwinian goals: 1. Find foreign markets to absorb excess production, i.e. where excess production can be dumped. 2. Extract foreign resources at low prices. 3. Deny geopolitical rivals access to these resources.

Read More »

Read More »

Illegal ivory: where does it come from, where does it go? | The Economist

The illegal ivory trade is big business. A single shipment can be worth up to $1.3m. The vast majority of ivory poached in Africa ends up in China. Click here to subscribe to The Economist on YouTube: http://econ.st/2GrYOQX Elephant poaching is most prolific in two areas of Africa, the savannas of Mozambique and Tanzania, in …

Read More »

Read More »

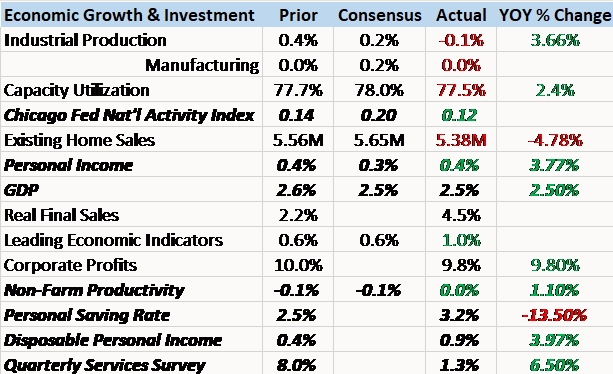

Bi-Weekly Economic Review: The New Normal Continues

There has been a lot of talk about the economic impact of the recent tax reform. All of it, including the analyses that include lots of fancy math, amounts to nothing more than speculation, usually informed by little more than the political bias of the analyst. I am guilty of that too to some degree but I don’t let my personal political views dictate how I view the economy for purposes of investing.

Read More »

Read More »

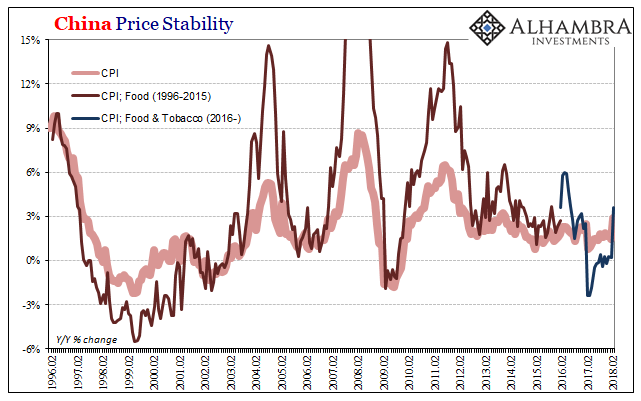

China Prices Include Lots of Base Effect, Still Undershoots

By far, the easiest to answer for today’s inflation/boom trifecta is China’s CPI. At 2.9% in February 2018, that’s the closest it has come to the government’s definition of price stability (3%) since October 2013. That, in the mainstream, demands the description “hot” if not “sizzling” even though it still undershoots. The primary reason behind the seeming acceleration was a more intense move in food prices.

Read More »

Read More »

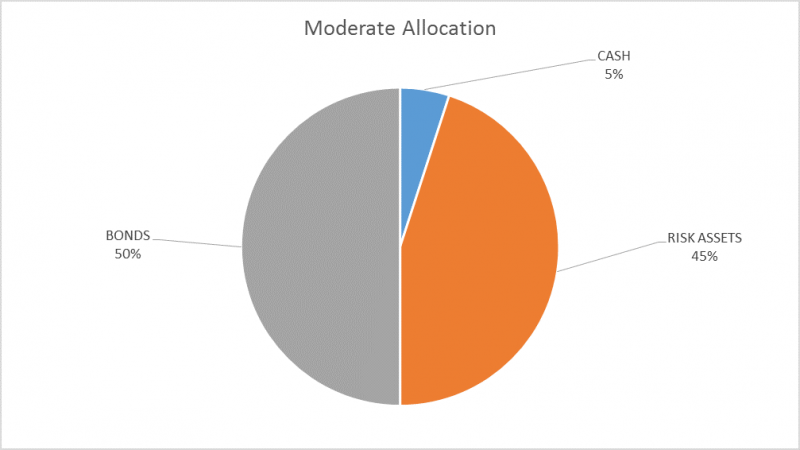

Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average.

Read More »

Read More »

Emerging Markets: Preview Week Ahead

EM FX ended Friday on a firm note and capped off a mostly firmer week. MXN, KRW, and ZAR were the best performers last week, while CLP, CZK, and PLN were the worst. US jobs data was mixed, with markets focusing on weak average hourly earnings rather than on the strong NFP number. Still, the data did nothing to change market expectations for a 25 bp by the FOMC this month.

Read More »

Read More »

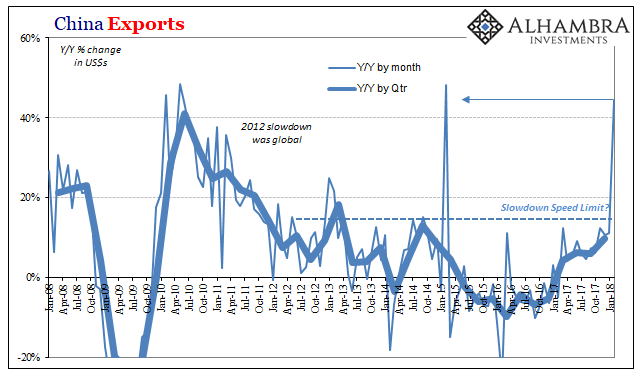

China Exports: Trump Tariffs, Booming Growth, or Tainted Trade?

China’s General Administration of Customs reported that Chinese exports to all other countries were in February 2018 an incredible 44.5% more than they were in February 2017. Such a massive growth rate coming now has served to intensify the economic boom narrative.

Read More »

Read More »

Forget “Free Trade”–It’s All About Capital Flows

Defenders and critics of "free trade" and globalization tend to present the issue as either/or: it's inherently good or bad. In the real world, it's not that simple. The confusion starts with defining free trade (and by extension, globalization).

Read More »

Read More »