Category Archive: 5) Global Macro

From cannabis to climate change: North America’s burning issues | The Economist

Canada is set to become only the second country in the world to legalise cannabis. Across the border, America is making global headlines on another burning issue—all captured by our cartoonist, KAL. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Political cartoonists have the arduous task of packing a mountain of information into …

Read More »

Read More »

How MDMA is being used to treat PTSD | The Economist

MDMA, the active ingredient in the party drug ecstasy, is being touted as a game-changing treatment for post-traumatic stress disorder. It is being trialled in America—and for one army veteran the drug has been a life-saver. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy In America around 22 military veterans kill themselves every …

Read More »

Read More »

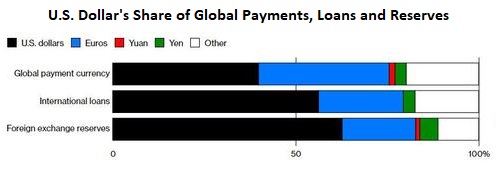

The Distortions of Doom Part 2: The Fatal Flaws of Reserve Currencies

The way forward is to replace the entire system of reserve currencies with a transparent free-for-all of all kinds of currencies. Over the years, I've endeavored to illuminate the arcane dynamics of global currencies by discussing Triffin's Paradox, which explains the conflicting dual roles of national currencies that also act as global reserve currencies, i.e. currencies that other nations use for global payments, loans and foreign exchange...

Read More »

Read More »

The Global Distortions of Doom Part 1: Hyper-Indebted Zombie Corporations

The defaults and currency crises in the periphery will then move into the core. It's funny how unintended consequences so rarely turn out to be good. The intended consequences of central banks' unprecedented tsunami of stimulus (quantitative easing, super-low interest rates and easy credit / abundant liquidity) over the past decade were: 1.

Read More »

Read More »

MACRO ANALYTICS – 10 04 18 – A Distorted Global Supply Chain w/Charles Hugh Smith

VIDEO NOTIFICATION SIGN-UP: http://bit.ly/2y63PvX-Sign-Up Thank you to all Macro Analytics/Gordon T Long YouTube followers. I will continue to add the following message to each video, which many have already seen to help all of those that haven’t learned of the new update. Thank you again for your support! To all Macro Analytics/Gordon T Long subscribers: …

Read More »

Read More »

China’s influence in Europe | The Economist

China’s investment in Europe is growing. Our cover leader this week explains why the money is welcome, but not when it is used to buy political influence. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Our cover this week focuses on China’s investment in Europe, which over the past few years has increased …

Read More »

Read More »

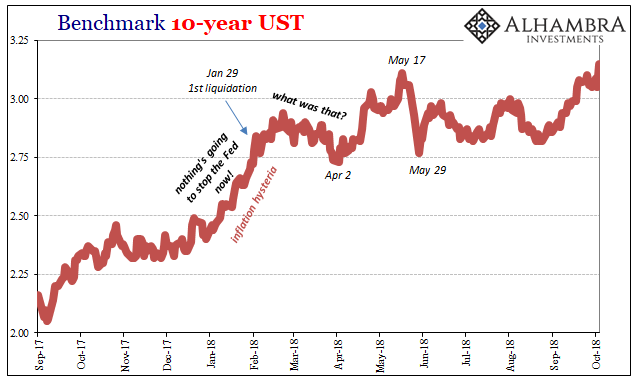

A Few Questions From Today’s BOND ROUT!!!!

On April 2, the benchmark 10-year US Treasury yield traded below 2.75%. It had been as high as 2.94% in later February at the tail end of last year’s inflation hysteria. But after the shock of global liquidations in late January and early February, liquidity concerns would override again at least for a short while. After April 2, the BOND ROUT!!!! was re-energized and away went interest rates.

Read More »

Read More »

How to fuel the future | The Economist

America, under President Donald Trump, is securing its “energy independence” with oil and gas. But unlike fossil fuels, renewables will not increase global warming —and China is moving fast. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Oil moves the world around and creates powerful countries. Oil is such a vital commodity that …

Read More »

Read More »

Pensions Now Depend on Bubbles Never Popping (But All Bubbles Pop)

We're living in a fantasy, folks. Bubbles pop, period. The nice thing about the "wealth" generated by bubbles is it's so easy: no need to earn wealth the hard way, by scrimping and saving capital and investing it wisely. Just sit back and let central bank stimulus push assets higher.

Read More »

Read More »

The data revolution: privacy, politics and predictive policing | The Economist

More than 90% of the world’s data appeared in the past two years. From privacy to politics, Facebook to facial recognition – discover the true impact of this data revolution. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Erlanger hospital, Tennessee – the medical staff here are at the forefront of efforts to …

Read More »

Read More »

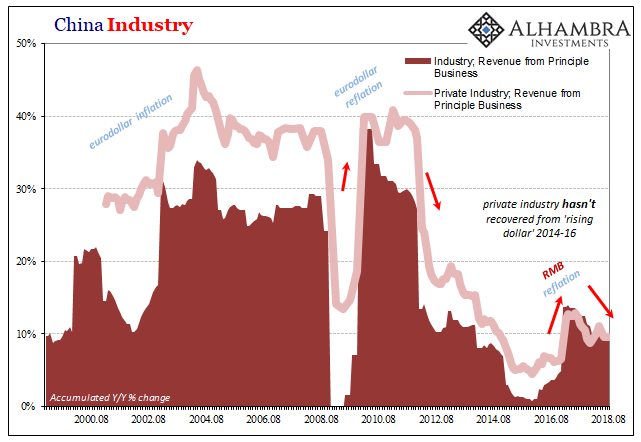

China’s Industrial Dollar

In December 2006, just weeks before the outbreak of “unforeseen” crisis, then-Federal Reserve Chairman Ben Bernanke discussed the breathtaking advance of China’s economy. He was in Beijing for a monetary conference, and the unofficial theme of his speech, as I read it, was “you can do better.” While economic gains were substantial, he said, they were uneven.

Read More »

Read More »

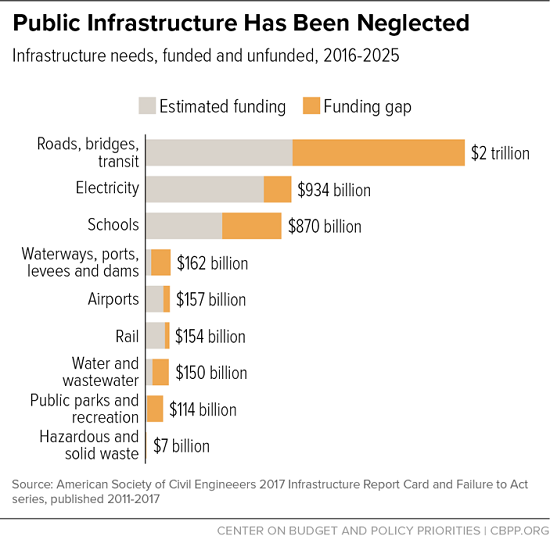

Fixing Infrastructure Isn’t as Simple as Spending Another Trillion Dollars

It isn't easy to add new subway lines or new highways, and so "solutions" don't really exist. If there's one thing Americans can still agree on, it's that America needs to spend more on infrastructure which is visibly falling apart in many places. This capital investment creates jobs and satisfies everyone's ideological requirements: investment in public infrastructure helps enterprises, local governments and residents.

Read More »

Read More »

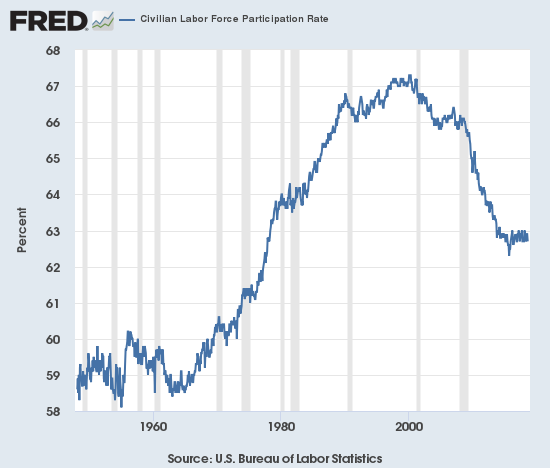

The Labor Shortage Is Real

Few conventional-media commentators are willing or able to discuss these factors in the labor shortage / declining participation trends. Is there a labor shortage in the U.S.? Employers are shouting "yes." Economists keep looking for wage increases as evidence of a labor shortage, and since wage increases are still relatively modest, the argument that there are severe labor shortages in parts of the U.S. is unpersuasive to many conventional...

Read More »

Read More »

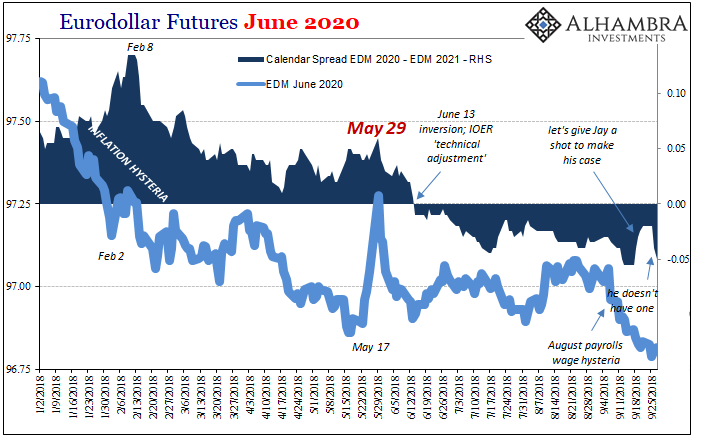

Make Your Case, Jay

June 13 sticks out for both eurodollar futures as well as IOER. On the surface, there should be no bearing on the former from the latter. They are technically unrelated; IOER being a current rate applied as an intended money alternative. Eurodollar futures are, as the term implies, about where all those money rates might fall in the future. Still, the eurodollar curve inverted conspicuously starting June 13. That was the day of the prior “rate...

Read More »

Read More »

Mapping global gun violence | The Economist

El Salvador, Venezuela and Guatemala have the worst gun violence in the world. America’s lax firearm laws are adding to their problems. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Since 1990 the number of gun deaths worldwide has reached 6.5 million. Three quarters of gun deaths occur in just 15 countries. Latin …

Read More »

Read More »

Eurodollars & Global Deflation Risk W/ Jeff Snider | Expert View | Real Vision™

Is the global economy poised to enter another deflationary cycle? Jeff Snider, head of global research and chief investment strategist at Alhambra Partners, believes that we have never enjoyed a true recovery from the global financial crisis – but instead, have merely bounced between cycles of deflation and reflation. In this piece, Snider unpacks the …

Read More »

Read More »

Droit du Seigneur and the Neofeudal Privileges of Class in America

Want to understand the full scope of neofeudalism in America? Follow the money and the power and privilege it buys. The repugnant reality of class privilege in America is captured by the phrase date rape: the violence of forced, non-consensual sex is abhorrent rape when committed by commoner criminals, but implicitly excusable date rape when committed by a member of America's privileged elite.

Read More »

Read More »

University: does a degree pay? | The Economist

The pressure for school-leavers to get a university degree is rising across the world. But does further education lead to better pay and opportunities? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Is university worth it? Many believe further education is the key to success. Around half of school leavers in the rich …

Read More »

Read More »

Monthly Macro Monitor – September 2018

Alhambra Investments CEO Joe Calhoun shares his opinions of the economy and market based on the most recent economic reports.

Read More »

Read More »

Charles Hugh Smith On Insights Into Jobs For Displaced Workers Affected By Intelligent Automation

Click here for the full transcript: http://financialrepressionauthority.com/2018/09/24/the-roundtable-insight-charles-hugh-smith-on-insights-into-the-jobs-for-displaced-workers-affected-by-intelligent-automation/

Read More »

Read More »