Category Archive: 5) Global Macro

2019: The Three Trends That Matter

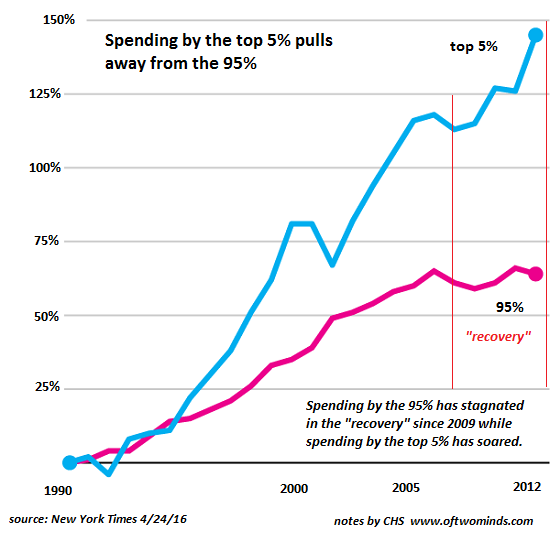

Look no further than Brexit in Britain, the yellow vests in France and the Deplorables in the U.S. for manifestations of a broken social contract and decaying social order. Among the many trends currently in play, Gordon Long and I discuss three that will matter as 2019 progresses: 2019 Themes (56 minutes).

Read More »

Read More »

Brace for Impact

As credit-asset bubbles pop, the dominoes start falling. The economy is far more precarious than the surface boom/bubble suggests. A great many households, enterprises and municipalities are in overloaded boats whose gunwales are just a few inches above the water; the slightest wave will swamp and sink them.

Read More »

Read More »

More Of What Was Behind December, And Not Just December

As more and more data rolls in even in this delayed fashion, the more what happened to end last year makes sense. The Census Bureau updated today its statistics for US trade in November 2018. Heading into the crucial month of December, these new figures suggest a big setback in the global economy that is almost certainly the reason markets became so chaotic.

Read More »

Read More »

MACRO ANALYTICS – 02-07-19 – 2019 Themes w/ Charles Hugh Smith

VIDEO NOTIFICATION SIGN-UP: http://bit.ly/2y63PvX-Sign-Up VIDEO ABSTRACT: http://charleshughsmith.blogspot.com/2019/02/2019-three-trends-that-matter.html Thank you to all Macro Analytics/Gordon T Long YouTube followers. I will continue to add the following message to each video, which many have already seen to help all of those that haven’t learned of the new update. Thank you again for your support! To all Macro Analytics/Gordon …

Read More »

Read More »

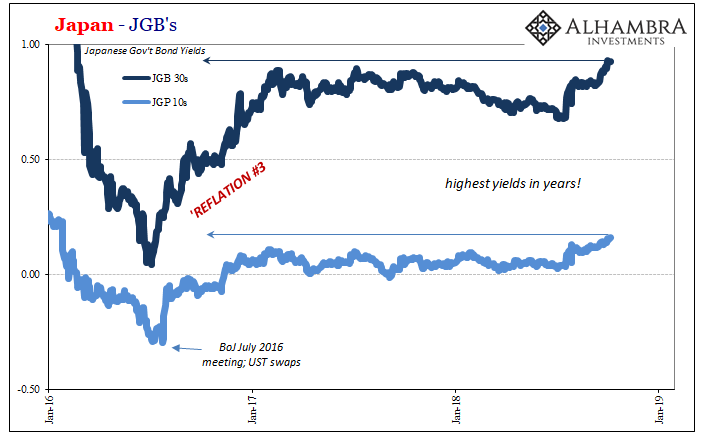

Lost In Translation

Since I don’t speak Japanese, I’m left to wonder if there is an intent to embellish the translation. Whoever is responsible for writing in English what is written by the Bank of Japan in Japanese, they are at times surely seeking out attention. However its monetary policy may be described in the original language, for us it has become so very clownish.

Read More »

Read More »

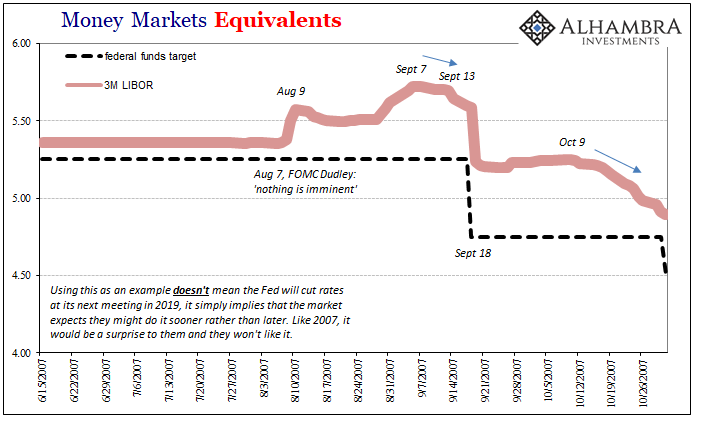

LIBOR Was Expected To Drop. It Dropped. What Might This Mean?

Everyone hates LIBOR, until it does something interesting. It used to be the most boring interest rate in the world. When it was that, it was also the most important. Though it followed along federal funds this was only because of the arb between onshore (NYC) and offshore (mainly London, sometimes Caymans) conducted by banks between themselves and their subs (whichever was located where).

Read More »

Read More »

The next global arms race? | The Economist

America and Russia have pulled out of the INF, a cold war-era weapons treaty. Why is this significant and what does this mean for global stability? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist on …

Read More »

Read More »

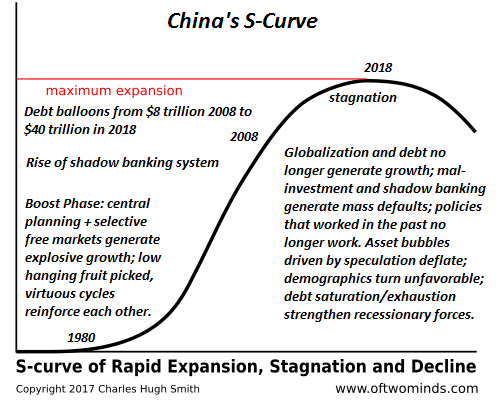

China’s S-Curve of Expansion, Stagnation and Decline

All the policies that worked in the Boost Phase no longer work. Natural and human systems tend to go through stages of expansion, stagnation and decline that follow what's known as the S-Curve. The dynamic isn't difficult to understand: an unfilled ecological niche is suddenly open due to a new adaptation; a bacteria evolves to exploit a new host, etc.

Read More »

Read More »

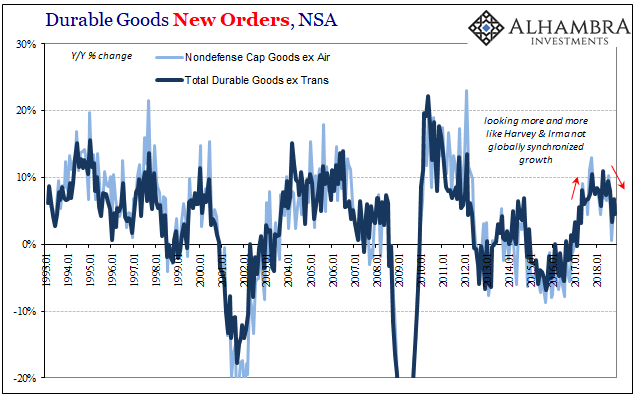

US Manufacturing Questions

The US economic data begins to trickle in slowly. Today, the reopened Census Bureau reports on orders and shipments to and from US factories dating back to last November. New orders for durable goods rose just 4.5% year-over-year in that month, while shipments gained 4.7%. The 6-month average for new orders was in November pulled down to just 6.6%, the lowest since September 2017 (hurricanes).

Read More »

Read More »

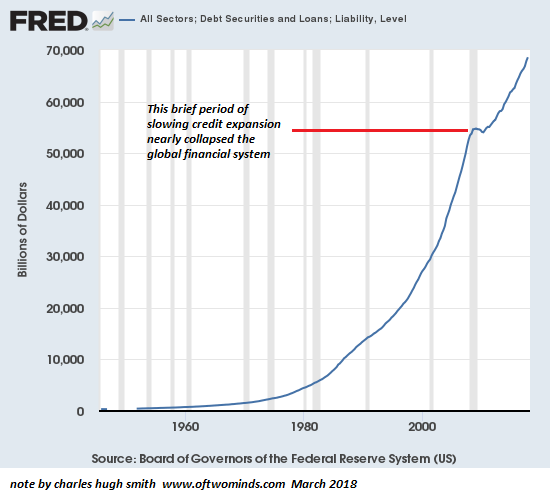

The Coming Global Financial Crisis: Debt Exhaustion

The global economy is way past the point of maximum debt saturation, and so the next stop is debt exhaustion. Just as generals fight the last war, central banks always fight the last financial crisis. The Global Financial Crisis (GFC) of 2008-09 was primarily one of liquidity as markets froze up as a result of the collapse of the highly leveraged subprime mortgage sector that had commoditized fraud (hat tip to Manoj S.) via liar loans and...

Read More »

Read More »

What will replace Facebook? | The Economist

Facebook has dominated the social-media landscape for the past 15 years. But breaches of its users’ privacy mean it is now slipping out of favour. Could an emerging technological movement take its place? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full …

Read More »

Read More »

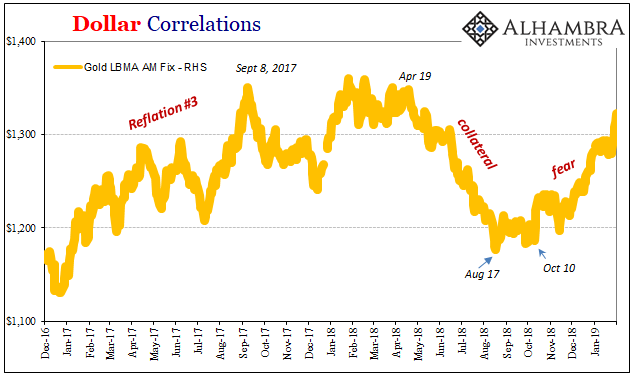

Fear Or Reflation Gold?

Gold is on fire, but why is it on fire? When the precious metals’ price falls, Stage 2, we have a pretty good idea what that means (collateral). But when it goes the other way, reflation or fear of deflation? Stage 1 or Stage 3? If it is Stage 1 reflation based on something like the Fed’s turnaround, then we would expect to find US$ markets trading in exactly the same way.

Read More »

Read More »

Bond Curves Right All Along, But It Won’t Matter (Yet)

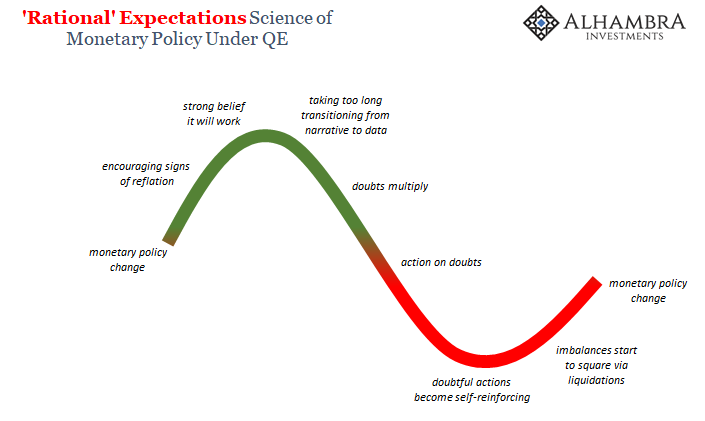

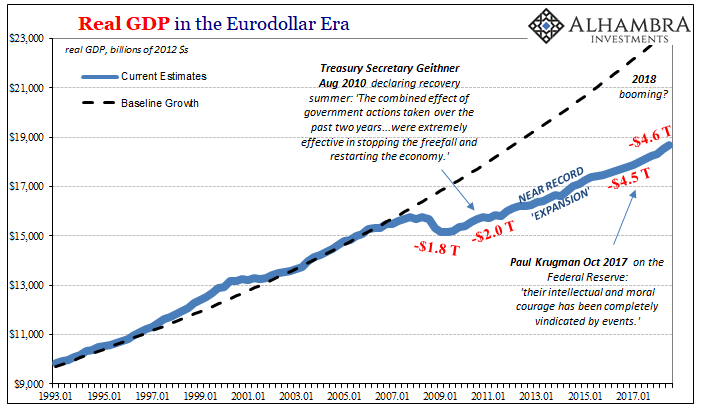

Men have long dreamed of optimal outcomes. There has to be a better way, a person will say every generation. Freedom is far too messy and unpredictable. Everybody hates the fat tails, unless and until they realize it is outlier outcomes that actually mark progress. The idea was born in the eighties that Economics had become sufficiently advanced that the business cycle was no longer a valid assumption.

Read More »

Read More »

Theresa May’s Brexit power struggle, cartooned | The Economist

With a dangerous Brexit deadline looming, our cartoonist KAL contemplates the British Prime Minister’s next move. Is this one power struggle Theresa May is destined to lose? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist …

Read More »

Read More »

Monthly Macro Monitor – February (VIDEO)

Alhambra Investments CEO Joe Calhoun discusses the latest information about markets, specific categories affecting the economy.

Read More »

Read More »

It’s Not That There Might Be One, It’s That There Might Be Another One

It was a tense exchange. When even politicians can sense that there’s trouble brewing, there really is trouble brewing. Typically the last to figure these things out, if parliamentarians are up in arms it already isn’t good, to put it mildly. Well, not quite the last to know, there are always central bankers faithfully pulling up the rear of recognizing disappointing reality.

Read More »

Read More »

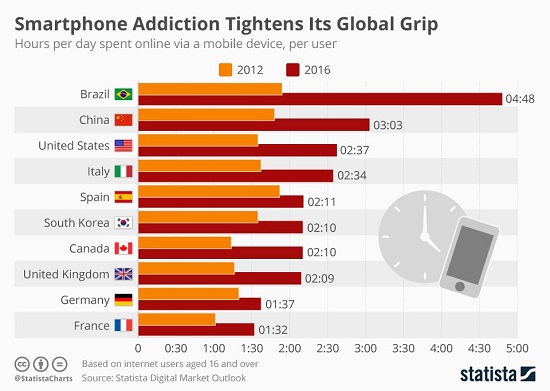

So If Half of Facebook Accounts Are Fake… What Is Facebook Worth?

The social media space is absolutely ripe for a new entrant who demands arduous verification and constantly monitors its user base to eliminate cloned and fake accounts. How many accounts on Facebook are fake? Recent estimates of half could be low. Here's an experiment: open a Facebook account with a name that cannot possibly be anyone else's real name, for example, Johns XQR Citizenry.

Read More »

Read More »

Charles Hugh Smith: Prepare Now today! 2019 Everything Is About To Change Going World Wide, Wait For

Charles Hugh Smith: Prepare Now today! 2019 Everything Is About To Change Going World Wide, Wait For

Read More »

Read More »

What happens when we sleep? | The Economist

Sleep is central to maintaining your physical and mental health, but many people don’t sleep enough. We all do it, but what happens to us when we sleep? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Every night almost everyone on the planet enters into a state of unconsciousness and paralysis – but …

Read More »

Read More »

So You Want to Get Rich: Focus on Human Capital

Wealth is flowing to those who earn money from their human capital and enterprise. So you want to get rich: OK, what's the plan? If you ask youngsters how to get rich, many will respond by listing the professions the media focuses on: entertainment, actors/actresses, pro athletes, and maybe a few lionized inventors or CEOs.

Read More »

Read More »