Category Archive: 5) Global Macro

How will quantum computing change the world? | The Economist

The potential for quantum computing to crack other countries’ encrypted networks has captured the attention of national governments. Which of the world’s fundamental challenges could be solved by quantum computing? Read more here: https://econ.st/2Zpildp Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s …

Read More »

Read More »

Charles Hugh Smith – The American Empire Will Fall In 2019

Channel Not Monetized If you have any issue about their copyright, please contact me by email: [email protected] . Thank you ! Thank

Read More »

Read More »

Charles Hugh Smith – Parallels Between The Decline of the Roman Empire and America

SBTV spoke with Charles Hugh Smith, author and the editor of the Of Two Minds blog, about the startling parallels (e.g. debasing of currency, lack of strong leadership, move towards populism, etc.) between the decline of the Roman Empire and America. Follow Charles Hugh Smith’s on his blog: https://www.oftwominds.com/blog.html Discussed in this interview: 07:33 Central …

Read More »

Read More »

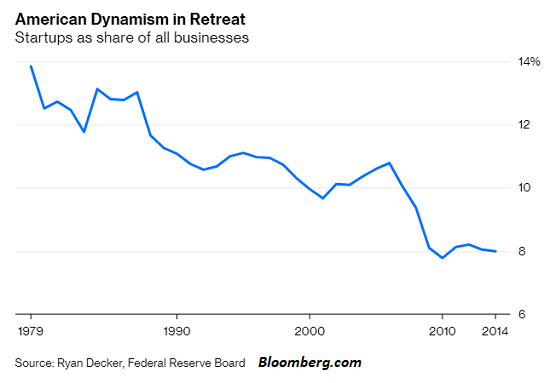

Main Street Small Business on the Precipice

As a generality, the average employee (including financial pundits) has no real experience or understanding of what it takes to start and operate a small business in the U.S. Government employees in the agencies that oversee and enforce regulations on small businesses also generally lack any experience in the businesses they regulate.

Read More »

Read More »

China’s Big Gamble(s): Betting on QE Again?

As an economic system, even the most committed socialists had come to realize it was a failure. What ultimately brought down the Soviet Union wasn’t missiles, tanks, and advanced air craft, it was a simple thing like bread. You can argue that Western military spending forced the Communist East to keep up, and therefore to expend way too much on guns at the expense of butter.

Read More »

Read More »

Charles Hugh Smith?We are seeing a general uprising against the elites taking place right now!

Charles Hugh Smith?We are seeing a general uprising against the elites taking place right now! Charles Hugh Smith?We are seeing a general uprising against the elites taking place right now! Charles Hugh Smith?We are seeing a general uprising against the elites taking place right now!...

Read More »

Read More »

Why Is What Was Once Affordable to Many Now Only Affordable to the Wealthy?

Let's start with an excerpt from a recent personal account by the insightful energy/systems analyst Ugo Bardi, who is Italian but writes his blog Cassandra's Legacy in English: Becoming Poor in Italy. The Effects of the Twilight of the Age of Oil.

Read More »

Read More »

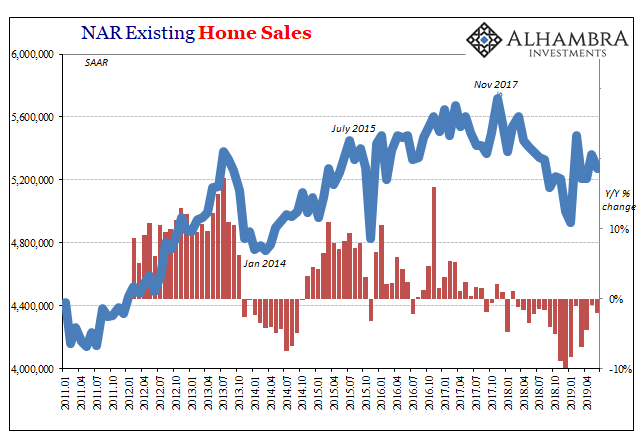

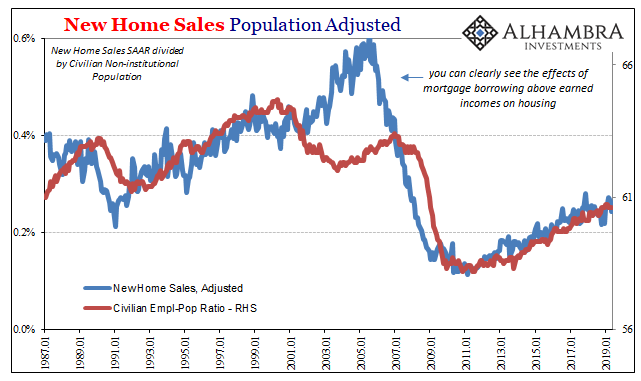

Real Estate Perfectly Sums Up The Rate Cuts

It’s only a confusing when you just accept the booming economy of the unemployment rate. From this perspective, 2018 was, and more so 2019 is, a downright conundrum. By all mainstream accounts, this just shouldn’t be happening.

Read More »

Read More »

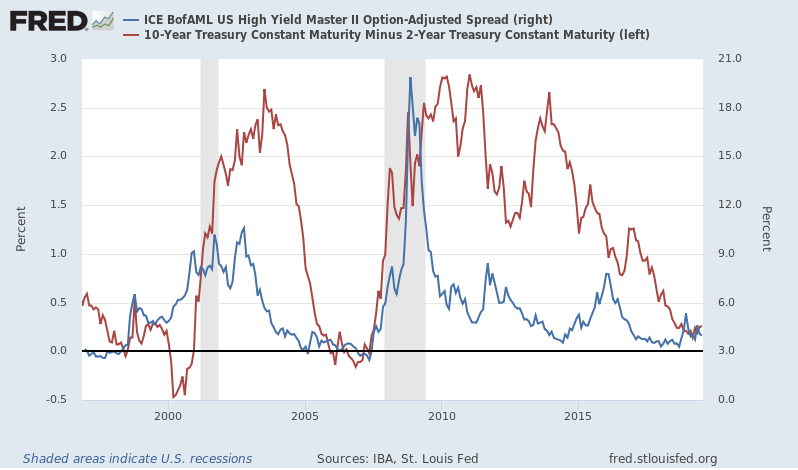

US Economic Crosscurrents Reach the 50 Mark

In the official narrative, the economy is robust and resilient. The fundamentals, particularly the labor market, are solid. It’s just that there has arisen an undercurrent or crosscurrent of some other stuff. Central bankers initially pointed the finger at trade wars and the negative “sentiment” it creates across the world but they’ve changed their view somewhat.

Read More »

Read More »

How to save humankind (according to James Lovelock) | The Economist

James Lovelock, the renowned scientist, is 100 years old. He believes the human race is under threat of destruction—but he has a radical plan for saving it Read more here: https://econ.st/2LKroSQ Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Is the human race under threat of destruction? This man thinks so and he …

Read More »

Read More »

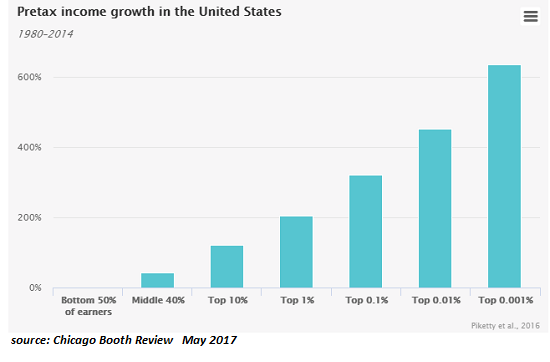

It’s Not Just the News That’s Fake–Everything’s Fake

What do we mean when we say corporate media is fake? We mean it's a carefully crafted con, a set of narratives, cherry-picked data and heavily massaged statistics (the unemployment rate, etc.) designed to instill the reader's confidence in a narrative that serves the interests not of the citizenry but of a select few pillaging the citizenry.

Read More »

Read More »

How donuts have benefitted America’s immigrants | The Economist

Donuts are the all-American confectionery. They have also helped a group of immigrants from Cambodia pursue the American dream. Read more here: https://econ.st/30Olhk6 Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy America has the biggest immigration population in the world. The country has long attracted people in search of a better life. Among …

Read More »

Read More »

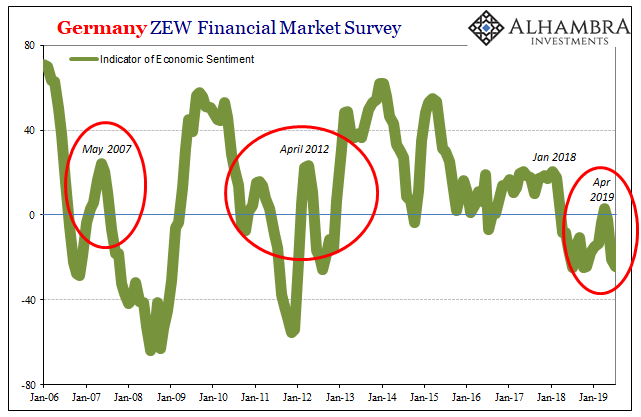

Germany Struggles On

The popular image of the German industrial machine politics is one which has Germany’s massive factories efficiently churning out goods for trade with the South of Europe (Club Med). Because of the common currency, numerous disparities starting with productivity differences had left the South highly indebted to the North just as the Global Financial Crisis would strike.

Read More »

Read More »

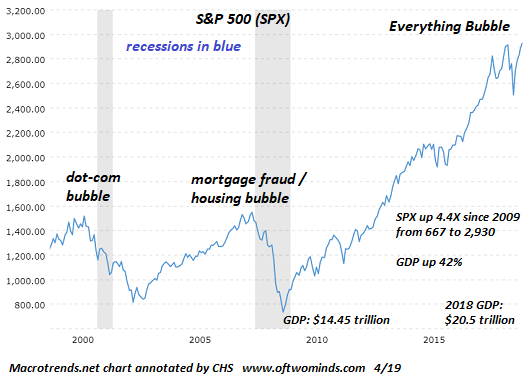

What Does It Mean That Real Estate, Not Equities, Is Driving Monetary Policy?

In the world of assets classes, I don’t believe it is equities which hold the Federal Reserve’s attention. After the 2006-11 debacle, the big bust, you can at least understand why policymakers might be more attuned to real estate no matter how the NYSE trades. It may be a decade ago, but that’s the one thing out of the Global Financial Crisis which was seared into the consciousness of everyone who lived through it.

Read More »

Read More »

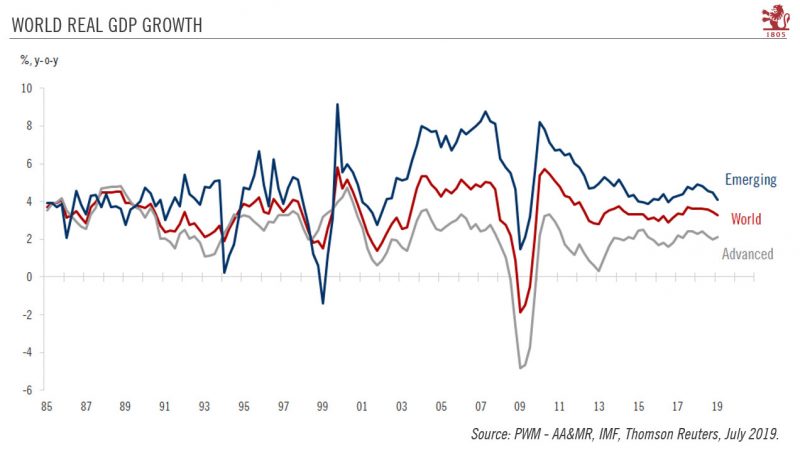

World growth forecast revised down

Signs of a potential global recession are appearing, such as a fall in fixed investment and industrial production and a build-up in unwanted inventories. We are revising down our world growth forecast.The effects of a negative shock dating back to early 2018 are still being propagated throughout the world economy.

Read More »

Read More »

Could solar geoengineering counter global warming? | The Economist

Global warming is probably the biggest threat facing humanity. If all else fails, could climate-controlling technology be the answer? Read more here: https://econ.st/2JSpnRm Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy This was one of the biggest volcanic explosions in history. It happened on June 15th 1991 in the north-west of the Philippines. …

Read More »

Read More »

Our Ruling Elites Have No Idea How Much We Want to See Them All in Prison Jumpsuits

Even the most distracted, fragmented tribe of the peasantry eventually notices that they're not in the top 1%, or the top 0.1%. Let's posit that America will confront a Great Crisis in the next decade. This is the presumption of The Fourth Turning, a 4-generational cycle of 80 years that correlates rather neatly with the Great Crises of the past: 1781 (Revolutionary War, constitutional crisis); 1861 (Civil War) and 1941 (World War II, global war).

Read More »

Read More »

Home Prices Could Crash to 2003 Levels, Housing Bubble Prediction – Charles Hugh Smith

USA housing bubble could get ugly. Please subscribe to our main channel here: https://www.youtube.com/channel/UCXuldJPtmI0x0DVQFsB9cSg This is the back-up channel for Bull-Boom-Bear-Bust financial/economic/investing news channel.

Read More »

Read More »

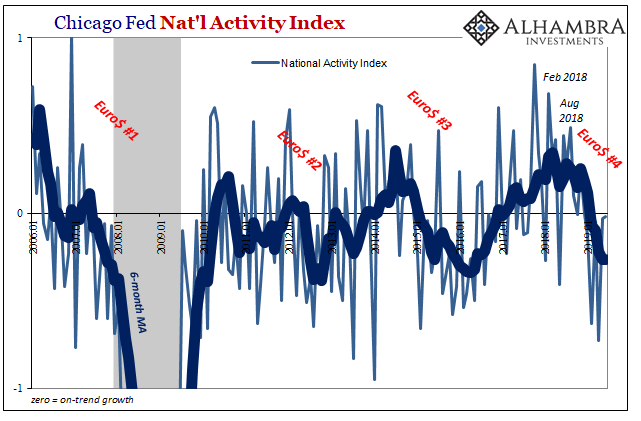

Monthly Macro Monitor: We’re Not There Yet

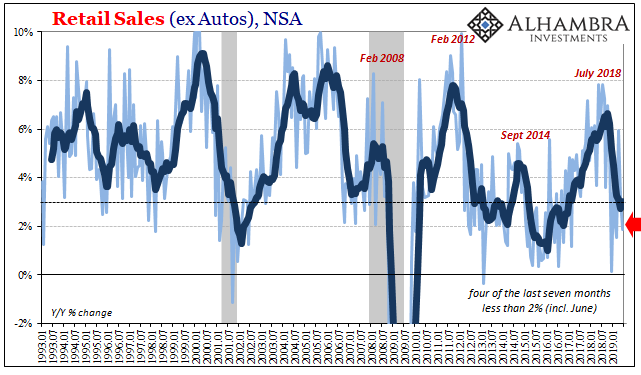

I first wrote about the current economic slowdown a year ago and Jeff Snider actually started seeing signs of slowdown in the Eurodollar market as early as May 2018. So, the slowdown we’re in now certainly isn’t a surprise here at Alhambra. I think though that we often forget how long these things take to develop.

Read More »

Read More »

Globally Synchronized, After All

For there to be a second half rebound, there has to be some established baseline growth. Whatever might have happened, if it was due to “transitory” factors temporarily interrupting the economic track then once those dissipate the economy easily gets back on track because the track itself was never bothered.

Read More »

Read More »