Category Archive: 5) Global Macro

The Black Swan Is a Drone

What was "possible" yesterday is now a low-cost proven capability, and the consequences are far from predictable. Predictably, the mainstream media is serving up heaping portions of reassurances that the drone attacks on Saudi oil facilities are no big deal and full production will resume shortly.

Read More »

Read More »

What a Relief that the U.S. and Global Economies Are Booming

Doing more of what's failed for ten years will finally fail spectacularly.. It was a huge relief to see the charts of the Baltic Dry Index (BDI) and the U.S. retail sector ETF (RTH): both have soared to the moon, signaling that both the U.S. and global economies are booming: the BDI is widely regarded as a proxy for global shipping, which is a proxy for global trade and economic activity.

Read More »

Read More »

Dollar Soft as Risk Sentiment Stoked Ahead of US Retail Sales

US-China relations appear to be thawing. Trading was volatile after the ECB decision; we are still dollar bulls. EM has benefitted from the shift in the global backdrop this week. The US data highlight is August retail sales. Vietnam cut rates 25 bp to 6.0%; Turkey reported July current account and IP.

Read More »

Read More »

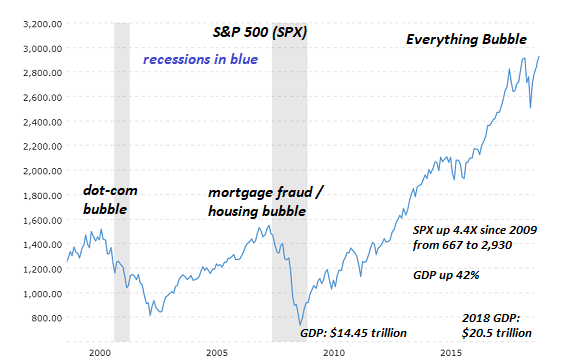

The Inevitable Bursting of Our Bubble Economy

All of America's bubbles will pop, and sooner rather than later. Financial bubbles manifest three dynamics: the one we're most familiar with is human greed, the desire to exploit a windfall and catch a work-free ride to riches. The second dynamic gets much less attention: financial manias arise when there is no other more productive, profitable use for capital, and these periods occur when there is an abundance of credit available to inflate the...

Read More »

Read More »

Chester Williams: from racism to the Rugby World Cup final | The Economist

Chester Williams was the only black player in South Africa’s 1995 World Cup winning side. He died on September 6th 2019. Earlier this year he spoke to The Economist about his experience playing for the Springboks and growing up and playing under Apartheid rule

Read More »

Read More »

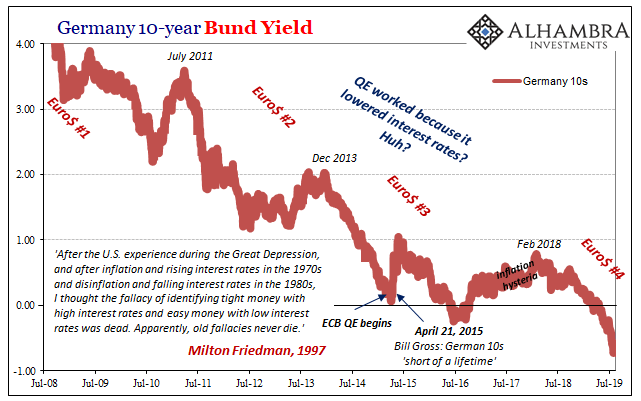

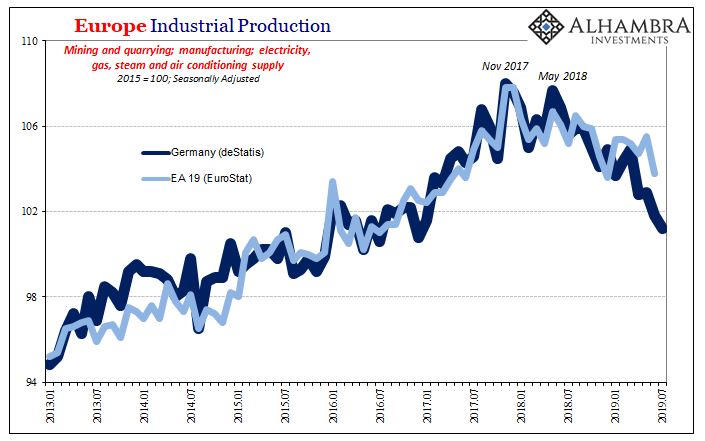

Your Unofficial Europe QE Preview

The thing about R* is mostly that it doesn’t really make much sense when you stop and think about it; which you aren’t meant to do. It is a reaction to unanticipated reality, a world that has turned out very differently than it “should” have. Central bankers are our best and brightest, allegedly, they certainly feel that way about themselves, yet the evidence is clearly lacking.

Read More »

Read More »

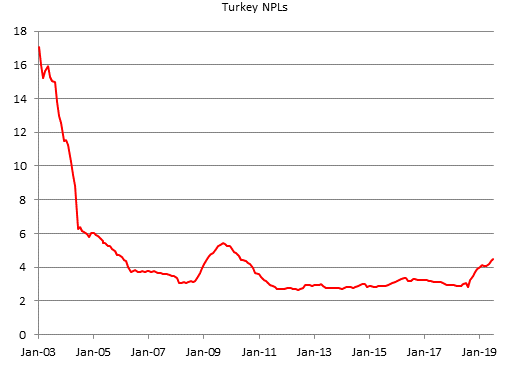

Turkey Monetary Policy Planting Seeds of Future Crisis

Turkey central bank meets September 12 and is expected to cut rates 275 bp. With Erdogan talking about single digit rates and inflation, it’s clear that rates are headed significantly lower. At some point soon, we think the risk/reward for investing in Turkey will send investors fleeing for the exits.POLITICAL OUTLOOK

President Erdogan sacked central bank Governor Murat Cetinkaya on July 6, ostensibly for not cutting rates quickly enough.

Read More »

Read More »

Jeff Snider & Luke Gromen: Global U.S. Dollar Shortage Demystified

Erik Townsend and Patrick Ceresna welcome Jeff Snider and Luke Gromen to MacroVoices. They discuss the impact of changing Eurodollar markets, the global dollar liquidity shortage and the future changes in global reserve currencies and more.

Read More »

Read More »

The Obligatory Europe QE Review

If Mario Draghi wanted to wow them, this wasn’t it. Maybe he couldn’t, handcuffed already by what seems to have been significant dissent in the ranks. And not just the Germans this time. Widespread dissatisfaction with what is now an idea whose time may have finally arrived.

Read More »

Read More »

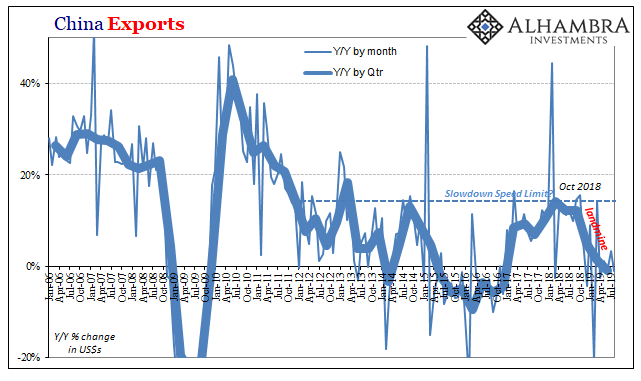

Dollar (In) Demand

The last time was bad, no getting around it. From the end of 2014 until the first months of 2016, the Chinese economy was in a perilous state. Dramatic weakness had emerged which had seemed impossible to reconcile with conventions about the country. Committed to growth over everything, and I mean everything, China was the one country the world thought it could count on for being immune to the widespread economic sickness.

Read More »

Read More »

A Bigger Boat

For every action there is a reaction. Not only is that Sir Isaac Newton’s third law, it’s also a statement about human nature. Unlike physics where causes and effects are near simultaneous, there is a time component to how we interact. In official capacities, even more so.

Read More »

Read More »

The Era Of Central Banks Pushing The Economy Forward Is Ending w/ Charles Hugh Smith

Thanks for watching this Silver Doctors Interview. Share your thoughts below and make sure to click the subscribe button to join the Silver Doctors Community. Today’s guest, Charles Hugh Smith, shares his thoughts on how capitalism as we have know it is being challenge. During our discussion he shares his thoughts on how monetary policy …

Read More »

Read More »

How lynching still affects American politics | The Economist

*This film contains disturbing images* Between 1877 and 1950 more than 4,000 African-Americans were lynched. Their deaths are still having an impact on voting patterns today. Read more here: https://econ.st/31cCxQq Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Many people know about the terror of lynchings. But one of the reasons why blacks …

Read More »

Read More »

Is The Negativity Overdone?

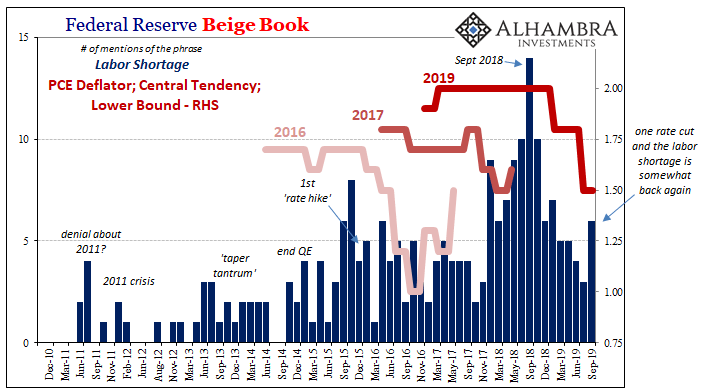

Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009.

Read More »

Read More »

EM Preview for the Week Ahead

Despite some positive developments last week, we think the three key issues for risk assets have not been resolved yet. Hong Kong protests continue, while reports suggest the US and China remain far apart. Even Brexit has likely been given only a three month reprieve. We remain negative on EM until these key issues have been ultimately resolved.

Read More »

Read More »

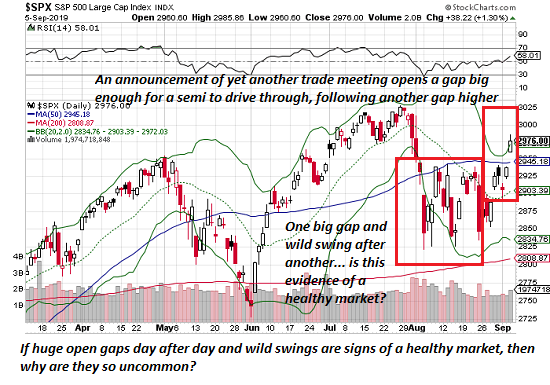

These Are Not Signs of a Healthy Market

The implicit narrative of the latest rally in stocks is that this is just another normal rally in the ongoing 10-year long Bull market. Nice, but do these three charts look "normal" to you? Let's take a quick glance at a daily chart of the S&P 500 (SPX), a weekly chart of TLT, the exchange-traded fund of the US Treasury 20-year bond, and silver.

Read More »

Read More »

Why we should talk to strangers, according to Malcolm Gladwell | The Economist Podcast

Malcolm Gladwell is a prolific author and thought leader. He talks to Anne McElvoy about his latest book “Talking to Strangers” and why we should adjust the way we interact with people we don’t know. Click here for the full interview: https://econ.st/2ZYUkcM Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy 00:09 – What …

Read More »

Read More »

Just Who Was The Intended Audience For The Rate Cut?

Federal Reserve policymakers appear to have grown more confident in their more optimistic assessment of the domestic situation. Since cutting the benchmark federal funds range by 25 bps on July 31, in speeches and in other ways Chairman Jay Powell and his group have taken on a more “hawkish” tilt. This isn’t all the way back to last year’s rate hikes, still a pronounced difference from a few months ago.

Read More »

Read More »

CHARLES HUGH SMITH – Having A Recession Is Healthy For Us

SUBSCRIBE For The Latest Issues About ; #FINANCIAL CRISIS #OIL PRICE #PETROL #GLOBAL ECONOMIC COLLAPSE #DOLLAR COLLAPSE #GOLD #SILVER #BITCOIN #ETHERIUM #CRYPTOCURRENCY #LITECOIN #FINANCIAL CRASH #GLOBAL RESET #FINANCIAL CRISIS #ECONOMIC COLLAPSE #NYSE #NASDAQ

Read More »

Read More »

Will Everything Change in 2020-2025 or Will Nothing Change?

Any domino-like expanding crisis will unfold in a status quo lacking any coherent response. Longtime readers know I've often referenced The Fourth Turning, the book that makes the case for an 80-year cycle of existential crisis in U.S. history.

Read More »

Read More »